Intro

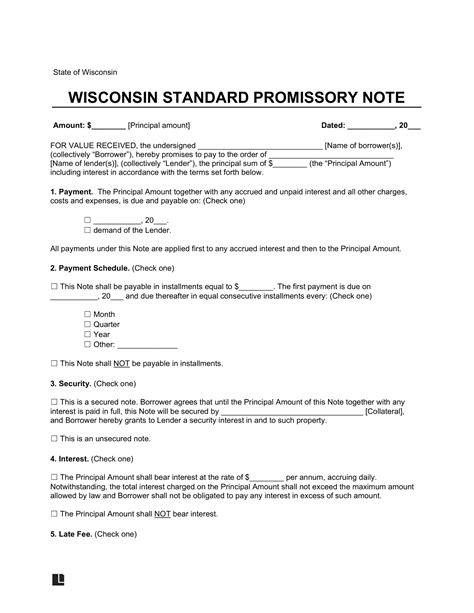

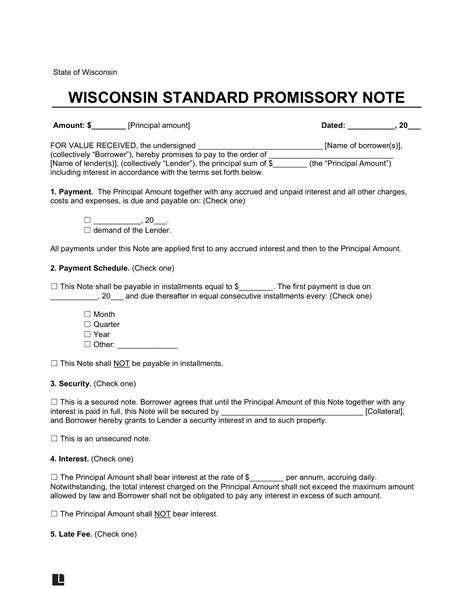

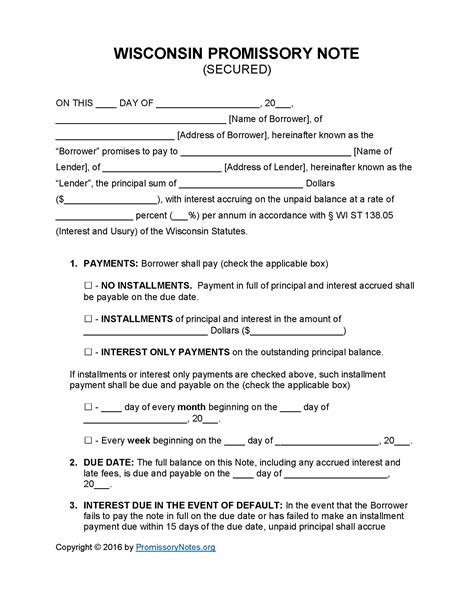

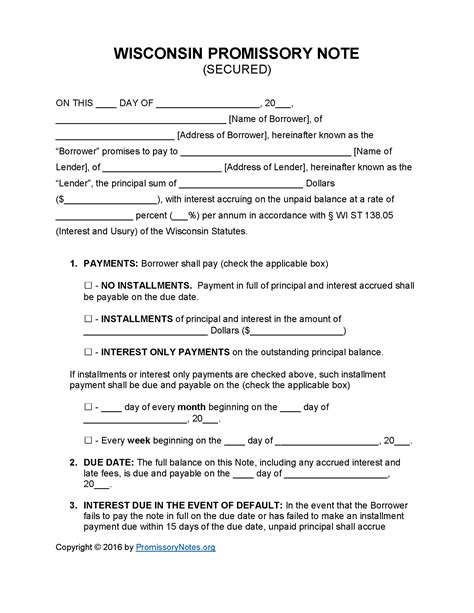

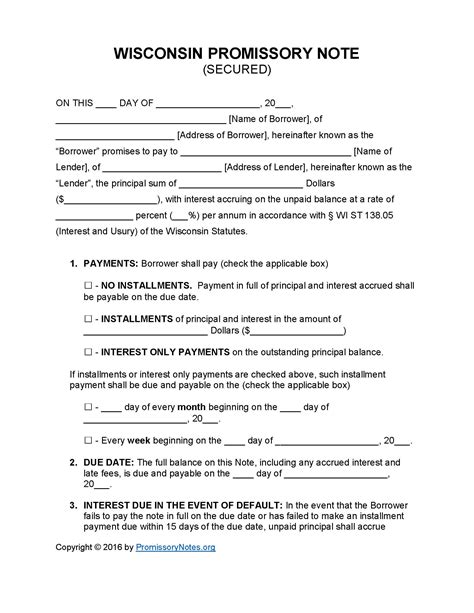

Secure your financial transactions with a comprehensive Wisconsin promissory note template. Learn the 5 essential elements to include, such as borrower and lender information, payment terms, interest rates, and default clauses. Create a legally binding agreement that protects your interests and facilitates smooth loan repayments in the Badger State.

