Intro

Discover the 5 essential elements of intercompany loan agreements, a crucial aspect of corporate finance. Learn how to structure loan terms, interest rates, and repayment schedules to minimize tax liabilities and maximize cash flow. Understand the importance of loan documentation, collateral, and default provisions to ensure compliant and enforceable agreements.

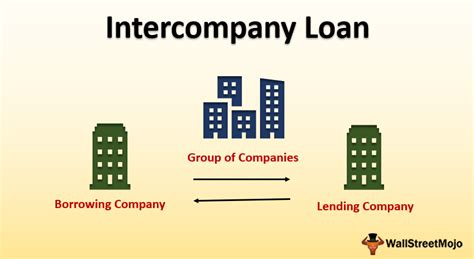

Intercompany loan agreements are a common financial tool used by companies to lend and borrow money within their corporate group. These agreements are essential for managing cash flow, financing new projects, and optimizing tax strategies. However, drafting an effective intercompany loan agreement requires careful consideration of several key elements. In this article, we will explore the five essential elements of intercompany loan agreements and provide practical guidance on how to structure these agreements to achieve your business objectives.

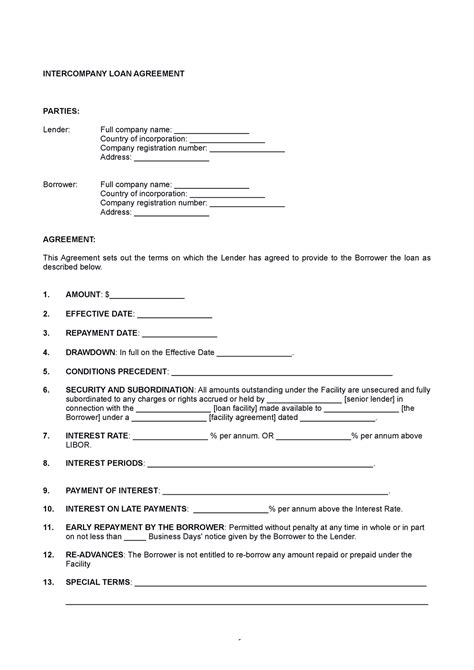

Element 1: Parties Involved

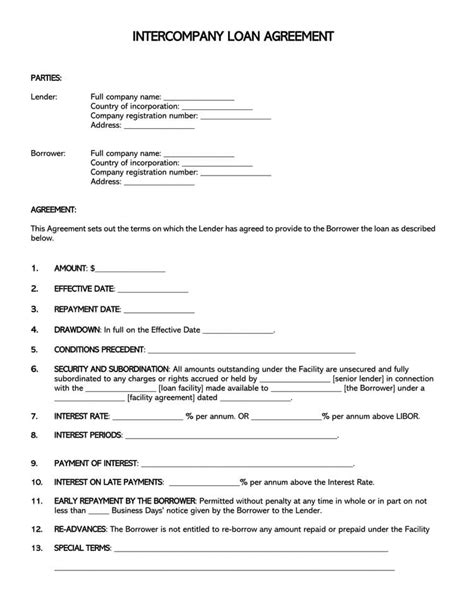

The first essential element of an intercompany loan agreement is to clearly identify the parties involved in the transaction. This includes the lender, the borrower, and any guarantors or collateral providers. It is crucial to specify the capacity in which each party is acting, such as a parent company lending to a subsidiary or a sister company borrowing from another sister company.

- Lender: The company providing the loan, which can be a parent company, a subsidiary, or another affiliate.

- Borrower: The company receiving the loan, which can be a subsidiary, a joint venture, or another affiliate.

- Guarantors: Any company or individual providing a guarantee for the loan, which can be a parent company, a subsidiary, or another affiliate.

Importance of Clear Party Identification

Clear party identification is essential to avoid confusion and ensure that all parties understand their roles and responsibilities. This includes identifying the correct legal entities, addresses, and contact information.

