Intro

Streamline your small business finance with 5 essential Excel templates. Discover how to create budgets, track expenses, manage invoices, and forecast cash flow with ease. Master financial planning, accounting, and bookkeeping with these customizable templates, ideal for entrepreneurs and small business owners seeking financial clarity and control.

Effective financial management is crucial for the success of any small business. It involves keeping track of income, expenses, profits, and losses, as well as making informed decisions about investments and resource allocation. One of the most powerful tools for managing small business finances is Microsoft Excel. With its versatile templates and formulas, Excel can help you streamline your financial operations, save time, and make data-driven decisions.

In this article, we will explore five essential Excel templates for small business finance. These templates will help you manage your financial data, create budgets, track expenses, and make projections. By the end of this article, you will have a solid understanding of how to use Excel templates to improve your small business finances.

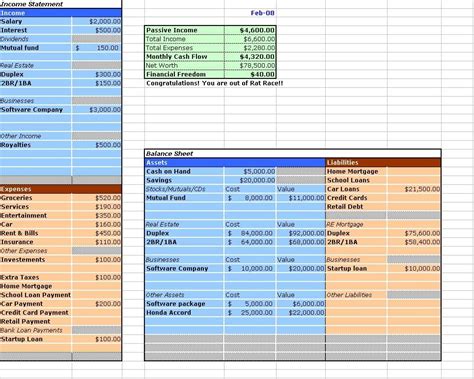

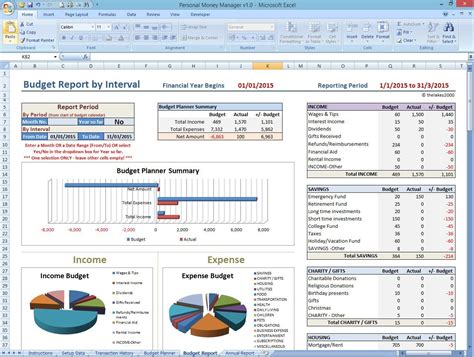

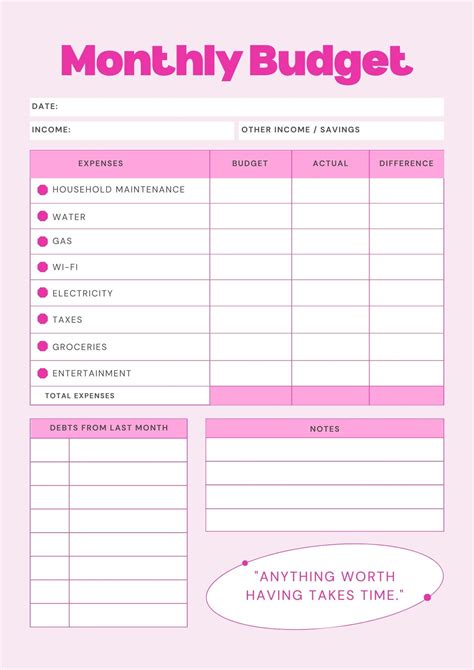

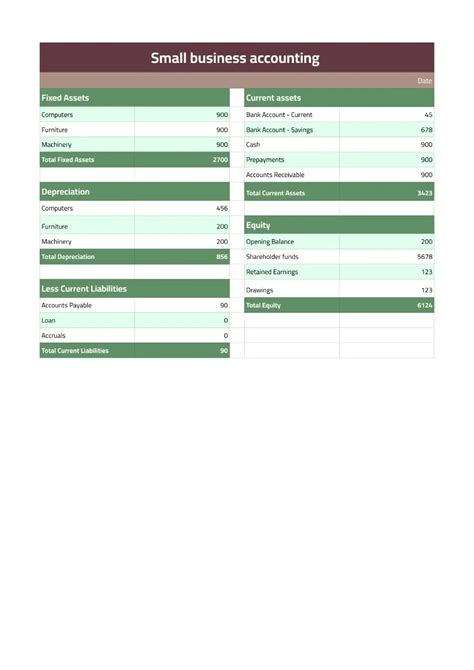

1. Budget Template

A budget template is a fundamental tool for any small business. It helps you track your income and expenses, identify areas for cost-cutting, and make informed decisions about investments. An Excel budget template typically includes the following columns:

- Income: List all your sources of income, including sales, services, and investments.

- Fixed Expenses: List all your fixed expenses, such as rent, utilities, and salaries.

- Variable Expenses: List all your variable expenses, such as marketing, travel, and supplies.

- Total Expenses: Calculate the total expenses by adding fixed and variable expenses.

- Net Income: Calculate the net income by subtracting total expenses from income.

You can use formulas to automatically calculate the total expenses and net income. For example, you can use the formula =SUM(B2:B10) to calculate the total expenses, where B2:B10 is the range of cells containing your expenses.

