Intro

Streamline retroactive pay calculations with our user-friendly Excel template. Easily compute back pay, gross-up amounts, and taxes owed. Ideal for HR, payroll, and accounting professionals, our retroactive pay calculator ensures accuracy and efficiency. Download now and simplify complex payroll adjustments with ease.

Retroactive pay can be a complex and time-consuming process to calculate, especially when dealing with multiple employees, pay periods, and compensation rates. However, with the help of an Excel template, you can simplify the calculation process and ensure accuracy. In this article, we will discuss the importance of retroactive pay, how to calculate it, and provide a step-by-step guide on using a retroactive pay calculator Excel template.

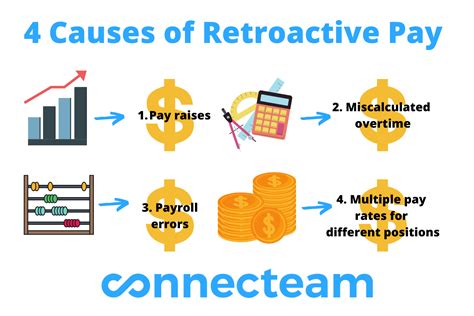

Retroactive pay, also known as back pay, is the payment of wages or salary that an employee should have received in the past but did not. This can occur due to various reasons such as underpayment, missed pay periods, or incorrect salary rates. Calculating retroactive pay can be a daunting task, especially when dealing with multiple employees and pay periods. However, with the help of an Excel template, you can streamline the calculation process and ensure accuracy.

Using a retroactive pay calculator Excel template can save you time and reduce errors. The template can help you calculate the total amount of retroactive pay due to an employee, including any applicable taxes and deductions. Additionally, the template can also help you track and record retroactive pay payments, making it easier to maintain accurate payroll records.

Benefits of Using a Retroactive Pay Calculator Excel Template

Using a retroactive pay calculator Excel template can provide several benefits, including:

- Accurate calculations: The template can help you calculate retroactive pay accurately, taking into account various factors such as pay periods, compensation rates, and taxes.

- Time-saving: The template can save you time and effort in calculating retroactive pay, allowing you to focus on other important tasks.

- Reduced errors: The template can help reduce errors in calculating retroactive pay, ensuring that employees receive the correct amount of back pay.

- Improved record-keeping: The template can help you track and record retroactive pay payments, making it easier to maintain accurate payroll records.

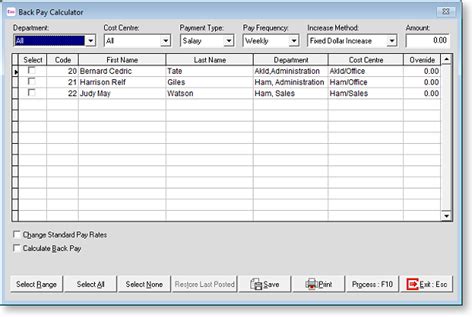

How to Use a Retroactive Pay Calculator Excel Template

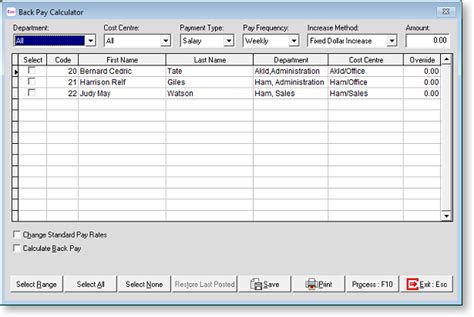

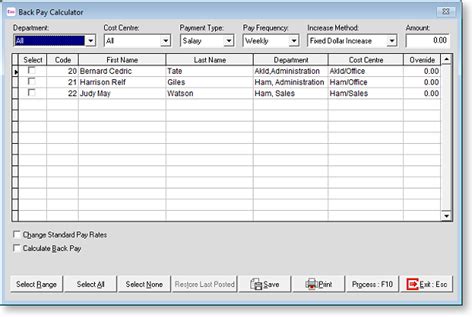

Using a retroactive pay calculator Excel template is straightforward. Here's a step-by-step guide:

- Download the template: Download a retroactive pay calculator Excel template from a reputable source.

- Enter employee information: Enter the employee's name, ID number, and other relevant information.

- Enter pay period information: Enter the pay period start and end dates, as well as the compensation rate.

- Enter retroactive pay information: Enter the retroactive pay amount, including any applicable taxes and deductions.

- Calculate retroactive pay: The template will calculate the total amount of retroactive pay due to the employee.

- Review and verify: Review and verify the calculation to ensure accuracy.

- Print or save: Print or save the template for future reference.

Step-by-Step Guide to Calculating Retroactive Pay

Calculating retroactive pay involves several steps:

- Determine the pay period: Determine the pay period for which retroactive pay is due.

- Determine the compensation rate: Determine the compensation rate for the pay period.

- Calculate the retroactive pay amount: Calculate the retroactive pay amount, including any applicable taxes and deductions.

- Calculate the total retroactive pay: Calculate the total retroactive pay due to the employee.

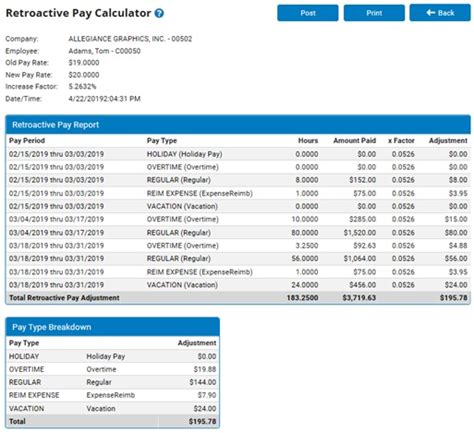

Retroactive Pay Calculator Excel Template Example

Here's an example of a retroactive pay calculator Excel template:

| Employee ID | Employee Name | Pay Period Start Date | Pay Period End Date | Compensation Rate | Retroactive Pay Amount | Total Retroactive Pay |

|---|---|---|---|---|---|---|

| 12345 | John Doe | 2022-01-01 | 2022-01-31 | $20/hour | $1000 | $1200 |

Common Errors to Avoid When Calculating Retroactive Pay

When calculating retroactive pay, it's essential to avoid common errors, including:

- Incorrect pay period dates: Ensure that the pay period start and end dates are accurate.

- Incorrect compensation rate: Ensure that the compensation rate is accurate and up-to-date.

- Incorrect retroactive pay amount: Ensure that the retroactive pay amount is accurate and includes any applicable taxes and deductions.

- Failure to calculate total retroactive pay: Ensure that the total retroactive pay due to the employee is calculated accurately.

Best Practices for Calculating Retroactive Pay

Here are some best practices for calculating retroactive pay:

- Use a retroactive pay calculator Excel template: Use a template to streamline the calculation process and ensure accuracy.

- Verify employee information: Verify employee information, including pay period dates and compensation rates.

- Calculate retroactive pay accurately: Calculate retroactive pay accurately, including any applicable taxes and deductions.

- Review and verify: Review and verify the calculation to ensure accuracy.

Retroactive Pay Calculator Image Gallery

By following these steps and using a retroactive pay calculator Excel template, you can ensure accurate calculations and simplify the process of calculating retroactive pay.