Intro

Master self-employment bookkeeping with 5 essential ledger templates. Easily track income, expenses, and tax deductions with our customizable templates. Simplify your accounting and ensure accuracy with our comprehensive guides, including invoicing, expense tracking, and financial reporting templates.

As a self-employed individual, managing your finances effectively is crucial to the success of your business. One essential tool to help you stay on top of your finances is a self-employment ledger template. A self-employment ledger template is a document that helps you track your income, expenses, and taxes, making it easier to manage your business finances.

In this article, we will explore five essential self-employment ledger templates that you can use to manage your finances effectively.

Why Use a Self-Employment Ledger Template?

Using a self-employment ledger template offers several benefits, including:

- Helps you track your income and expenses accurately

- Makes it easier to manage your taxes and reduce your tax liability

- Enables you to identify areas where you can cut costs and improve profitability

- Provides a clear picture of your business's financial performance

- Helps you make informed decisions about your business

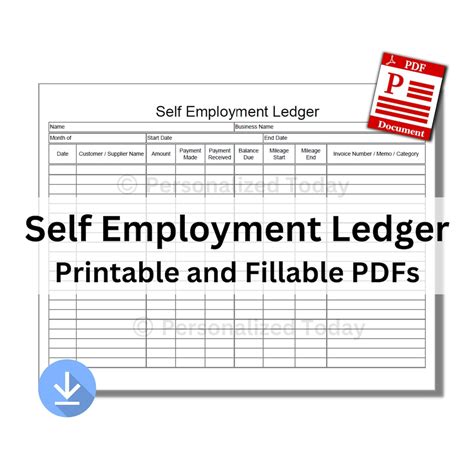

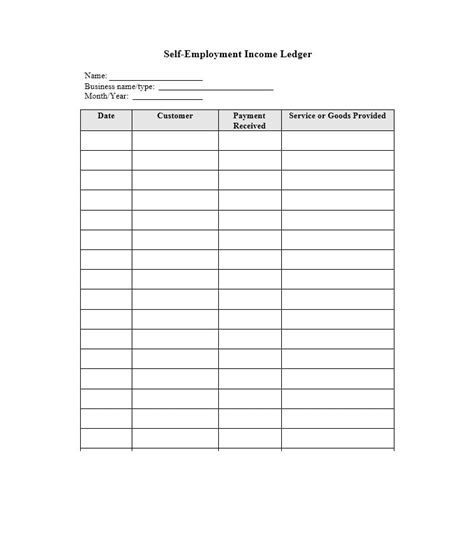

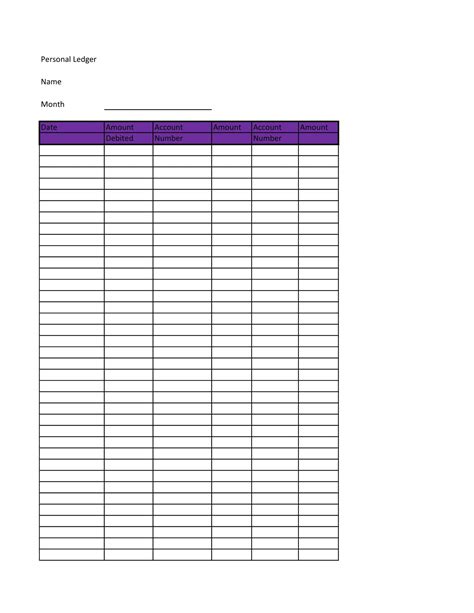

Template 1: Simple Self-Employment Ledger Template

A simple self-employment ledger template is ideal for freelancers or small business owners who have a straightforward financial situation. This template typically includes columns for:

