Intro

Boost your real estate investment analysis with these 5 free Excel templates for financial modeling. Easily calculate key metrics, track cash flows, and create detailed financial projections. Get instant access to customizable templates for property valuation, rental income, and investment returns. Simplify your financial modeling and make data-driven decisions with these free Excel templates.

Real estate financial modeling is a crucial aspect of the property development and investment process. It helps investors, developers, and analysts to evaluate the financial viability of a project, identify potential risks, and make informed decisions. Microsoft Excel is a widely used tool for real estate financial modeling due to its flexibility, functionality, and ease of use. In this article, we will explore five free Excel templates for real estate financial modeling that can help you streamline your analysis and make more accurate predictions.

Benefits of Using Excel Templates for Real Estate Financial Modeling

Using Excel templates for real estate financial modeling offers numerous benefits, including:

- Increased efficiency: Excel templates can save you time and effort by providing a pre-built structure and formulas for your financial models.

- Improved accuracy: Templates can help reduce errors and ensure consistency in your financial models, leading to more accurate predictions and better decision-making.

- Enhanced transparency: Excel templates make it easier to understand and communicate complex financial data to stakeholders, including investors, lenders, and partners.

- Customization: Templates can be tailored to suit specific project requirements, allowing you to focus on the unique aspects of your real estate development or investment project.

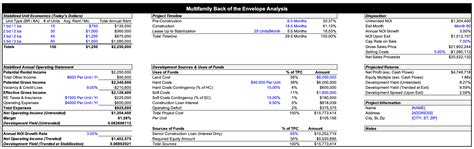

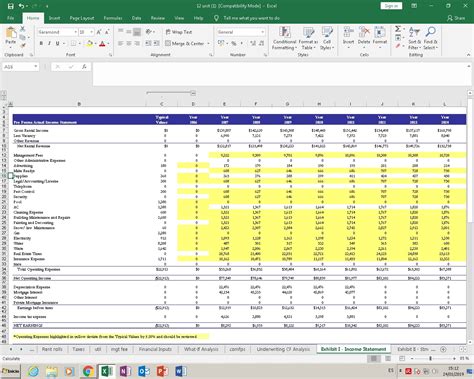

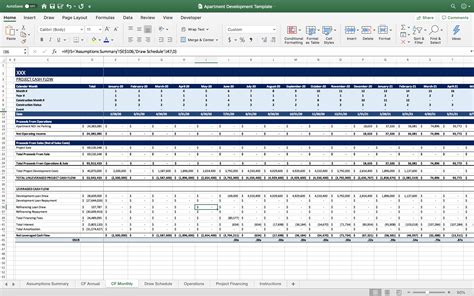

Template 1: Real Estate Development Pro Forma Template

This template provides a comprehensive framework for evaluating the financial viability of a real estate development project. It includes sections for:

- Project assumptions: Input your project's key assumptions, such as construction costs, rental income, and vacancy rates.

- Income statement: Generate a projected income statement based on your project's revenue and expenses.

- Cash flow statement: Create a projected cash flow statement to analyze your project's liquidity and funding requirements.

- Break-even analysis: Determine the break-even point for your project, including the minimum occupancy rate required to cover expenses.

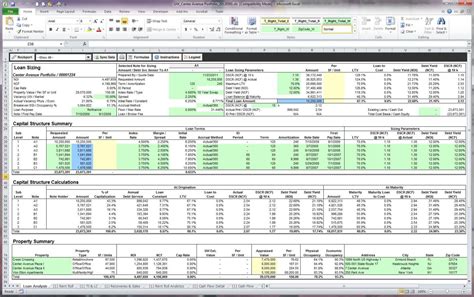

Template 2: Real Estate Investment Analysis Template

This template is designed for analyzing the financial performance of existing or potential real estate investments. It includes sections for:

- Property details: Input the property's key characteristics, such as location, size, and age.

- Financial performance: Analyze the property's historical financial performance, including income, expenses, and cash flow.

