Intro

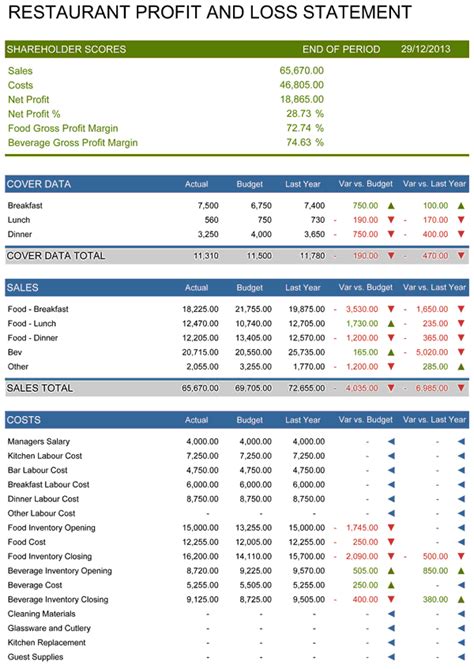

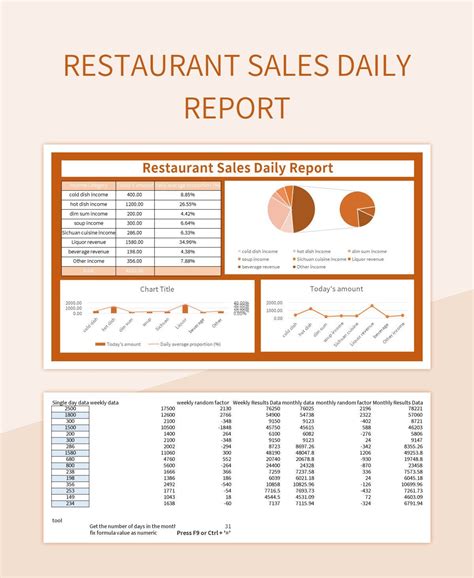

Streamline your restaurants finances with our free Restaurant P&L Template in Excel, downloadable and ready to use. Easily track income, expenses, and profitability with this comprehensive template, featuring key performance indicators, sales analysis, and cost control. Optimize your restaurants financial management and boost profitability with this essential tool.

The restaurant industry is highly competitive, and to stay ahead of the game, it's essential to have a solid understanding of your restaurant's financial performance. One of the most critical financial statements for any restaurant is the profit and loss (P&L) statement. In this article, we'll explore the importance of a P&L statement for restaurants, its components, and provide a free restaurant P&L template in Excel for download.

What is a Restaurant P&L Statement?

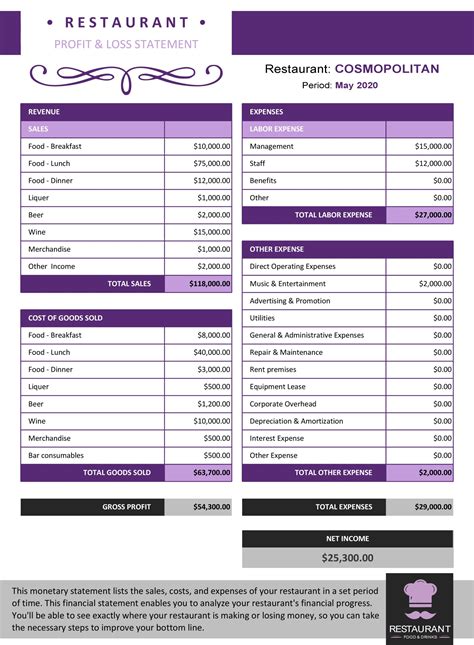

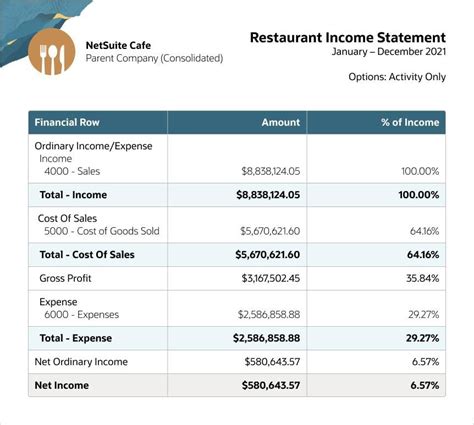

A restaurant P&L statement, also known as an income statement, is a financial report that summarizes a restaurant's revenues and expenses over a specific period. It provides a snapshot of the restaurant's financial performance, helping owners and managers identify areas of strength and weakness. The P&L statement is typically prepared on a monthly or quarterly basis, but it can also be generated annually.

Why is a Restaurant P&L Statement Important?

A restaurant P&L statement is crucial for several reasons:

- Identify profitability: The P&L statement helps you determine whether your restaurant is making a profit or loss.

- Track expenses: By monitoring expenses, you can identify areas where costs can be reduced or optimized.

- Make informed decisions: The P&L statement provides valuable insights into your restaurant's financial performance, enabling you to make informed decisions about pricing, menu engineering, and marketing strategies.

