Intro

Boost your savings with the 52-Week Savings Challenge Printable Template! This simple yet effective plan helps you build a savings habit, achieve financial goals, and develop a healthy money mindset. Get your free template now and start your journey to financial freedom with a structured savings plan, budgeting tips, and money management strategies.

Saving money can be a daunting task, especially for those who struggle with creating and sticking to a budget. However, with a clear plan and a bit of discipline, anyone can develop healthy saving habits and achieve their financial goals. One popular and effective way to do this is by following a 52-week savings challenge.

The 52-week savings challenge is a simple yet powerful plan that helps you save money by setting aside a specific amount each week for a year. The challenge starts with saving an amount equal to the number of the week. For example, in week 1, you would save $1, in week 2, you would save $2, and so on. By the end of the 52 weeks, you would have saved over $1,300.

In this article, we will explore the benefits of the 52-week savings challenge, provide a printable template to help you get started, and offer tips and strategies for success.

Benefits of the 52-Week Savings Challenge

The 52-week savings challenge offers numerous benefits, including:

- Develops a savings habit: By setting aside a specific amount each week, you develop a savings habit that can benefit you for the rest of your life.

- Increases savings: The challenge helps you save a significant amount of money over the course of a year.

- Improves financial discipline: The challenge requires you to prioritize saving and make sacrifices when necessary, helping you develop financial discipline.

- Reduces debt: By saving money, you can reduce debt and improve your overall financial health.

- Boosts confidence: Reaching your savings goals can give you a sense of accomplishment and boost your confidence in your ability to manage your finances.

How to Get Started with the 52-Week Savings Challenge

Getting started with the 52-week savings challenge is easy. Here are the steps to follow:

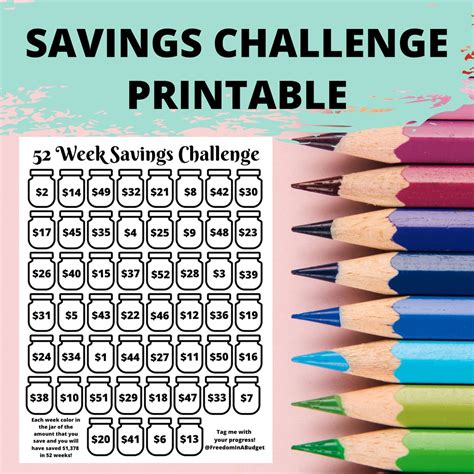

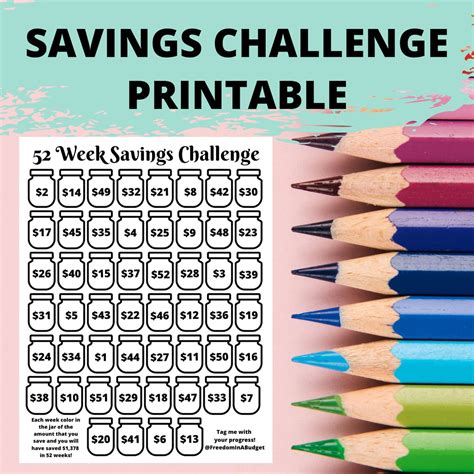

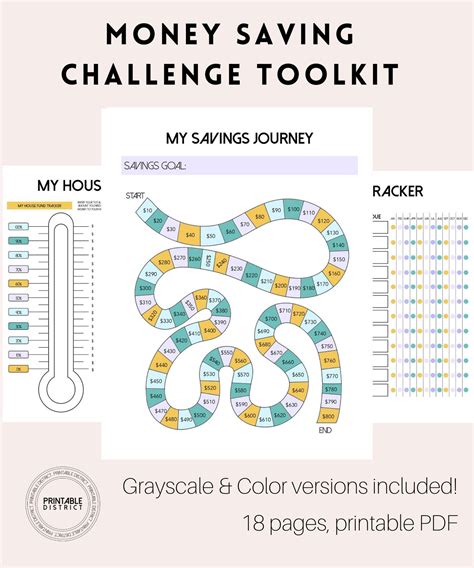

- Download and print the template: You can download and print a 52-week savings challenge template to help you stay on track.

- Set up a separate savings account: Open a separate savings account specifically for the challenge to keep your savings separate from your everyday spending money.

- Start saving: Begin saving the designated amount each week, starting with $1 in week 1 and increasing by $1 each week.

- Make it automatic: Set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

- Track your progress: Use the template to track your progress and stay motivated.

