5 Ways To Optimize Your Realtor P&L Template Summary

Maximize profits with a finely-tuned Realtor P&L template. Discover the top 5 ways to optimize your real estate businesss financial performance, including streamlining revenue tracking, expense categorization, and cash flow management. Learn how to create a data-driven decision-making framework and unlock growth with a tailored P&L statement.

As a realtor, managing your finances effectively is crucial to the success of your business. One essential tool to help you achieve this is a Profit and Loss (P&L) template. A well-optimized P&L template can help you track your income and expenses, identify areas for improvement, and make informed decisions to grow your business. In this article, we will explore five ways to optimize your realtor P&L template.

Understanding the Importance of a P&L Template

Before we dive into the optimization techniques, it's essential to understand the importance of a P&L template for realtors. A P&L template is a financial statement that summarizes your business's revenues and expenses over a specific period. It provides a snapshot of your business's financial performance, helping you identify areas of strength and weakness.

Why Realtors Need a P&L Template

As a realtor, you face unique financial challenges, such as fluctuating income, irregular expenses, and intense competition. A P&L template can help you navigate these challenges by:

- Tracking your income from various sources, such as sales commissions, rentals, and consulting services

- Identifying areas where you can reduce expenses and improve profitability

- Making informed decisions about investments, marketing strategies, and staffing

- Providing a clear picture of your business's financial performance to lenders, investors, or partners

5 Ways to Optimize Your Realtor P&L Template

Now that we've established the importance of a P&L template, let's explore five ways to optimize yours:

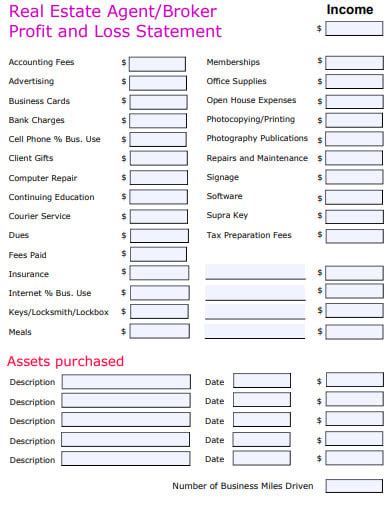

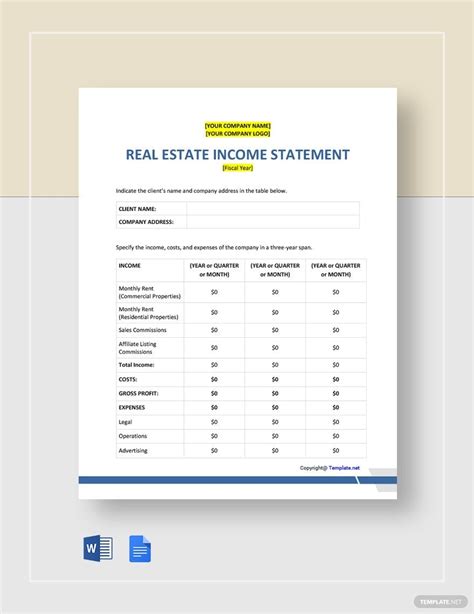

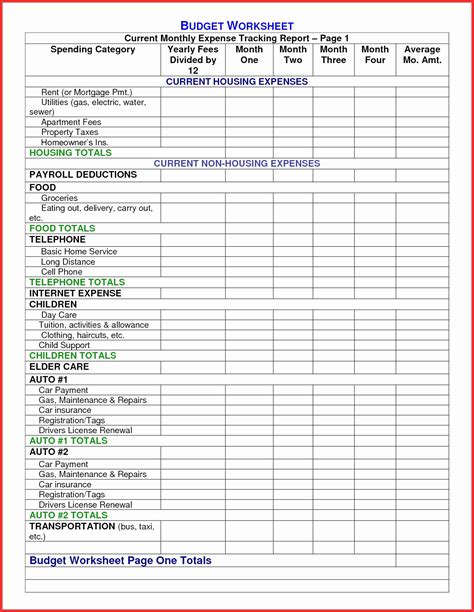

1. Categorize Your Income and Expenses

To optimize your P&L template, categorize your income and expenses into clear and relevant groups. For example, you can categorize your income into:

