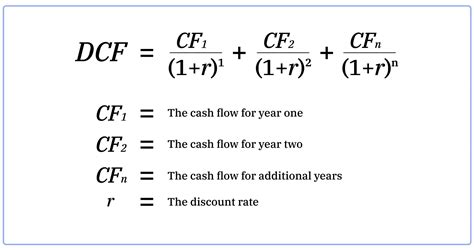

Creating a Discounted Cash Flow (DCF) model in Excel is a valuable skill for any finance professional or investor. A DCF model helps estimate the present value of future cash flows, which is essential for evaluating investment opportunities or determining the intrinsic value of a company. Here, we'll break down the process into five simple steps to build a DCF Excel template.

Step 1: Set Up the DCF Model Structure

To start building your DCF Excel template, you need to set up the model structure. This involves creating separate sections for inputs, assumptions, and calculations.

- Create a new Excel spreadsheet and set up the following sections:

- Inputs: This section will contain the data and assumptions used in the model.

- Assumptions: This section will outline the key assumptions made in the model, such as the discount rate and growth rate.

- Calculations: This section will perform the actual DCF calculations.

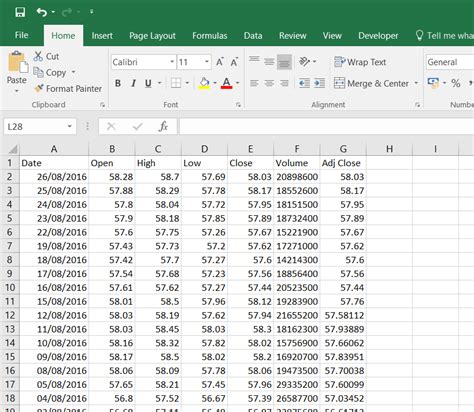

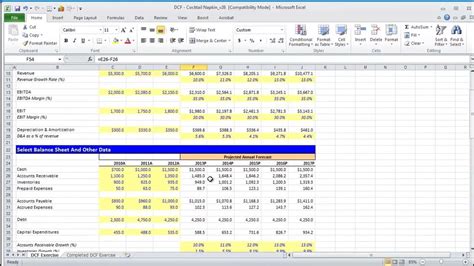

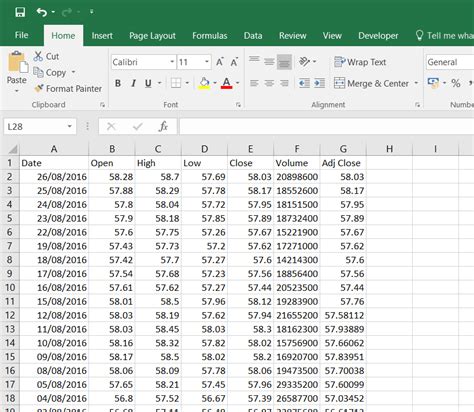

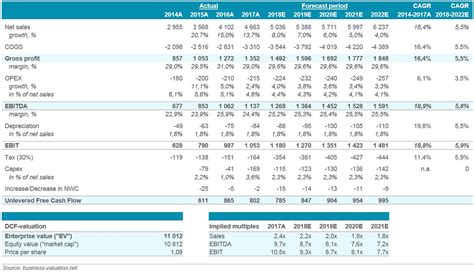

Step 2: Enter Historical Financial Data

The next step is to enter the company's historical financial data, including revenue, net income, and cash flows.

- Gather the company's historical financial data for the past 5-10 years.

- Enter the data into the "Inputs" section of the model, using separate columns for each year.

- Use formulas to calculate key metrics, such as revenue growth rate and net income margin.

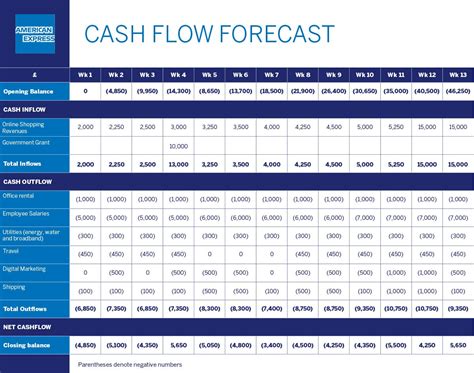

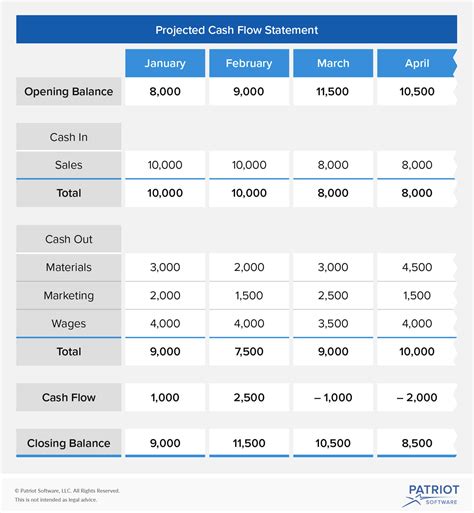

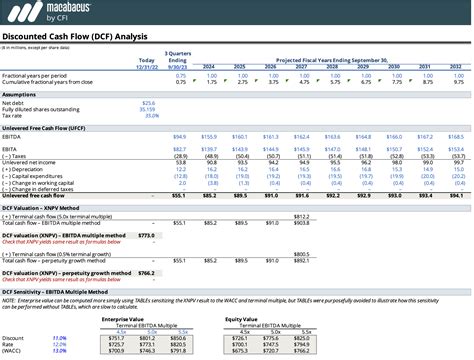

Step 3: Estimate Future Cash Flows

Now, you need to estimate the company's future cash flows.