- Valuation: Estimate the property's value using various methods, such as the income approach, sales comparison approach, and cost approach.

- Sensitivity analysis: Test the sensitivity of your valuation to changes in key assumptions, such as discount rates and growth rates.

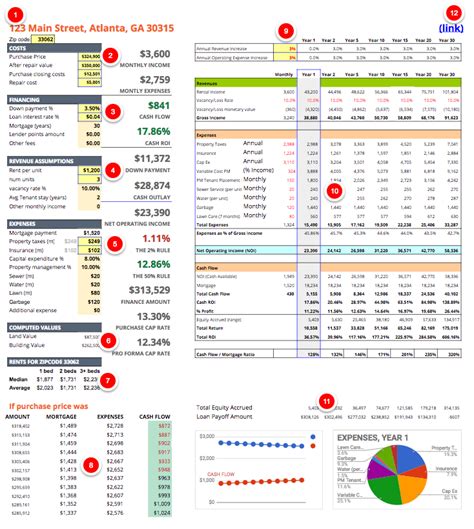

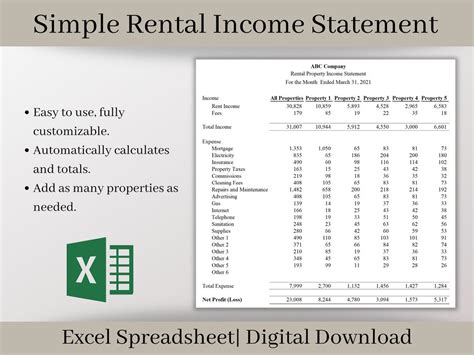

Template 3: Real Estate Rental Property Template

This template is designed for analyzing the financial performance of rental properties. It includes sections for:

- Rental income: Calculate the rental income from your property, including the number of units, rent per unit, and occupancy rate.

- Operating expenses: Estimate the property's operating expenses, including taxes, insurance, maintenance, and utilities.

- Cash flow analysis: Analyze the property's cash flow, including the net operating income (NOI), debt service, and cash flow before taxes.

- Return on investment (ROI) analysis: Calculate the property's ROI, including the capitalization rate, gross yield, and net yield.

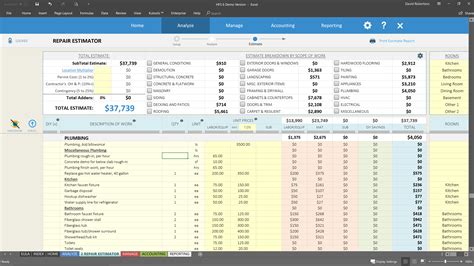

Template 4: Real Estate Flipping Template

This template is designed for analyzing the financial performance of real estate flipping projects. It includes sections for:

- Purchase details: Input the property's purchase price, closing costs, and financing details.

- Renovation budget: Estimate the renovation costs, including materials, labor, and permits.

- Sales projections: Calculate the potential sales price and revenue from the flipped property.

- Profit analysis: Analyze the project's profit, including the gross profit, net profit, and return on investment (ROI).

Template 5: Real Estate Partnership Template

This template is designed for analyzing the financial performance of real estate partnerships. It includes sections for:

- Partnership details: Input the partnership's key details, including the number of partners, ownership percentages, and capital contributions.

- Financial statements: Generate the partnership's financial statements, including the income statement, balance sheet, and cash flow statement.

- Distribution analysis: Analyze the distribution of profits and losses among partners, including the calculation of each partner's share.

- Tax analysis: Estimate the partnership's tax liability and each partner's tax obligations.

Conclusion

Real estate financial modeling is a critical aspect of the property development and investment process. Using Excel templates can help you streamline your analysis, improve accuracy, and make more informed decisions. The five free Excel templates provided in this article can help you analyze various aspects of real estate financial modeling, from development and investment to rental properties and partnerships. By leveraging these templates, you can save time, reduce errors, and increase your chances of success in the competitive real estate market.

Real Estate Financial Modeling Templates Gallery