Intro

Create a legally binding Virginia Promissory Note with our essential template guide. Learn the 7 crucial elements to include, such as borrower and lender information, payment terms, and default clauses. Ensure your note is enforceable and compliant with Virginia state laws. Download a free template and safeguard your loan agreements.

In the state of Virginia, a promissory note is a legally binding document that outlines the terms of a loan between two parties. It is a crucial document that protects both the lender and the borrower by providing a clear understanding of the loan's terms and conditions. A Virginia promissory note template typically includes seven essential parts that make it a comprehensive and enforceable agreement. In this article, we will explore these essential parts and provide guidance on how to create a valid promissory note in Virginia.

Understanding the Importance of a Promissory Note

Before we dive into the essential parts of a Virginia promissory note template, it's essential to understand the importance of this document. A promissory note serves as a written promise by the borrower to repay the loan to the lender. It provides a clear understanding of the loan's terms, including the amount borrowed, interest rate, repayment terms, and any other conditions. This document helps prevent misunderstandings and disputes between the parties involved.

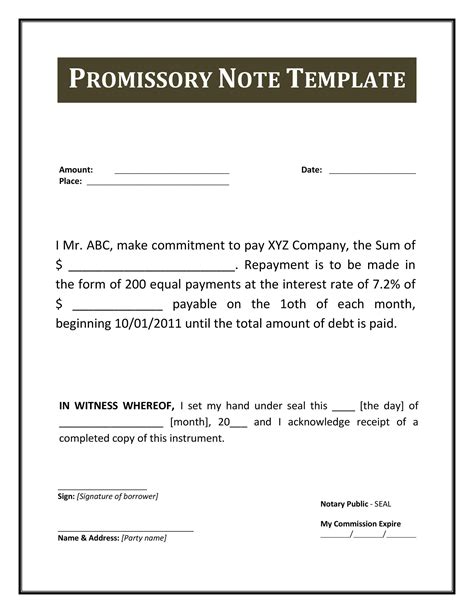

The Essential Parts of a Virginia Promissory Note Template

A Virginia promissory note template typically includes the following seven essential parts:

1. Parties Involved

The first essential part of a Virginia promissory note template is the identification of the parties involved. This includes the lender's name, address, and contact information, as well as the borrower's name, address, and contact information.

2. Loan Amount and Interest Rate

The second essential part is the loan amount and interest rate. This section outlines the amount borrowed, the interest rate, and how the interest will be calculated.

3. Repayment Terms

The third essential part is the repayment terms. This section outlines the repayment schedule, including the frequency of payments, the amount of each payment, and the due date for each payment.

4. Default and Late Payment Provisions

The fourth essential part is the default and late payment provisions. This section outlines the consequences of default or late payment, including any additional fees or penalties.

5. Security and Collateral

The fifth essential part is the security and collateral section. This section outlines any security or collateral provided by the borrower to secure the loan.

6. Governing Law and Jurisdiction

The sixth essential part is the governing law and jurisdiction section. This section outlines the laws that will govern the agreement and the jurisdiction in which any disputes will be resolved.

7. Signatures and Date

The seventh and final essential part is the signatures and date section. This section requires the signatures of both the lender and the borrower, as well as the date of signing.

Creating a Valid Promissory Note in Virginia

To create a valid promissory note in Virginia, it's essential to include all seven essential parts outlined above. Additionally, the document should be in writing, signed by both parties, and witnessed by a notary public. It's also recommended to have a lawyer review the document to ensure it complies with Virginia state laws.

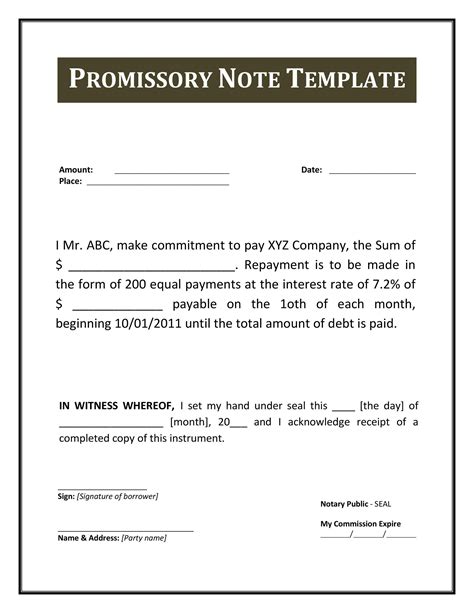

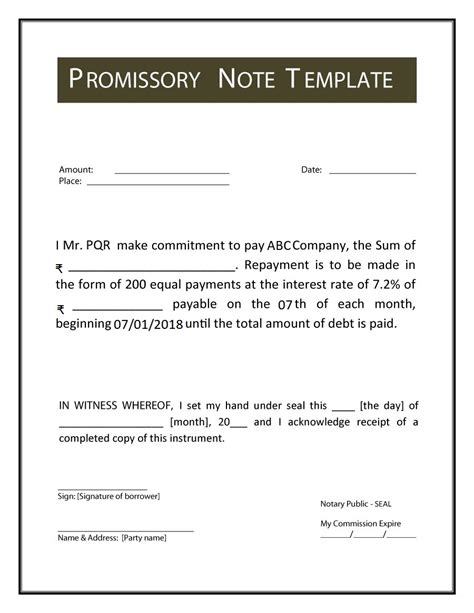

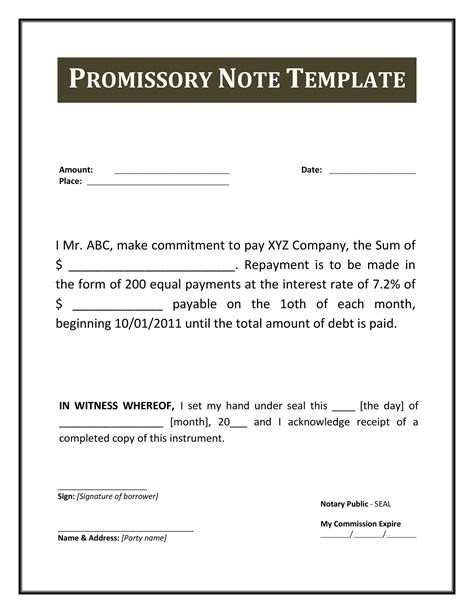

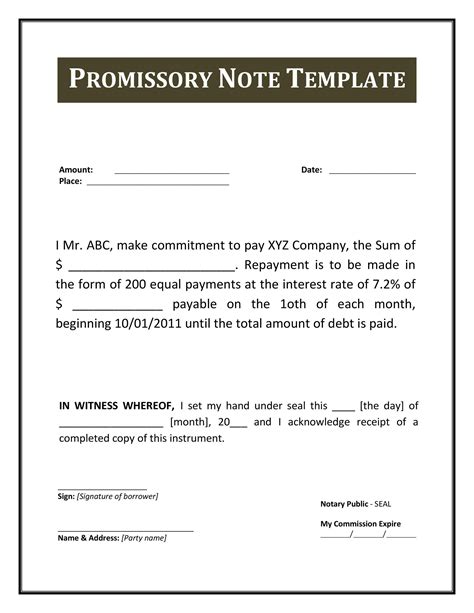

Gallery of Promissory Note Templates

Promissory Note Templates

Final Thoughts

A Virginia promissory note template is a crucial document that outlines the terms of a loan between two parties. By including all seven essential parts outlined above, you can create a comprehensive and enforceable agreement that protects both the lender and the borrower. Remember to have a lawyer review the document to ensure it complies with Virginia state laws. With this guide, you can create a valid promissory note that meets your needs and protects your interests.