Intro

Unlock the power of informed loan decisions with our Reverse Mortgage Calculator Excel guide. Simplify your retirement planning by calculating loan amounts, interest rates, and payouts. Learn how to utilize Excel templates, formulas, and functions to make data-driven decisions. Get expert tips on navigating HECM loans, mortgage insurance, and tax implications.

With the increasing complexity of financial decisions, especially when it comes to retirement planning, understanding the intricacies of reverse mortgages can be overwhelming. A reverse mortgage calculator Excel template can be a valuable tool to simplify the decision-making process, helping homeowners make informed choices about their financial futures. In this article, we will delve into the world of reverse mortgages, explore the benefits of using a reverse mortgage calculator in Excel, and provide guidance on how to create or use one effectively.

Understanding Reverse Mortgages

A reverse mortgage is a type of loan that allows homeowners aged 62 and older to borrow money using the equity in their home as collateral. Unlike traditional mortgages, where the borrower makes monthly payments to the lender, in a reverse mortgage, the lender makes payments to the borrower. This financial product can be used to supplement retirement income, pay off high-interest debts, cover healthcare costs, or achieve other financial goals.

Benefits of Reverse Mortgages

- Supplement Retirement Income: Reverse mortgages can provide an additional income stream to support living expenses, hobbies, or travel.

- Pay Off High-Interest Debts: Homeowners can use reverse mortgage funds to pay off debts with higher interest rates, such as credit cards or personal loans.

- Home Improvements: Funds can be used for home repairs, renovations, or accessibility modifications.

- Healthcare Costs: Reverse mortgage proceeds can cover medical expenses, including in-home care or nursing home fees.

The Role of a Reverse Mortgage Calculator in Excel

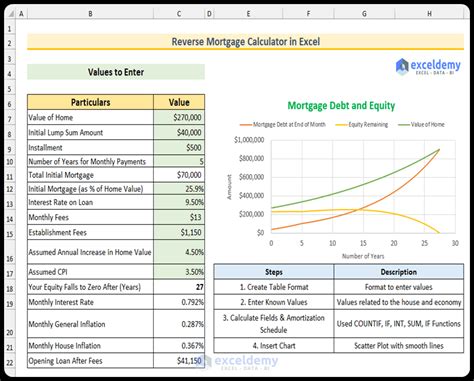

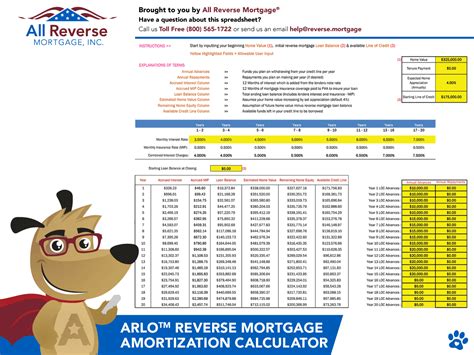

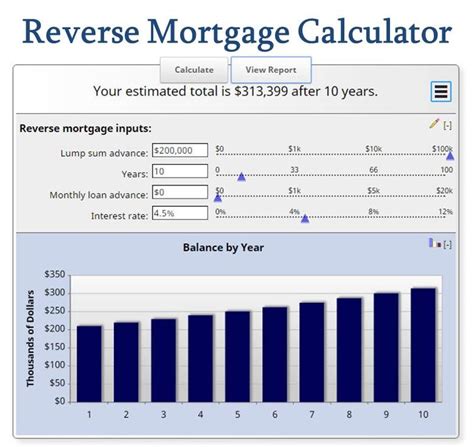

A reverse mortgage calculator in Excel is a powerful tool designed to help homeowners understand the potential benefits and implications of a reverse mortgage. By inputting specific financial details and assumptions, the calculator can estimate the amount of money available through a reverse mortgage, the impact on monthly cash flow, and how the loan may affect the homeowner's estate upon passing.

Key Features of a Reverse Mortgage Calculator in Excel

- Personalized Estimates: Based on the homeowner's age, property value, and outstanding mortgage balance, the calculator provides a personalized estimate of the available loan amount.

- Cash Flow Analysis: It helps homeowners understand how a reverse mortgage might affect their monthly cash flow, including any reductions in income due to loan repayments.

- Scenario Analysis: Users can test different scenarios, such as varying property values or interest rates, to see how these changes impact the reverse mortgage outcome.

- Flexibility: Many Excel templates allow for customization, enabling users to tailor the calculator to their specific needs and circumstances.

Creating a Reverse Mortgage Calculator in Excel

While creating a comprehensive reverse mortgage calculator in Excel requires some financial knowledge and Excel skills, there are basic steps and formulas that can guide you through the process.

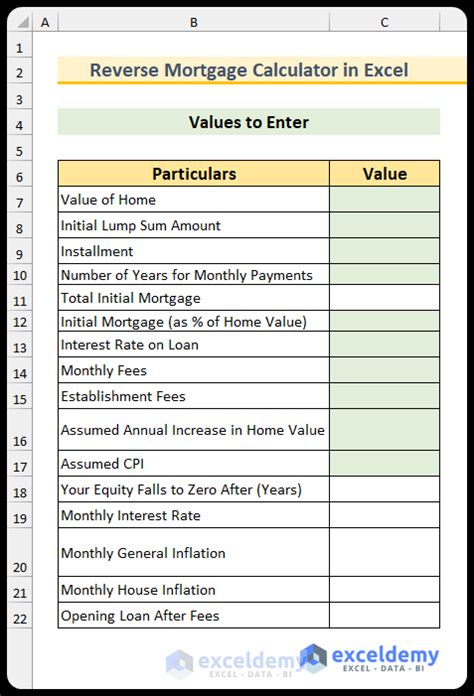

- Input Sheet: Create a sheet where users can input their data, such as property value, outstanding mortgage balance, age, and desired loan terms.

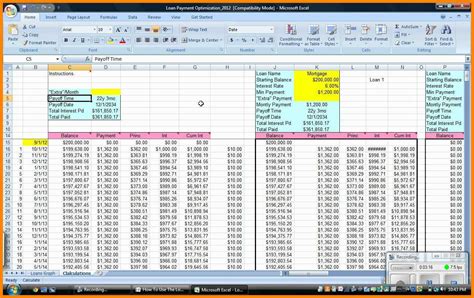

- Calculation Sheet: Set up a separate sheet to perform the calculations. This will involve formulas to determine the maximum loan amount based on the user's inputs and the lender's terms.

- Output Sheet: Design a sheet to display the results, including the estimated loan amount, monthly payments (if any), and potential cash flow impacts.

Essential Formulas and Functions

- Loan Amount Calculation: Utilize the PMT function in Excel to calculate the maximum loan amount based on the interest rate, loan term, and property value.

- Cash Flow Analysis: Use the IPMT and PPMT functions to analyze the interest and principal payments over time, if applicable.

Conclusion

A reverse mortgage calculator in Excel is a valuable tool for homeowners considering a reverse mortgage. By understanding how to create or effectively use a reverse mortgage calculator, individuals can make more informed decisions about their financial futures. Whether supplementing retirement income, paying off high-interest debts, or covering healthcare costs, a reverse mortgage can be a strategic financial move. However, it's crucial to carefully consider the implications and seek professional advice before making a decision.

Reverse Mortgage Calculator Excel Image Gallery

We hope this guide has been informative and helpful in your exploration of reverse mortgage calculators in Excel. Remember, while these tools are incredibly useful, it's always wise to consult with a financial advisor before making significant financial decisions. If you have any experiences or insights about using a reverse mortgage calculator in Excel, please share your thoughts in the comments below.