Intro

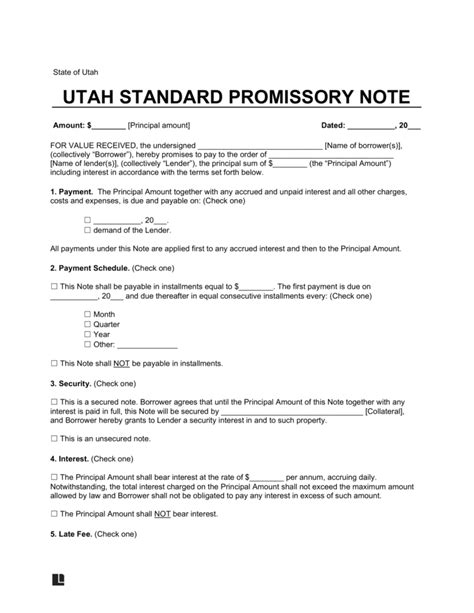

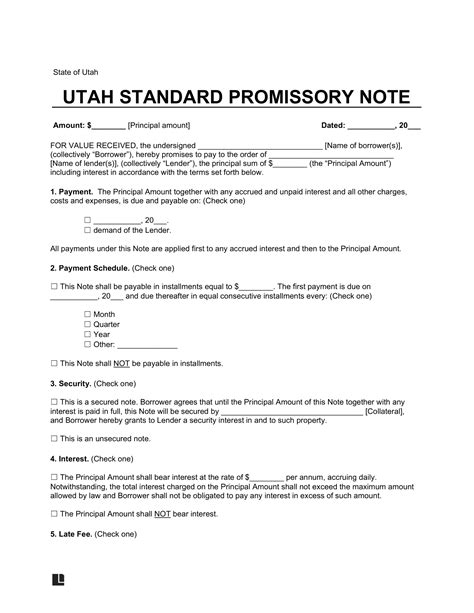

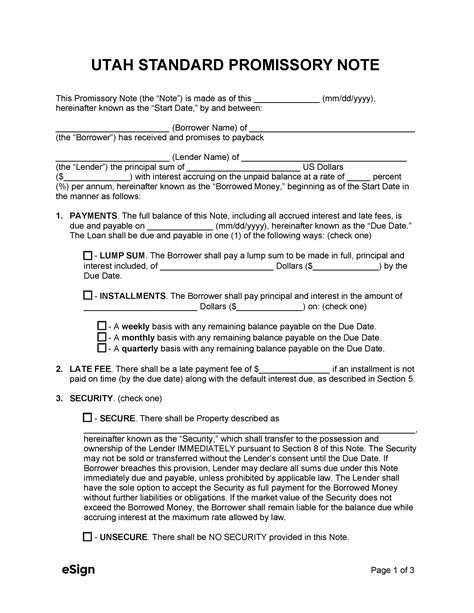

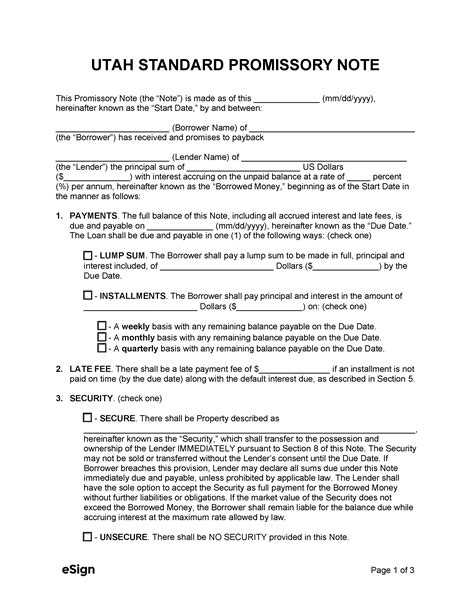

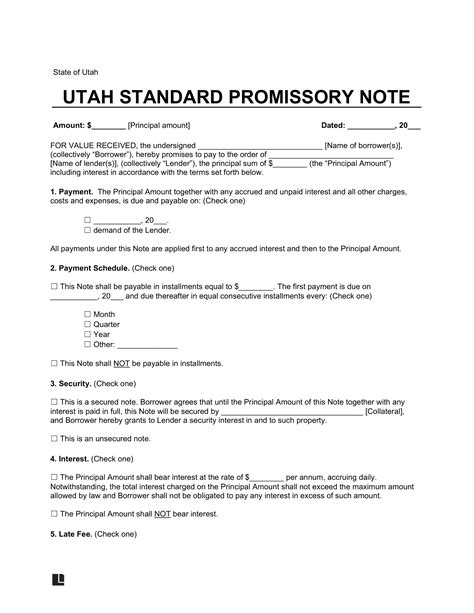

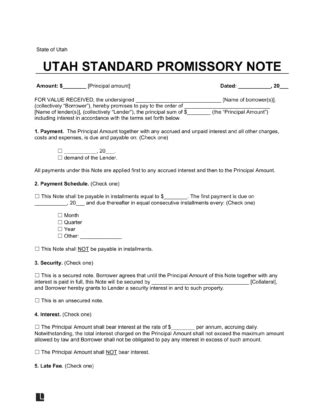

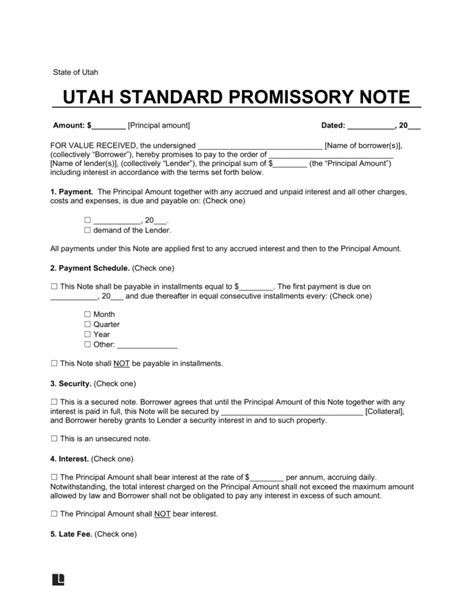

Secure loan agreements in Utah with a comprehensive promissory note template. Create a legally binding contract that outlines terms, interest rates, and repayment plans. Protect lenders and borrowers with a customizable template that includes essential clauses and provisions, ensuring a smooth loan process.

A Utah promissory note template is a crucial document used in securing loan agreements between two parties, typically a lender and a borrower. It outlines the terms and conditions of the loan, ensuring that both parties understand their obligations and responsibilities. In this article, we will delve into the importance of a promissory note template, its components, and how to create a secure loan agreement in Utah.

Why Do You Need a Promissory Note Template in Utah?

A promissory note template is essential for any loan agreement in Utah, as it provides a clear and concise record of the loan terms. This document helps prevent misunderstandings and disputes that may arise during the loan repayment period. By using a promissory note template, both parties can ensure that they understand their obligations and responsibilities, minimizing the risk of litigation.

Key Components of a Utah Promissory Note Template

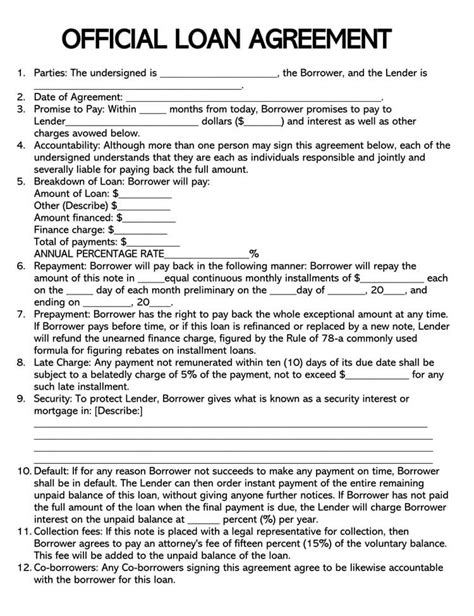

A typical Utah promissory note template includes the following key components:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The percentage of interest charged on the loan amount.

- Repayment Terms: The schedule of payments, including the payment amount, frequency, and due dates.

- Collateral: Any assets or property used to secure the loan.

- Default Provisions: The consequences of failing to meet the repayment terms, such as late fees or acceleration of the loan.