- Sales commissions

- Rental income

- Consulting services

- Other revenue streams

Similarly, categorize your expenses into:

- Operating expenses (e.g., office rent, utilities, marketing)

- Personnel expenses (e.g., salaries, benefits, training)

- Travel and entertainment expenses

- Other expenses (e.g., insurance, equipment, software)

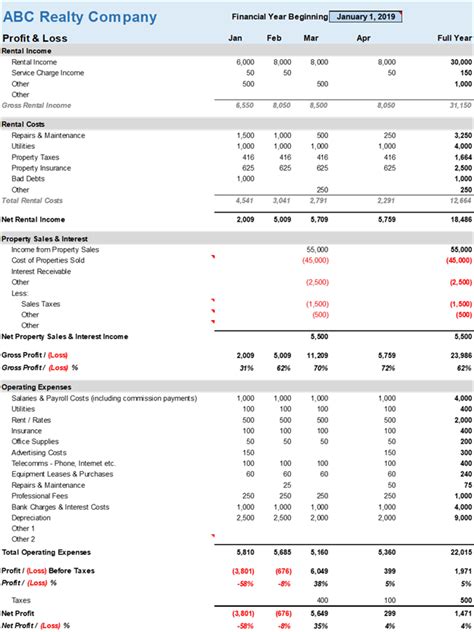

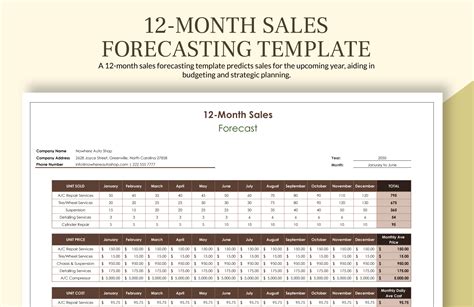

2. Use a Rolling 12-Month Period

Using a rolling 12-month period can help you track your financial performance over time. This involves updating your P&L template every month to reflect the previous 12 months' financial data.

For example, if you're updating your P&L template in March, include financial data from March of the previous year to February of the current year. This will help you identify trends, patterns, and areas for improvement.

3. Include Key Performance Indicators (KPIs)

In addition to tracking income and expenses, include KPIs that provide insight into your business's performance. Examples of KPIs for realtors include:

- Sales volume

- Average sale price

- Number of transactions

- Customer satisfaction ratings

- Marketing return on investment (ROI)

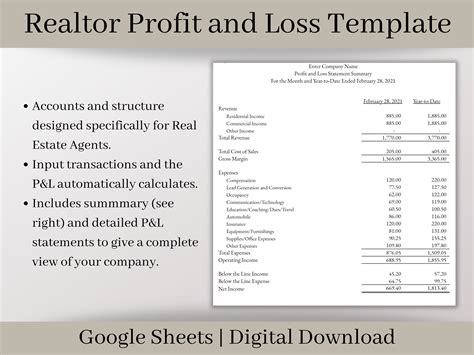

4. Automate Data Entry and Calculations

To save time and reduce errors, automate data entry and calculations in your P&L template. Consider using accounting software or spreadsheet formulas to:

- Import financial data from bank statements or accounting systems

- Calculate totals, percentages, and ratios

- Create charts and graphs to visualize financial performance

5. Regularly Review and Revise Your P&L Template

Finally, regularly review and revise your P&L template to ensure it remains accurate and relevant. Schedule regular reviews (e.g., quarterly or annually) to:

- Update financial data and KPIs

- Revise categorizations or calculations as needed

- Identify areas for improvement and implement changes

Gallery of Realtor P&L Templates

Realtor P&L Template Gallery

Conclusion: Take Control of Your Finances

By implementing these five optimization techniques, you can take control of your finances and make informed decisions to grow your real estate business. Remember to regularly review and revise your P&L template to ensure it remains accurate and relevant.

Final Thoughts

A well-optimized P&L template is a powerful tool for realtors. By categorizing your income and expenses, using a rolling 12-month period, including KPIs, automating data entry and calculations, and regularly reviewing and revising your template, you can gain valuable insights into your business's financial performance.

Take the first step today and optimize your realtor P&L template. Share your experiences and tips in the comments below!