Unlock the secrets of military retirement pay charts in 7 easy steps. Discover how to calculate your benefits, understand the different pay scales, and make informed decisions about your military pension. Learn about high-3 average pay, longevity pay, and cost-of-living adjustments (COLAs) to maximize your retirement income.

Planning for retirement is a crucial aspect of military life. After dedicating years of service to the country, military personnel look forward to a well-deserved retirement. One of the key benefits of military retirement is the pension, which can provide a significant source of income. However, understanding military retirement pay charts can be a daunting task. In this article, we will break down the process into 7 easy steps, making it easier for military personnel and their families to navigate the system.

Step 1: Understanding the Basics of Military Retirement

Military retirement pay is a benefit provided to military personnel who have completed a minimum of 20 years of service. The pension is based on the individual's length of service and their final pay grade. The retirement pay is calculated using the following formula:

2.5% x Number of Years Served x Final Pay Grade

For example, if an individual serves for 20 years and has a final pay grade of E-7 (Sergeant First Class), their retirement pay would be calculated as follows:

2.5% x 20 x E-7 = 50% of E-7 pay grade

Types of Military Retirement

There are two main types of military retirement: High-3 and REDUX. High-3 is the traditional retirement plan, which calculates the pension based on the individual's highest 36 months of pay. REDUX, on the other hand, is a reduced retirement plan that provides a smaller pension in exchange for a $30,000 bonus at the 15-year mark.

Step 2: Choosing a Retirement Plan

Military personnel have the option to choose between the High-3 and REDUX retirement plans. The choice of plan depends on individual circumstances and financial goals. High-3 is generally considered the better option, as it provides a higher pension. However, REDUX may be more attractive to those who want to receive a lump sum bonus.

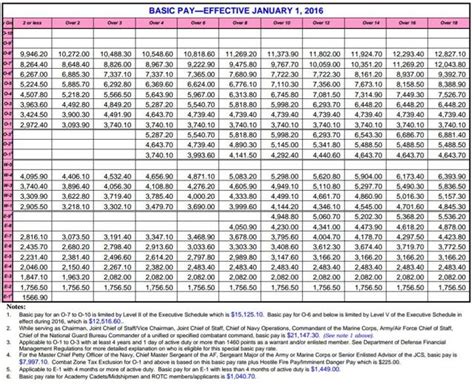

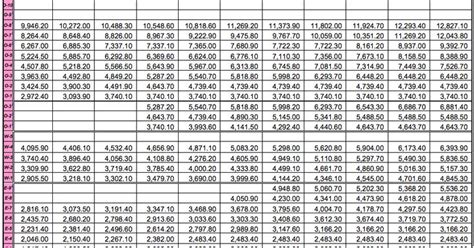

Step 3: Calculating Retirement Pay

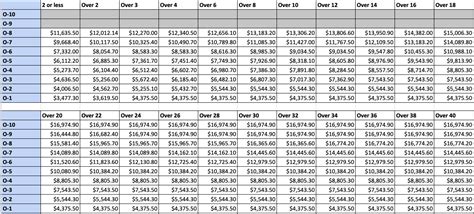

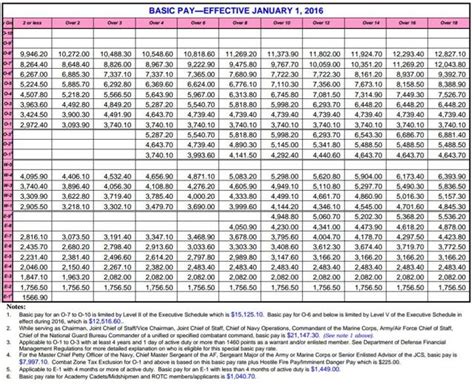

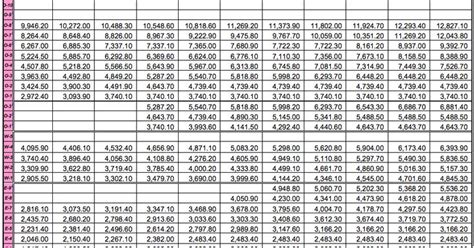

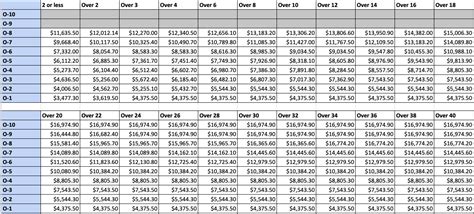

To calculate retirement pay, military personnel need to know their final pay grade and number of years served. The retirement pay charts provide a scale to determine the pension based on these factors. The charts are updated annually to reflect changes in pay grades and cost of living adjustments.

Retirement Pay Charts

Retirement pay charts are available on the Defense Finance and Accounting Service (DFAS) website. The charts provide a detailed breakdown of retirement pay based on pay grade and years of service. Military personnel can use these charts to estimate their retirement pay.