Benefits of a Budget Template

A budget template offers several benefits, including:

- Helps you track your income and expenses

- Identifies areas for cost-cutting

- Enables you to make informed decisions about investments

- Improves financial management and planning

2. Expense Tracker Template

An expense tracker template is a useful tool for tracking your business expenses. It helps you monitor your spending, identify areas for cost-cutting, and make informed decisions about resource allocation. An Excel expense tracker template typically includes the following columns:

- Date: Record the date of each expense

- Category: Categorize each expense, such as travel, supplies, or equipment

- Description: Describe each expense

- Amount: Record the amount of each expense

- Total: Calculate the total expenses

You can use formulas to automatically calculate the total expenses. For example, you can use the formula =SUM(D2:D10) to calculate the total expenses, where D2:D10 is the range of cells containing your expenses.

Benefits of an Expense Tracker Template

An expense tracker template offers several benefits, including:

- Helps you monitor your spending

- Identifies areas for cost-cutting

- Enables you to make informed decisions about resource allocation

- Improves financial management and planning

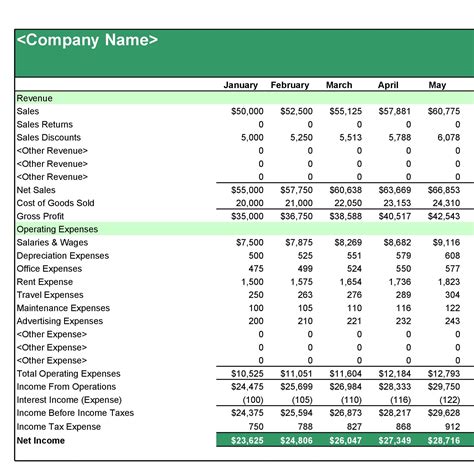

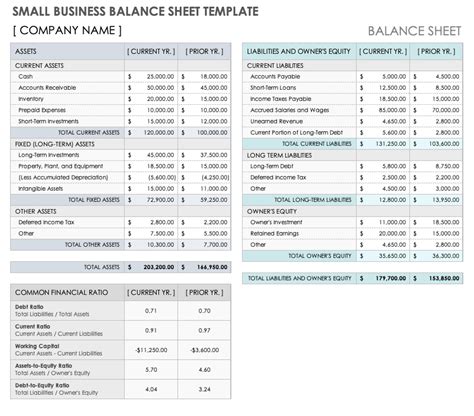

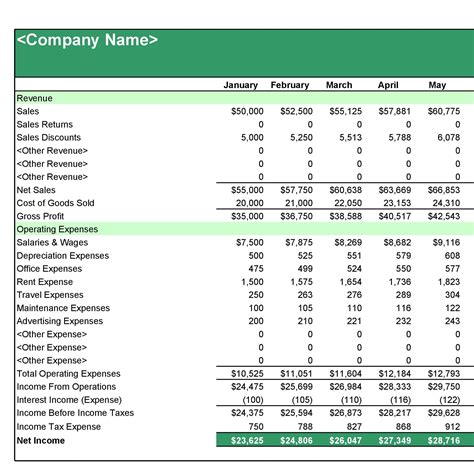

3. Income Statement Template

An income statement template is a useful tool for tracking your business income and expenses. It helps you monitor your financial performance, identify areas for improvement, and make informed decisions about investments. An Excel income statement template typically includes the following columns:

- Revenue: Record your business revenue

- Cost of Goods Sold: Record the cost of goods sold

- Gross Profit: Calculate the gross profit by subtracting the cost of goods sold from revenue

- Operating Expenses: Record your operating expenses

- Net Income: Calculate the net income by subtracting operating expenses from gross profit

You can use formulas to automatically calculate the gross profit and net income. For example, you can use the formula =SUM(B2:B10)-SUM(C2:C10) to calculate the gross profit, where B2:B10 is the range of cells containing your revenue and C2:C10 is the range of cells containing your cost of goods sold.

Benefits of an Income Statement Template

An income statement template offers several benefits, including:

