Access Robins Credit Union online banking for secure account management, bill pay, and transfers, with convenient mobile banking and online services, including account monitoring and financial tools.

The world of online banking has revolutionized the way people manage their finances, providing unparalleled convenience and flexibility. Robins Credit Union, a leading financial institution, offers its members a comprehensive online banking platform that enables them to access their accounts, pay bills, and transfer funds from the comfort of their own homes. In this article, we will delve into the world of Robins Credit Union online banking, exploring its features, benefits, and advantages.

Online banking has become an essential tool for individuals and businesses alike, allowing them to manage their finances efficiently and effectively. With Robins Credit Union online banking, members can access their accounts 24/7, view their account balances, and review their transaction history. This level of accessibility and transparency enables members to stay on top of their finances, making it easier to budget, save, and plan for the future. Moreover, online banking reduces the need for physical visits to the credit union, saving time and effort for members with busy schedules.

The importance of online banking cannot be overstated, as it provides a secure and convenient way to manage finances. Robins Credit Union's online banking platform is designed with security in mind, utilizing state-of-the-art encryption and authentication protocols to protect members' sensitive information. This ensures that members can access their accounts with confidence, knowing that their financial data is safe and secure. Furthermore, online banking enables members to set up account alerts, receive notifications, and monitor their accounts for suspicious activity, providing an additional layer of security and peace of mind.

Getting Started with Robins Credit Union Online Banking

To get started with Robins Credit Union online banking, members need to enroll in the service by visiting the credit union's website. The enrollment process is straightforward, requiring members to provide their account information, create a username and password, and set up security questions. Once enrolled, members can access their accounts using their username and password, or by using the credit union's mobile banking app. The mobile app provides an additional layer of convenience, enabling members to access their accounts on-the-go, using their smartphones or tablets.

Key Features of Robins Credit Union Online Banking

The online banking platform offered by Robins Credit Union is packed with features that make managing finances easy and convenient. Some of the key features include: * Account access: Members can view their account balances, review their transaction history, and access their account statements. * Bill pay: Members can pay bills online, setting up one-time or recurring payments to vendors and service providers. * Fund transfers: Members can transfer funds between their accounts, or to accounts at other financial institutions. * Account alerts: Members can set up account alerts, receiving notifications when transactions are posted, or when their account balances fall below a certain threshold. * Mobile banking: Members can access their accounts using the credit union's mobile banking app, depositing checks, and transferring funds on-the-go.Benefits of Robins Credit Union Online Banking

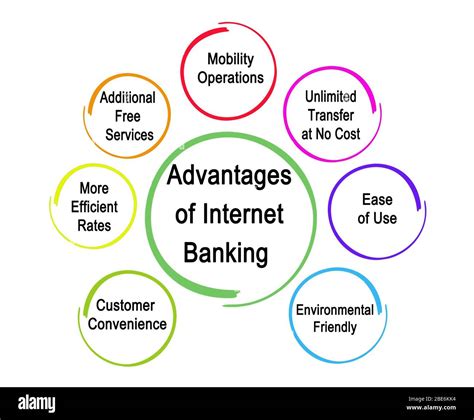

The benefits of Robins Credit Union online banking are numerous, providing members with a convenient, secure, and efficient way to manage their finances. Some of the key benefits include:

- Convenience: Members can access their accounts 24/7, from anywhere with an internet connection.

- Security: The online banking platform is designed with security in mind, utilizing state-of-the-art encryption and authentication protocols.

- Efficiency: Members can manage their finances quickly and easily, reducing the need for physical visits to the credit union.

- Cost savings: Members can avoid late fees and penalties by paying bills online, and can also reduce their reliance on paper checks and statements.

Security Measures in Place

Robins Credit Union takes the security of its online banking platform seriously, implementing a range of measures to protect members' sensitive information. Some of the security measures in place include: * Encryption: The online banking platform uses state-of-the-art encryption to protect members' data, both in transit and at rest. * Authentication: Members are required to authenticate themselves using a username and password, or by using the credit union's mobile banking app. * Firewalls: The credit union's online banking platform is protected by firewalls, which block unauthorized access to the system. * Monitoring: The credit union's online banking platform is monitored 24/7, with suspicious activity reported to members and law enforcement agencies.Mobile Banking with Robins Credit Union

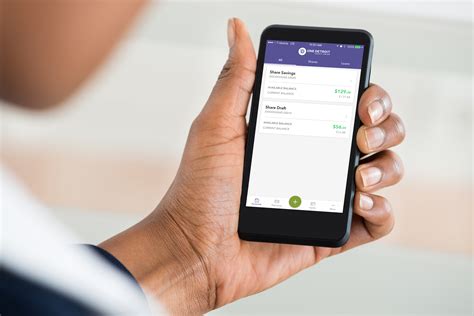

Robins Credit Union's mobile banking app provides members with an additional layer of convenience, enabling them to access their accounts on-the-go. The app is available for both iOS and Android devices, and can be downloaded from the App Store or Google Play. Once downloaded, members can use the app to:

- View their account balances and transaction history

- Transfer funds between their accounts

- Pay bills using the bill pay feature

- Deposit checks using the remote deposit capture feature

- Access their account statements and tax documents

Tips for Using Robins Credit Union Online Banking

To get the most out of Robins Credit Union online banking, members should follow these tips: * Use strong passwords and keep them confidential * Monitor their accounts regularly for suspicious activity * Set up account alerts to receive notifications when transactions are posted * Use the bill pay feature to pay bills on time and avoid late fees * Keep their computer and mobile devices up-to-date with the latest security patches and software updatesCommon Issues with Robins Credit Union Online Banking

While Robins Credit Union online banking is designed to be secure and convenient, members may occasionally encounter issues when using the platform. Some common issues include:

- Forgotten passwords or usernames

- Difficulty logging in due to authentication issues

- Problems with bill pay or fund transfers

- Issues with mobile banking app connectivity

- Concerns about security and data protection

Resolving Common Issues

To resolve common issues with Robins Credit Union online banking, members can follow these steps: * Contact the credit union's customer support team for assistance with forgotten passwords or usernames * Check their account settings and authentication protocols to resolve login issues * Review their bill pay and fund transfer settings to ensure accuracy and completeness * Check their mobile device settings and app updates to resolve connectivity issues * Contact the credit union's security team to report concerns about security and data protectionOnline Banking Image Gallery

Final Thoughts on Robins Credit Union Online Banking

In conclusion, Robins Credit Union online banking provides members with a convenient, secure, and efficient way to manage their finances. With its range of features, including account access, bill pay, and fund transfers, members can take control of their financial lives and achieve their goals. By following the tips and best practices outlined in this article, members can get the most out of online banking and enjoy the benefits it has to offer. Whether you're a seasoned online banking user or just getting started, Robins Credit Union's online banking platform is an essential tool for managing your finances and achieving financial success.

We invite you to share your thoughts and experiences with Robins Credit Union online banking in the comments below. Have you used the platform to manage your finances? What features do you find most useful? Do you have any tips or advice for getting the most out of online banking? By sharing your insights and expertise, you can help others make the most of this powerful tool and achieve their financial goals. Additionally, if you found this article helpful, please share it with your friends and family on social media, and consider subscribing to our newsletter for more informative articles and updates on personal finance and online banking.