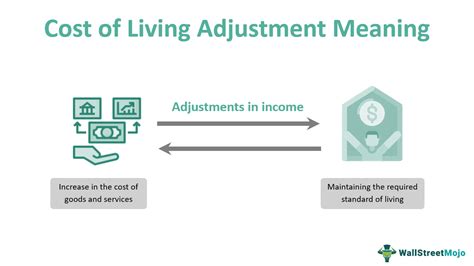

Step 4: Understanding Cost of Living Adjustments (COLAs)

COLAs are annual adjustments made to retirement pay to reflect changes in the cost of living. The COLA is calculated based on the Consumer Price Index (CPI) and is typically applied in January of each year. COLAs can significantly impact retirement pay over time.

COLA Example

For example, if an individual's retirement pay is $2,000 per month and the COLA is 2%, their new retirement pay would be:

$2,000 x 1.02 = $2,040 per month

Step 5: Understanding Survivor Benefit Plan (SBP)

The SBP is an insurance plan that provides a monthly annuity to the surviving spouse of a military retiree. The plan is optional and can be elected at the time of retirement. The SBP premium is deducted from the retiree's pension.

SBP Example

For example, if an individual elects the SBP and their retirement pay is $2,000 per month, the premium would be:

$2,000 x 6.5% = $130 per month

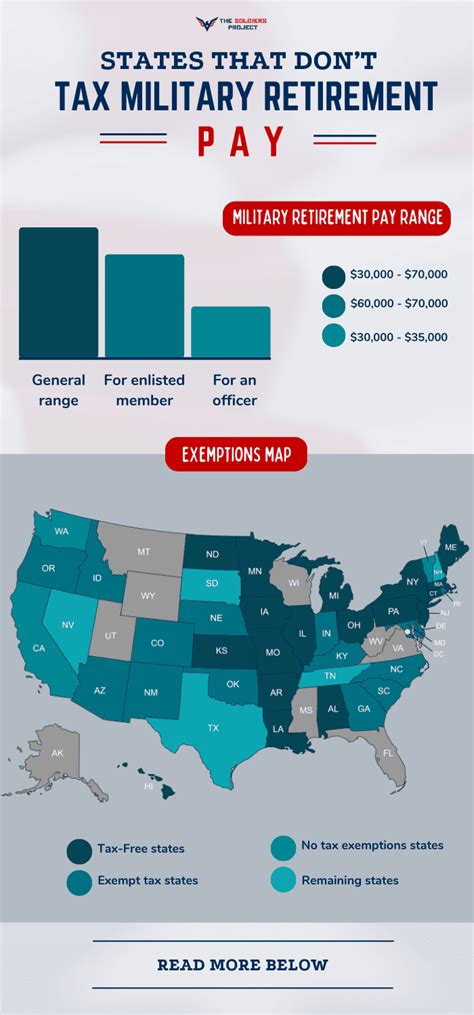

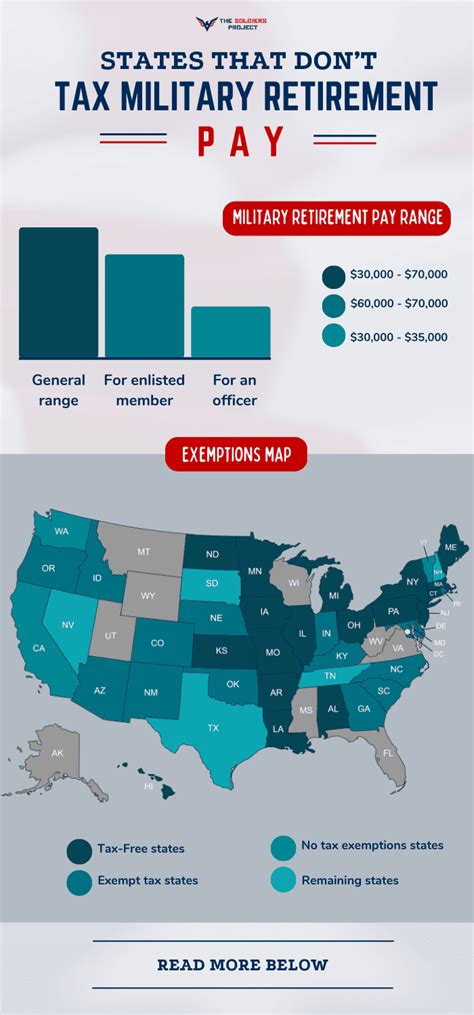

Step 6: Understanding Taxation of Military Retirement Pay

Military retirement pay is taxable income. However, some states exempt military retirement pay from state income tax. Military personnel should consult with a tax professional to understand the tax implications of their retirement pay.

Taxation Example

For example, if an individual's retirement pay is $2,000 per month and they live in a state that exempts military retirement pay from state income tax, their federal income tax would be:

$2,000 x 24% = $480 per month

Step 7: Reviewing and Updating Retirement Pay

Military personnel should regularly review their retirement pay to ensure accuracy and make any necessary adjustments. This includes updating their address, beneficiary information, and tax withholding.

Review and Update Example

For example, if an individual moves to a new state, they should update their address with the DFAS to ensure correct taxation and payment of their retirement pay.

Military Retirement Pay Charts Image Gallery

We hope this article has provided a comprehensive understanding of military retirement pay charts and the 7 easy steps to navigate the system. If you have any questions or need further clarification, please don't hesitate to comment below. Share this article with fellow military personnel and families to help them understand the benefits of military retirement.