- Helps you monitor your financial performance

- Identifies areas for improvement

- Enables you to make informed decisions about investments

- Improves financial management and planning

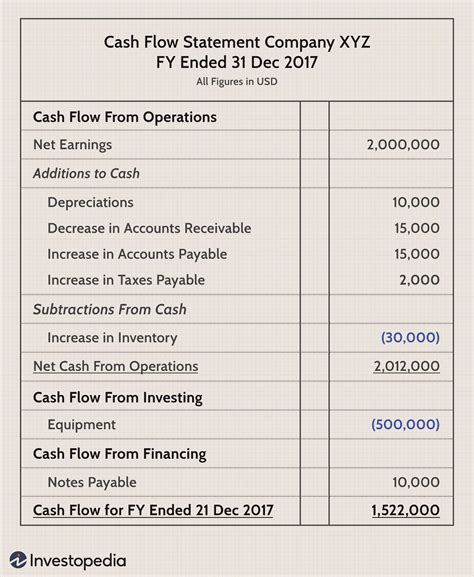

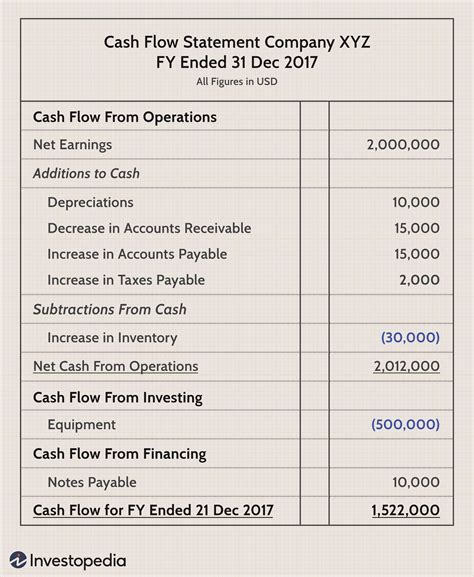

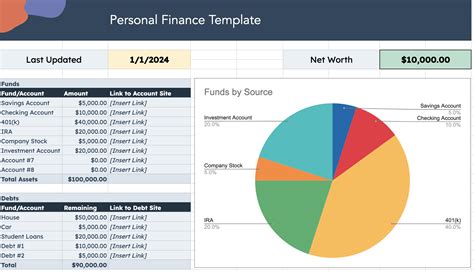

4. Cash Flow Template

A cash flow template is a useful tool for tracking your business cash inflows and outflows. It helps you monitor your cash position, identify areas for improvement, and make informed decisions about investments. An Excel cash flow template typically includes the following columns:

- Cash Inflows: Record your cash inflows, such as sales and investments

- Cash Outflows: Record your cash outflows, such as expenses and investments

- Net Cash Flow: Calculate the net cash flow by subtracting cash outflows from cash inflows

You can use formulas to automatically calculate the net cash flow. For example, you can use the formula =SUM(B2:B10)-SUM(C2:C10) to calculate the net cash flow, where B2:B10 is the range of cells containing your cash inflows and C2:C10 is the range of cells containing your cash outflows.

Benefits of a Cash Flow Template

A cash flow template offers several benefits, including:

- Helps you monitor your cash position

- Identifies areas for improvement

- Enables you to make informed decisions about investments

- Improves financial management and planning

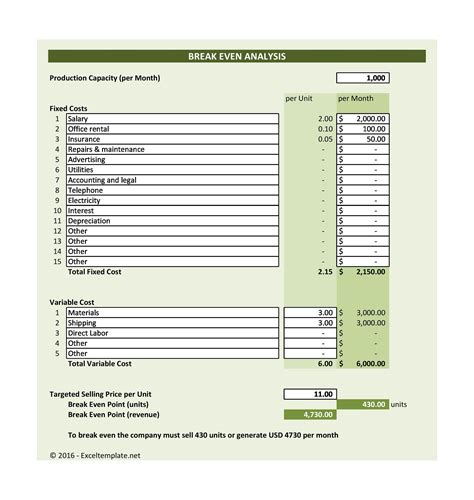

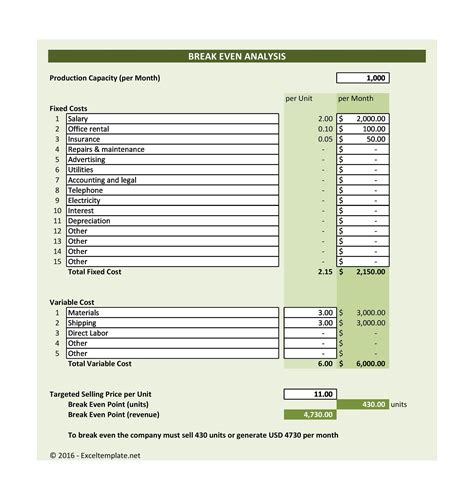

5. Break-Even Analysis Template

A break-even analysis template is a useful tool for determining the point at which your business becomes profitable. It helps you calculate the sales required to cover your fixed and variable costs. An Excel break-even analysis template typically includes the following columns:

- Fixed Costs: Record your fixed costs, such as rent and salaries

- Variable Costs: Record your variable costs, such as materials and marketing

- Sales: Record your sales

- Contribution Margin: Calculate the contribution margin by subtracting variable costs from sales

- Break-Even Point: Calculate the break-even point by dividing fixed costs by contribution margin

You can use formulas to automatically calculate the contribution margin and break-even point. For example, you can use the formula =SUM(B2:B10)-SUM(C2:C10) to calculate the contribution margin, where B2:B10 is the range of cells containing your sales and C2:C10 is the range of cells containing your variable costs.

Benefits of a Break-Even Analysis Template

A break-even analysis template offers several benefits, including:

- Helps you determine the point at which your business becomes profitable

- Identifies areas for cost-cutting

- Enables you to make informed decisions about investments

- Improves financial management and planning

Small Business Finance Templates Gallery

In conclusion, using Excel templates can significantly improve your small business finances. By tracking your income and expenses, creating budgets, and making projections, you can make informed decisions about investments and resource allocation. The five essential Excel templates for small business finance discussed in this article can help you streamline your financial operations, save time, and achieve your business goals.

We hope this article has been informative and helpful in your search for the best Excel templates for small business finance. If you have any questions or need further assistance, please don't hesitate to ask.