Intro

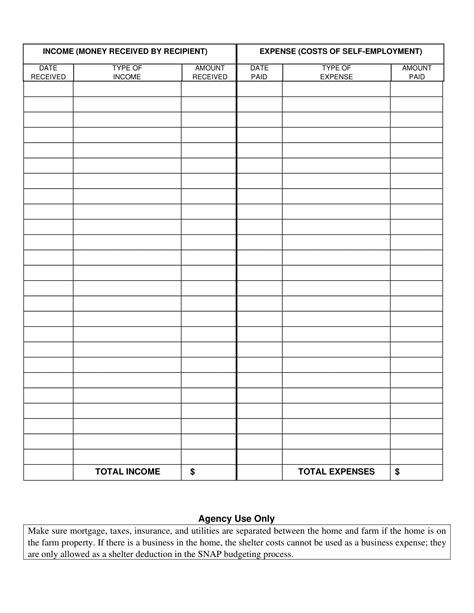

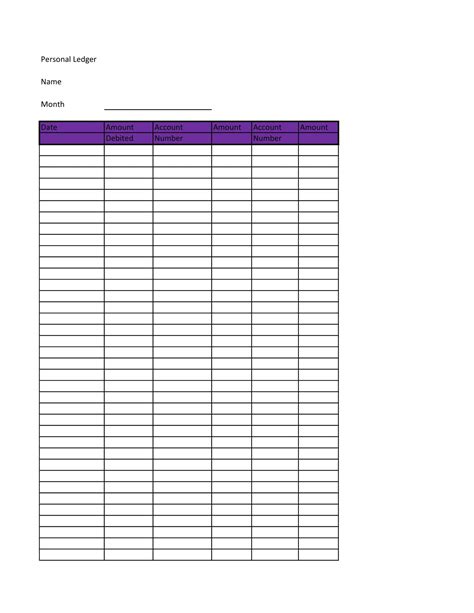

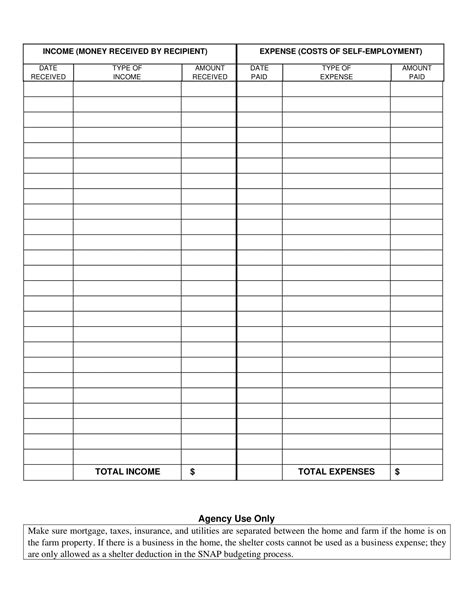

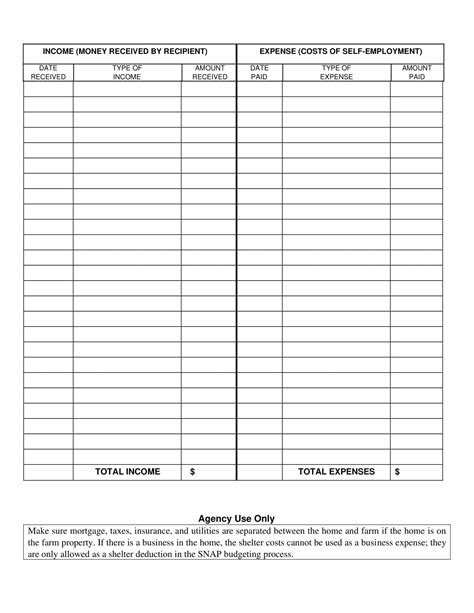

Boost your freelancing or consulting business with our 5 free self-employment ledger templates. Easily track income, expenses, and tax-deductible costs with these customizable and printable templates. Simplify your financial record-keeping, stay organized, and ensure accurate tax reporting with these essential tools for self-employed individuals and small business owners.

Maintaining accurate financial records is essential for any business, and self-employed individuals are no exception. One of the most important tools for managing finances is a self-employment ledger. A self-employment ledger helps track income, expenses, and taxes, making it easier to stay organized and ensure compliance with tax laws. In this article, we will provide you with five free self-employment ledger templates that you can use to manage your finances effectively.

Benefits of Using a Self-Employment Ledger

Using a self-employment ledger offers numerous benefits, including:

- Improved organization: A self-employment ledger helps you keep track of your income and expenses, making it easier to stay organized and focused on your business.

- Accurate financial records: A ledger ensures that your financial records are accurate and up-to-date, reducing the risk of errors and discrepancies.

