Intro

Master QuickBooks Online setup with our 7-step guide. Ensure seamless accounting and bookkeeping by following our expert advice on setting up QuickBooks Online, including company file setup, chart of accounts configuration, and user access control. Streamline financial management and boost productivity with accurate QB setup.

As a small business owner, managing your finances effectively is crucial for success. One of the most popular accounting software solutions for small businesses is QuickBooks Online. With its user-friendly interface and robust features, QuickBooks Online can help you streamline your financial management, reduce errors, and increase productivity. However, setting up QuickBooks Online correctly is essential to ensure you get the most out of this powerful tool. In this article, we will guide you through the 7 essential QuickBooks Online setup steps to get you started.

Step 1: Create a QuickBooks Online Account

The first step in setting up QuickBooks Online is to create an account. To do this, go to the QuickBooks Online website and click on the "Sign Up" button. Fill out the registration form with your business information, including your business name, email address, and password. Once you've completed the registration process, you'll receive an email to verify your account.

Choose the Right QuickBooks Online Plan

When creating your account, you'll need to choose a QuickBooks Online plan that suits your business needs. QuickBooks Online offers four plans: Simple Start, Essentials, Plus, and Advanced. Each plan has different features and pricing, so it's essential to choose the one that best fits your business requirements.

Step 2: Set Up Your Company File

Once you've created your account and chosen your plan, it's time to set up your company file. This is where you'll enter your business information, including your company name, address, and tax ID number. You'll also need to set up your accounting preferences, such as your accounting method and fiscal year.

Enter Your Business Information

When setting up your company file, you'll need to enter your business information, including:

- Company name and address

- Tax ID number

- Accounting method (cash or accrual)

- Fiscal year

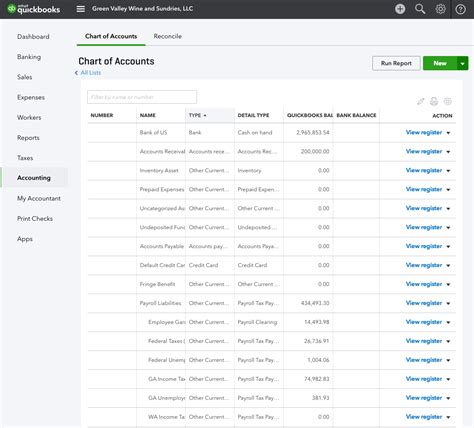

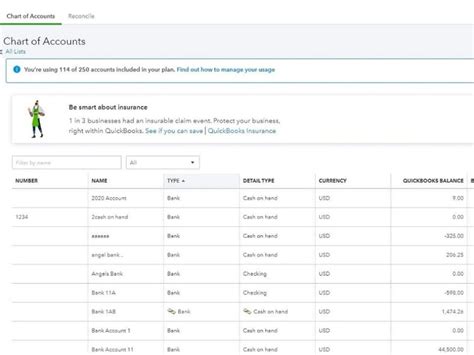

Step 3: Set Up Your Chart of Accounts

Your chart of accounts is the backbone of your accounting system. It's where you'll set up your accounts, including your assets, liabilities, equity, revenues, and expenses. QuickBooks Online provides a default chart of accounts, but you can customize it to fit your business needs.

Understand Your Chart of Accounts

When setting up your chart of accounts, it's essential to understand the different types of accounts:

- Assets: Cash, accounts receivable, inventory

- Liabilities: Accounts payable, loans payable

- Equity: Common stock, retained earnings

- Revenues: Sales, service revenue

- Expenses: Cost of goods sold, operating expenses

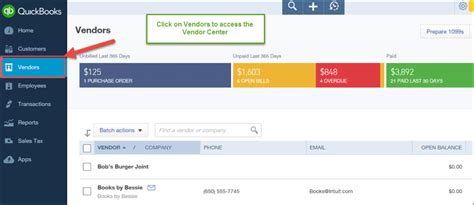

Step 4: Set Up Your Vendors and Customers

Your vendors and customers are essential to your business. In QuickBooks Online, you'll need to set up your vendors and customers to track your transactions and invoices.

Enter Your Vendors and Customers

When setting up your vendors and customers, you'll need to enter their information, including:

- Name and address

- Contact information

- Payment terms

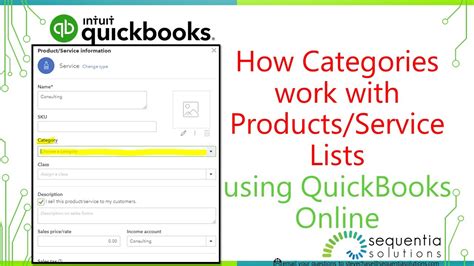

Step 5: Set Up Your Items and Services

Your items and services are what you sell to your customers. In QuickBooks Online, you'll need to set up your items and services to track your sales and inventory.

Enter Your Items and Services

When setting up your items and services, you'll need to enter their information, including:

- Name and description

- Price and cost

- Inventory quantities

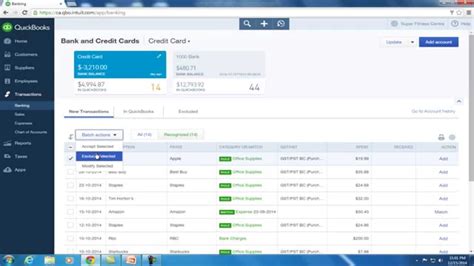

Step 6: Set Up Your Bank Feeds

Your bank feeds are essential to tracking your financial transactions. In QuickBooks Online, you can connect your bank accounts to track your transactions and reconcile your statements.

Connect Your Bank Accounts

When setting up your bank feeds, you'll need to connect your bank accounts to QuickBooks Online. This will allow you to track your transactions and reconcile your statements.

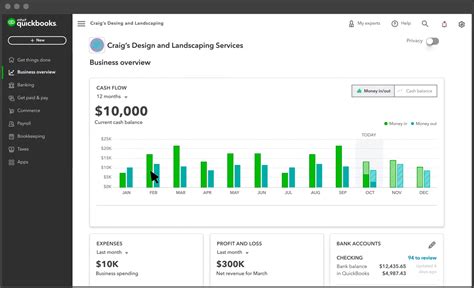

Step 7: Set Up Your Reporting and Analytics

Your reporting and analytics are essential to understanding your business performance. In QuickBooks Online, you can set up custom reports and analytics to track your financial performance.

Create Custom Reports

When setting up your reporting and analytics, you can create custom reports to track your financial performance. This includes:

- Balance sheet reports

- Income statement reports

- Cash flow reports

QuickBooks Online Setup Image Gallery

In conclusion, setting up QuickBooks Online correctly is essential to ensure you get the most out of this powerful accounting software. By following these 7 essential QuickBooks Online setup steps, you'll be able to streamline your financial management, reduce errors, and increase productivity. Take the first step today and start growing your business with confidence.

We hope you found this article helpful. If you have any questions or need further assistance, please don't hesitate to comment below. Share this article with your friends and colleagues who may benefit from it.