Intro

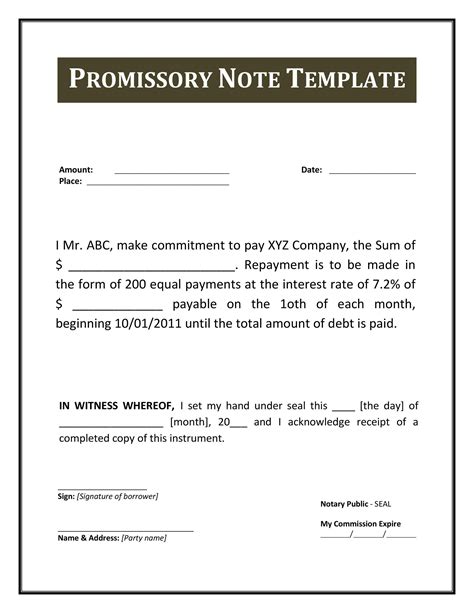

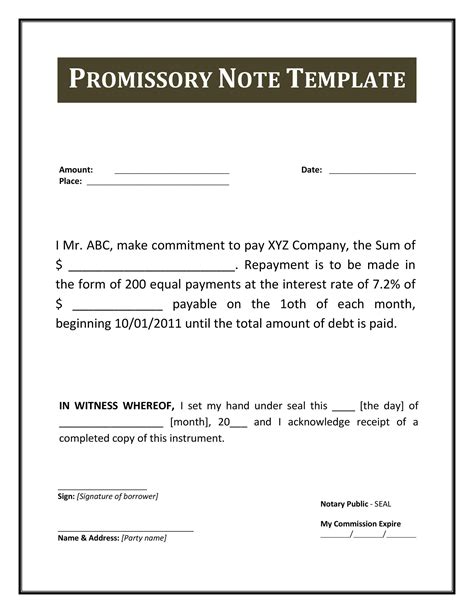

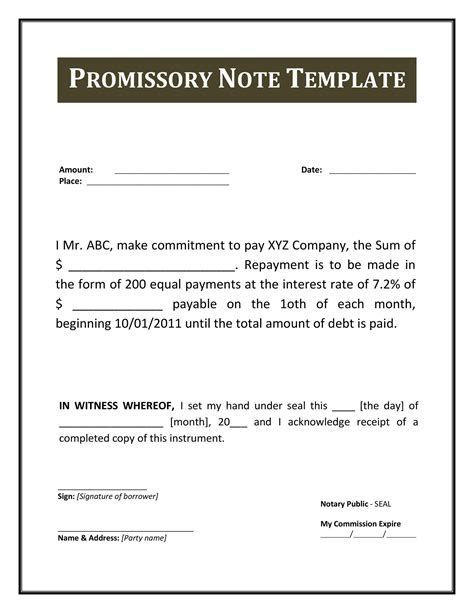

Unlock the power of a promissory note template with our comprehensive guide. Learn the 7 essential elements to include, such as loan amount, interest rate, and repayment terms, to create a binding agreement. Discover how to protect lenders and borrowers with a clear, concise, and legally binding promissory note.

A promissory note is a crucial document that outlines the terms of a loan between two parties, specifying the amount borrowed, interest rate, repayment terms, and other essential details. When creating a promissory note template, it's vital to include the following seven essential elements to ensure the document is comprehensive, clear, and enforceable.

1. Introduction and Parties Involved

The promissory note template should start by introducing the parties involved in the loan agreement, including the borrower (also known as the maker) and the lender (also known as the payee). This section should clearly state the names and addresses of both parties.

Key Considerations:

- Ensure the names and addresses of both parties are accurate and up-to-date.

- Verify the borrower's identity and creditworthiness before entering into the loan agreement.

