Discover expert retirement planning strategies, including savings tips, investment advice, and pension guidance, to secure a comfortable post-work life and achieve financial freedom through informed decision-making.

Retirement planning is a crucial aspect of an individual's financial journey, as it enables them to live comfortably and securely after their working years. With the rising costs of living and increasing life expectancy, it's essential to start planning for retirement early to ensure a stable financial future. In this article, we'll delve into the world of retirement planning, exploring its importance, benefits, and strategies to help individuals create a comprehensive plan tailored to their needs.

Retirement planning involves a series of complex decisions, from determining retirement goals and risk tolerance to selecting the right investment vehicles and managing expenses. It requires a deep understanding of personal finance, investing, and tax planning, making it a daunting task for many individuals. However, with the right guidance and expertise, anyone can create a successful retirement plan. Whether you're just starting your career or nearing retirement age, it's essential to take control of your financial future and start planning for the years ahead.

The importance of retirement planning cannot be overstated. A well-crafted plan can provide individuals with the financial freedom to pursue their passions, travel, and spend time with loved ones, without the burden of financial stress. It can also help mitigate the risks associated with retirement, such as outliving one's assets, inflation, and healthcare expenses. By starting early and being proactive, individuals can ensure a comfortable and secure retirement, free from financial worries.

Understanding Retirement Planning

Understanding retirement planning is the first step towards creating a successful plan. It involves setting clear goals, assessing financial resources, and determining the right investment strategies. Individuals must consider their retirement objectives, such as travel, hobbies, or spending time with family, and estimate the costs associated with these activities. They must also assess their financial resources, including income, savings, and investments, to determine how much they can afford to set aside for retirement.

Retirement Planning Benefits

Retirement planning offers numerous benefits, from tax advantages and investment growth to increased financial security and peace of mind. By starting early, individuals can take advantage of compound interest, which can significantly boost their retirement savings over time. They can also reduce their tax liability by contributing to tax-deferred retirement accounts, such as 401(k) or IRA plans. Additionally, retirement planning can help individuals develop healthy financial habits, such as budgeting, saving, and investing, which can benefit them throughout their lives.Retirement Planning Strategies

Retirement planning strategies vary depending on an individual's age, income, and financial goals. Some common strategies include:

- Starting early: The sooner individuals start saving for retirement, the more time their money has to grow.

- Maximizing tax-advantaged accounts: Contributing to tax-deferred retirement accounts, such as 401(k) or IRA plans, can help reduce tax liability and boost retirement savings.

- Diversifying investments: Spreading investments across different asset classes, such as stocks, bonds, and real estate, can help minimize risk and maximize returns.

- Managing expenses: Reducing expenses and creating a sustainable budget can help individuals save more for retirement and ensure a comfortable lifestyle.

Retirement Planning Steps

Creating a retirement plan involves several steps, from setting clear goals to selecting the right investment vehicles. Individuals must:- Determine their retirement objectives and estimate the costs associated with these activities.

- Assess their financial resources, including income, savings, and investments.

- Choose the right investment strategies, such as tax-advantaged accounts or diversified portfolios.

- Manage expenses and create a sustainable budget.

- Monitor and adjust their plan regularly to ensure they're on track to meet their retirement goals.

Retirement Planning Tools and Resources

Retirement planning tools and resources are abundant, from online calculators and software to financial advisors and retirement planning workshops. Individuals can use these tools to estimate their retirement needs, create a personalized plan, and track their progress over time. Some popular retirement planning tools include:

- Retirement calculators: Online calculators that help individuals estimate their retirement needs and create a personalized plan.

- Financial planning software: Software programs that enable individuals to track their expenses, investments, and retirement accounts in one place.

- Financial advisors: Professionals who specialize in retirement planning and can provide personalized guidance and advice.

Retirement Planning Challenges

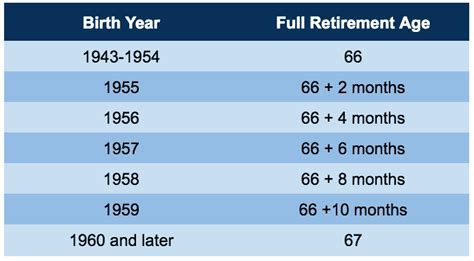

Retirement planning is not without its challenges, from market volatility and inflation to healthcare expenses and longevity risk. Individuals must be aware of these risks and take steps to mitigate them, such as diversifying their investments, managing expenses, and creating a sustainable budget. They must also stay informed about changes in the retirement landscape, such as updates to tax laws or retirement account rules.Retirement Planning for Different Age Groups

Retirement planning strategies vary depending on an individual's age and financial goals. Here are some tips for different age groups:

- 20s and 30s: Start early, take advantage of tax-advantaged accounts, and focus on building an emergency fund.

- 40s and 50s: Max out tax-advantaged accounts, diversify investments, and create a sustainable budget.

- 60s and beyond: Focus on preserving wealth, managing expenses, and creating a retirement income stream.

Retirement Planning for Small Business Owners

Small business owners face unique retirement planning challenges, from managing business expenses to creating a retirement income stream. They must consider their business goals and retirement objectives, and create a plan that balances these competing interests. Some strategies for small business owners include:- SEP-IRA plans: Tax-deferred retirement plans designed for self-employed individuals and small business owners.

- Solo 401(k) plans: Tax-deferred retirement plans designed for self-employed individuals and small business owners.

- Business succession planning: Planning for the transition of business ownership and management, which can help ensure a smooth retirement.

Retirement Planning FAQs

Here are some frequently asked questions about retirement planning:

- What is the best age to start retirement planning? The sooner, the better. Ideally, individuals should start planning for retirement in their 20s or 30s.

- How much should I save for retirement? The amount individuals should save for retirement depends on their income, expenses, and retirement goals. A general rule of thumb is to save at least 10% to 15% of income towards retirement.

- What are the best investment strategies for retirement? The best investment strategies for retirement depend on an individual's risk tolerance, time horizon, and financial goals. Some popular strategies include tax-advantaged accounts, diversified portfolios, and dividend-paying stocks.

Retirement Planning Image Gallery

Final Thoughts on Retirement Planning

In conclusion, retirement planning is a vital aspect of an individual's financial journey. By starting early, being proactive, and seeking professional guidance, individuals can create a comprehensive plan tailored to their needs and goals. Whether you're just starting your career or nearing retirement age, it's essential to take control of your financial future and start planning for the years ahead. We invite you to share your thoughts and experiences with retirement planning in the comments below. If you found this article helpful, please share it with your friends and family to help them start planning for a secure and comfortable retirement.