Intro

Discover how to create a simple interest calculator with ease! Learn 5 easy methods to calculate interest rates, principal amounts, and time periods. Master the basics of simple interest calculation and make informed financial decisions. Get started with our step-by-step guide and take control of your finances with simple interest calculation made easy.

In today's fast-paced financial world, understanding interest calculations is crucial for making informed decisions about investments, loans, and savings. A simple interest calculator can be a valuable tool for individuals, businesses, and financial institutions alike. In this article, we will explore five easy ways to create a simple interest calculator, including using online tools, spreadsheet software, programming languages, and even manual calculations.

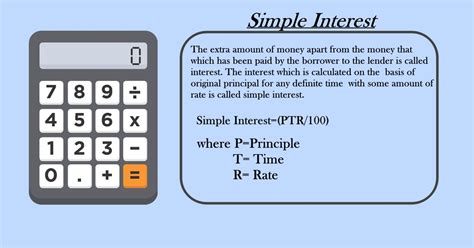

What is Simple Interest?

Before we dive into creating a simple interest calculator, let's define what simple interest is. Simple interest is a type of interest calculation where the interest is calculated only on the initial principal amount. It is not compounded, meaning that the interest is not added to the principal amount at regular intervals, resulting in a fixed interest rate over the specified period.

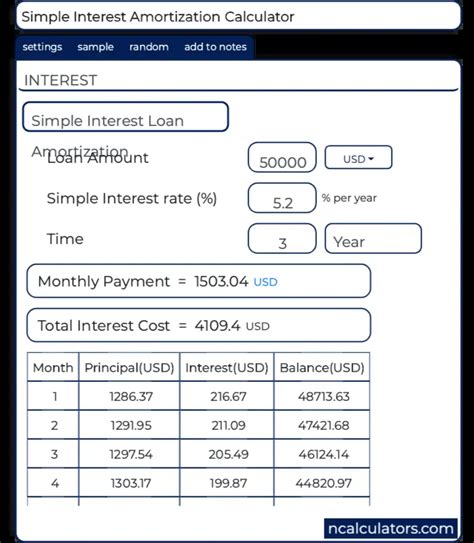

Method 1: Using Online Simple Interest Calculators

One of the easiest ways to create a simple interest calculator is to use online tools. There are numerous websites that offer free simple interest calculators, such as Calculator.net, Investopedia, and NerdWallet. These online calculators allow you to input the principal amount, interest rate, and time period, and then calculate the simple interest.

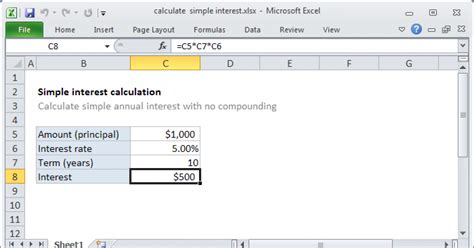

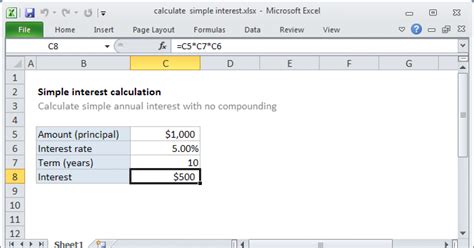

Method 2: Using Spreadsheet Software

Another easy way to create a simple interest calculator is to use spreadsheet software like Microsoft Excel or Google Sheets. You can create a simple interest formula using the following formula:

Simple Interest = Principal x Rate x Time

Where:

- Principal is the initial amount

- Rate is the interest rate as a decimal

- Time is the time period in years

For example, if you want to calculate the simple interest on a principal amount of $1,000 with an interest rate of 5% per annum for 2 years, you can use the following formula:

=1000 x 0.05 x 2

Method 3: Using Programming Languages

If you have programming skills, you can create a simple interest calculator using programming languages like Python, Java, or C++. Here is an example of a simple interest calculator in Python:

def simple_interest(principal, rate, time):

return principal * rate * time

principal = 1000

rate = 0.05

time = 2

interest = simple_interest(principal, rate, time)

print("Simple Interest: ", interest)

