Intro

Download a free New Mexico Promissory Note Template and learn how to create a legally binding loan agreement. Understand the key elements, including repayment terms, interest rates, and default clauses. Use this guide to navigate the process and ensure a secure transaction, whether youre a lender or borrower in New Mexico.

The Land of Enchantment, New Mexico, is a state known for its rich cultural heritage, stunning natural beauty, and thriving business environment. As a business owner, investor, or individual, you may need to borrow or lend money to achieve your financial goals. In such cases, a promissory note is a vital document that outlines the terms of the loan, ensuring a smooth transaction and minimizing potential disputes. In this article, we will provide a comprehensive guide on New Mexico promissory note templates, including a free download and essential information to help you create a legally binding agreement.

Understanding Promissory Notes

A promissory note is a written promise by a borrower to repay a loan to the lender, typically with interest and within a specified timeframe. This document serves as a contract between the two parties, outlining the terms and conditions of the loan. Promissory notes are commonly used in various financial transactions, such as personal loans, mortgages, and business investments.

Benefits of Using a Promissory Note

Using a promissory note template offers several benefits to both lenders and borrowers. Some of the advantages include:

• Clarity and specificity: A promissory note clearly outlines the terms and conditions of the loan, ensuring both parties understand their obligations. • Legally binding: A promissory note is a legally binding document, providing a clear record of the agreement and helping to prevent disputes. • Flexibility: Promissory notes can be customized to suit the specific needs of the parties involved, allowing for flexible repayment terms and interest rates. • Protection: A promissory note protects both lenders and borrowers by providing a clear record of the loan and its terms, reducing the risk of misunderstandings or miscommunications.

Types of Promissory Notes

There are several types of promissory notes, each with its own unique characteristics and purposes. Some of the most common types include:

• Secured promissory notes: These notes are secured by collateral, such as property or assets, to reduce the risk of default. • Unsecured promissory notes: These notes are not secured by collateral, relying on the borrower's creditworthiness and ability to repay the loan. • Installment promissory notes: These notes require the borrower to make regular installment payments, typically monthly or quarterly. • Balloon promissory notes: These notes require a large payment, or "balloon payment," at the end of the loan term.

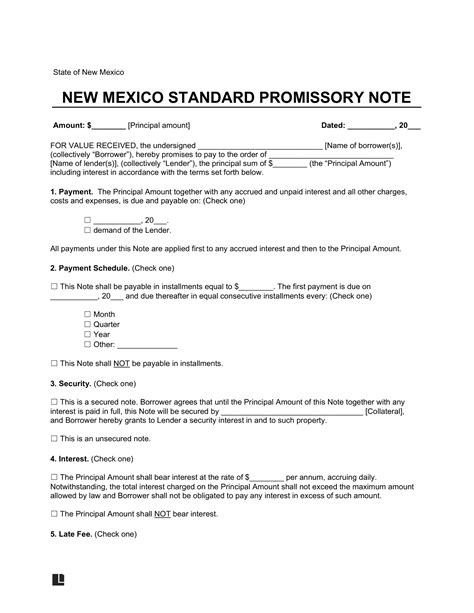

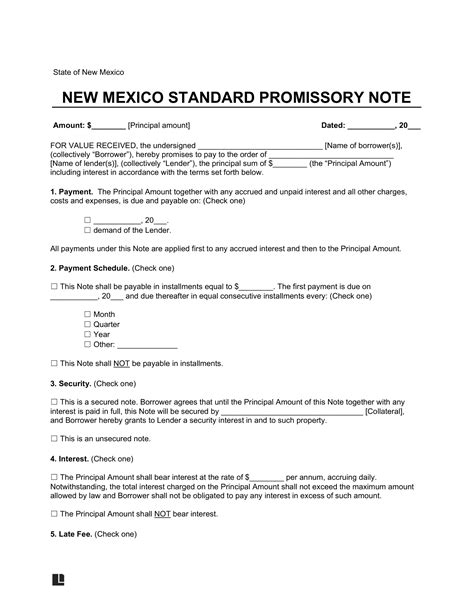

New Mexico Promissory Note Template

When creating a promissory note in New Mexico, it's essential to include the following elements:

• ** Parties involved**: Identify the lender and borrower, including their names, addresses, and contact information. • Loan amount: Specify the amount borrowed, including the interest rate and repayment terms. • Repayment terms: Outline the repayment schedule, including the payment amount, frequency, and due date. • Interest rate: Specify the interest rate, including the type (e.g., fixed or variable) and the calculation method. • Collateral: Identify any collateral securing the loan, including a description of the property or assets. • Default provisions: Outline the consequences of default, including late fees, penalties, and acceleration clauses.

Free Download: New Mexico Promissory Note Template

To help you create a comprehensive and legally binding promissory note, we offer a free download of our New Mexico promissory note template. This template is designed to provide a solid foundation for your agreement, ensuring that you include all the necessary elements and protections.

Download the New Mexico Promissory Note Template

Please note that this template is for informational purposes only and should not be used as a substitute for professional advice. It's essential to consult with an attorney or financial expert to ensure your promissory note complies with New Mexico state laws and regulations.

FAQs

Q: What is a promissory note? A: A promissory note is a written promise by a borrower to repay a loan to the lender, typically with interest and within a specified timeframe.

Q: What are the benefits of using a promissory note? A: Using a promissory note provides clarity and specificity, is legally binding, flexible, and offers protection for both lenders and borrowers.

Q: What types of promissory notes are available? A: Common types of promissory notes include secured, unsecured, installment, and balloon promissory notes.

Q: What elements should I include in a New Mexico promissory note? A: Essential elements include parties involved, loan amount, repayment terms, interest rate, collateral, and default provisions.

New Mexico Promissory Note Template Image Gallery

By following this guide and using our free New Mexico promissory note template, you can create a comprehensive and legally binding agreement that protects your interests and ensures a smooth transaction. Remember to consult with an attorney or financial expert to ensure compliance with state laws and regulations.

We hope this article has provided valuable insights and information on New Mexico promissory note templates. If you have any further questions or comments, please don't hesitate to share them below.