Intro

Maximize your real estate business with a comprehensive profit and loss template. Easily track income and expenses, stay on top of financial performance, and make data-driven decisions. Our expert guide provides a customizable template and actionable insights to boost your real estate agent profitability, revenue growth, and cash flow management.

As a real estate agent, managing your finances effectively is crucial to your success. One of the most essential tools to help you achieve this is a profit and loss template. In this article, we will explore the importance of using a real estate agent profit and loss template, its benefits, and provide a comprehensive guide on how to create and use one.

A profit and loss template, also known as an income statement, is a financial document that summarizes your revenue and expenses over a specific period. As a real estate agent, using a profit and loss template can help you track your income, identify areas where you can cut costs, and make informed decisions about your business.

Benefits of Using a Real Estate Agent Profit and Loss Template

Using a real estate agent profit and loss template can have numerous benefits for your business. Some of the most significant advantages include:

- Improved financial management: A profit and loss template helps you track your income and expenses, making it easier to manage your finances and make informed decisions.

- Increased profitability: By identifying areas where you can cut costs, you can increase your profitability and achieve your business goals.

- Enhanced decision-making: A profit and loss template provides you with a clear picture of your business's financial performance, enabling you to make informed decisions about investments, pricing, and other business strategies.

- Reduced stress: By having a clear understanding of your business's financial performance, you can reduce stress and anxiety, and focus on growing your business.

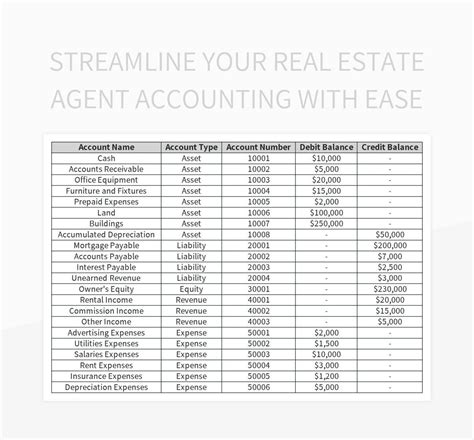

Components of a Real Estate Agent Profit and Loss Template

A real estate agent profit and loss template typically includes the following components:

- Revenue: This section includes all the income generated by your business, including commission income, referral fees, and other sources of revenue.

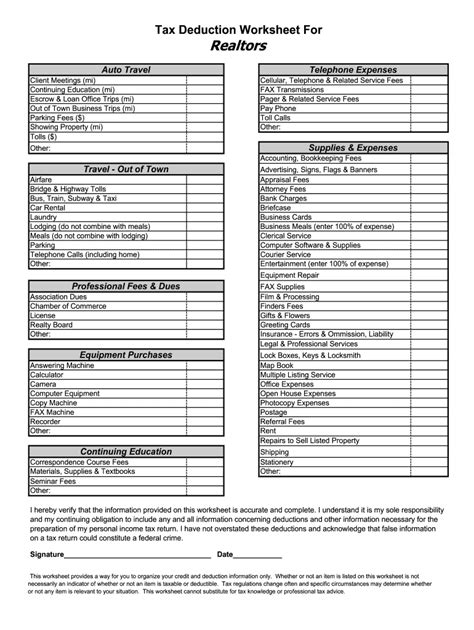

- Cost of goods sold: This section includes the direct costs associated with selling a property, such as marketing expenses, staging costs, and other direct expenses.

- Operating expenses: This section includes indirect expenses, such as office expenses, salaries, and benefits, insurance, and other overhead costs.

- Non-operating income and expenses: This section includes income and expenses that are not directly related to your business operations, such as interest income, interest expenses, and gains or losses from investments.

Creating a Real Estate Agent Profit and Loss Template

Creating a real estate agent profit and loss template is relatively straightforward. You can use a spreadsheet software like Microsoft Excel or Google Sheets to create a template. Here's a step-by-step guide to help you get started:

- Determine your accounting period: Decide on the accounting period for which you want to create the template. This could be monthly, quarterly, or annually.

- Identify your revenue streams: List all the revenue streams for your business, including commission income, referral fees, and other sources of revenue.

- List your expenses: Identify all the expenses associated with your business, including direct and indirect expenses.

- Categorize your expenses: Categorize your expenses into different sections, such as cost of goods sold, operating expenses, and non-operating income and expenses.

- Create a template: Use a spreadsheet software to create a template that includes all the components mentioned above.

