Pennsylvania, known as the Keystone State, has a rich history and a thriving economy. One of the essential documents used in various financial transactions in the state is the Pennsylvania promissory note template. This article will provide an in-depth understanding of the Pennsylvania promissory note template sample, its importance, and how to use it effectively.

Understanding the Pennsylvania Promissory Note Template

A promissory note is a legally binding document that outlines the terms and conditions of a loan or debt between two parties. It serves as a written promise to repay a debt, including the amount borrowed, interest rate, repayment schedule, and any other relevant terms. In Pennsylvania, a promissory note template is a standardized document that helps lenders and borrowers create a clear and enforceable agreement.

Benefits of Using a Pennsylvania Promissory Note Template

Using a Pennsylvania promissory note template offers several benefits to both lenders and borrowers. Some of the advantages include:

- Clarity and specificity: A promissory note template ensures that all terms and conditions are clearly outlined, reducing the risk of misunderstandings or disputes.

- Enforceability: A well-drafted promissory note is a legally binding document, making it easier to enforce repayment terms if the borrower defaults.

- Flexibility: A promissory note template can be customized to suit the specific needs of the parties involved, including the loan amount, interest rate, and repayment schedule.

Key Components of a Pennsylvania Promissory Note Template

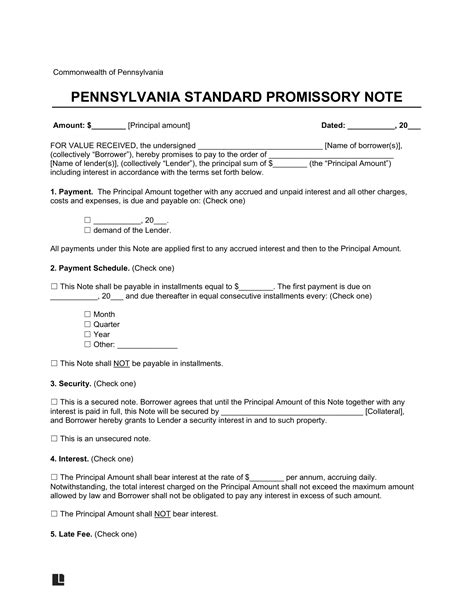

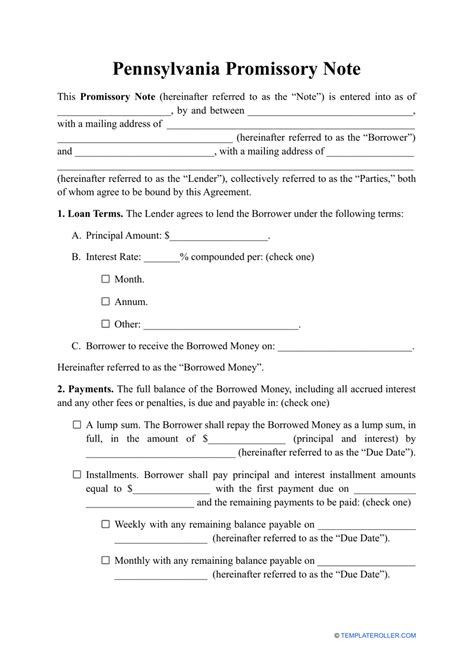

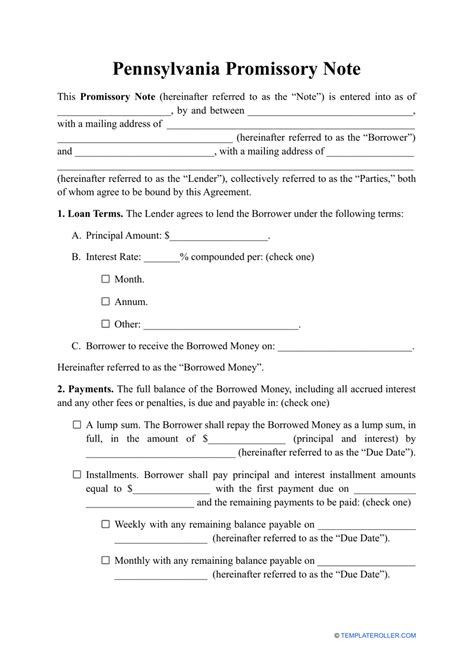

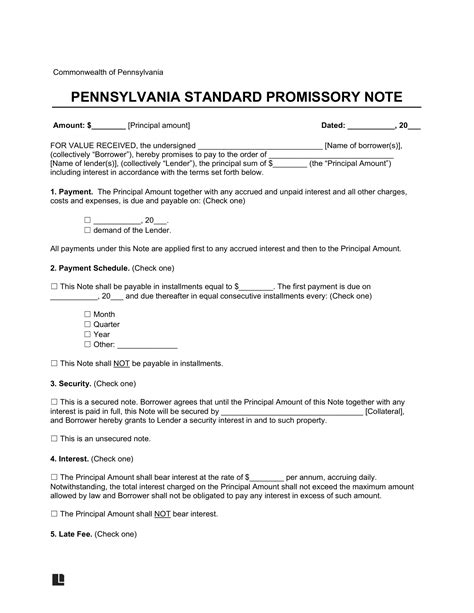

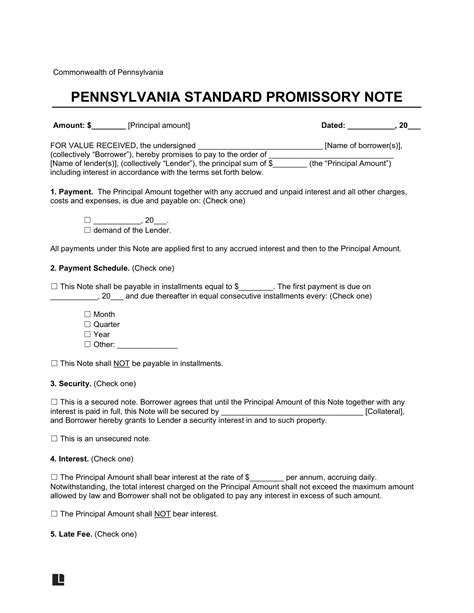

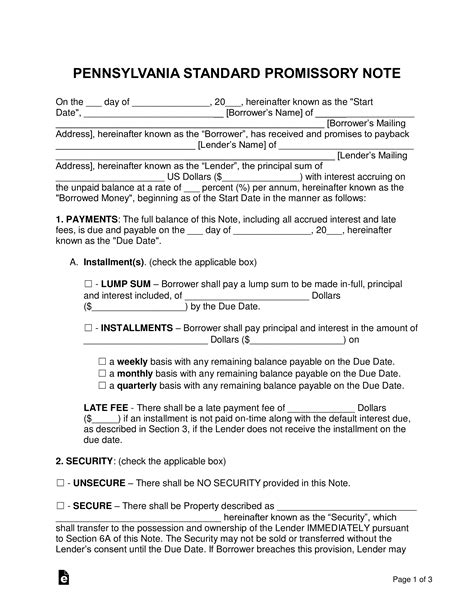

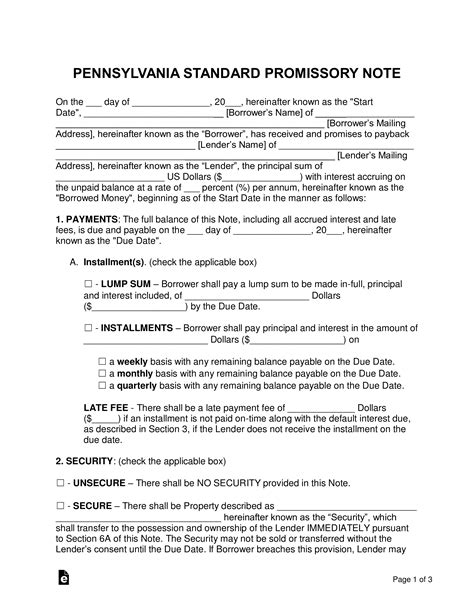

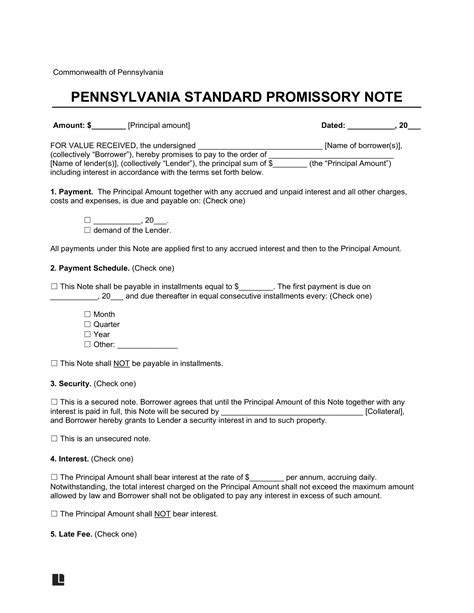

A Pennsylvania promissory note template typically includes the following key components:

- Borrower and lender information: The names and addresses of the borrower and lender are essential to identify the parties involved in the agreement.