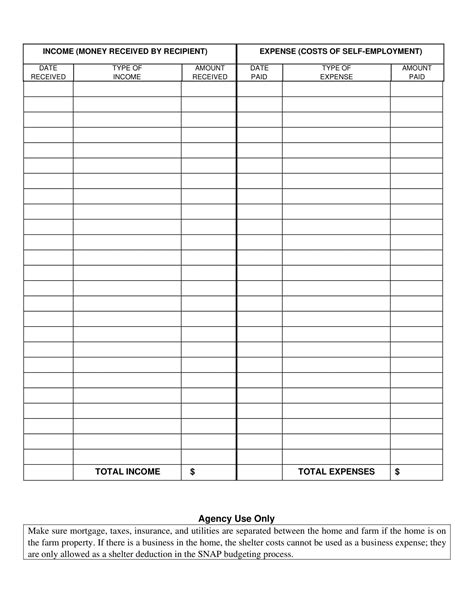

- Tax compliance: A self-employment ledger helps you track your taxes, ensuring that you are compliant with tax laws and regulations.

- Better decision-making: With accurate financial records, you can make informed decisions about your business, including investments, pricing, and budgeting.

Types of Self-Employment Ledger Templates

There are several types of self-employment ledger templates available, each with its own unique features and benefits. Some common types include:

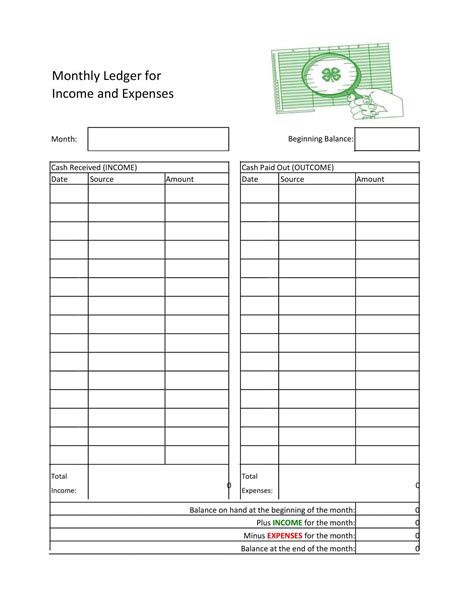

- Basic templates: These templates provide a simple and straightforward way to track income and expenses.

- Advanced templates: These templates offer more features and functionality, including budgeting and forecasting tools.

- Industry-specific templates: These templates are designed for specific industries, such as construction or healthcare.

- Digital templates: These templates are designed for use with digital tools, such as spreadsheets and accounting software.

