Intro

Master simple interest calculations in Excel with our easy-to-follow guide. Learn how to create a simple interest calculator in Excel using formulas and functions. Understand the concept of simple interest, its applications, and how to calculate it manually. Boost your financial analysis skills with our step-by-step tutorial and calculator examples.

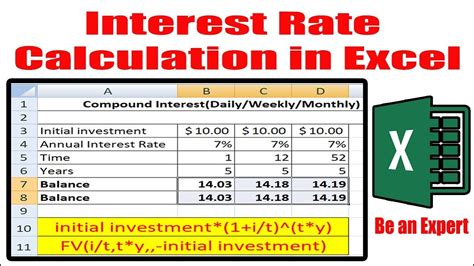

Calculating simple interest is a fundamental concept in finance, and using a simple interest calculator in Excel can make it even easier. Simple interest is a type of interest that is calculated only on the initial principal amount, without considering any accrued interest. In this article, we will explore how to create a simple interest calculator in Excel, and provide a step-by-step guide on how to use it.

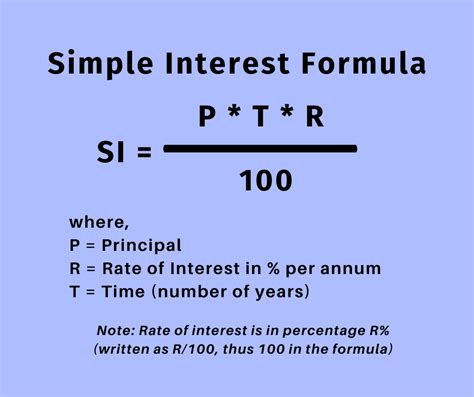

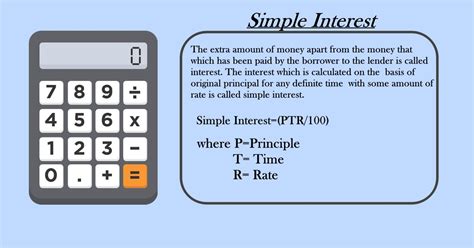

What is Simple Interest?

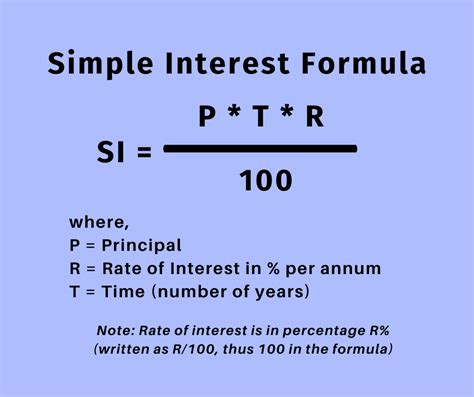

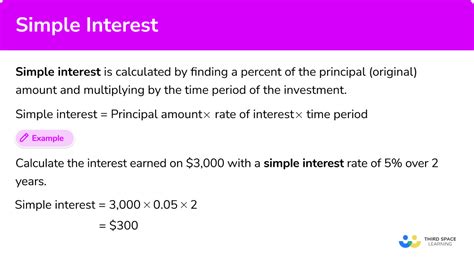

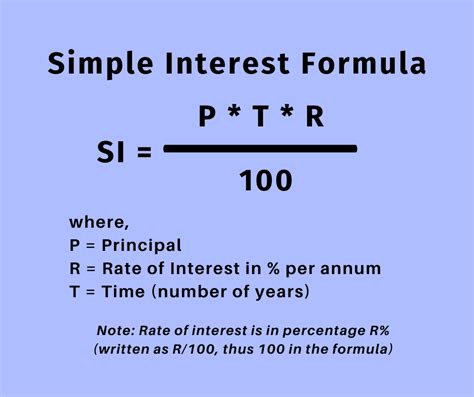

Simple interest is a type of interest that is calculated on the initial principal amount, without considering any accrued interest. It is commonly used in savings accounts, certificates of deposit (CDs), and other types of investments. Simple interest is calculated using the formula:

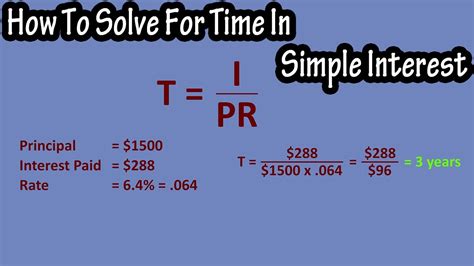

Simple Interest = Principal x Rate x Time

Where:

