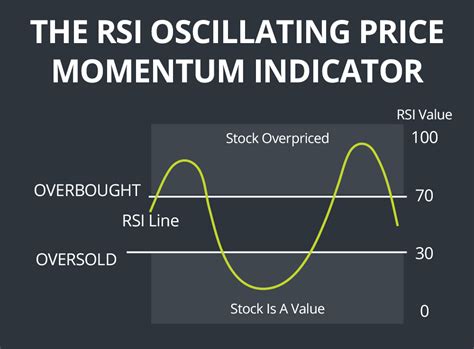

The Relative Strength Index (RSI) is a widely used technical indicator in finance that helps investors and traders gauge the magnitude of recent price changes in order to determine overbought or oversold conditions. Calculating the RSI in Excel is a straightforward process that can be accomplished in a few easy steps. In this article, we will explore three methods to calculate the RSI in Excel, each with its own unique approach.

What is RSI?

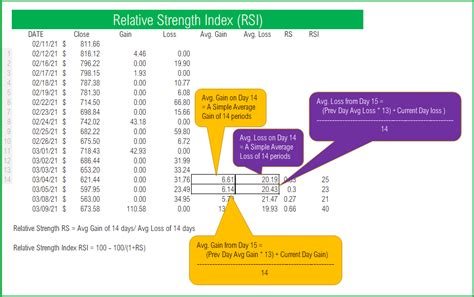

Before diving into the calculations, it's essential to understand the concept of RSI. The Relative Strength Index is a momentum oscillator that measures the speed and change of price movements. It was developed by J. Welles Wilder Jr. in the 1970s and is commonly used to identify overbought and oversold conditions in financial markets. The RSI is calculated based on the average gain of up days and the average loss of down days over a specified period.

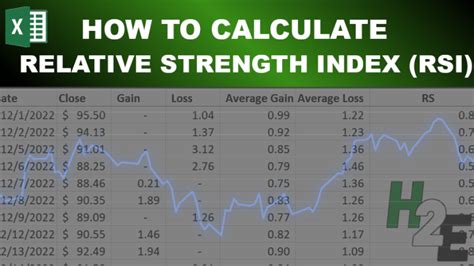

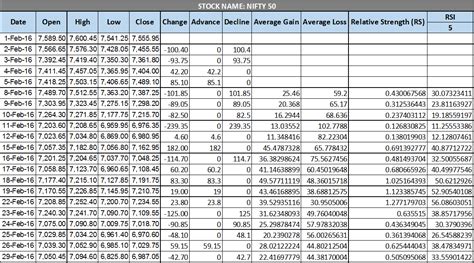

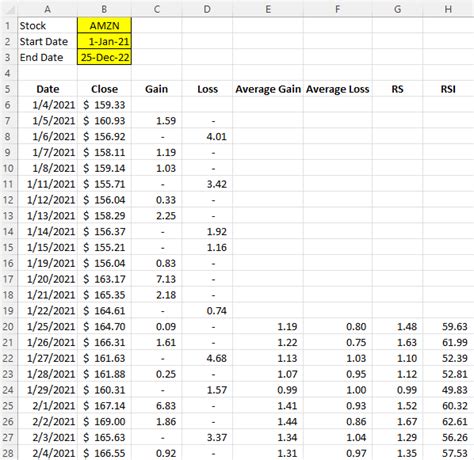

Method 1: Using Excel Formulas

The first method involves using Excel formulas to calculate the RSI. This approach requires you to calculate the average gain and average loss over a specified period, typically 14 days.

Step 1: Create a table with the following columns:

| Date | Close Price | Gain | Loss |

|---|

Step 2: Calculate the gain and loss for each day:

- Gain:

=IF(Close Price > Previous Close Price, Close Price - Previous Close Price, 0) - Loss:

=IF(Close Price < Previous Close Price, Previous Close Price - Close Price, 0)

Step 3: Calculate the average gain and average loss over the specified period:

- Average Gain:

=AVERAGE(Gain, 14) - Average Loss:

=AVERAGE(Loss, 14)

Step 4: Calculate the RS (Relative Strength) and RSI:

- RS:

=Average Gain / Average Loss - RSI:

=100 - (100 / (1 + RS))

Method 2: Using Excel Functions

The second method involves using Excel functions, specifically the AVERAGEIF and IFS functions.

