Create A Solid Rv Installment Payment Contract In 5 Steps Summary

Secure your RV purchase with a solid installment payment contract. Learn how to create a comprehensive agreement in 5 easy steps, including outlining payment terms, specifying default consequences, and defining warranty and maintenance obligations. Protect your investment and ensure a smooth transaction with our expert guide to RV installment payment contracts.

Purchasing a recreational vehicle (RV) can be a significant investment, and many buyers opt for installment payments to make the purchase more manageable. As a seller, it's essential to create a solid RV installment payment contract to protect both parties' interests. Here's a step-by-step guide to help you create a comprehensive contract:

Understanding the Importance of a Solid Contract

Before diving into the contract creation process, it's crucial to understand the importance of having a solid agreement in place. A well-crafted contract can help prevent disputes, ensure timely payments, and provide a clear understanding of the terms and conditions of the sale.

Step 1: Define the Parties and the RV Details

The first step in creating a solid RV installment payment contract is to define the parties involved and the RV details. This section should include:

- The buyer's and seller's names and addresses

- A detailed description of the RV, including its make, model, year, and Vehicle Identification Number (VIN)

- The purchase price and the amount financed

- The interest rate and any applicable fees

Example:

"THIS INSTALLMENT PAYMENT CONTRACT ('Contract') is made and entered into on [DATE] ('Effective Date') by and between [SELLER'S NAME] ('Seller') with a principal place of business at [SELLER'S ADDRESS] and [BUYER'S NAME] ('Buyer') with a principal place of residence at [BUYER'S ADDRESS].

The RV being sold is a [MAKE] [MODEL] [YEAR] with a VIN of [VIN]. The purchase price of the RV is $[PURCHASE PRICE], with an amount financed of $[AMOUNT FINANCED]. The interest rate is [INTEREST RATE]% per annum, and the Buyer shall pay an annual fee of $[ANNUAL FEE]."

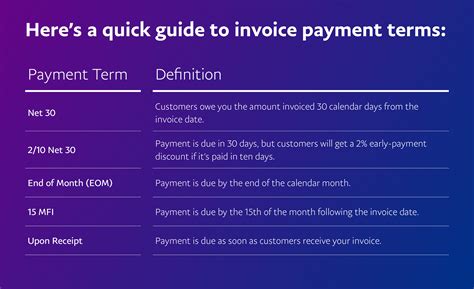

Step 2: Outline the Payment Terms

The second step is to outline the payment terms, including the payment schedule, amount, and method. This section should include:

- The payment amount and frequency (e.g., monthly, quarterly)

- The payment method (e.g., check, bank transfer, online payment)

- The payment due date and any late payment fees

- The total number of payments and the final payment date

Example:

"The Buyer shall make [NUMBER] payments of $[PAYMENT AMOUNT] each, payable on the [PAYMENT DUE DATE] day of each month, commencing on [FIRST PAYMENT DATE] and continuing until [FINAL PAYMENT DATE]. The Buyer shall make payments by [PAYMENT METHOD]. A late payment fee of $[LATE PAYMENT FEE] shall be assessed if payment is not received within [NUMBER] days of the due date."

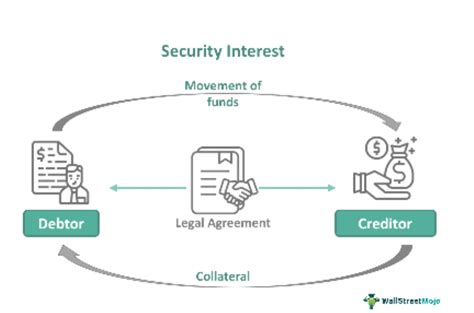

Step 3: Define the Security Interest

The third step is to define the security interest, which gives the seller the right to repossess the RV if the buyer defaults on payments.

- The security interest section should include:

- A statement indicating that the RV is collateral for the loan

- A description of the RV and its location

- The buyer's obligation to maintain the RV in good condition

Example:

"The RV is collateral for the loan, and the Seller retains a security interest in the RV until the Buyer has made all payments under this Contract. The RV is located at [LOCATION] and shall be maintained by the Buyer in good condition and repair. The Buyer shall not remove or alter any identification numbers or marks on the RV."

