Intro

Secure your business loans with a promissory note template. Learn how to create a legally binding agreement with our detailed guide, featuring a downloadable template. Understand the importance of collateral, interest rates, and repayment terms. Protect your investments and ensure mutually beneficial agreements with our expert insights on secured promissory notes.

A secured promissory note is a crucial document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It serves as a binding contract, ensuring that both parties understand their obligations and responsibilities. In this article, we will delve into the world of secured promissory notes, exploring their importance, key components, and providing a comprehensive template for safe business loans.

The Importance of Secured Promissory Notes

A secured promissory note is a type of loan agreement that requires the borrower to provide collateral to secure the loan. This collateral can be in the form of assets, such as property, equipment, or inventory. The purpose of a secured promissory note is to protect the lender's interests by ensuring that the borrower has a vested interest in repaying the loan.

Key Components of a Secured Promissory Note

A secured promissory note typically includes the following key components:

- Parties involved: The lender and borrower's names, addresses, and contact information.

- Loan amount: The total amount borrowed, including interest rates and fees.

- Repayment terms: The schedule for repayment, including the frequency and amount of payments.

- Collateral: A description of the assets used to secure the loan.

- Default provisions: The consequences of failing to repay the loan, including late payment fees and potential foreclosure.

- Governing law: The jurisdiction that governs the loan agreement.

