Intro

Unlock the power of Relative Strength Index (RSI) in Excel with our step-by-step guide. Learn three effective ways to calculate RSI in Excel, including using formulas, add-ins, and charting tools. Boost your technical analysis skills and make informed investment decisions with our expert tips and tricks on RSI calculation, momentum indicators, and stock market analysis.

Calculating the Relative Strength Index (RSI) in Excel can be a valuable skill for traders and investors looking to gauge the strength of a stock or other financial instrument. In this article, we will explore three different methods to calculate RSI in Excel.

What is RSI?

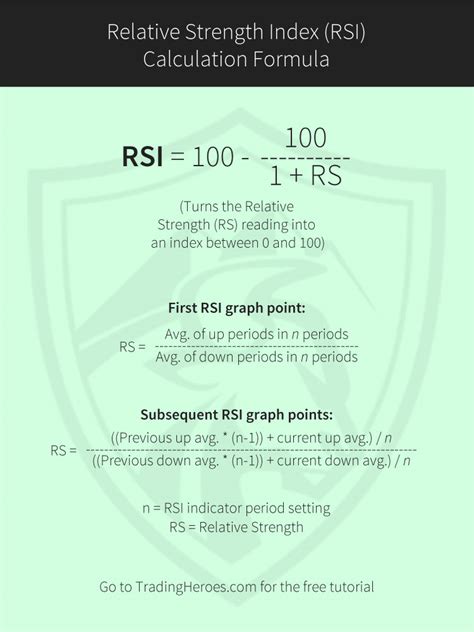

Before diving into the calculations, let's quickly review what RSI is. The Relative Strength Index (RSI) is a technical indicator that measures the magnitude of recent price changes to determine overbought or oversold conditions. It is calculated over a specific period, usually 14 days, and is expressed as a value between 0 and 100.

Method 1: Using the Average Gain and Loss Formula

The first method to calculate RSI in Excel involves using the average gain and loss formula.

Here's how to do it:

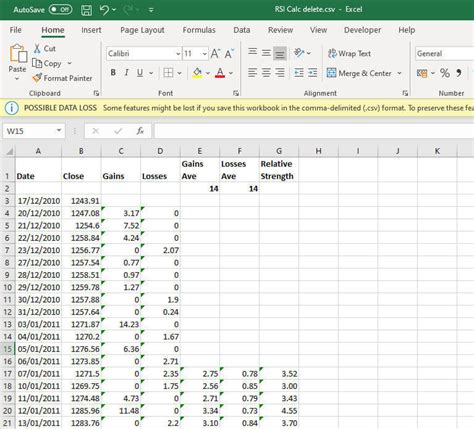

- Create a table with the following columns: Date, Close Price, Gain, Loss, Average Gain, Average Loss, and RSI.

- In the Gain column, enter the formula

=IF(Close Price > Previous Close Price, Close Price - Previous Close Price, 0)and drag it down to fill the rest of the cells. - In the Loss column, enter the formula

=IF(Close Price < Previous Close Price, Previous Close Price - Close Price, 0)and drag it down to fill the rest of the cells. - In the Average Gain column, enter the formula

=AVERAGE(Gain)and drag it down to fill the rest of the cells. - In the Average Loss column, enter the formula

=AVERAGE(Loss)and drag it down to fill the rest of the cells. - In the RSI column, enter the formula

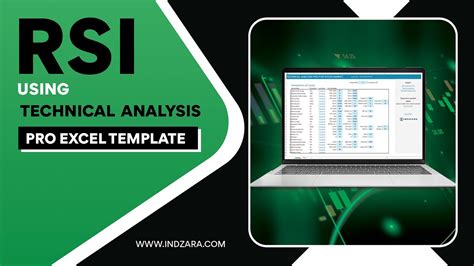

=100 - (100 / (1 + Average Gain / Average Loss))and drag it down to fill the rest of the cells.

Method 2: Using the Wilder Formula

The second method to calculate RSI in Excel involves using the Wilder formula.

Here's how to do it:

- Create a table with the following columns: Date, Close Price, and RSI.

- In the RSI column, enter the formula

=100 - (100 / (1 + (SUM(Close Price - Previous Close Price) / SUM(Previous Close Price - Close Price)) / 14))and drag it down to fill the rest of the cells.

Method 3: Using the RSI Function in Excel

The third method to calculate RSI in Excel involves using the RSI function.

Here's how to do it:

- Create a table with the following columns: Date, Close Price, and RSI.

- In the RSI column, enter the formula

=RSI(Close Price, 14)and drag it down to fill the rest of the cells.

Gallery of RSI Calculation Methods

RSI Calculation Methods Gallery

Conclusion

In conclusion, calculating RSI in Excel can be done using three different methods: the average gain and loss formula, the Wilder formula, or the RSI function. Each method has its own advantages and disadvantages, and the choice of which method to use depends on the individual's preference and needs. By following the steps outlined in this article, traders and investors can easily calculate RSI in Excel and make more informed investment decisions.

FAQs

- What is RSI? RSI stands for Relative Strength Index, a technical indicator that measures the magnitude of recent price changes to determine overbought or oversold conditions.

- What is the RSI formula? The RSI formula is: RSI = 100 - (100 / (1 + Average Gain / Average Loss))

- How do I calculate RSI in Excel? There are three methods to calculate RSI in Excel: the average gain and loss formula, the Wilder formula, or the RSI function.

- What is the difference between the three methods? The three methods differ in their approach to calculating RSI. The average gain and loss formula uses the average gain and loss over a specific period, while the Wilder formula uses the sum of the gains and losses. The RSI function is a built-in function in Excel that calculates RSI.