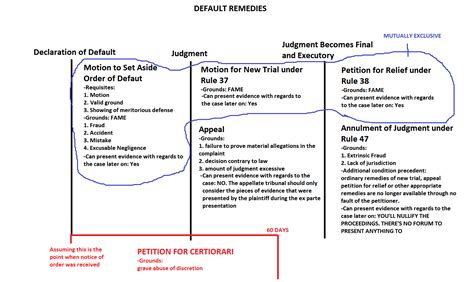

Step 4: Outline the Default and Remedies

The fourth step is to outline the default and remedies, which specify the actions the seller can take if the buyer defaults on payments.

- The default and remedies section should include:

- A statement indicating what constitutes default (e.g., missed payments, failure to maintain the RV)

- The seller's right to repossess the RV

- The buyer's obligation to pay any deficiency after the RV is repossessed and sold

Example:

"If the Buyer fails to make any payment when due or fails to maintain the RV in good condition, the Seller may declare the Buyer in default. Upon default, the Seller may repossess the RV and sell it at a public or private sale. The Buyer shall be liable for any deficiency resulting from the sale, including reasonable costs and expenses."

Step 5: Include Additional Provisions

The final step is to include additional provisions that may be relevant to the sale, such as:

- A statement indicating that the contract is the entire agreement between the parties

- A clause specifying the governing law and jurisdiction

- A section outlining the buyer's and seller's obligations regarding notices and communications

Example:

"This Contract constitutes the entire agreement between the parties and supersedes all prior negotiations, understandings, and agreements. This Contract shall be governed by and construed in accordance with the laws of [STATE]. Any disputes arising out of or related to this Contract shall be resolved through arbitration in accordance with the rules of the American Arbitration Association."

By following these five steps, you can create a comprehensive RV installment payment contract that protects both parties' interests and ensures a smooth transaction.