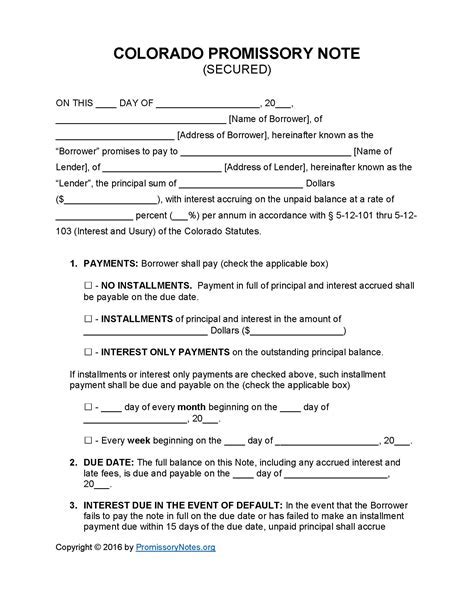

2. Loan Amount and Interest Rate

The promissory note template should specify the loan amount, interest rate, and any applicable fees or charges. This section should also outline the repayment terms, including the frequency and amount of payments.

Key Considerations:

- Ensure the loan amount and interest rate are clearly stated and agreed upon by both parties.

- Verify the interest rate is compliant with applicable laws and regulations.

3. Repayment Terms

The promissory note template should outline the repayment terms, including the frequency and amount of payments, as well as any late payment fees or penalties.

Key Considerations:

- Ensure the repayment terms are clear and concise, including the payment schedule and any late payment fees.

- Verify the repayment terms are compliant with applicable laws and regulations.

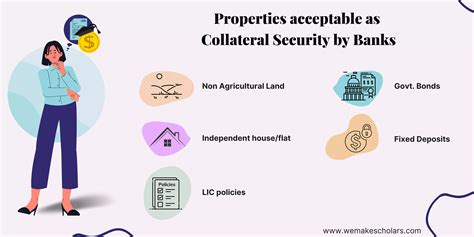

4. Security and Collateral

The promissory note template should specify any security or collateral provided by the borrower to secure the loan. This section should outline the type and value of the collateral, as well as any conditions or requirements for its release.

Key Considerations:

- Ensure the security or collateral is clearly described and valued.

- Verify the security or collateral is compliant with applicable laws and regulations.

5. Default and Acceleration

The promissory note template should outline the events that constitute default, including late payments, non-payment, or breach of any other terms or conditions. This section should also specify the lender's rights and remedies in the event of default, including acceleration of the loan.

Key Considerations:

- Ensure the default and acceleration provisions are clear and concise.

- Verify the default and acceleration provisions are compliant with applicable laws and regulations.

6. Governing Law and Jurisdiction

The promissory note template should specify the governing law and jurisdiction that applies to the loan agreement. This section should outline the laws and regulations that govern the loan, as well as the courts that have jurisdiction over any disputes.

Key Considerations:

- Ensure the governing law and jurisdiction are clearly stated and agreed upon by both parties.

- Verify the governing law and jurisdiction are compliant with applicable laws and regulations.

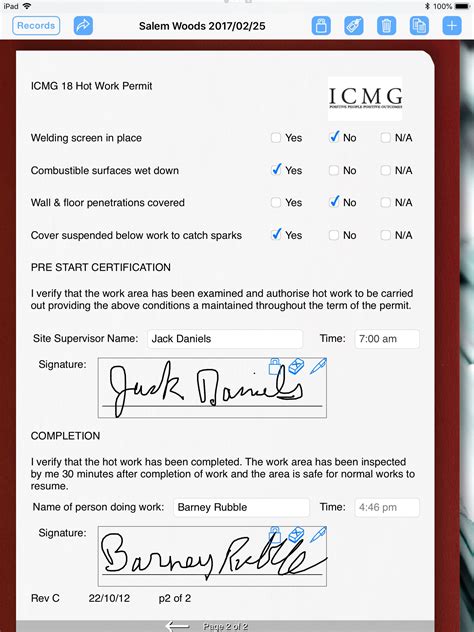

7. Signatures and Acknowledgments

The promissory note template should include a section for the signatures and acknowledgments of both parties, confirming their agreement to the terms and conditions of the loan.

Key Considerations:

- Ensure the signatures and acknowledgments are authentic and voluntary.

- Verify the signatures and acknowledgments are compliant with applicable laws and regulations.

Gallery of Promissory Note Templates

Promissory Note Template Gallery

By including these seven essential elements in a promissory note template, lenders and borrowers can ensure a comprehensive and enforceable loan agreement that protects the interests of both parties.