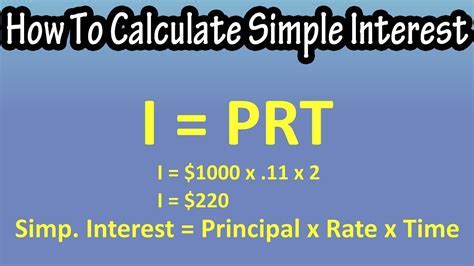

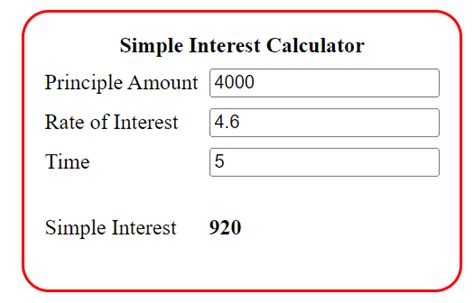

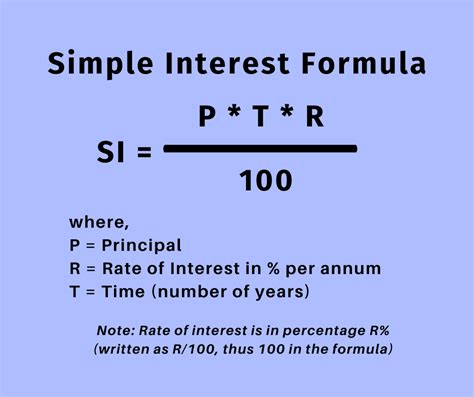

Method 4: Using a Simple Interest Formula

If you prefer to calculate simple interest manually, you can use the following formula:

Simple Interest = (Principal x Rate x Time) / 100

Where:

- Principal is the initial amount

- Rate is the interest rate as a percentage

- Time is the time period in years

For example, if you want to calculate the simple interest on a principal amount of $1,000 with an interest rate of 5% per annum for 2 years, you can use the following formula:

Simple Interest = (1000 x 5 x 2) / 100 Simple Interest = 100

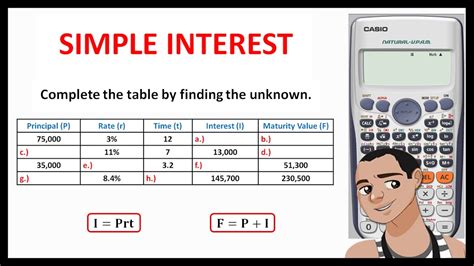

Method 5: Using a Simple Interest Table

Another way to create a simple interest calculator is to use a simple interest table. A simple interest table is a pre-calculated table that shows the simple interest for different principal amounts, interest rates, and time periods. You can create a simple interest table using spreadsheet software or programming languages.

For example, here is a simple interest table for a principal amount of $1,000 with different interest rates and time periods:

| Interest Rate | Time Period | Simple Interest |

|---|---|---|

| 5% | 1 year | 50 |

| 5% | 2 years | 100 |

| 5% | 3 years | 150 |

| 10% | 1 year | 100 |

| 10% | 2 years | 200 |

| 10% | 3 years | 300 |

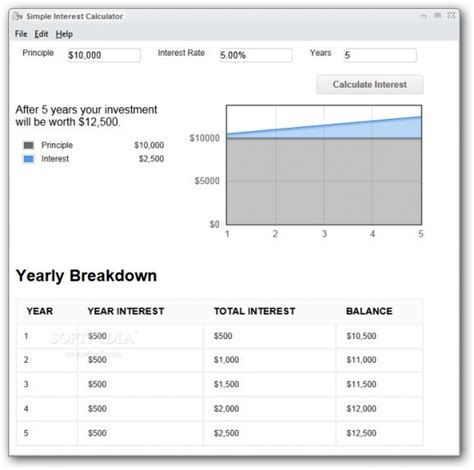

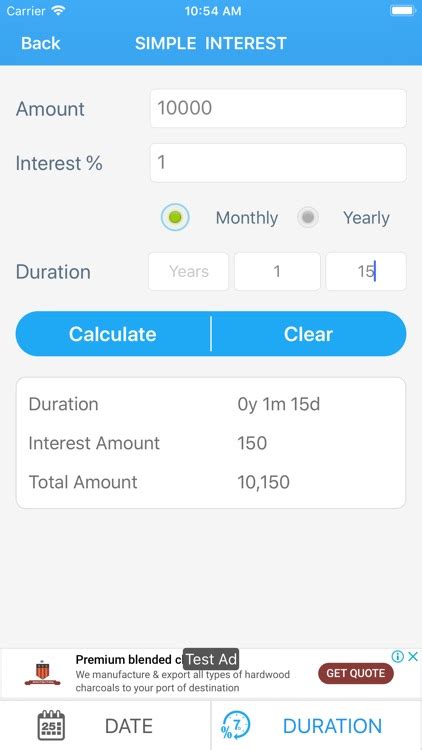

Gallery of Simple Interest Calculators

Simple Interest Calculator Gallery

In conclusion, creating a simple interest calculator can be done in various ways, including using online tools, spreadsheet software, programming languages, manual calculations, and simple interest tables. By choosing the method that best suits your needs, you can easily calculate simple interest and make informed financial decisions.

We hope this article has been helpful in explaining the different ways to create a simple interest calculator. If you have any questions or comments, please feel free to share them with us.