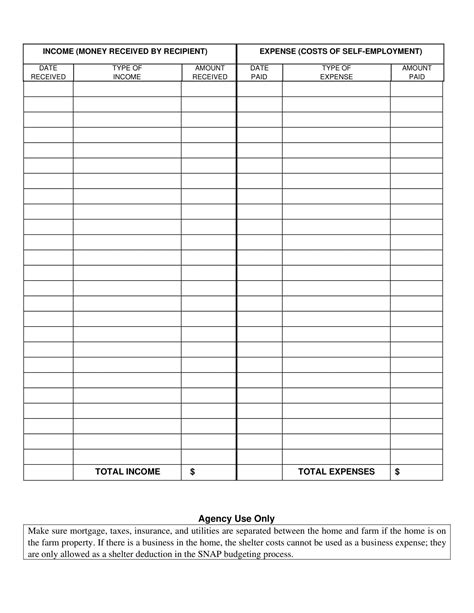

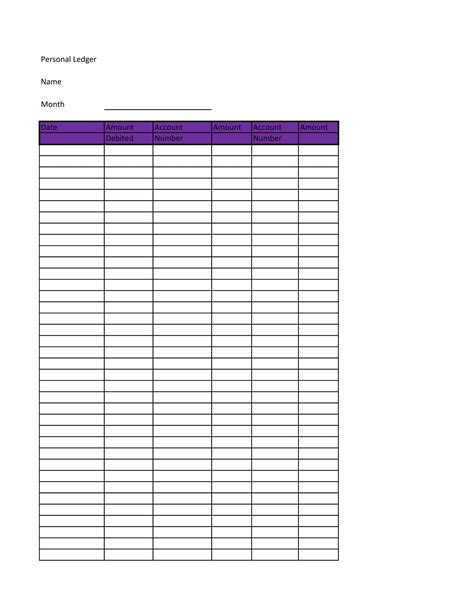

5 Free Self-Employment Ledger Templates

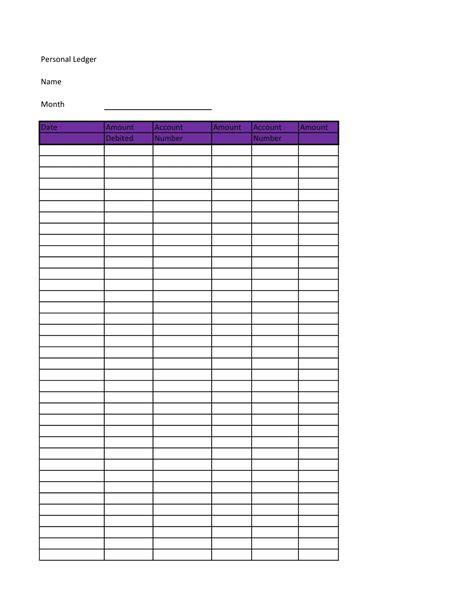

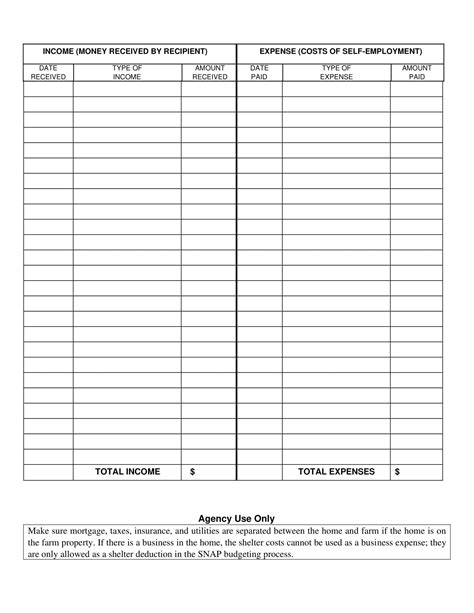

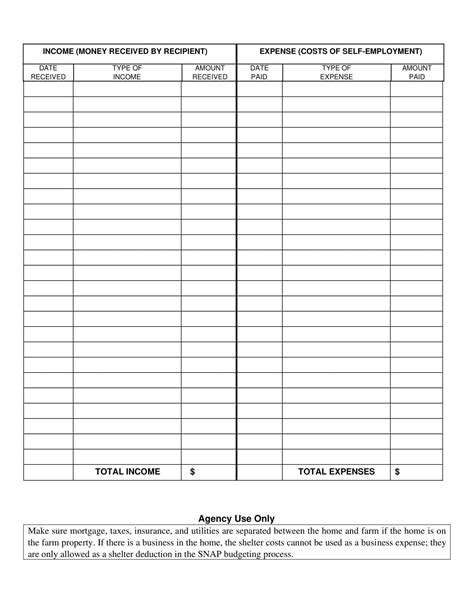

Here are five free self-employment ledger templates that you can use to manage your finances:

- Microsoft Excel Self-Employment Ledger Template: This template is designed for use with Microsoft Excel and provides a basic and straightforward way to track income and expenses.

- Google Sheets Self-Employment Ledger Template: This template is designed for use with Google Sheets and offers a simple and easy-to-use way to track finances.

- PDF Self-Employment Ledger Template: This template is designed for use with Adobe Acrobat and provides a basic and easy-to-use way to track income and expenses.

- Self-Employment Ledger Template for Freelancers: This template is designed specifically for freelancers and provides a way to track income and expenses, as well as budgeting and forecasting tools.

- Self-Employment Ledger Template for Small Business Owners: This template is designed specifically for small business owners and provides a way to track income and expenses, as well as budgeting and forecasting tools.

How to Use a Self-Employment Ledger Template

Using a self-employment ledger template is easy and straightforward. Here are the steps to follow:

- Download the template: Choose a template that meets your needs and download it to your computer.

- Enter your income: Enter your income into the template, including any deposits or payments.

- Enter your expenses: Enter your expenses into the template, including any bills or payments.

- Track your taxes: Track your taxes, including any deductions or credits.

- Review and update regularly: Review and update your ledger regularly to ensure accuracy and compliance with tax laws.

Common Mistakes to Avoid When Using a Self-Employment Ledger Template

Here are some common mistakes to avoid when using a self-employment ledger template:

- Inaccurate entries: Make sure to enter accurate and complete information into the template.

- Inconsistent tracking: Make sure to track your income and expenses consistently, using the same method and frequency.

- Lack of review: Review your ledger regularly to ensure accuracy and compliance with tax laws.

- Failure to update: Update your ledger regularly to reflect changes in your business or finances.

Conclusion

Using a self-employment ledger template is an essential part of managing your finances as a self-employed individual. By choosing the right template and following the steps outlined above, you can ensure accuracy and compliance with tax laws. Remember to avoid common mistakes and review and update your ledger regularly to ensure the success of your business.

Self Employment Ledger Template Gallery

We hope this article has provided you with the information you need to choose the right self-employment ledger template for your business. Remember to review and update your ledger regularly to ensure accuracy and compliance with tax laws. If you have any questions or comments, please leave them below.