- Date

- Description of income or expense

- Income

- Expense

- Total

Here is an example of what a simple self-employment ledger template might look like:

| Date | Description | Income | Expense | Total |

|---|---|---|---|---|

| 01/01/2023 | Client Payment | $1000 | $1000 | |

| 01/02/2023 | Office Supplies | $50 | $950 | |

| 01/03/2023 | Consulting Fee | $2000 | $2950 |

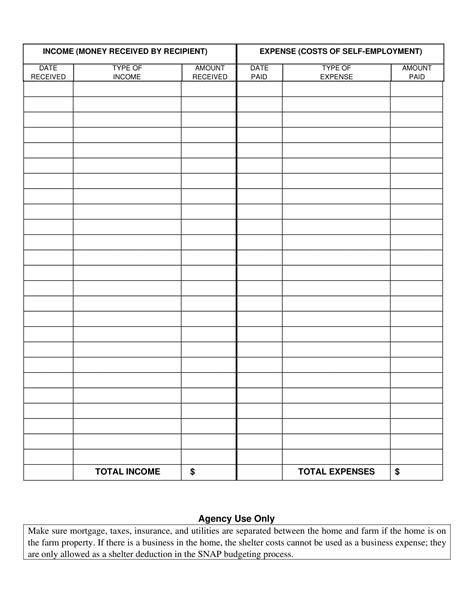

Template 2: Comprehensive Self-Employment Ledger Template

A comprehensive self-employment ledger template is suitable for businesses with more complex financial situations. This template typically includes columns for:

- Date

- Description of income or expense

- Income

- Expense

- Category (e.g., salary, rent, equipment)

- Total

Here is an example of what a comprehensive self-employment ledger template might look like:

| Date | Description | Income | Expense | Category | Total |

|---|---|---|---|---|---|

| 01/01/2023 | Client Payment | $1000 | Income | $1000 | |

| 01/02/2023 | Office Rent | $500 | Rent | $500 | |

| 01/03/2023 | Equipment Purchase | $2000 | Equipment | $2500 |

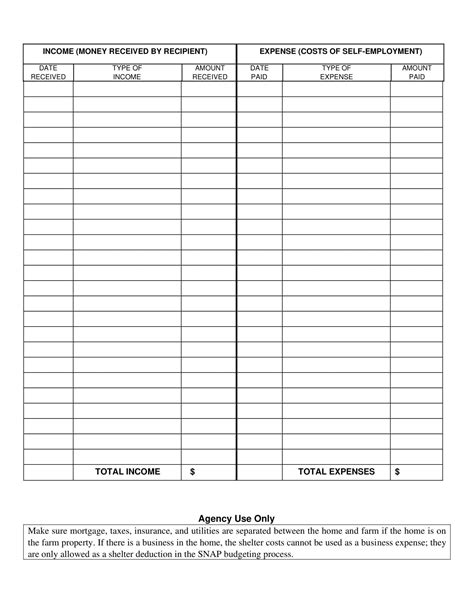

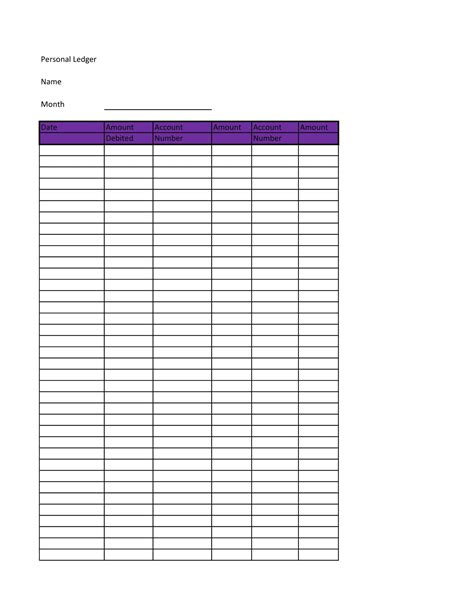

Template 3: Self-Employment Ledger Template with Tax Columns

A self-employment ledger template with tax columns is ideal for businesses that need to track taxes separately. This template typically includes columns for:

