Calculating simple interest in Excel can be a daunting task, especially for those who are new to the world of finance and accounting. However, with the right formulas and techniques, you can easily calculate simple interest in Excel and make your financial calculations a breeze.

In this article, we will explore the world of simple interest, its formula, and how to calculate it in Excel. We will also provide examples, screenshots, and step-by-step instructions to make it easy for you to follow along.

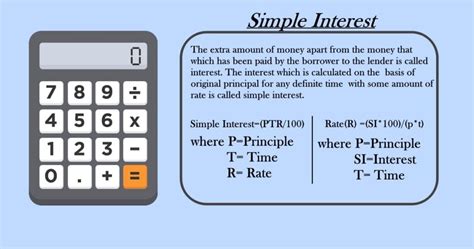

What is Simple Interest?

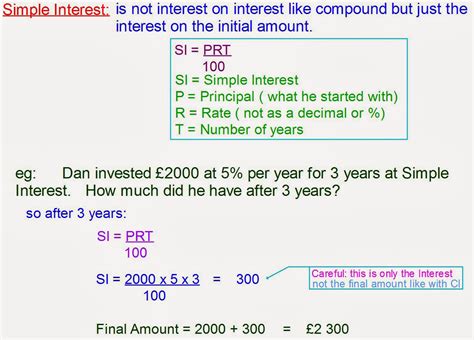

Simple interest is a type of interest that is calculated on the principal amount of a loan or investment. It is called "simple" because it does not take into account the compounding effect of interest, unlike compound interest. Simple interest is commonly used in short-term investments, loans, and credit cards.

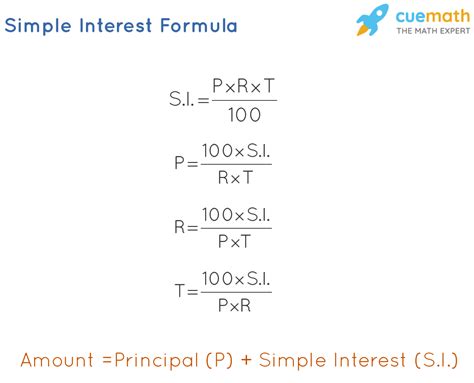

Simple Interest Formula

The formula for simple interest is:

Simple Interest (SI) = Principal (P) x Rate (R) x Time (T)

Where:

- Principal (P) is the initial amount of money invested or borrowed.

- Rate (R) is the interest rate, expressed as a decimal.

- Time (T) is the time period over which the interest is calculated, expressed in years.

For example, if you invest $1,000 at an interest rate of 5% per annum for 2 years, the simple interest would be:

SI = $1,000 x 0.05 x 2 = $100

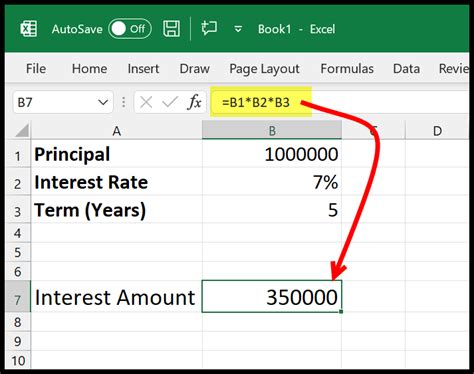

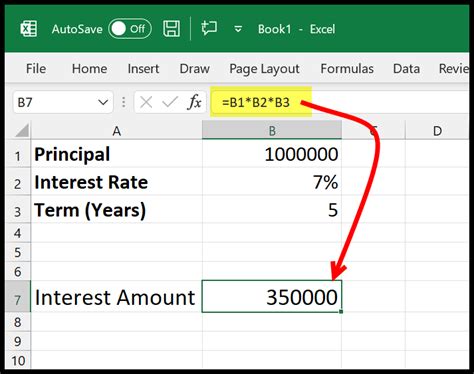

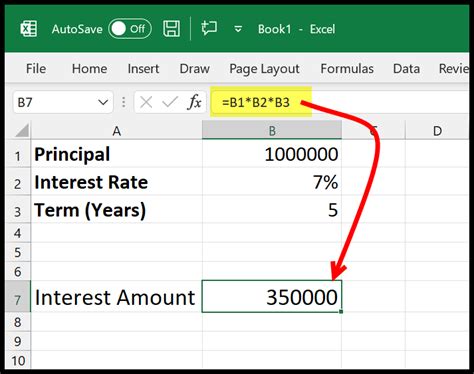

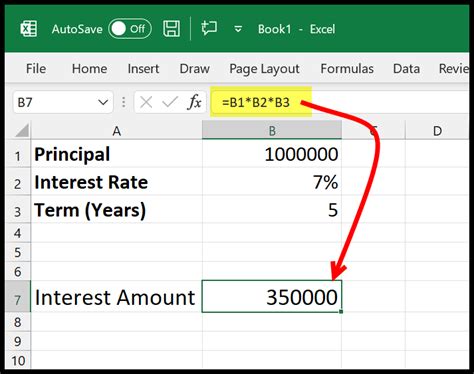

How to Calculate Simple Interest in Excel

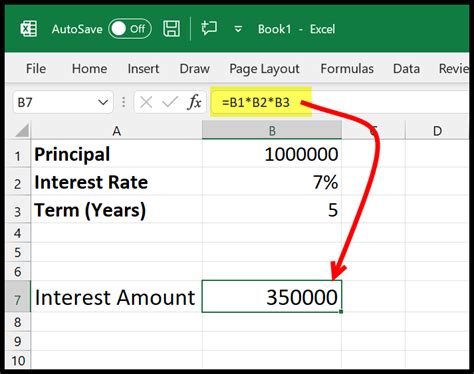

Calculating simple interest in Excel is a straightforward process that involves using the formula above. Here's how to do it:

- Open a new Excel spreadsheet and enter the principal amount, interest rate, and time period in separate cells.

- In a new cell, enter the formula:

=A1*B1*C1, where A1 is the principal cell, B1 is the interest rate cell, and C1 is the time period cell. - Press Enter to calculate the simple interest.

For example, if you enter the following values:

| Cell | Value |

|---|---|

| A1 | $1,000 |

| B1 | 0.05 |

| C1 | 2 |

The formula =A1*B1*C1 would return a value of $100, which is the simple interest.

Using Excel Functions to Calculate Simple Interest

Excel also provides several functions that can be used to calculate simple interest, including:

RATE: returns the interest rate for a given principal, time, and interest.IPMT: returns the interest payment for a given principal, interest rate, and time.

These functions can be used to calculate simple interest in a more efficient and accurate way.

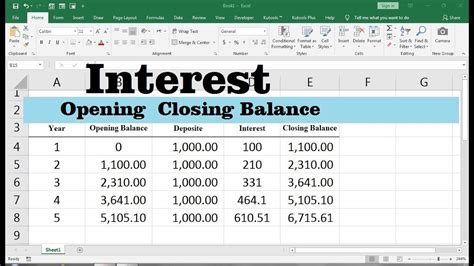

Examples of Simple Interest Calculations in Excel

Here are some examples of simple interest calculations in Excel:

Example 1: Calculating Simple Interest on a Savings Account

| Cell | Value |

|---|---|

| A1 | $5,000 |

| B1 | 0.02 |

| C1 | 1 |

Using the formula =A1*B1*C1, the simple interest would be: $100

Example 2: Calculating Simple Interest on a Loan

| Cell | Value |

|---|---|

| A1 | $10,000 |

| B1 | 0.05 |

| C1 | 3 |

Using the formula =A1*B1*C1, the simple interest would be: $1,500

Common Errors to Avoid When Calculating Simple Interest in Excel

When calculating simple interest in Excel, there are several common errors to avoid:

- Using the wrong formula or function.

- Entering incorrect values for principal, interest rate, or time.

- Not using decimal points for interest rates.

- Not formatting cells correctly.

By avoiding these errors, you can ensure accurate and efficient simple interest calculations in Excel.

Conclusion

Calculating simple interest in Excel is a straightforward process that involves using the formula above or Excel functions. By following the steps and examples outlined in this article, you can easily calculate simple interest in Excel and make your financial calculations a breeze. Remember to avoid common errors and use the correct formulas and functions to ensure accurate results.

Simple Interest Image Gallery