Step 1: Create a table with the following columns:

| Date | Close Price | Gain | Loss |

|---|

Step 2: Calculate the gain and loss for each day using the AVERAGEIF function:

- Gain:

=AVERAGEIF(Close Price, ">0", Close Price - Previous Close Price) - Loss:

=AVERAGEIF(Close Price, "<0", Previous Close Price - Close Price)

Step 3: Calculate the average gain and average loss over the specified period using the IFS function:

- Average Gain:

=IFS(Gain, ">0", AVERAGE(Gain), 14) - Average Loss:

=IFS(Loss, ">0", AVERAGE(Loss), 14)

Step 4: Calculate the RS and RSI:

- RS:

=Average Gain / Average Loss - RSI:

=100 - (100 / (1 + RS))

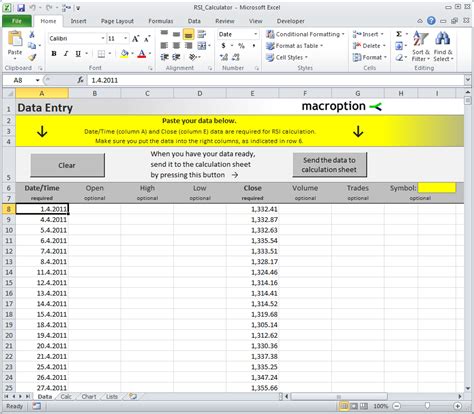

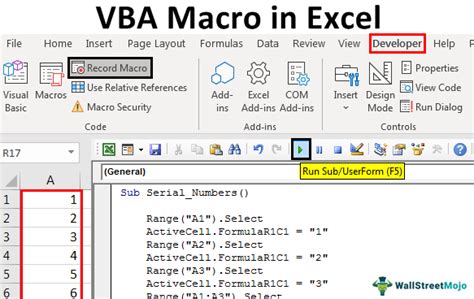

Method 3: Using a VBA Macro

The third method involves using a VBA macro to calculate the RSI.

Step 1: Open the Visual Basic Editor by pressing Alt + F11 or navigating to Developer > Visual Basic in the Excel ribbon.

Step 2: Create a new module by clicking Insert > Module and paste the following code:

Sub CalculateRSI()

' Define variables

Dim dataRange As Range

Dim closePrice As Range

Dim gain As Range

Dim loss As Range

Dim averageGain As Double

Dim averageLoss As Double

Dim rs As Double

Dim rsi As Double

' Set data range

Set dataRange = Range("A1:E100")

' Calculate gain and loss

For Each row In dataRange.Rows

If row.Cells(2).Value > row.Cells(1).Value Then

row.Cells(3).Value = row.Cells(2).Value - row.Cells(1).Value

Else

row.Cells(4).Value = row.Cells(1).Value - row.Cells(2).Value

End If

Next row

' Calculate average gain and loss

averageGain = Application.WorksheetFunction.Average(dataRange.Columns(3))

averageLoss = Application.WorksheetFunction.Average(dataRange.Columns(4))

' Calculate RS and RSI

rs = averageGain / averageLoss

rsi = 100 - (100 / (1 + rs))

' Output RSI value

Range("F1").Value = rsi

End Sub

Step 3: Run the macro by clicking Developer > Macros and selecting CalculateRSI.

Each of these methods offers a unique approach to calculating the RSI in Excel. By following these steps, you can easily calculate the RSI for any stock or financial instrument.

Gallery of RSI Calculation Methods

RSI Calculation Methods

FAQs

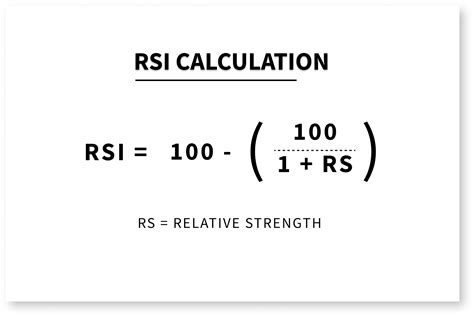

Q: What is the RSI calculation formula? A: The RSI calculation formula is: RSI = 100 - (100 / (1 + RS)), where RS is the Relative Strength.

Q: How do I calculate the RSI in Excel? A: You can calculate the RSI in Excel using formulas, functions, or a VBA macro.

Q: What is the best way to calculate the RSI? A: The best way to calculate the RSI depends on your personal preference and level of expertise. Formulas and functions are easy to use, while a VBA macro offers more flexibility and customization options.

We hope this article has helped you understand how to calculate the RSI in Excel. If you have any questions or need further assistance, please don't hesitate to comment below.