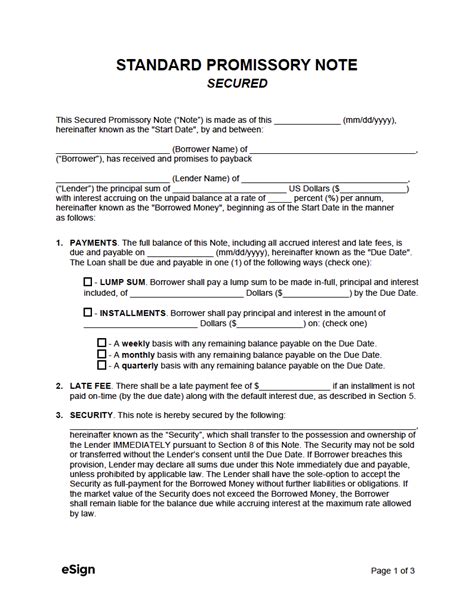

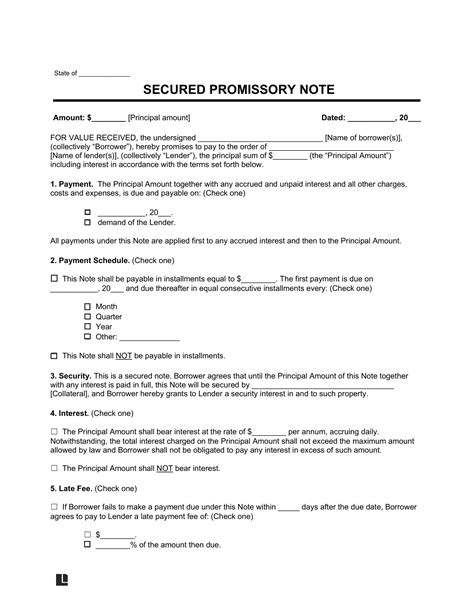

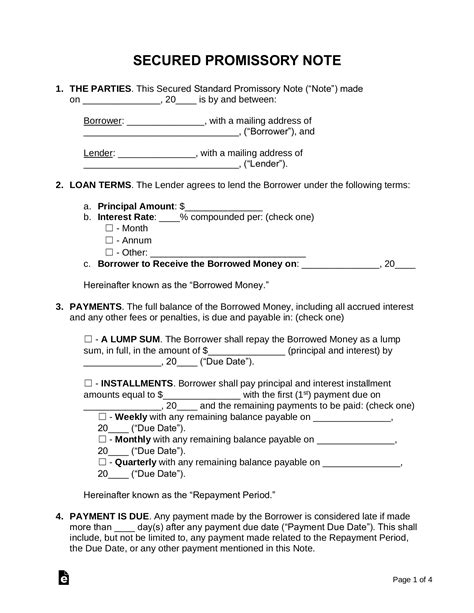

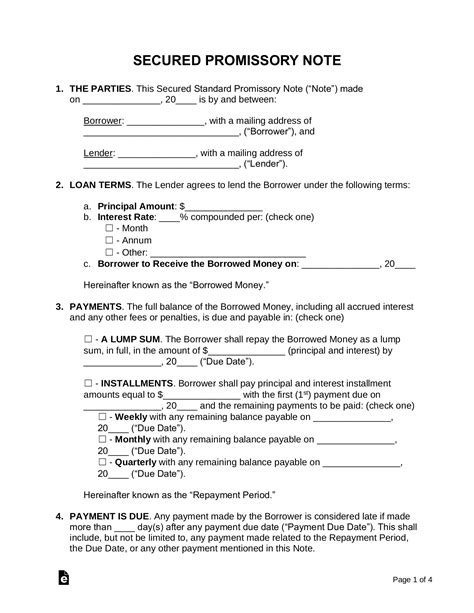

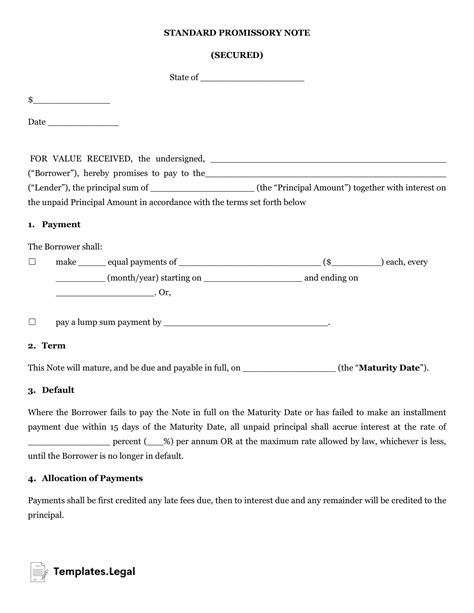

Secured Promissory Note Template

Below is a comprehensive template for a secured promissory note:

SECURED PROMISSORY NOTE

This Secured Promissory Note ("Note") is made and entered into on [DATE] ("Effective Date") by and between [LENDER'S NAME] ("Lender") with a principal place of business at [LENDER'S ADDRESS] and [BORROWER'S NAME] ("Borrower") with a principal place of business at [BORROWER'S ADDRESS].

1. Loan Amount and Interest

The Lender agrees to lend to the Borrower, and the Borrower agrees to borrow from the Lender, the sum of $[LOAN AMOUNT] ("Loan Amount"). The Loan Amount shall bear interest at a rate of [INTEREST RATE]% per annum, compounded annually.

2. Repayment Terms

The Borrower shall repay the Loan Amount, together with interest accrued thereon, in accordance with the following repayment schedule:

- Repayment Amount: $[REPAYMENT AMOUNT]

- Repayment Frequency: [REPAYMENT FREQUENCY] (e.g., monthly, quarterly)

- Repayment Term: [REPAYMENT TERM] years

3. Collateral

The Borrower hereby grants to the Lender a security interest in the following collateral:

- Description of Collateral: [DESCRIPTION OF COLLATERAL]

- Collateral Value: $[COLLATERAL VALUE]

4. Default Provisions

If the Borrower fails to make any payment under this Note when due, the Lender may, at its option, declare the entire unpaid principal balance of the Loan Amount, together with accrued interest, immediately due and payable.

5. Governing Law

This Note shall be governed by and construed in accordance with the laws of [GOVERNING LAW JURISDICTION].

6. Entire Agreement

This Note constitutes the entire agreement between the parties and supersedes all prior negotiations, understandings, and agreements between the parties.

7. Amendments

This Note may not be amended or modified except in writing signed by both parties.

By signing below, the parties acknowledge that they have read, understand, and agree to the terms and conditions of this Secured Promissory Note.

