Intro

Plan your retirement with ease using Google Sheets. Discover 7 simple and effective ways to organize your finances, create a retirement budget, and track your progress. Learn how to use templates, formulas, and charts to secure your financial future. Get started with Google Sheets retirement planning and make informed decisions for a stress-free retirement.

Planning for retirement can be a daunting task, but with the right tools and strategies, you can set yourself up for success. One powerful tool that can help you plan your retirement is Google Sheets. In this article, we'll explore seven ways to plan your retirement with Google Sheets.

The Importance of Retirement Planning

Retirement planning is essential for ensuring that you have enough money to live comfortably in your golden years. Without a plan, you risk running out of money or having to work longer than you want to. According to a recent survey, 64% of Americans are not confident in their ability to retire comfortably. With Google Sheets, you can create a personalized plan that helps you achieve your retirement goals.

Why Use Google Sheets for Retirement Planning?

Google Sheets is a free online spreadsheet tool that offers a range of benefits for retirement planning. Here are just a few reasons why you should consider using Google Sheets:

- Easy to use: Google Sheets is intuitive and easy to use, even if you're not familiar with spreadsheets.

- Collaboration: Google Sheets allows you to collaborate with your partner or financial advisor in real-time.

- Accessibility: You can access your Google Sheet from anywhere, at any time, as long as you have an internet connection.

- Automatic calculations: Google Sheets can perform complex calculations automatically, saving you time and reducing errors.

7 Ways to Plan Your Retirement with Google Sheets

Here are seven ways to plan your retirement with Google Sheets:

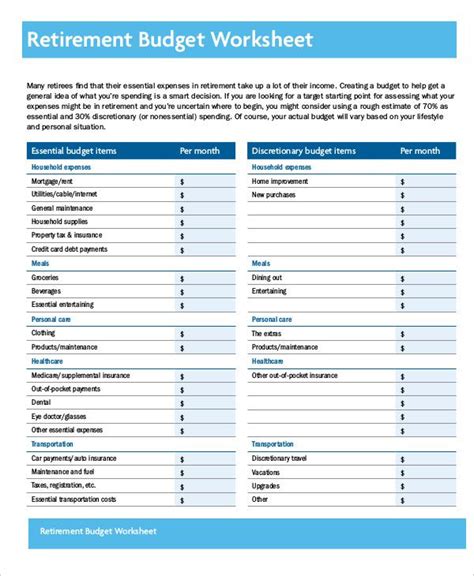

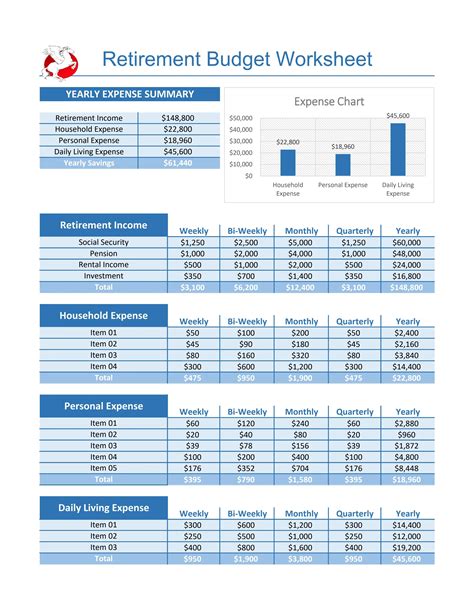

1. Create a Retirement Budget

Creating a retirement budget is essential for ensuring that you have enough money to cover your living expenses. With Google Sheets, you can create a budget template that includes projected income and expenses. You can also use formulas to calculate your net worth and track your progress over time.

Step-by-Step Instructions:

- Create a new Google Sheet and title it "Retirement Budget"

- Set up columns for income and expenses

- Enter projected income and expenses for each month

- Use formulas to calculate net worth and track progress

2. Calculate Your Retirement Savings

Calculating your retirement savings is crucial for determining how much you need to save each month. With Google Sheets, you can create a calculator that takes into account your income, expenses, and retirement goals. You can also use formulas to calculate the impact of different savings rates on your retirement savings.

Step-by-Step Instructions:

- Create a new Google Sheet and title it "Retirement Savings Calculator"

- Set up columns for income, expenses, and retirement goals

- Enter projected income and expenses for each month

- Use formulas to calculate retirement savings and track progress

3. Create a Retirement Investment Plan

Creating a retirement investment plan is essential for growing your retirement savings over time. With Google Sheets, you can create a template that outlines your investment goals and strategy. You can also use formulas to calculate the impact of different investment returns on your retirement savings.

Step-by-Step Instructions:

- Create a new Google Sheet and title it "Retirement Investment Plan"

- Set up columns for investment goals and strategy

- Enter projected investment returns and fees

- Use formulas to calculate the impact of different investment returns on retirement savings

4. Track Your Retirement Progress

Tracking your retirement progress is essential for staying on track and making adjustments as needed. With Google Sheets, you can create a template that tracks your retirement savings and investment progress over time. You can also use formulas to calculate your retirement readiness and identify areas for improvement.

Step-by-Step Instructions:

- Create a new Google Sheet and title it "Retirement Progress Tracking"

- Set up columns for retirement savings and investment progress

- Enter projected progress for each month

- Use formulas to calculate retirement readiness and identify areas for improvement

5. Create a Retirement Tax Plan

Creating a retirement tax plan is essential for minimizing taxes and maximizing your retirement income. With Google Sheets, you can create a template that outlines your tax strategy and calculates the impact of different tax scenarios on your retirement income.

Step-by-Step Instructions:

- Create a new Google Sheet and title it "Retirement Tax Plan"

- Set up columns for tax strategy and calculations

- Enter projected tax rates and income

- Use formulas to calculate the impact of different tax scenarios on retirement income

6. Create a Retirement Health Care Plan

Creating a retirement health care plan is essential for ensuring that you have adequate health insurance coverage in retirement. With Google Sheets, you can create a template that outlines your health care needs and calculates the cost of different health insurance options.

Step-by-Step Instructions:

- Create a new Google Sheet and title it "Retirement Health Care Plan"

- Set up columns for health care needs and insurance options

- Enter projected health care costs and insurance premiums

- Use formulas to calculate the cost of different health insurance options

7. Create a Retirement Estate Plan

Creating a retirement estate plan is essential for ensuring that your assets are distributed according to your wishes after you pass away. With Google Sheets, you can create a template that outlines your estate planning goals and calculates the impact of different estate planning strategies on your retirement assets.

Step-by-Step Instructions:

- Create a new Google Sheet and title it "Retirement Estate Plan"

- Set up columns for estate planning goals and strategies

- Enter projected asset values and distribution plans

- Use formulas to calculate the impact of different estate planning strategies on retirement assets

Retirement Planning Image Gallery

By following these seven steps, you can create a comprehensive retirement plan that helps you achieve your retirement goals. Remember to regularly review and update your plan to ensure that you're on track to a secure and fulfilling retirement.

We hope this article has been helpful in providing you with a roadmap for planning your retirement with Google Sheets. Do you have any questions or comments about retirement planning? Share them with us in the comments section below!