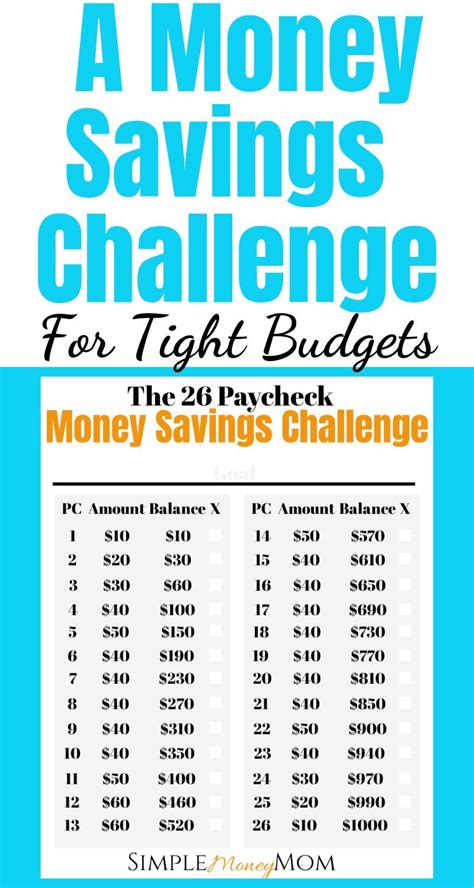

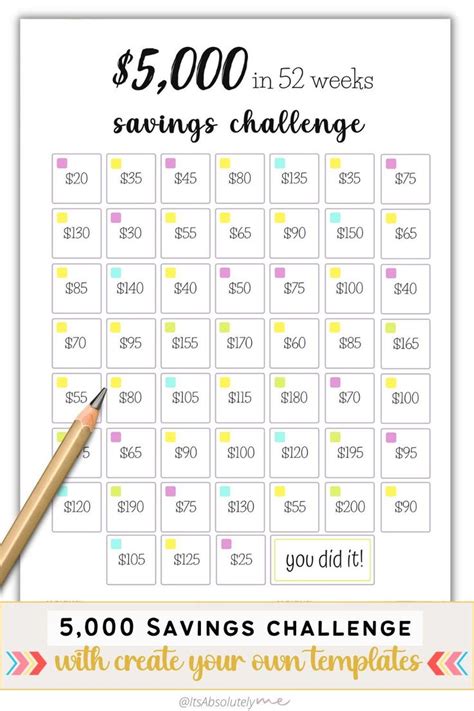

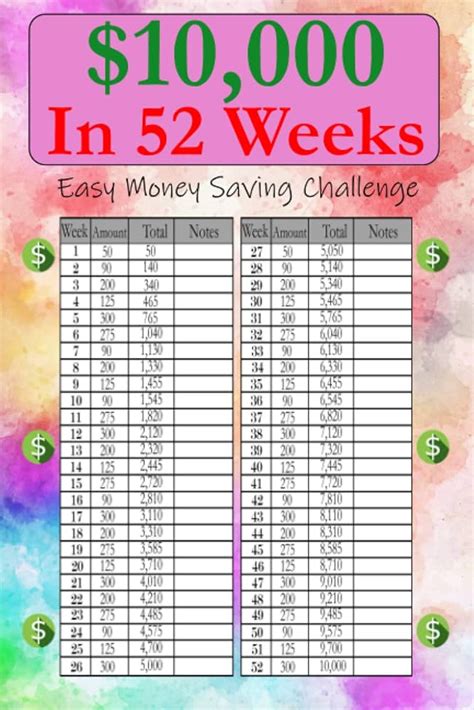

52-Week Savings Challenge Template

Here is a printable 52-week savings challenge template to help you get started:

| Week | Savings Amount | Total Savings |

|---|---|---|

| 1 | $1 | $1 |

| 2 | $2 | $3 |

| 3 | $3 | $6 |

| 4 | $4 | $10 |

| 5 | $5 | $15 |

| ... | ... | ... |

| 52 | $52 | $1,378 |

Tips and Strategies for Success

Here are some tips and strategies to help you succeed with the 52-week savings challenge:

- Start small: If you're new to saving, start with a smaller amount and gradually increase it over time.

- Make it a habit: Try to save at the same time each week to make it a habit.

- Use the 50/30/20 rule: Allocate 50% of your income towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Avoid dipping into savings: Try to avoid dipping into your savings for non-essential purchases.

- Celebrate milestones: Celebrate your progress and milestones along the way to stay motivated.

Overcoming Obstacles

Here are some common obstacles you may face with the 52-week savings challenge and tips on how to overcome them:

- Missed payments: If you miss a payment, don't get discouraged. Simply get back on track as soon as possible.