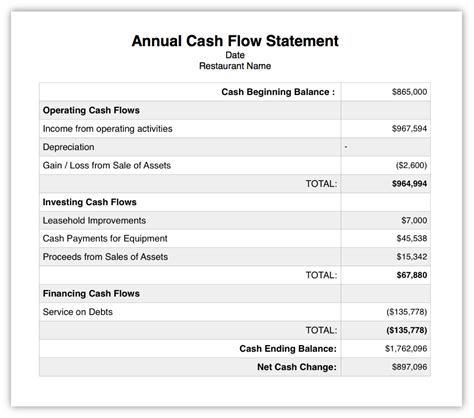

- Improve cash flow: By monitoring revenues and expenses, you can identify opportunities to improve cash flow and reduce the risk of insolvency.

Components of a Restaurant P&L Statement

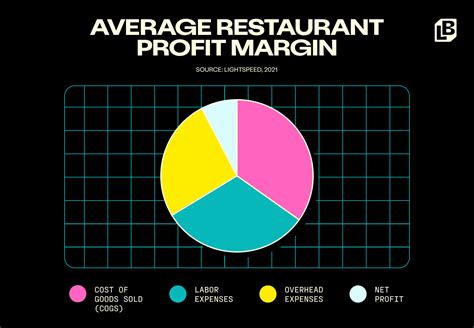

A typical restaurant P&L statement consists of the following components:

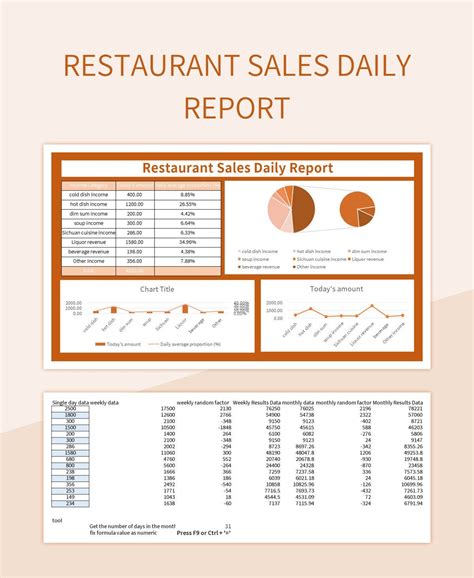

- Revenues: This section includes all sources of income, such as food sales, beverage sales, and other revenue streams like catering or merchandise sales.

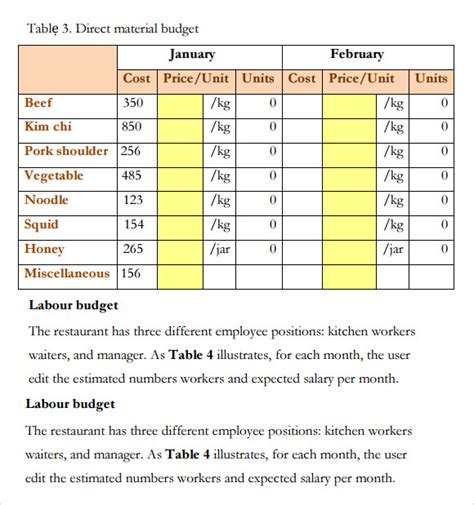

- Cost of Goods Sold (COGS): This section includes the direct costs associated with producing and selling menu items, such as food costs, labor costs, and overheads.

- Gross Profit: This is the difference between revenues and COGS.

- Operating Expenses: This section includes indirect costs, such as occupancy costs, marketing expenses, and administrative expenses.

- Operating Profit: This is the difference between gross profit and operating expenses.

- Net Profit: This is the final profit after deducting taxes, interest, and other non-operating expenses.

Free Restaurant P&L Template in Excel

To help you get started with creating a P&L statement for your restaurant, we've created a free template in Excel. You can download the template by clicking on the link below:

Download Free Restaurant P&L Template in Excel

This template is designed to help you easily track your restaurant's revenues and expenses, and calculate your gross profit, operating profit, and net profit. The template includes the following sections:

- Revenues

- COGS

- Gross Profit

- Operating Expenses

- Operating Profit

- Net Profit

How to Use the Template

Using the template is easy. Simply follow these steps:

- Download the template and save it to your computer.

- Enter your restaurant's revenues and expenses into the relevant sections.

- The template will automatically calculate your gross profit, operating profit, and net profit.

- Review your P&L statement regularly to identify areas for improvement and make informed decisions about your restaurant's operations.

Tips for Creating an Accurate P&L Statement

To ensure that your P&L statement is accurate and reliable, follow these tips:

- Keep accurate records: Ensure that you have accurate and up-to-date records of your restaurant's revenues and expenses.

- Classify expenses correctly: Classify your expenses correctly into COGS, operating expenses, and non-operating expenses.

- Use accounting software: Consider using accounting software to help you manage your restaurant's finances and generate accurate financial statements.

- Review and revise regularly: Review and revise your P&L statement regularly to ensure that it accurately reflects your restaurant's financial performance.

Restaurant P&L Statement Image Gallery

By following these tips and using our free restaurant P&L template in Excel, you'll be able to create an accurate and reliable P&L statement that will help you make informed decisions about your restaurant's operations. Remember to review and revise your P&L statement regularly to ensure that it accurately reflects your restaurant's financial performance.

We hope this article has been helpful in explaining the importance of a restaurant P&L statement and providing a free template to help you get started. If you have any questions or need further assistance, please don't hesitate to comment below.