- Use the historical data to estimate the company's future revenue growth rate and net income margin.

- Enter the estimated future cash flows into the "Calculations" section of the model.

- Use formulas to calculate the present value of the future cash flows, using the discount rate and growth rate assumptions.

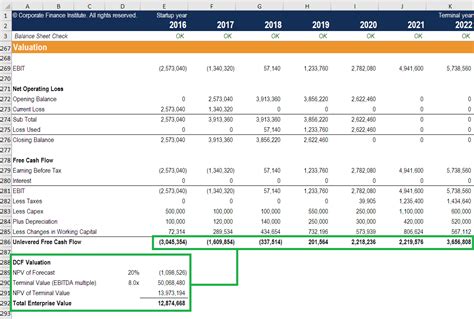

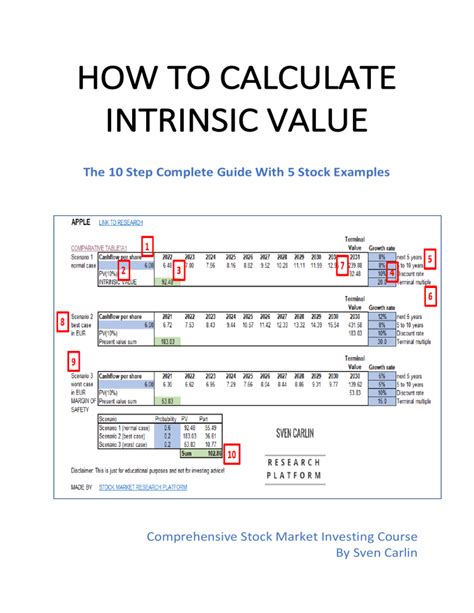

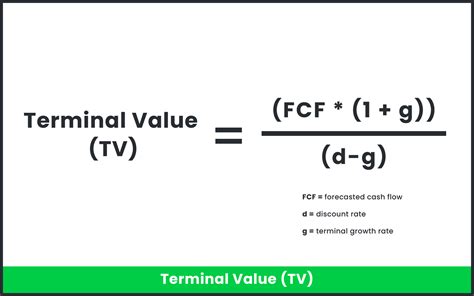

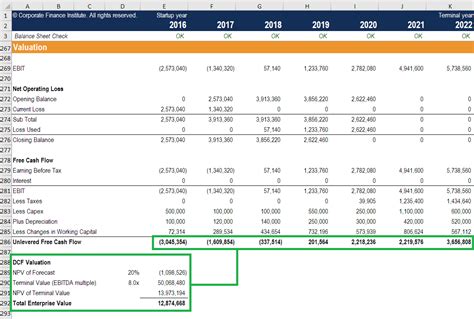

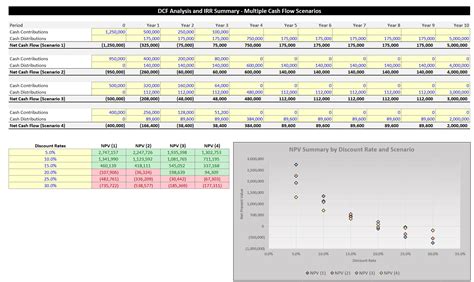

Step 4: Calculate the Terminal Value

The terminal value represents the present value of all future cash flows beyond the forecast period.

- Use the perpetuity growth model or the exit multiple method to estimate the terminal value.

- Enter the estimated terminal value into the "Calculations" section of the model.

- Use formulas to calculate the present value of the terminal value, using the discount rate assumption.

Step 5: Calculate the Intrinsic Value

Finally, you can calculate the intrinsic value of the company by adding the present value of the future cash flows and the terminal value.

- Use formulas to calculate the intrinsic value, using the present value of the future cash flows and the terminal value.

- Enter the estimated intrinsic value into the "Calculations" section of the model.

- Use charts and graphs to visualize the results and compare the intrinsic value to the current market price.

Gallery of DCF Model Images

DCF Model Image Gallery

By following these five simple steps, you can create a comprehensive DCF Excel template to estimate the intrinsic value of a company. Remember to use historical financial data, estimate future cash flows, calculate the terminal value, and calculate the intrinsic value. With practice and experience, you can refine your DCF model to make more accurate investment decisions.

Take Action!

Try building your own DCF Excel template using the steps outlined above. Practice using different companies and scenarios to refine your skills. Share your experience and ask questions in the comments section below.