Intro

Streamline your self-employment finances with a free Excel template. Discover 5 expert ways to organize your ledger, track income and expenses, and simplify tax prep. Master budgeting, invoicing, and cash flow management with a customizable spreadsheet, ensuring accuracy and ease in your freelance or small business endeavors.

As a self-employed individual, keeping track of your finances is crucial for the success of your business. One of the most effective ways to manage your finances is by using a self-employment ledger. In this article, we will explore five ways to organize your self-employment ledger using an Excel template.

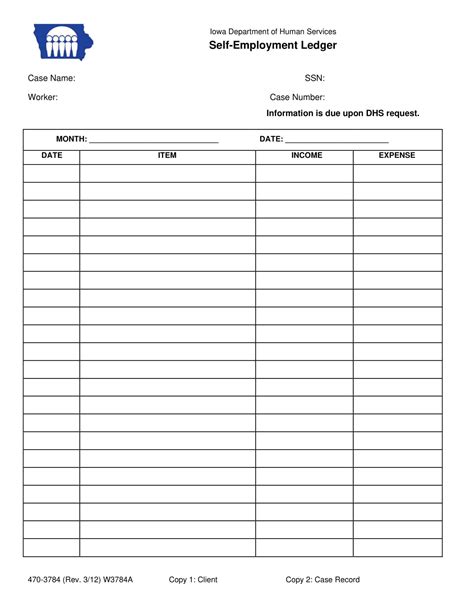

Self-employment ledgers are essential for tracking income, expenses, and tax-deductible expenses. They help you stay organized, ensure accuracy, and provide a clear picture of your business's financial performance. With an Excel template, you can create a customized self-employment ledger that suits your business needs.

Benefits of Using a Self-Employment Ledger

Using a self-employment ledger offers numerous benefits, including:

- Improved financial management: A self-employment ledger helps you track your income and expenses, making it easier to manage your finances.

- Accurate tax reporting: A self-employment ledger ensures that you accurately report your income and expenses on your tax return.

- Increased productivity: With a self-employment ledger, you can quickly identify areas where you can reduce expenses and increase profits.

- Better decision-making: A self-employment ledger provides you with a clear picture of your business's financial performance, enabling you to make informed decisions.

5 Ways to Organize Your Self-Employment Ledger with Excel Template

Here are five ways to organize your self-employment ledger using an Excel template:

1. Categorize Your Income and Expenses

Create separate columns for different types of income and expenses, such as:

- Income: consulting fees, product sales, services rendered

- Expenses: rent, utilities, marketing, travel

This will help you track your income and expenses by category, making it easier to identify areas where you can reduce expenses.

2. Set Up a Budgeting System

Create a budgeting system by setting up separate columns for budgeted income and expenses. This will help you track your actual income and expenses against your budgeted amounts.

- Budgeted income: projected income for the month

- Budgeted expenses: projected expenses for the month

- Actual income: actual income received

- Actual expenses: actual expenses incurred

3. Track Your Tax-Deductible Expenses

Create a separate column for tax-deductible expenses, such as:

- Business use of your home

- Business use of your car

- Travel expenses

- Meals and entertainment

This will help you track your tax-deductible expenses and ensure that you accurately report them on your tax return.

4. Use Formulas to Calculate Totals

Use formulas to calculate totals for each category, such as:

- Total income: =SUM(B2:B10)

- Total expenses: =SUM(C2:C10)

- Net profit: =B2-C2

This will help you quickly calculate your total income, expenses, and net profit.

5. Create a Dashboard for Quick Analysis

Create a dashboard that provides a quick analysis of your financial performance, such as:

- Total income and expenses for the month

- Net profit for the month

- Year-to-date income and expenses

- Year-to-date net profit

This will help you quickly analyze your financial performance and make informed decisions.

