Intro

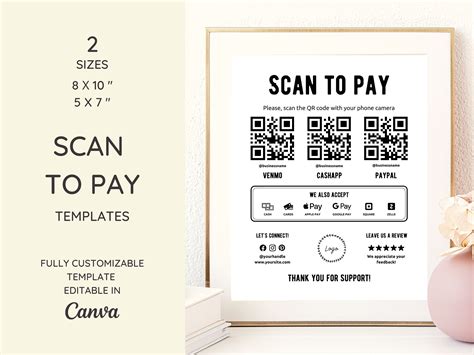

Boost efficiency with a Scan To Pay template, designed to streamline transactions and simplify payment processing. Learn how to reduce errors, increase productivity, and enhance customer satisfaction with this innovative solution. Discover the benefits of scan-to-pay technology and optimize your payment workflow with our expert guide.

In today's fast-paced digital world, convenience and speed are paramount when it comes to transactions. Gone are the days of waiting in line or fumbling for cash. The rise of mobile payments has revolutionized the way we conduct transactions, making them faster, more convenient, and secure. One innovative solution that has gained significant traction in recent years is the scan to pay template. In this article, we will delve into the world of scan to pay, exploring its benefits, working mechanisms, and the steps to create a seamless transaction experience.

What is Scan to Pay?

Scan to pay is a mobile payment method that allows users to make transactions by scanning a QR code or barcode using their smartphones. This technology uses near-field communication (NFC) or optical scanning to read the code, which is linked to the user's bank account or credit card. The scan to pay template is a digital template that merchants can use to generate these QR codes, making it easy for customers to make payments.

Benefits of Scan to Pay

The scan to pay template offers numerous benefits for both merchants and customers. Some of the key advantages include:

- Convenience: Scan to pay eliminates the need for cash, cards, or other payment methods, making transactions faster and more convenient.

- Security: Transactions are encrypted and secure, reducing the risk of fraud and theft.

- Cost-effective: Scan to pay reduces the need for physical payment infrastructure, such as card machines or cash registers, saving merchants money.

- Increased sales: By offering a seamless payment experience, merchants can increase sales and customer satisfaction.

How Scan to Pay Works

The scan to pay process is straightforward:

- Merchant setup: Merchants create a scan to pay template and link it to their bank account or credit card.

- Customer scan: Customers scan the QR code or barcode using their smartphone.

- Transaction initiation: The scan to pay app initiates the transaction, requesting the customer's payment details.

- Transaction confirmation: The customer confirms the transaction, and the payment is processed.

- Receipt generation: The scan to pay app generates a receipt, which is sent to the customer's email or mobile device.

Steps to Create a Scan to Pay Template

Creating a scan to pay template is a straightforward process:

- Choose a payment gateway: Select a payment gateway that supports scan to pay, such as PayPal or Stripe.

- Design the template: Use a design tool or template builder to create a custom scan to pay template.

- Add payment details: Link the template to your bank account or credit card.

- Test the template: Test the template to ensure it works correctly.

Best Practices for Scan to Pay

To ensure a seamless scan to pay experience, follow these best practices:

- Use a clear and concise template design: Ensure the template is easy to read and understand.

- Test the template regularly: Regularly test the template to ensure it works correctly.

- Use secure payment gateways: Use reputable and secure payment gateways to protect customer data.

Future of Scan to Pay

The future of scan to pay looks promising, with advancements in technology and increased adoption expected to drive growth. Some potential developments include:

- Increased adoption: More merchants and customers are expected to adopt scan to pay, driving growth and innovation.

- Advanced security features: Expect to see more advanced security features, such as biometric authentication and encryption.

- Integration with other technologies: Scan to pay may be integrated with other technologies, such as blockchain and artificial intelligence.

Scan to Pay Image Gallery

In conclusion, the scan to pay template is a game-changer for merchants and customers alike. With its convenience, security, and cost-effectiveness, it's no wonder that scan to pay is gaining traction worldwide. By following best practices and staying up-to-date with the latest developments, you can ensure a seamless scan to pay experience for your customers. Share your thoughts on scan to pay in the comments below!