Intro

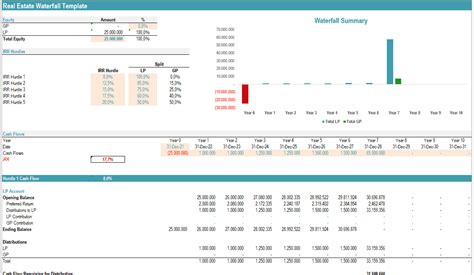

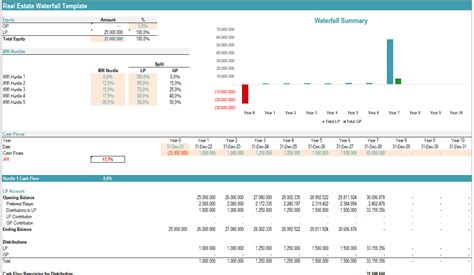

Master real estate financial analysis with our comprehensive guide to the Real Estate Waterfall Model Excel Template. Learn how to calculate returns, prioritize investments, and optimize cash flows using this essential tool. Includes step-by-step instructions, example templates, and expert tips for successful real estate investing and portfolio management.

Investing in real estate can be a lucrative venture, but it requires careful planning and analysis to ensure success. One tool that can help investors make informed decisions is the Real Estate Waterfall Model Excel template. In this article, we will delve into the world of real estate investing and explore the benefits of using a waterfall model to analyze potential investments.

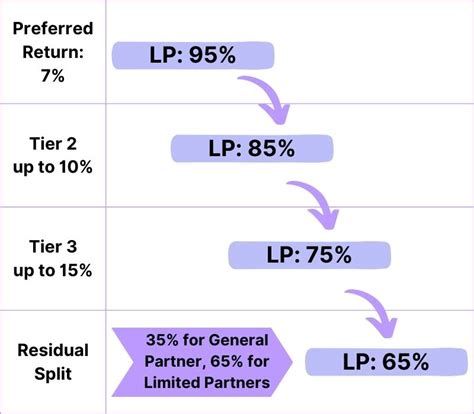

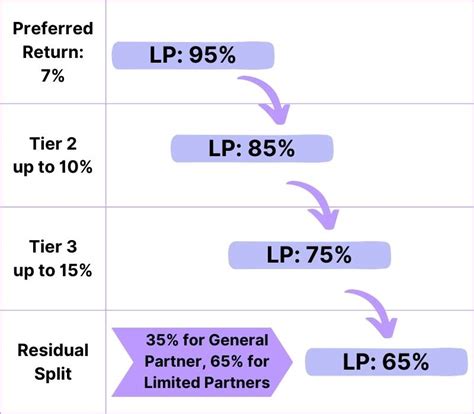

The Real Estate Waterfall Model is a financial modeling tool used to analyze the cash flow and returns of a real estate investment. It is called a "waterfall" because it calculates the distribution of cash flows in a cascading manner, with each tier representing a different level of return. The model is particularly useful for analyzing joint venture or partnership structures, where multiple parties are involved in the investment.

Benefits of Using a Real Estate Waterfall Model

Using a Real Estate Waterfall Model Excel template can provide numerous benefits to investors, including:

-

Improved Cash Flow Analysis

A waterfall model allows investors to analyze the cash flow of a real estate investment in a detailed and structured manner. It helps to identify potential cash flow risks and opportunities, enabling investors to make more informed decisions.

-

Enhanced Transparency

The model provides a clear and transparent view of the investment's cash flow distribution, making it easier for investors to understand how their returns will be calculated.

-

Increased Accuracy

By using a waterfall model, investors can reduce the risk of errors in their cash flow analysis, which can lead to more accurate predictions of returns.

-

Better Decision Making

The model enables investors to analyze different scenarios and make more informed decisions about their investments.

Key Components of a Real Estate Waterfall Model

A typical Real Estate Waterfall Model Excel template includes the following key components:

-

Investment Assumptions

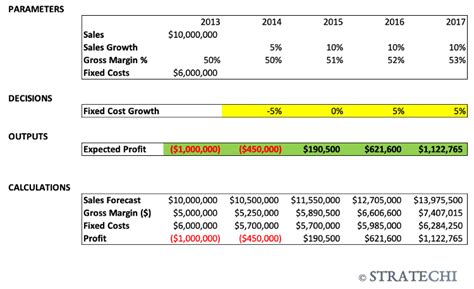

This section outlines the key assumptions about the investment, including the purchase price, financing terms, and operating expenses.