- Principal is the initial amount deposited or borrowed

- Rate is the interest rate as a decimal

- Time is the time period in years

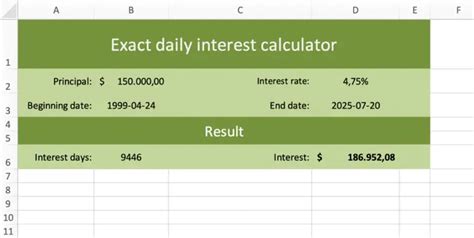

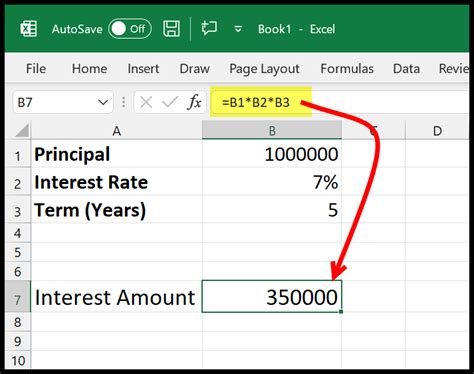

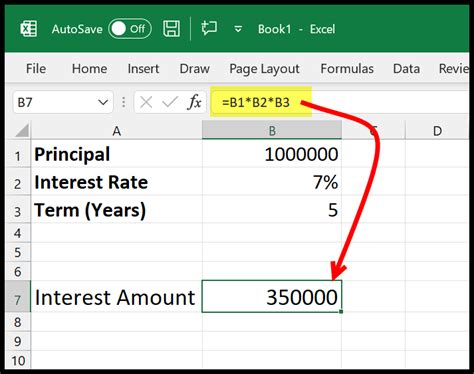

How to Create a Simple Interest Calculator in Excel

To create a simple interest calculator in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns:

- Principal

- Rate

- Time

- Simple Interest

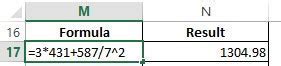

- Enter the formula

=A2*B2*C2in the Simple Interest column, assuming the principal is in cell A2, the rate is in cell B2, and the time is in cell C2. - Format the cells to display the calculations.

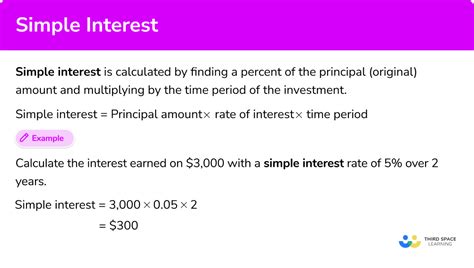

Example: Calculating Simple Interest

Suppose you deposit $1,000 into a savings account with an annual interest rate of 2%. You want to calculate the simple interest earned over a period of 5 years.

| Principal | Rate | Time | Simple Interest |

|---|---|---|---|

| $1,000 | 2% | 5 | =A2B2C2 |

Using the formula, the simple interest earned would be:

Simple Interest = $1,000 x 2% x 5 = $100

Benefits of Using a Simple Interest Calculator in Excel

Using a simple interest calculator in Excel has several benefits:

- Easy to use: Simply enter the principal, rate, and time, and the calculator will do the rest.

- Fast calculations: Excel can perform calculations quickly and accurately.

- Flexibility: You can easily modify the formula to calculate simple interest for different scenarios.

- Accuracy: Excel reduces the risk of human error, ensuring accurate calculations.

Tips and Variations

Here are some additional tips and variations to consider:

- Use the formula

=A2*(B2/100)*C2to calculate simple interest if the rate is entered as a percentage. - Use the formula

=A2*B2*C2/100to calculate simple interest if the rate is entered as a decimal. - Create a dropdown menu to select different interest rates or time periods.

- Use conditional formatting to highlight cells that meet certain conditions.

Simple Interest Calculator Gallery

Conclusion

In conclusion, creating a simple interest calculator in Excel is a straightforward process that can save you time and effort. By following the steps outlined in this article, you can create a calculator that accurately calculates simple interest for any scenario. Whether you're a student, a financial analyst, or simply someone looking to manage your finances, a simple interest calculator in Excel is a valuable tool to have in your toolkit.

We hope you found this article helpful. If you have any questions or need further assistance, please don't hesitate to comment below. Share this article with your friends and colleagues who may find it useful, and don't forget to subscribe to our blog for more Excel tips and tutorials.