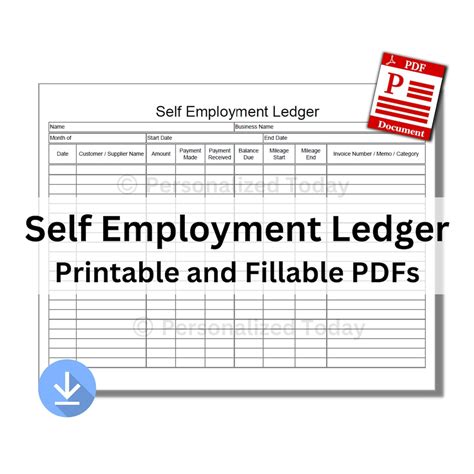

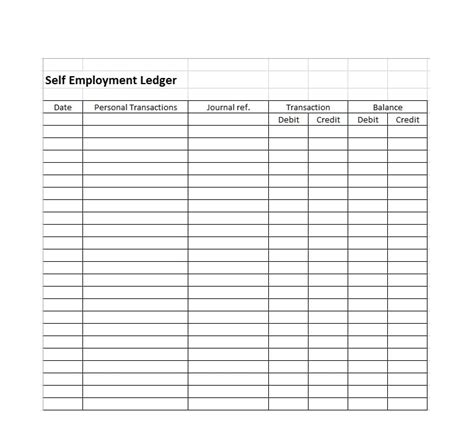

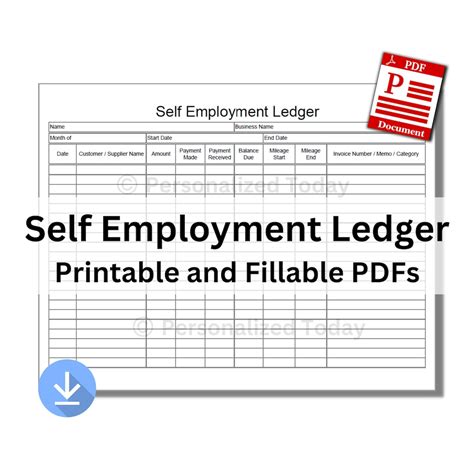

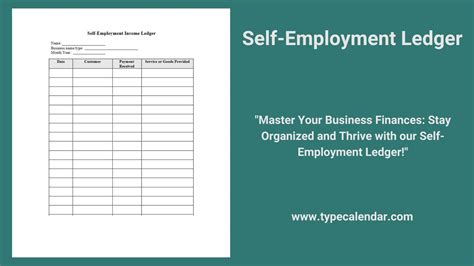

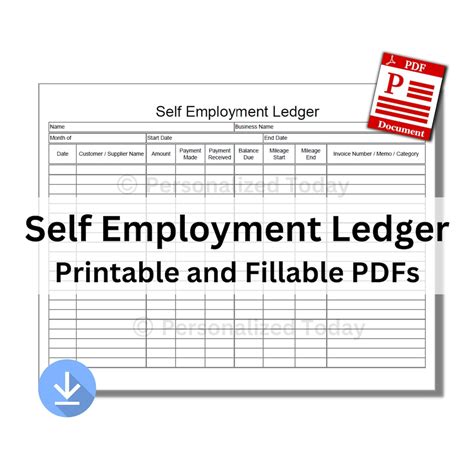

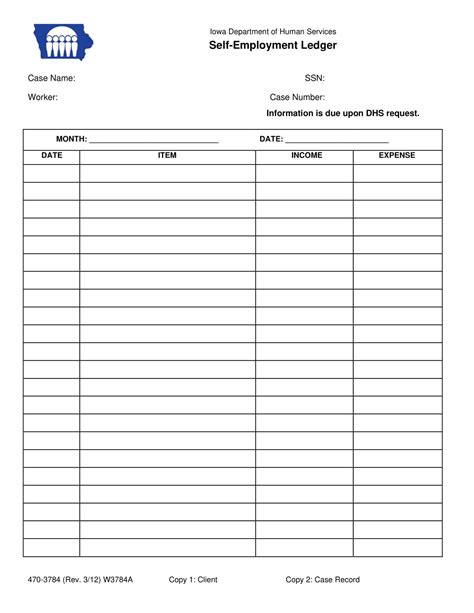

Self-Employment Ledger Template Images

In conclusion, using a self-employment ledger is essential for managing your finances and ensuring the success of your business. By following these five ways to organize your self-employment ledger using an Excel template, you can create a customized ledger that suits your business needs. Remember to categorize your income and expenses, set up a budgeting system, track your tax-deductible expenses, use formulas to calculate totals, and create a dashboard for quick analysis.