Intro

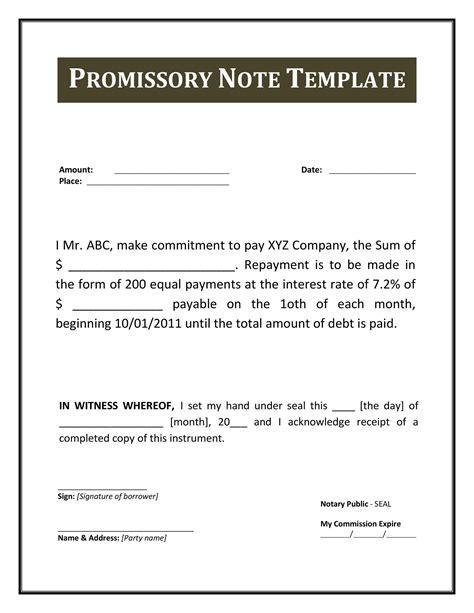

Create enforceable agreements with our 5 essential promissory note templates. Download customizable templates for personal, business, and real estate loans, ensuring compliance with lending laws. Streamline your lending process with our free promissory note samples, and protect your interests with legally binding loan agreements.

In the world of finance and business, a promissory note is a crucial document that outlines the terms of a loan or debt between two parties. It serves as a binding agreement, ensuring that the borrower repays the lender according to the agreed-upon conditions. With the right promissory note template, individuals and businesses can protect their interests and avoid potential disputes. In this article, we will explore five essential promissory note templates, their benefits, and how to use them effectively.

What is a Promissory Note?

A promissory note is a written promise to pay a debt or loan. It is a legally binding document that outlines the terms of the agreement, including the amount borrowed, interest rate, repayment schedule, and any collateral or security provided. Promissory notes can be used for various purposes, such as personal loans, business loans, mortgages, and more.

Benefits of Using a Promissory Note Template

Using a promissory note template offers several benefits, including:

- Clarity and precision: A template ensures that all essential terms and conditions are included, reducing the risk of misunderstandings or disputes.

- Efficiency: Templates save time and effort, allowing you to create a promissory note quickly and easily.

- Professionalism: A well-structured template presents a professional image, which is essential for business transactions.

- Protection: A promissory note template helps protect both parties' interests by outlining the terms and conditions of the loan.

5 Essential Promissory Note Templates

Here are five essential promissory note templates, each designed for specific purposes:

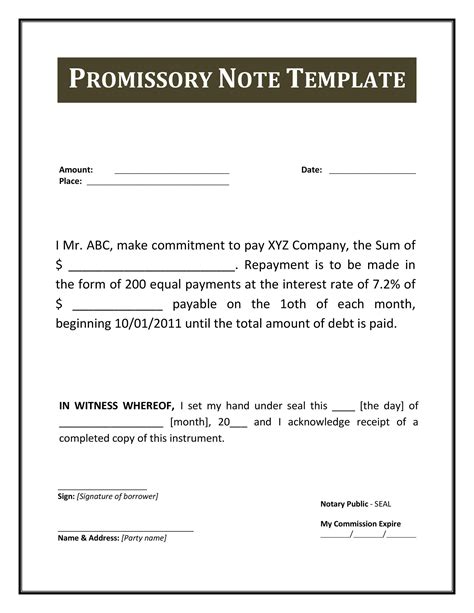

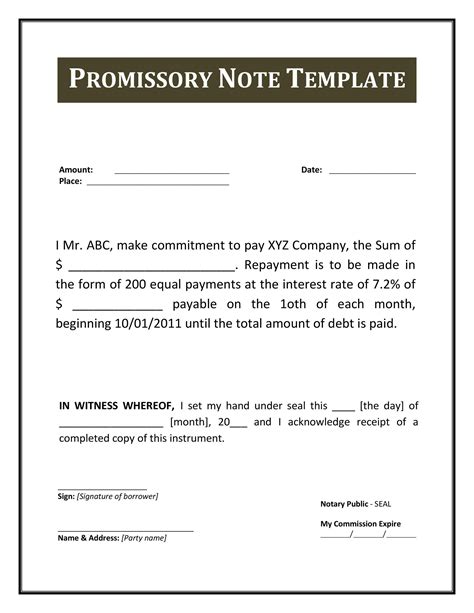

1. Personal Promissory Note Template

A personal promissory note template is ideal for loans between individuals, such as friends or family members. This template includes essential terms, such as:

- Loan amount and interest rate

- Repayment schedule and due dates

- Collateral or security (if applicable)