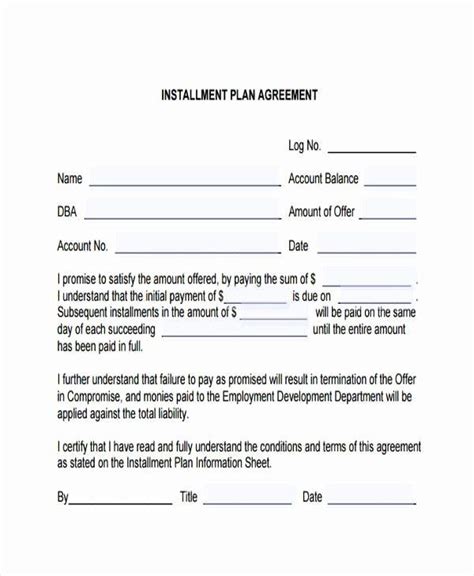

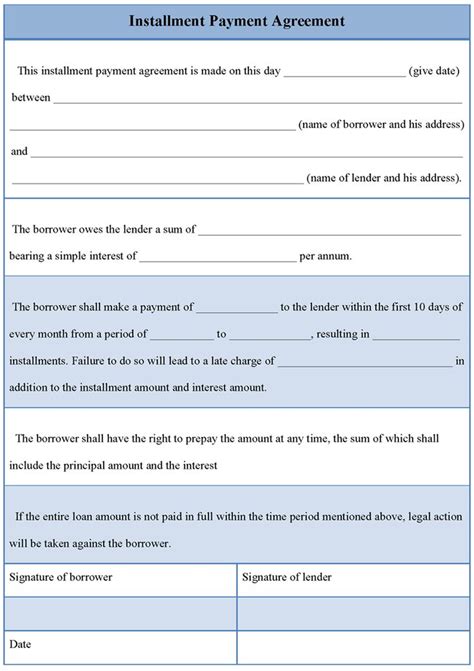

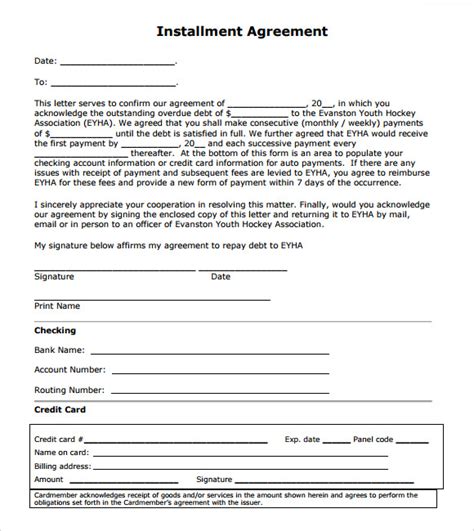

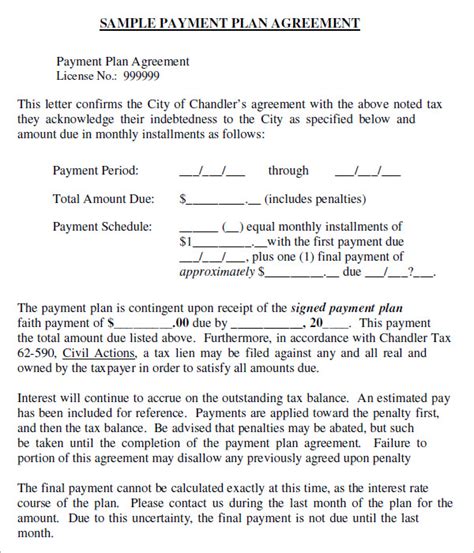

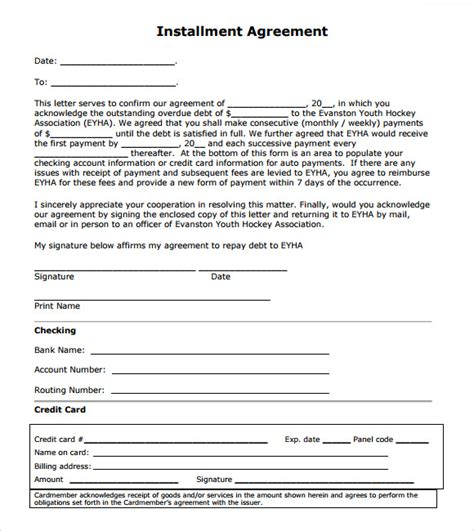

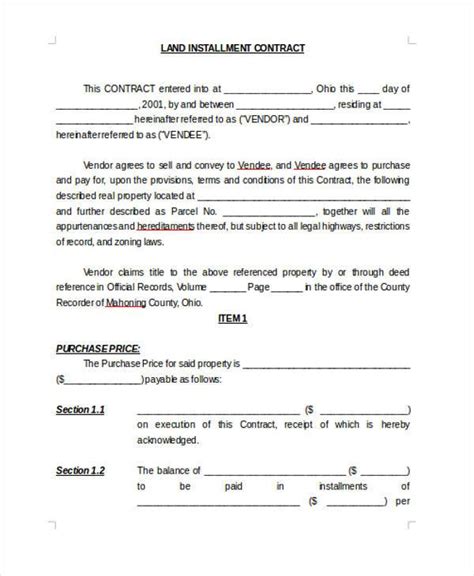

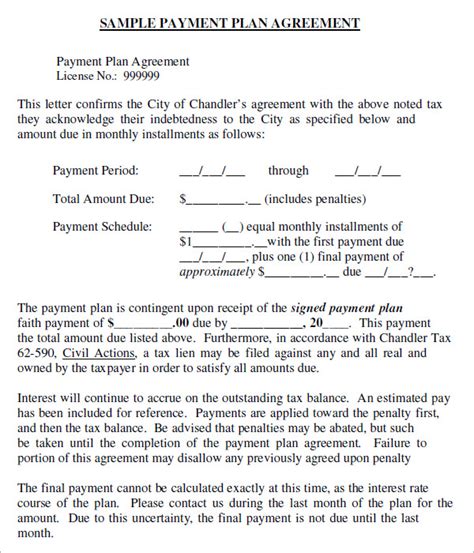

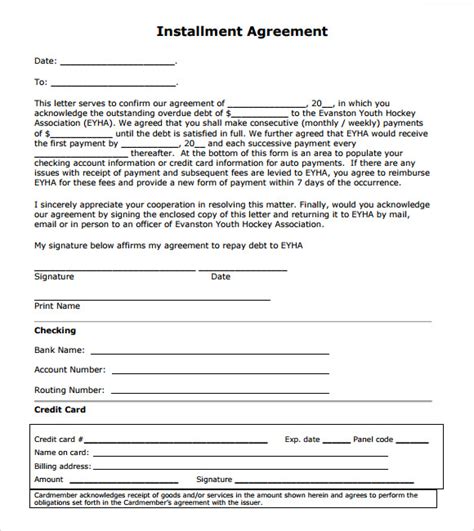

Gallery of RV Installment Payment Contract Samples

RV Installment Payment Contract Samples

We hope this article has provided you with valuable insights into creating a solid RV installment payment contract. Remember to consult with a lawyer or financial advisor to ensure your contract is compliant with local laws and regulations.