Intro

Maximize your military benefits and calculate your retirement with the National Guard. Discover 5 ways serving in the National Guard pays off, from education assistance to home loan guarantees, and learn how to make the most of your service. Plan your financial future with our expert guide to National Guard retirement benefits.

As a member of the National Guard, you're not only serving your country, but you're also investing in your future. One of the most significant benefits of serving in the National Guard is the potential for a substantial retirement payout. If you're curious about how your service can translate into a comfortable retirement, you're in the right place. In this article, we'll explore five ways the National Guard pays off in the long run.

Understanding the National Guard Retirement System

The National Guard offers a unique retirement system that rewards members for their service. The system is based on a points system, where members earn points for each year of service, as well as for participating in drills and training exercises. These points are then used to calculate the member's retirement benefit.

How the Points System Works

The points system is relatively straightforward. Members earn one point for each day of active service, as well as one point for each drill period or training exercise. These points are then multiplied by the member's base pay to determine their retirement benefit.

For example, let's say a member has 20 years of service and has accumulated 4,000 points. If their base pay is $50,000 per year, their retirement benefit would be calculated as follows:

4,000 points x $50,000 per year = $200,000

5 Ways the National Guard Pays Off in Retirement

Now that we've covered the basics of the National Guard retirement system, let's dive into the five ways it pays off in the long run.

1. Tax-Free Retirement Benefits

One of the most significant advantages of the National Guard retirement system is that the benefits are tax-free. This means that members can enjoy their retirement benefits without worrying about paying taxes on them.

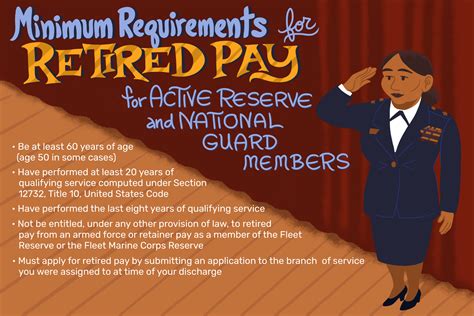

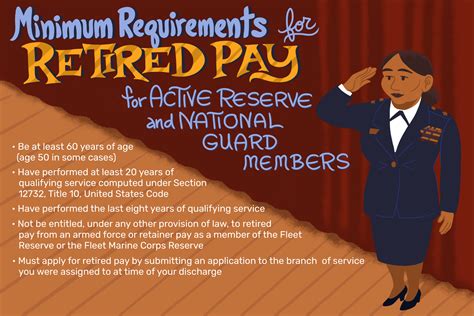

2. Early Retirement Eligibility

Members of the National Guard are eligible to retire after 20 years of service, which is significantly earlier than the typical retirement age in the civilian world. This means that members can enjoy their retirement benefits while still in their 40s or 50s.

3. Increased Benefits with Rank and Time in Service

The National Guard retirement system rewards members for their rank and time in service. As members advance in rank and accumulate more time in service, their retirement benefits increase accordingly.

4. Access to Tricare and Other Military Benefits

Members of the National Guard are eligible for Tricare, the military's healthcare program, as well as other military benefits such as access to base facilities and shopping at the commissary.

5. Potential for Concurrent Retirement and Disability Pay

In some cases, members of the National Guard may be eligible for concurrent retirement and disability pay. This means that members can receive both their retirement benefits and disability pay at the same time.

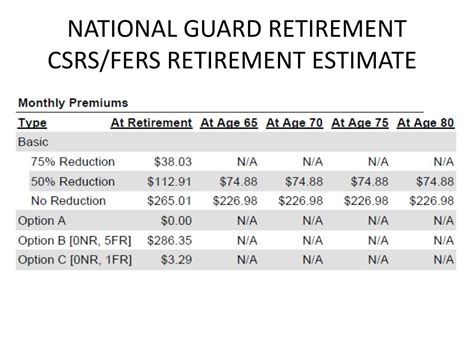

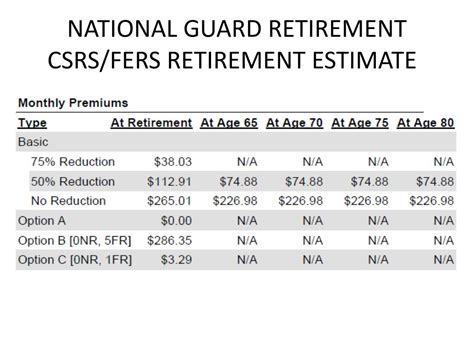

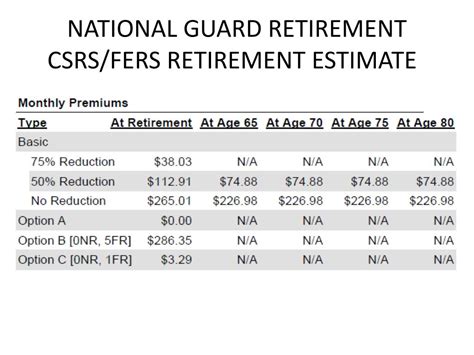

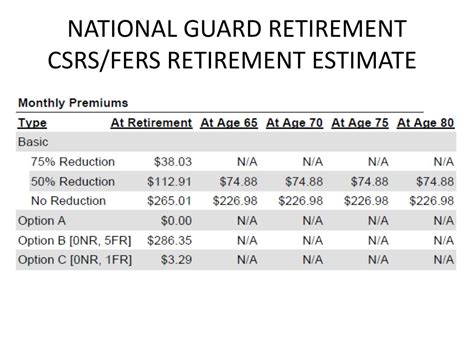

Calculating Your Retirement Benefits

To calculate your retirement benefits, you'll need to use the National Guard's retirement calculator. This tool takes into account your rank, time in service, and other factors to provide an estimate of your retirement benefits.

Here's an example of how to use the calculator:

- Enter your rank and time in service

- Enter your base pay and other relevant information

- The calculator will provide an estimate of your retirement benefits

Example Retirement Benefit Calculation

Let's say we have a member who is a Captain with 20 years of service. Their base pay is $60,000 per year, and they have accumulated 4,500 points. Using the retirement calculator, we can estimate their retirement benefits as follows:

4,500 points x $60,000 per year = $270,000

Conclusion

Serving in the National Guard is a significant commitment, but it can also be a smart investment in your future. By understanding the National Guard retirement system and calculating your retirement benefits, you can plan for a comfortable retirement and enjoy the fruits of your labor.

We hope this article has provided valuable insights into the National Guard retirement system and how it can pay off in the long run. If you have any questions or comments, please don't hesitate to reach out.

Gallery of National Guard Retirement Benefits

National Guard Retirement Benefits Image Gallery