When it comes to lending or borrowing money, a promissory note template is an essential document that outlines the terms and conditions of the loan. In Wisconsin, a promissory note is a legally binding contract between the borrower and the lender, and it's crucial to ensure that it includes all the necessary elements to avoid any disputes or misunderstandings. In this article, we'll explore the five essential elements of a promissory note template in Wisconsin.

Why Do You Need a Promissory Note Template in Wisconsin?

A promissory note template is a crucial document that provides a clear understanding of the loan terms, repayment schedule, and the rights and obligations of both parties involved. It helps to prevent disputes and ensures that the borrower and lender are on the same page. In Wisconsin, a promissory note is a necessary document for any loan transaction, and it's essential to include all the required elements to make it legally binding.

Essential Element #1: Parties Involved

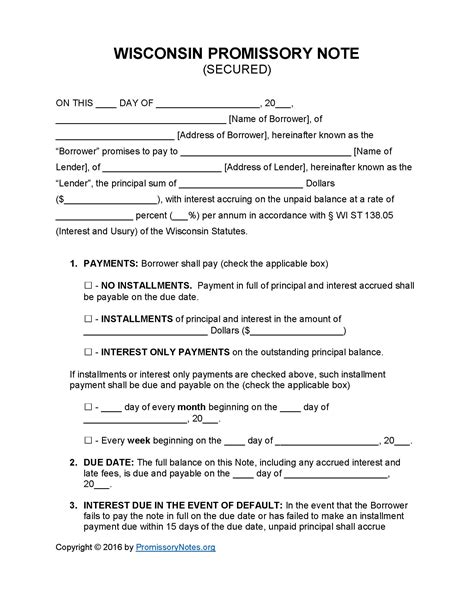

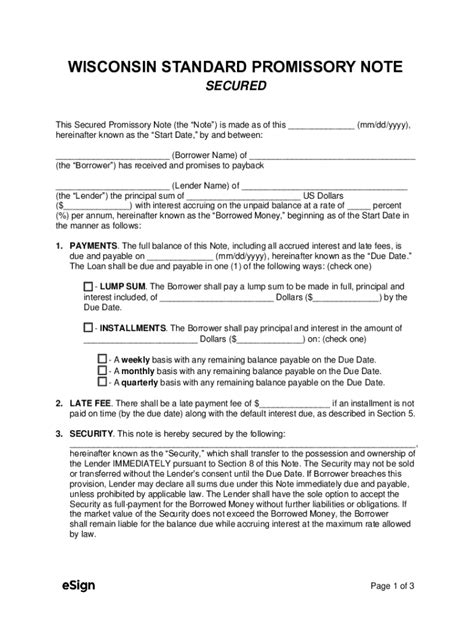

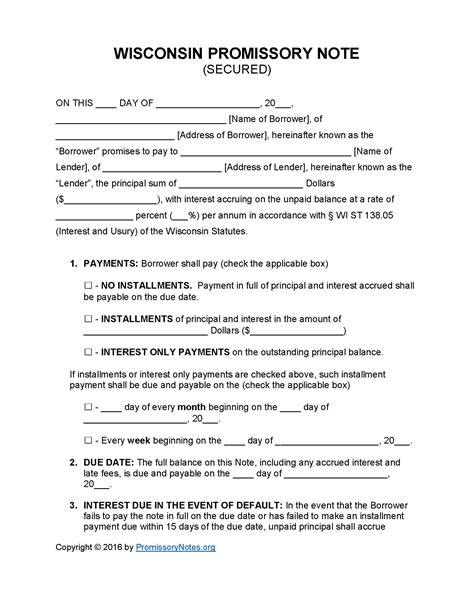

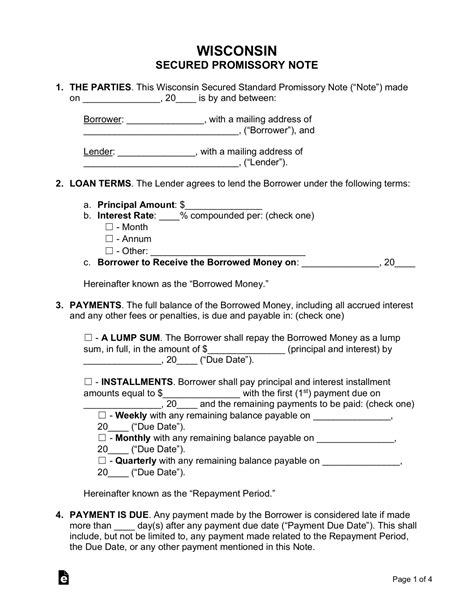

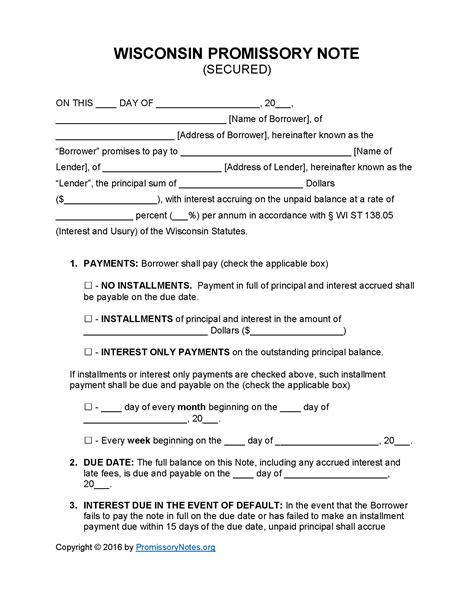

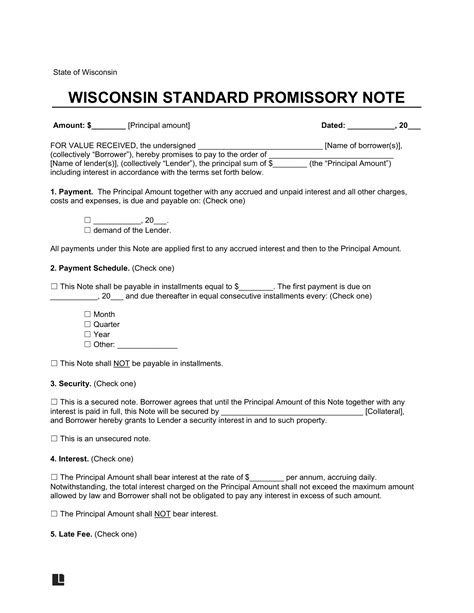

The first essential element of a promissory note template in Wisconsin is the identification of the parties involved. This includes the borrower's name, address, and contact information, as well as the lender's name, address, and contact information.

Essential Element #2: Loan Amount and Interest Rate

The second essential element of a promissory note template in Wisconsin is the loan amount and interest rate. This includes the principal amount borrowed, the interest rate, and the method of calculating interest. The interest rate can be fixed or variable, and it's essential to specify the interest rate and the method of calculation to avoid any disputes.

Essential Element #3: Repayment Terms

The third essential element of a promissory note template in Wisconsin is the repayment terms. This includes the repayment schedule, the amount of each payment, and the due date for each payment. The repayment terms should be clear and concise, and it's essential to specify the consequences of default or late payment.

Understanding Repayment Terms

Repayment terms are a critical component of a promissory note template in Wisconsin. The repayment terms should be clear and concise, and it's essential to specify the following:

- Repayment schedule: The repayment schedule should include the frequency of payments, the amount of each payment, and the due date for each payment.

