Intro

Unlock the secrets to real estate investing with our 5-step guide to mastering the Real Estate DCF Model Template. Learn how to accurately forecast cash flows, calculate net present value, and make informed investment decisions using discounted cash flow analysis, financial modeling, and real estate valuation techniques.

The world of real estate investing can be complex and intimidating, especially for those new to the field. One of the most effective tools for evaluating real estate investment opportunities is the Real Estate DCF (Discounted Cash Flow) Model Template. In this article, we will break down the 5 steps to master this template and provide you with the knowledge to confidently analyze potential investments.

Real estate investing involves a significant amount of risk, and making informed decisions is crucial to achieving success. The Real Estate DCF Model Template is a widely accepted and powerful tool for evaluating the potential return on investment (ROI) of a property. By mastering this template, you'll be able to analyze various investment scenarios, identify potential pitfalls, and make data-driven decisions.

What is a Real Estate DCF Model Template?

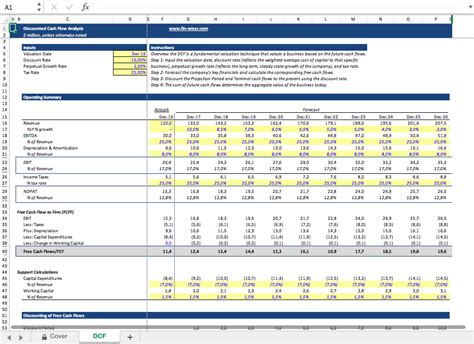

A Real Estate DCF Model Template is a financial model that estimates the present value of future cash flows from a real estate investment. It takes into account various factors such as property income, expenses, capital expenditures, and debt financing to determine the net present value (NPV) of the investment.

Step 1: Gathering Data and Inputs

The first step in mastering the Real Estate DCF Model Template is to gather the necessary data and inputs. This includes:

- Property income: Rental income, sales revenue, or other sources of income

- Property expenses: Operating expenses, maintenance costs, property taxes, and insurance

- Capital expenditures: Renovations, upgrades, or other one-time expenses

- Debt financing: Loan terms, interest rates, and repayment schedules

- Market data: Cap rates, discount rates, and other market-specific metrics

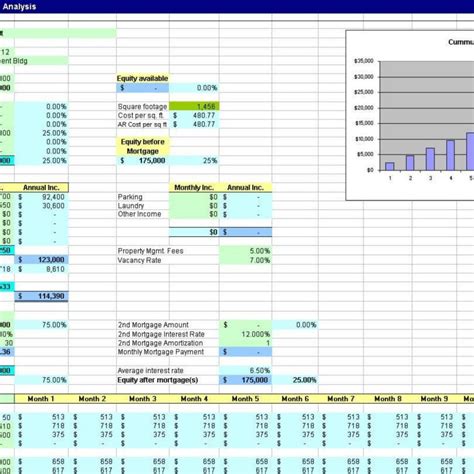

Step 2: Setting Up the Model

Once you have gathered the necessary data and inputs, it's time to set up the model. This involves:

- Creating a timeline for the investment: This includes the holding period, cash flow projections, and exit strategy

- Estimating cash flows: Based on the data and inputs gathered, estimate the cash flows for each year of the holding period

- Applying the discount rate: Apply the discount rate to the cash flows to determine the present value

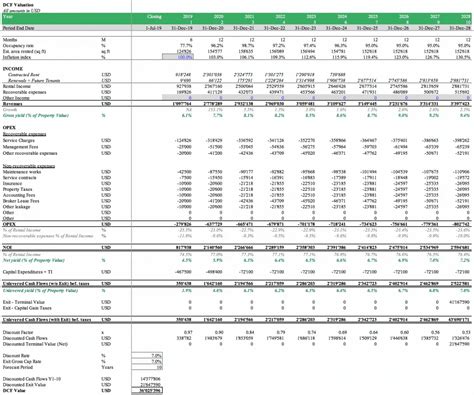

Step 3: Calculating the Net Present Value (NPV)

The NPV is the most critical output of the Real Estate DCF Model Template. It represents the present value of the future cash flows from the investment. To calculate the NPV:

- Discount the cash flows: Apply the discount rate to each cash flow to determine the present value

- Calculate the NPV: Sum up the present value of all cash flows to determine the NPV

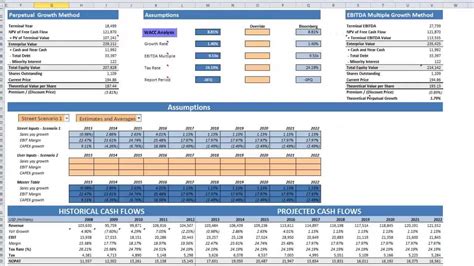

Step 4: Sensitivity Analysis and Scenario Planning

No investment is without risk, and it's essential to test the sensitivity of the model to various inputs and assumptions. This involves:

- Conducting sensitivity analysis: Test the model's sensitivity to changes in inputs such as cap rates, discount rates, and cash flows

- Creating scenario plans: Develop alternative scenarios to account for potential risks and opportunities

Step 5: Interpreting Results and Making Decisions

The final step is to interpret the results of the model and make informed decisions. This involves:

- Evaluating the NPV: Determine if the NPV is positive, negative, or zero

- Analyzing the results: Consider the results in the context of the investment goals and risk tolerance

- Making decisions: Based on the results, decide whether to proceed with the investment, negotiate terms, or walk away

By following these 5 steps, you'll be able to master the Real Estate DCF Model Template and make informed decisions about potential investments.

Gallery of Real Estate DCF Model Templates

Real Estate DCF Model Template Gallery

By mastering the Real Estate DCF Model Template, you'll be able to analyze potential investments with confidence and make informed decisions. Remember to always keep learning and adapting to new situations, and don't be afraid to seek help when needed.

Final Thoughts

In conclusion, the Real Estate DCF Model Template is a powerful tool for evaluating real estate investment opportunities. By following the 5 steps outlined in this article, you'll be able to master this template and make informed decisions about potential investments. Remember to always keep learning, stay adaptable, and seek help when needed.

Share Your Thoughts

What are your thoughts on the Real Estate DCF Model Template? Have you used it before? Share your experiences and insights in the comments below!