Element 2: Loan Terms and Conditions

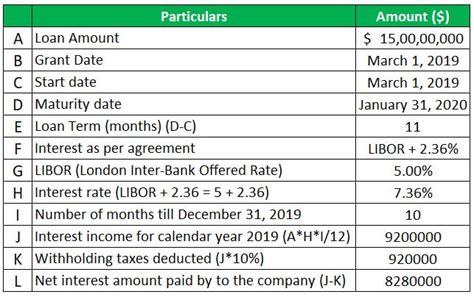

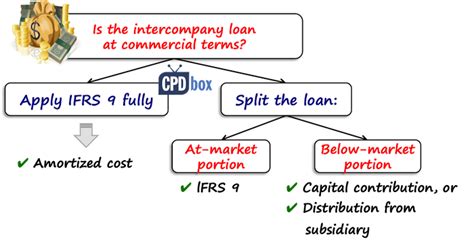

The second essential element of an intercompany loan agreement is to outline the loan terms and conditions. This includes the loan amount, interest rate, repayment schedule, and any fees or charges associated with the loan.

- Loan amount: The principal amount borrowed by the borrower.

- Interest rate: The rate at which interest is charged on the loan, which can be fixed or floating.

- Repayment schedule: The schedule outlining when and how the borrower will repay the loan, including the frequency and amount of payments.

Importance of Clear Loan Terms

Clear loan terms are essential to ensure that both parties understand their obligations and responsibilities. This includes specifying the loan amount, interest rate, and repayment schedule to avoid any misunderstandings or disputes.

Element 3: Collateral and Security

The third essential element of an intercompany loan agreement is to specify any collateral or security provided to secure the loan. This can include tangible assets such as property, equipment, or inventory, as well as intangible assets such as patents, trademarks, or copyrights.

- Collateral: Any asset provided by the borrower to secure the loan, which can be tangible or intangible.

- Security: Any agreement or arrangement that provides a level of protection or assurance to the lender, such as a guarantee or indemnity.

Importance of Collateral and Security

Collateral and security are essential to mitigate the risk of default by the borrower. This provides the lender with a level of protection and assurance that the loan will be repaid.

Element 4: Covenants and Representations

The fourth essential element of an intercompany loan agreement is to outline any covenants and representations made by the borrower. This can include affirmative covenants, such as maintaining a certain level of liquidity or profitability, as well as negative covenants, such as restricting the borrower's ability to incur additional debt or make certain investments.

- Affirmative covenants: Any positive commitment or undertaking made by the borrower, such as maintaining a certain level of liquidity or profitability.

- Negative covenants: Any restriction or limitation imposed on the borrower, such as restricting the borrower's ability to incur additional debt or make certain investments.

Importance of Covenants and Representations

Covenants and representations are essential to ensure that the borrower complies with certain standards or requirements. This provides the lender with a level of comfort and assurance that the borrower will manage the loan responsibly.

Element 5: Governing Law and Dispute Resolution

The fifth essential element of an intercompany loan agreement is to specify the governing law and dispute resolution mechanism. This can include the jurisdiction and courts that will have jurisdiction over any disputes or claims arising under the agreement.

- Governing law: The law that will govern the interpretation and enforcement of the agreement, which can be the law of a specific jurisdiction or a set of rules or principles.

- Dispute resolution: The mechanism or process for resolving any disputes or claims arising under the agreement, which can include arbitration, mediation, or litigation.

Importance of Governing Law and Dispute Resolution

Governing law and dispute resolution are essential to ensure that any disputes or claims arising under the agreement are resolved in a fair and efficient manner. This provides both parties with a level of certainty and predictability.

Intercompany Loan Agreement Image Gallery

In conclusion, intercompany loan agreements are a crucial financial tool for managing cash flow, financing new projects, and optimizing tax strategies. By understanding the five essential elements of intercompany loan agreements, you can structure these agreements to achieve your business objectives and mitigate potential risks.