- Payment amount: The payment amount should include the principal and interest, and it's essential to specify the method of calculating interest.

- Late payment fees: The promissory note template should specify the late payment fees and the consequences of default or late payment.

Essential Element #4: Default and Late Payment Provisions

The fourth essential element of a promissory note template in Wisconsin is the default and late payment provisions. This includes the consequences of default or late payment, such as late payment fees, acceleration of the loan, and the lender's right to demand payment in full.

Default and Late Payment Provisions

Default and late payment provisions are a critical component of a promissory note template in Wisconsin. The default and late payment provisions should be clear and concise, and it's essential to specify the following:

- Late payment fees: The promissory note template should specify the late payment fees and the method of calculating late payment fees.

- Acceleration of the loan: The promissory note template should specify the lender's right to accelerate the loan in the event of default or late payment.

- Demand for payment: The promissory note template should specify the lender's right to demand payment in full in the event of default or late payment.

Essential Element #5: Governing Law and Jurisdiction

The fifth essential element of a promissory note template in Wisconsin is the governing law and jurisdiction. This includes the state and federal laws that govern the loan, as well as the jurisdiction and venue for any disputes or litigation.

Governing Law and Jurisdiction

Governing law and jurisdiction are critical components of a promissory note template in Wisconsin. The governing law and jurisdiction should be clear and concise, and it's essential to specify the following:

- Governing law: The promissory note template should specify the state and federal laws that govern the loan.

- Jurisdiction and venue: The promissory note template should specify the jurisdiction and venue for any disputes or litigation.

Gallery of Promissory Note Template Wisconsin

Promissory Note Template Wisconsin Image Gallery

Conclusion

A promissory note template is a critical document that outlines the terms and conditions of a loan in Wisconsin. It's essential to include all the necessary elements, such as the parties involved, loan amount and interest rate, repayment terms, default and late payment provisions, and governing law and jurisdiction. By including these essential elements, you can ensure that your promissory note template is comprehensive, clear, and legally binding.