- Loan amount: The amount borrowed, including any interest or fees, must be clearly stated.

- Interest rate: The interest rate, including any compounding frequency, must be specified.

- Repayment schedule: The repayment schedule, including the payment amount, frequency, and due dates, must be outlined.

- Default provisions: The consequences of default, including any late fees or penalties, must be clearly stated.

How to Use a Pennsylvania Promissory Note Template

Using a Pennsylvania promissory note template is straightforward. Here are the steps to follow:

- Download a sample template: Obtain a sample Pennsylvania promissory note template from a reputable source.

- Fill in the necessary information: Complete the template by filling in the borrower and lender information, loan amount, interest rate, repayment schedule, and default provisions.

- Customize the template: Review the template and customize it to suit the specific needs of the parties involved.

- Review and sign: Review the completed template carefully and sign it in the presence of a witness or notary public, if required.

Pennsylvania Promissory Note Template Sample

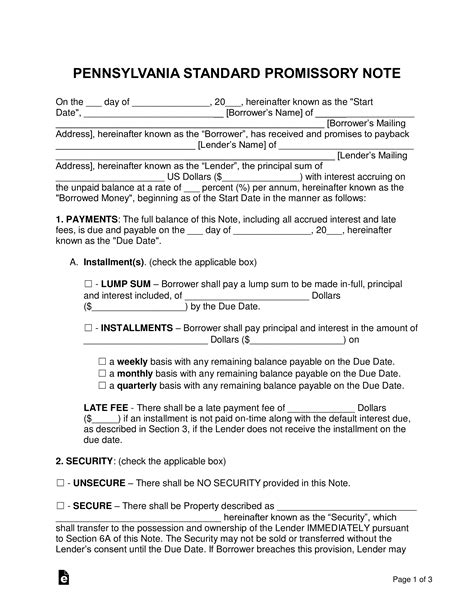

Here is a sample Pennsylvania promissory note template:

"PROMISSORY NOTE

This Promissory Note ('Note') is made and entered into on [DATE] ('Effective Date') by and between [BORROWER NAME] ('Borrower') and [LENDER NAME] ('Lender').

- Loan Amount: The Lender agrees to lend the Borrower the sum of $[LOAN AMOUNT] ('Loan Amount').

- Interest Rate: The Borrower agrees to pay interest on the Loan Amount at the rate of [INTEREST RATE]% per annum.

- Repayment Schedule: The Borrower agrees to repay the Loan Amount, including interest, in [NUMBER] equal installments of $[PAYMENT AMOUNT] each, due on the [DUE DATE] day of each month.

- Default Provisions: If the Borrower fails to make any payment when due, the entire Loan Amount shall become immediately due and payable.

By signing below, the parties acknowledge that they have read, understand, and agree to the terms and conditions of this Note.

BORROWER:

LENDER:

Date: [DATE]

Witness/Notary Public: [WITNESS/NOTARY PUBLIC]

FAQs

Q: What is a promissory note? A: A promissory note is a legally binding document that outlines the terms and conditions of a loan or debt between two parties.

Q: Why is a promissory note template important? A: A promissory note template ensures that all terms and conditions are clearly outlined, reducing the risk of misunderstandings or disputes.

Q: Can I customize a promissory note template? A: Yes, a promissory note template can be customized to suit the specific needs of the parties involved.

Q: What are the key components of a promissory note template? A: The key components of a promissory note template include borrower and lender information, loan amount, interest rate, repayment schedule, and default provisions.

Pennsylvania Promissory Note Template Image Gallery

We hope this article has provided a comprehensive understanding of the Pennsylvania promissory note template sample. By using a promissory note template, lenders and borrowers can create a clear and enforceable agreement that outlines the terms and conditions of a loan or debt. Remember to customize the template to suit your specific needs and review it carefully before signing. If you have any questions or need further assistance, please don't hesitate to ask.