LENDER

[LENDER'S SIGNATURE] [LENDER'S NAME] [LENDER'S TITLE]

BORROWER

[BORROWER'S SIGNATURE] [BORROWER'S NAME] [BORROWER'S TITLE]

Benefits of Using a Secured Promissory Note Template

Using a secured promissory note template offers several benefits, including:

- Protection for lenders: A secured promissory note provides lenders with a level of security, ensuring that borrowers have a vested interest in repaying the loan.

- Clear expectations: A secured promissory note template outlines the terms and conditions of the loan agreement, ensuring that both parties understand their obligations and responsibilities.

- Reduced risk: By providing collateral, borrowers demonstrate their commitment to repaying the loan, reducing the risk of default.

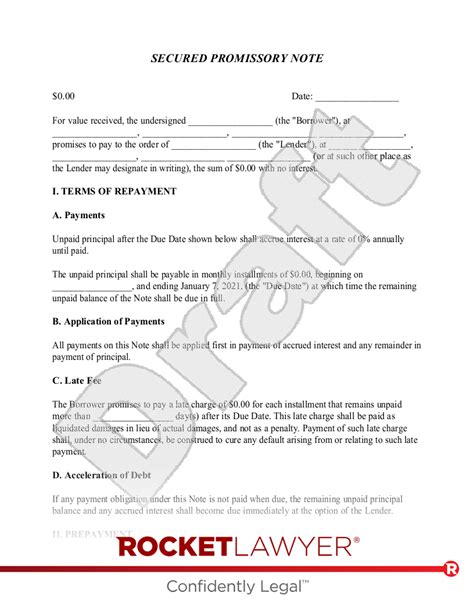

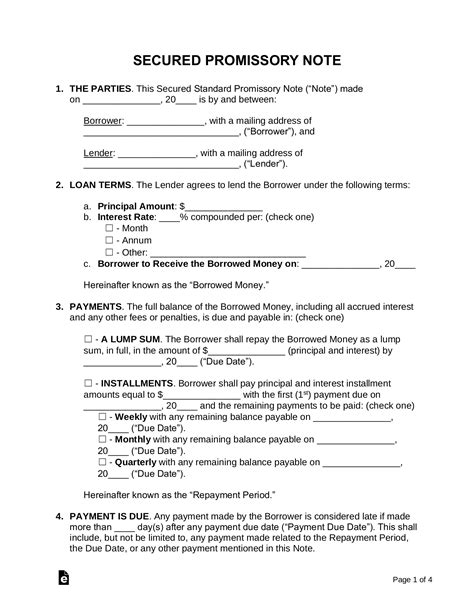

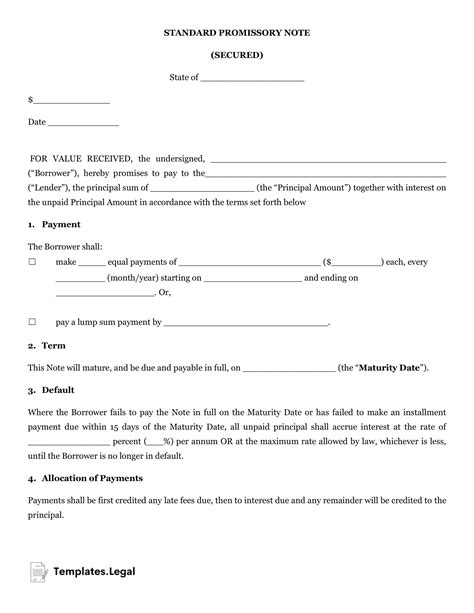

Secured Promissory Note Template Image Gallery

Conclusion

A secured promissory note template is an essential tool for lenders and borrowers, providing a clear and binding agreement that outlines the terms and conditions of a loan. By using a secured promissory note template, lenders can ensure that borrowers have a vested interest in repaying the loan, reducing the risk of default. Borrowers can also benefit from using a secured promissory note template, as it provides a clear understanding of their obligations and responsibilities.