Intro

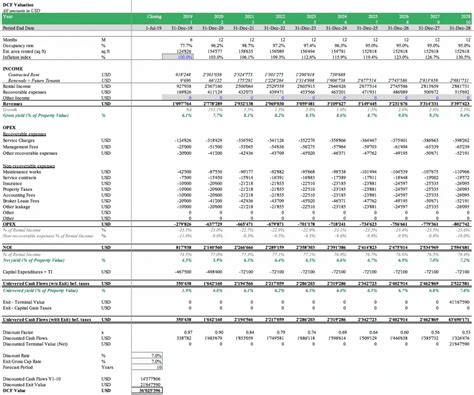

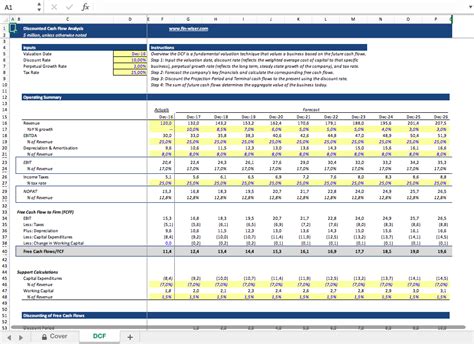

Unlock accurate real estate valuations with our free Real Estate DCF Model Excel Template Download. Master discounted cash flow analysis for property investments using this comprehensive template, incorporating key metrics such as Net Operating Income (NOI), Capitalization Rate, and Weighted Average Cost of Capital (WACC).

As a real estate investor or analyst, having a reliable and accurate discounted cash flow (DCF) model is crucial for making informed investment decisions. A DCF model helps you estimate the present value of future cash flows of a real estate investment, allowing you to determine its potential return on investment (ROI). In this article, we will explore the concept of a real estate DCF model, its components, and provide a free Excel template for download.

What is a Real Estate DCF Model?

A real estate DCF model is a financial model used to estimate the present value of future cash flows of a real estate investment. It takes into account the initial investment, operating cash flows, and terminal value of the property to determine its potential ROI. The DCF model is widely used in real estate investment analysis, as it provides a comprehensive framework for evaluating the financial performance of a property.

Components of a Real Estate DCF Model

A typical real estate DCF model consists of the following components:

- Initial Investment: The initial purchase price of the property, including any closing costs or other expenses.

- Operating Cash Flows: The annual cash flows generated by the property, including rental income, expenses, and capital expenditures.

- Terminal Value: The estimated value of the property at the end of the holding period, typically calculated using a capitalization rate or a multiple of earnings.

- Discount Rate: The rate used to discount future cash flows to their present value, reflecting the time value of money and the risk associated with the investment.

- Holding Period: The length of time the property is expected to be held, typically ranging from 5 to 10 years.

How to Create a Real Estate DCF Model in Excel

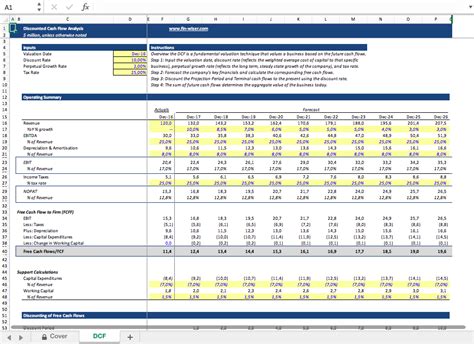

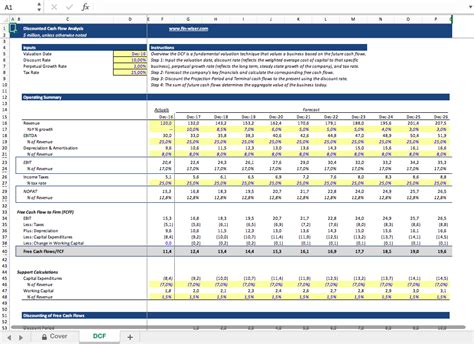

Creating a real estate DCF model in Excel involves setting up a spreadsheet with the following steps:

- Input Assumptions: Enter the initial investment, operating cash flows, terminal value, discount rate, and holding period into the spreadsheet.

- Calculate Cash Flows: Calculate the annual cash flows using the operating cash flows and terminal value.

- Discount Cash Flows: Discount the future cash flows to their present value using the discount rate and holding period.

- Calculate Net Present Value (NPV): Calculate the NPV of the investment by summing the present value of the cash flows.

- Calculate Internal Rate of Return (IRR): Calculate the IRR of the investment by finding the discount rate that sets the NPV equal to zero.

Real Estate DCF Model Excel Template Free Download

To help you get started with creating your own real estate DCF model, we are providing a free Excel template for download. The template includes the following features:

- Pre-built formulas for calculating cash flows, discounting cash flows, and calculating NPV and IRR

- Input sections for entering assumptions and data

- Output sections for displaying results

- Sample data for illustration purposes

You can download the template by clicking on the link below:

[Insert link to download template]

Using the Real Estate DCF Model Excel Template

To use the template, follow these steps:

- Enter Assumptions: Enter the initial investment, operating cash flows, terminal value, discount rate, and holding period into the input sections.

- Review Output: Review the output sections to see the calculated cash flows, NPV, and IRR.

- Analyze Results: Analyze the results to determine the potential ROI of the investment.

- Refine Assumptions: Refine your assumptions and re-run the model to see how changes affect the results.

Gallery of Real Estate DCF Model Excel Templates

Real Estate DCF Model Excel Templates

We hope this article has provided you with a comprehensive understanding of the real estate DCF model and how to create one in Excel. By using the free Excel template provided, you can start analyzing potential real estate investments and making informed decisions.