- Governing Law: The state laws that govern the loan agreement.

How to Create a Secure Loan Agreement in Utah

To create a secure loan agreement in Utah, follow these steps:

- Define the Loan Terms: Clearly outline the loan amount, interest rate, and repayment terms.

- Identify the Parties: Specify the lender and borrower's names, addresses, and contact information.

- Include Collateral: If applicable, describe the collateral used to secure the loan.

- Outline Default Provisions: Specify the consequences of default, such as late fees or acceleration of the loan.

- Governing Law: State that the loan agreement is governed by Utah state laws.

- Signatures: Obtain signatures from both parties, acknowledging their agreement to the terms.

Benefits of Using a Utah Promissory Note Template

Using a Utah promissory note template offers several benefits, including:

- Clarity: Clearly outlines the loan terms and conditions.

- Protection: Provides protection for both parties in case of disputes or litigation.

- Compliance: Ensures compliance with Utah state laws and regulations.

- Efficiency: Saves time and effort in creating a loan agreement from scratch.

Common Mistakes to Avoid When Using a Utah Promissory Note Template

When using a Utah promissory note template, avoid the following common mistakes:

- Insufficient Information: Failing to provide complete and accurate information.

- Ambiguous Language: Using vague or unclear language.

- Missing Signatures: Failing to obtain signatures from both parties.

- Non-Compliance: Failing to comply with Utah state laws and regulations.

Gallery of Utah Promissory Note Templates

Utah Promissory Note Template Image Gallery

In conclusion, a Utah promissory note template is a vital document for securing loan agreements between two parties. By using a template, you can ensure clarity, protection, and compliance with Utah state laws and regulations. Remember to avoid common mistakes and use the template effectively to create a secure loan agreement.