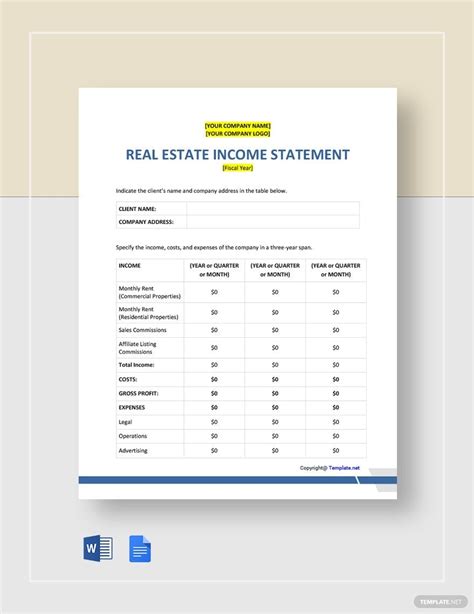

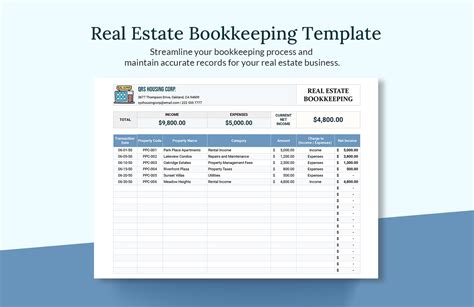

Example of a Real Estate Agent Profit and Loss Template

Here's an example of a real estate agent profit and loss template:

| Revenue | January | February | March |

|---|---|---|---|

| Commission income | $10,000 | $12,000 | $15,000 |

| Referral fees | $1,000 | $1,500 | $2,000 |

| Other revenue | $500 | $1,000 | $1,500 |

| Total revenue | $11,500 | $14,500 | $18,500 |

| Cost of goods sold | January | February | March |

|---|---|---|---|

| Marketing expenses | $1,500 | $2,000 | $2,500 |

| Staging costs | $1,000 | $1,500 | $2,000 |

| Other direct expenses | $500 | $1,000 | $1,500 |

| Total cost of goods sold | $3,000 | $4,500 | $6,000 |

| Operating expenses | January | February | March |

|---|---|---|---|

| Office expenses | $1,000 | $1,500 | $2,000 |

| Salaries and benefits | $2,000 | $2,500 | $3,000 |

| Insurance | $500 | $1,000 | $1,500 |

| Total operating expenses | $3,500 | $5,000 | $6,500 |

| Non-operating income and expenses | January | February | March |

|---|---|---|---|

| Interest income | $100 | $200 | $300 |

| Interest expenses | $500 | $1,000 | $1,500 |

| Total non-operating income and expenses | -$400 | -$800 | -$1,200 |

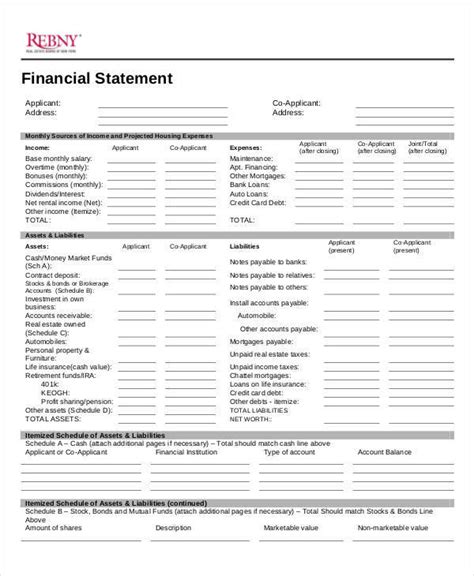

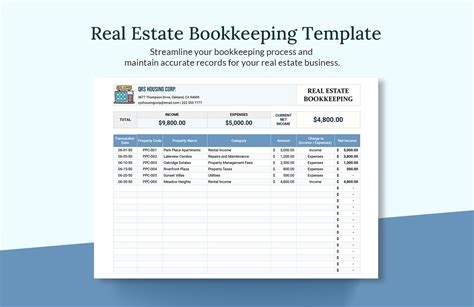

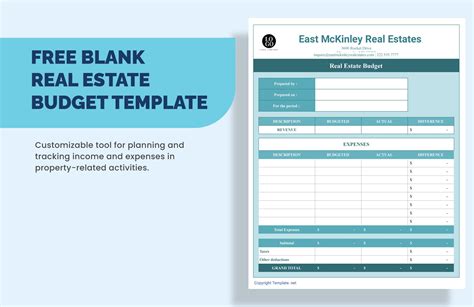

Gallery of Real Estate Agent Profit and Loss Templates

Real Estate Agent Profit and Loss Template Gallery

Conclusion

In conclusion, using a real estate agent profit and loss template is essential for managing your finances effectively, increasing profitability, and making informed decisions about your business. By following the steps outlined in this article, you can create a template that meets your specific needs and helps you achieve your business goals. Remember to regularly review and update your template to ensure it remains accurate and relevant.

We hope this article has provided you with a comprehensive guide to creating and using a real estate agent profit and loss template. If you have any questions or need further assistance, please don't hesitate to comment below.