- Date

- Description of income or expense

- Income

- Expense

- Tax

- Total

Here is an example of what a self-employment ledger template with tax columns might look like:

| Date | Description | Income | Expense | Tax | Total |

|---|---|---|---|---|---|

| 01/01/2023 | Client Payment | $1000 | $200 | $800 | |

| 01/02/2023 | Office Supplies | $50 | $50 | ||

| 01/03/2023 | Consulting Fee | $2000 | $400 | $1600 |

Template 4: Self-Employment Ledger Template with Budgeting Columns

A self-employment ledger template with budgeting columns is suitable for businesses that want to track their budget and actual spending. This template typically includes columns for:

- Date

- Description of income or expense

- Income

- Expense

- Budget

- Actual

- Variance

Here is an example of what a self-employment ledger template with budgeting columns might look like:

| Date | Description | Income | Expense | Budget | Actual | Variance |

|---|---|---|---|---|---|---|

| 01/01/2023 | Client Payment | $1000 | $500 | $1000 | $500 | |

| 01/02/2023 | Office Supplies | $50 | $50 | $50 | 0 | |

| 01/03/2023 | Consulting Fee | $2000 | $1000 | $2000 | $1000 |

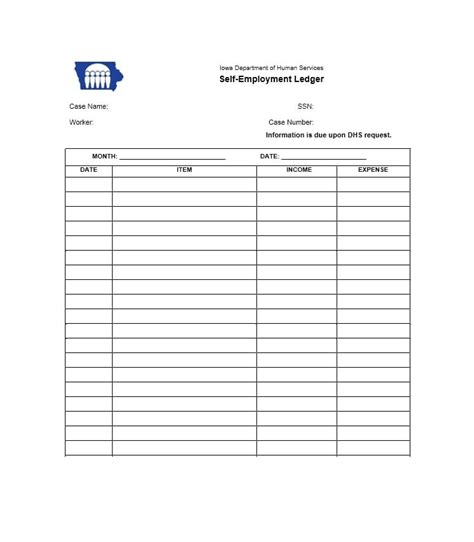

Template 5: Self-Employment Ledger Template with Cash Flow Columns

A self-employment ledger template with cash flow columns is ideal for businesses that want to track their cash inflows and outflows. This template typically includes columns for:

- Date

- Description of income or expense

- Cash In

- Cash Out

- Net Cash Flow

- Total

Here is an example of what a self-employment ledger template with cash flow columns might look like:

| Date | Description | Cash In | Cash Out | Net Cash Flow | Total |

|---|---|---|---|---|---|

| 01/01/2023 | Client Payment | $1000 | $1000 | $1000 | |

| 01/02/2023 | Office Rent | $500 | -$500 | $500 | |

| 01/03/2023 | Consulting Fee | $2000 | $2000 | $3000 |

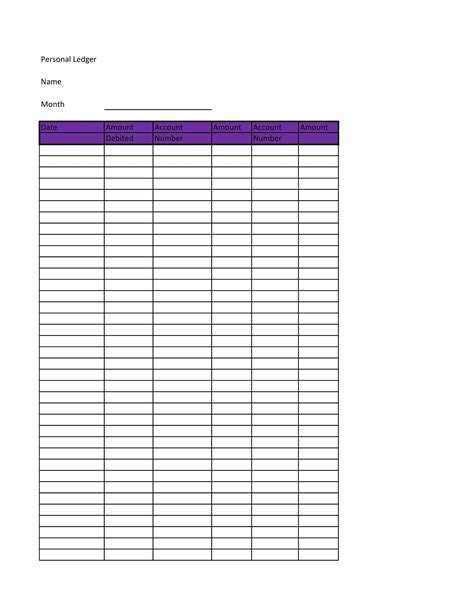

Gallery of Self Employment Ledger Templates

Self Employment Ledger Templates Image Gallery

Conclusion

Using a self-employment ledger template can help you manage your finances effectively and reduce your tax liability. The five templates provided in this article are essential for any self-employed individual, and you can choose the one that best suits your business needs. Remember to customize your template to fit your specific financial situation and use it regularly to track your income, expenses, and taxes.

Call to Action

Try using one of the self-employment ledger templates provided in this article to track your finances and reduce your tax liability. Share your experience with us in the comments section below, and don't forget to share this article with your friends and family who may benefit from it.