- Default and late payment provisions

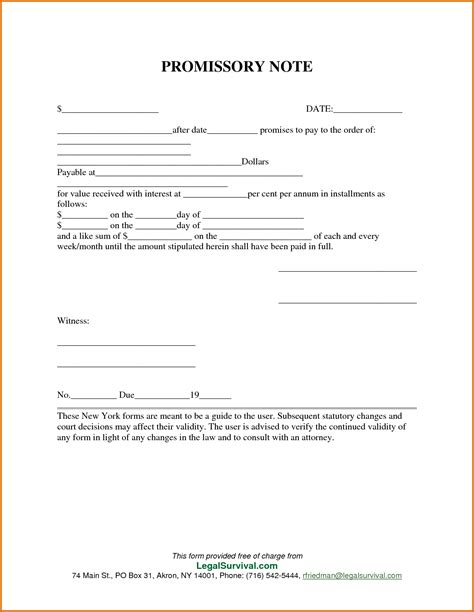

2. Business Promissory Note Template

A business promissory note template is designed for loans between businesses or individuals and companies. This template includes additional terms, such as:

- Business name and address

- Loan purpose and amount

- Interest rate and repayment schedule

- Collateral or security (if applicable)

- Default and late payment provisions

3. Mortgage Promissory Note Template

A mortgage promissory note template is used for loans secured by real property, such as a home or building. This template includes essential terms, such as:

- Property description and address

- Loan amount and interest rate

- Repayment schedule and due dates

- Collateral or security (the property itself)

- Default and late payment provisions

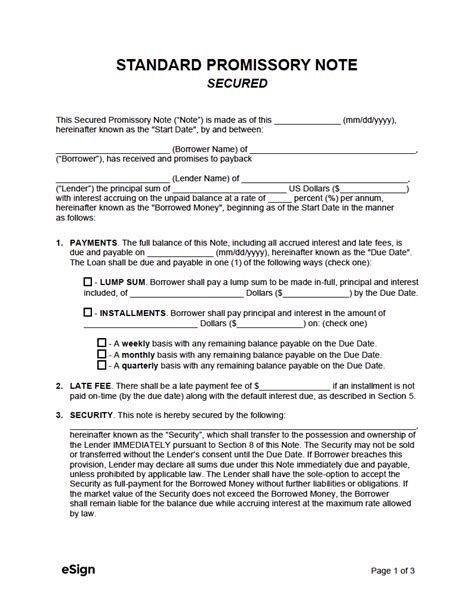

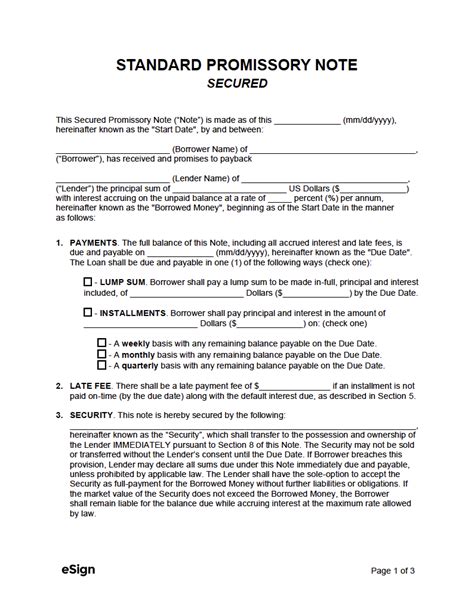

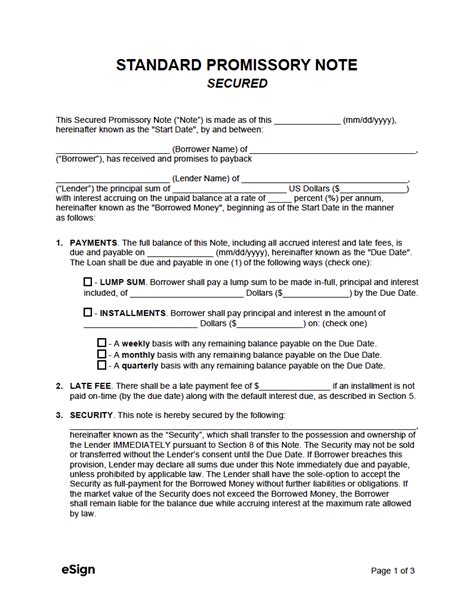

4. Secured Promissory Note Template

A secured promissory note template is used for loans secured by collateral, such as assets or equipment. This template includes essential terms, such as:

- Collateral description and value

- Loan amount and interest rate

- Repayment schedule and due dates

- Default and late payment provisions

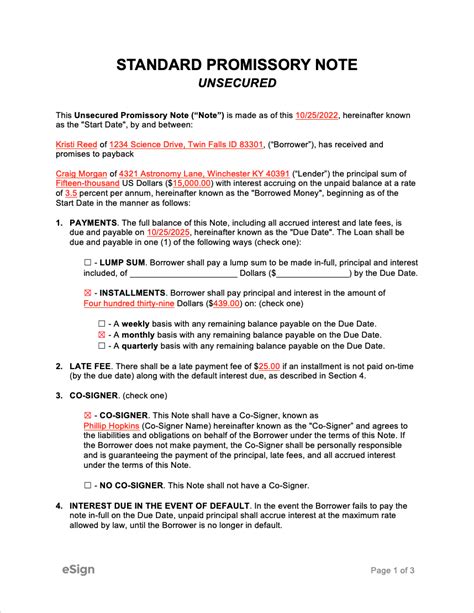

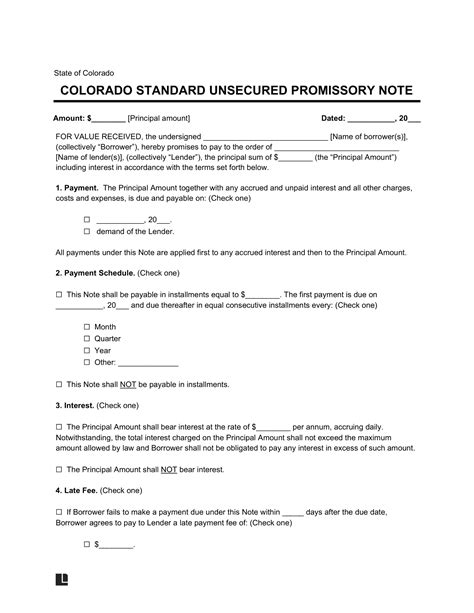

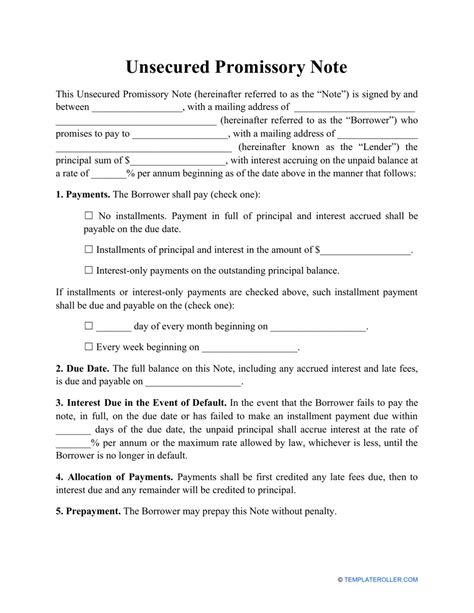

5. Unsecured Promissory Note Template

An unsecured promissory note template is used for loans without collateral, relying solely on the borrower's creditworthiness. This template includes essential terms, such as:

- Loan amount and interest rate

- Repayment schedule and due dates

- Default and late payment provisions

How to Use a Promissory Note Template Effectively

To use a promissory note template effectively, follow these steps:

- Choose the right template: Select a template that matches your specific needs and purposes.

- Fill in the blanks: Carefully fill in the required information, ensuring accuracy and completeness.

- Review and revise: Review the template, making any necessary revisions to ensure it meets your needs.

- Sign and date: Sign and date the promissory note, making it a binding agreement.

- Store safely: Store the promissory note in a safe and secure location, such as a file cabinet or digital storage.

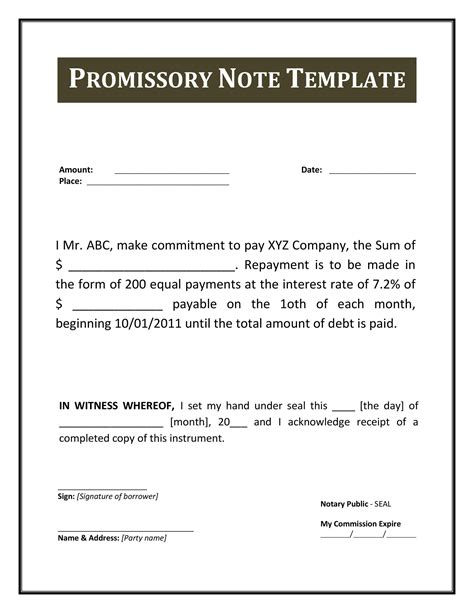

Promissory Note Templates Gallery

Conclusion

In conclusion, a promissory note template is an essential tool for individuals and businesses to ensure a smooth and secure lending process. By choosing the right template and following the steps outlined above, you can create a binding agreement that protects both parties' interests. Remember to review and revise the template carefully, and store it safely to avoid any potential disputes.

We hope this article has provided you with valuable insights into the world of promissory notes. If you have any questions or comments, please feel free to share them below.