- Financial setbacks: If you experience a financial setback, such as a job loss or medical emergency, adjust your savings amount accordingly and get back on track when possible.

- Lack of motivation: If you're struggling to stay motivated, remind yourself of your goals and the benefits of saving.

Conclusion

The 52-week savings challenge is a simple yet effective way to develop healthy saving habits and achieve your financial goals. By following the tips and strategies outlined in this article, you can overcome obstacles and stay on track. Remember to celebrate your progress and milestones along the way to stay motivated.

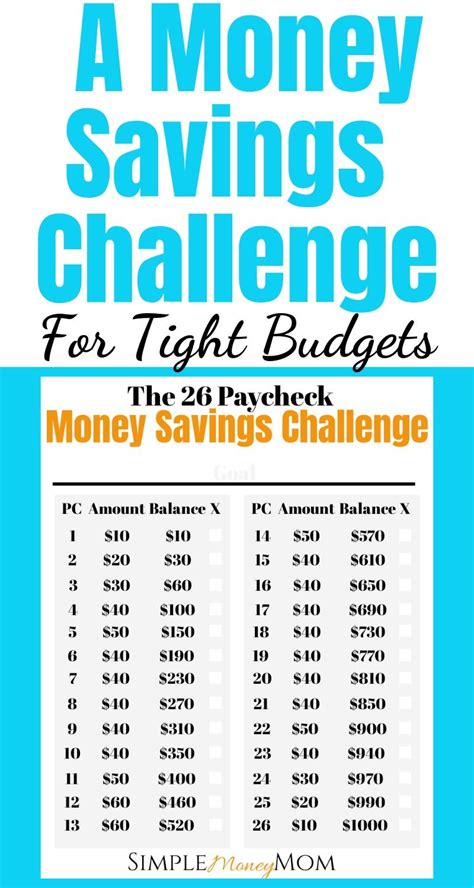

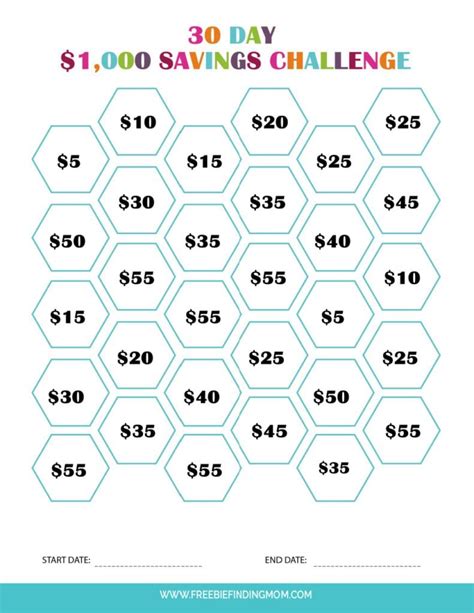

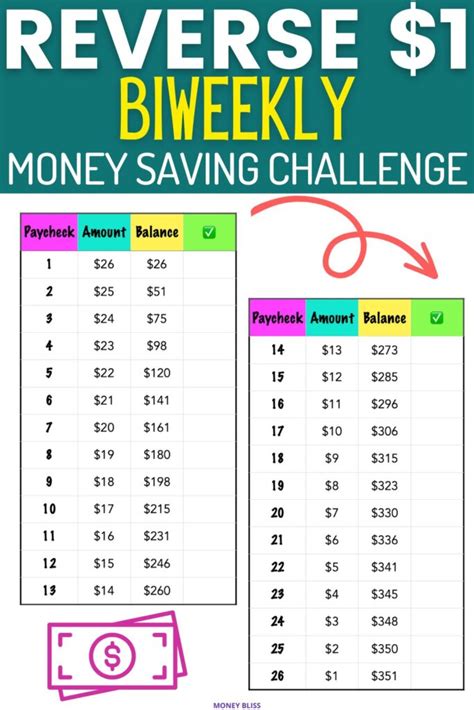

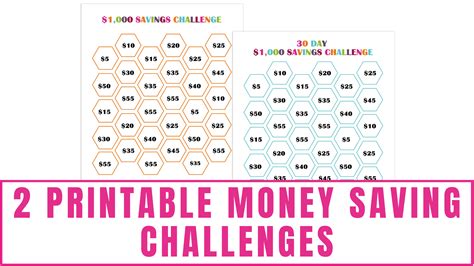

Gallery of Savings Challenge Images

52-Week Savings Challenge Image Gallery

We hope this article has inspired you to take control of your finances and start saving with the 52-week savings challenge. Remember to stay motivated, overcome obstacles, and celebrate your progress along the way. Good luck!