-

Cash Flow Projections

This section provides detailed cash flow projections for the investment, including rental income, expenses, and capital expenditures.

-

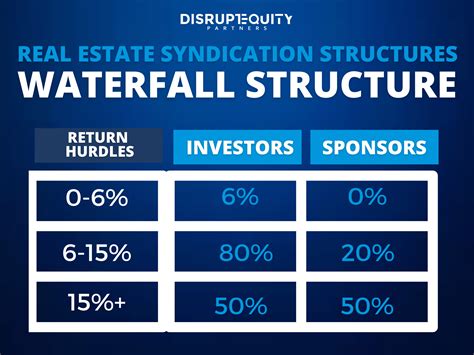

Waterfall Structure

This section outlines the waterfall structure, including the different tiers of return and the corresponding cash flow distribution.

-

Return Analysis

This section analyzes the returns of the investment, including the internal rate of return (IRR) and the net present value (NPV).

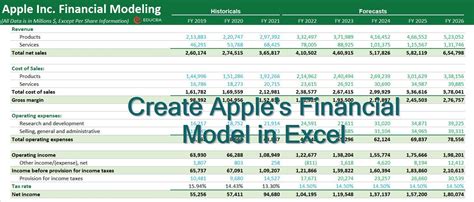

How to Create a Real Estate Waterfall Model in Excel

Creating a Real Estate Waterfall Model in Excel requires a good understanding of financial modeling and Excel skills. Here are the general steps to follow:

-

Set up the Investment Assumptions

Enter the key assumptions about the investment, including the purchase price, financing terms, and operating expenses.

-

Create the Cash Flow Projections

Build a detailed cash flow projection model, including rental income, expenses, and capital expenditures.

-

Set up the Waterfall Structure

Outline the waterfall structure, including the different tiers of return and the corresponding cash flow distribution.

-

Analyze the Returns

Analyze the returns of the investment, including the IRR and NPV.

Common Mistakes to Avoid When Creating a Real Estate Waterfall Model

When creating a Real Estate Waterfall Model, there are several common mistakes to avoid, including:

-

Overly Complex Model

Avoid creating a model that is too complex, as this can make it difficult to understand and maintain.

-

Inaccurate Assumptions

Ensure that the assumptions about the investment are accurate and realistic.

-

Insufficient Cash Flow Analysis

Make sure to analyze the cash flow of the investment in detail, including all relevant expenses and income.

-

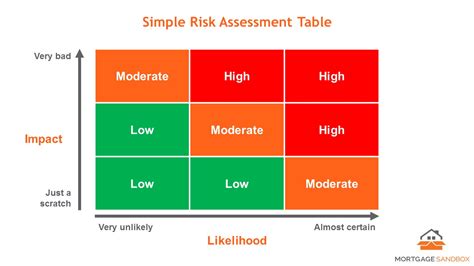

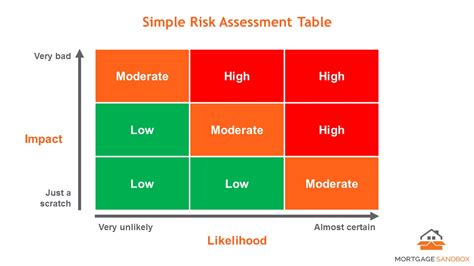

Failure to Consider Risk

Failure to consider the risks associated with the investment, including market risks and operational risks.

Real Estate Waterfall Model Excel Template Best Practices

Here are some best practices to follow when creating a Real Estate Waterfall Model Excel template:

-

Keep it Simple

Keep the model simple and easy to understand, avoiding unnecessary complexity.

-

Use Clear and Concise Labels

Use clear and concise labels for all inputs and outputs, making it easy to understand the model.

-

Use Consistent Formatting

Use consistent formatting throughout the model, making it easy to read and understand.

-

Test and Validate the Model

Test and validate the model, ensuring that it is accurate and reliable.

Real Estate Waterfall Model Gallery

Real Estate Waterfall Model Image Gallery

We hope this article has provided a comprehensive guide to creating a Real Estate Waterfall Model in Excel. By following the best practices outlined above, you can create a robust and accurate model that will help you make informed decisions about your real estate investments.

We encourage you to share your thoughts and experiences with Real Estate Waterfall Models in the comments below. If you have any questions or need further clarification on any of the topics discussed, please don't hesitate to ask.