Small Nonprofit Budget Template And Financial Planning Guide Summary

Manage your small nonprofits finances with ease using our comprehensive budget template and financial planning guide. Learn how to create a realistic budget, track expenses, and make informed decisions with our expert advice and downloadable template, featuring key aspects such as income statements, balance sheets, and cash flow management.

As a nonprofit organization, managing finances effectively is crucial to achieving your mission and ensuring the long-term sustainability of your organization. A well-crafted budget template and financial planning guide can help you navigate the complexities of nonprofit finance and make informed decisions about resource allocation.

Creating a budget for a small nonprofit can be a daunting task, especially for those with limited financial expertise. However, with the right tools and guidance, you can develop a comprehensive budget that supports your organization's goals and objectives. In this article, we will provide a comprehensive guide to creating a small nonprofit budget template and financial planning guide.

Why a Nonprofit Budget Template is Essential

A nonprofit budget template is a vital tool for any organization, providing a clear and concise outline of projected income and expenses over a specific period. A well-designed budget template helps ensure that your organization is financially sustainable, makes informed decisions about resource allocation, and is prepared for unexpected expenses or revenue shortfalls.

Some of the key benefits of using a nonprofit budget template include:

- Improved financial management and transparency

- Enhanced decision-making and strategic planning

- Increased accountability and oversight

- Better communication with stakeholders and funders

- Reduced financial risk and improved sustainability

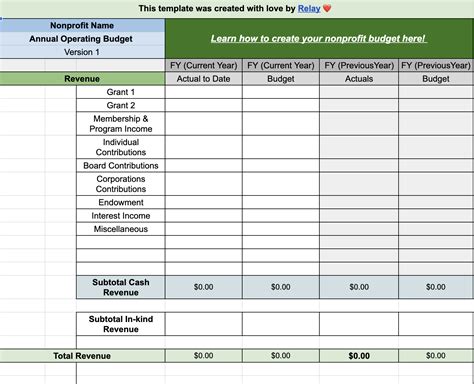

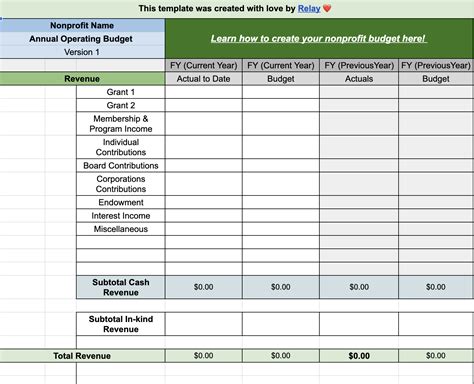

Key Components of a Nonprofit Budget Template

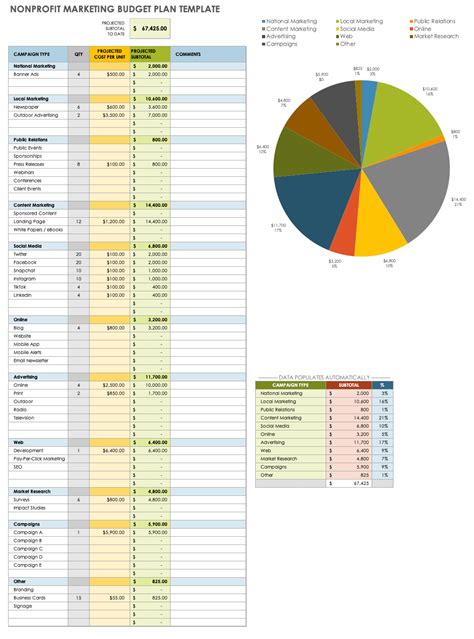

A comprehensive nonprofit budget template should include the following key components:

- Income statement: a summary of projected income from various sources, including donations, grants, and program revenue

- Expense statement: a summary of projected expenses, including salaries, benefits, operating expenses, and program expenses

- Cash flow statement: a summary of projected cash inflows and outflows over a specific period

- Balance sheet: a snapshot of the organization's assets, liabilities, and equity at a specific point in time

Creating a Small Nonprofit Budget Template

To create a small nonprofit budget template, follow these steps:

- Identify your organization's income sources: Start by identifying all sources of income, including donations, grants, program revenue, and other funding sources.

- Categorize expenses: Categorize expenses into different categories, such as salaries, benefits, operating expenses, and program expenses.

- Estimate income and expenses: Estimate projected income and expenses for each category based on historical data and future projections.

- Create a budget template: Use a spreadsheet or budgeting software to create a budget template that includes the income statement, expense statement, cash flow statement, and balance sheet.

- Review and revise: Review and revise the budget template regularly to ensure it accurately reflects your organization's financial situation and goals.

Financial Planning Guide for Small Nonprofits

In addition to creating a budget template, it's essential to develop a comprehensive financial planning guide that outlines your organization's financial goals and objectives. A financial planning guide should include the following components:

- Financial goals and objectives: Clearly define your organization's financial goals and objectives, including short-term and long-term targets.

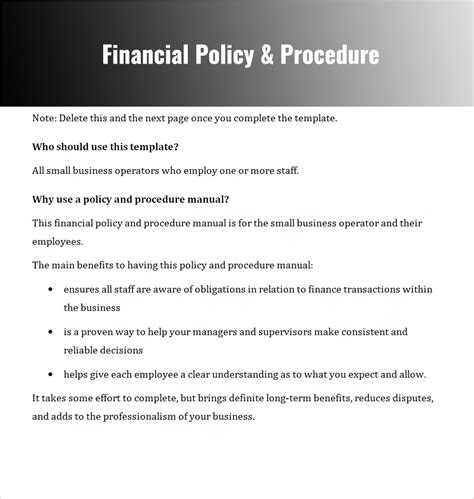

- Financial policies and procedures: Establish clear financial policies and procedures, including accounting practices, financial reporting, and internal controls.

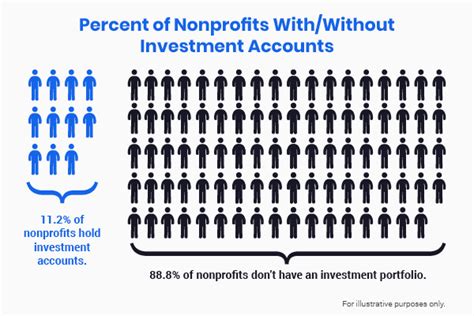

- Investment strategy: Develop an investment strategy that aligns with your organization's financial goals and risk tolerance.

- Risk management: Identify potential financial risks and develop strategies to mitigate them.

Nonprofit Financial Planning Guide

A nonprofit financial planning guide is a comprehensive document that outlines your organization's financial goals, objectives, and strategies. The guide should be reviewed and updated regularly to ensure it remains relevant and effective.

Best Practices for Nonprofit Financial Management

To ensure effective financial management, follow these best practices:

- Develop a comprehensive budget template and financial planning guide

- Regularly review and revise financial plans and budgets

- Establish clear financial policies and procedures

- Invest in financial reporting and accounting software

- Develop a risk management strategy

- Foster a culture of transparency and accountability

Common Financial Mistakes Nonprofits Make

Nonprofits often make financial mistakes that can have serious consequences. Some common financial mistakes include:

- Poor budgeting and financial planning

- Inadequate financial reporting and transparency

- Insufficient internal controls and risk management

- Over-reliance on a single funding source

- Failure to diversify investments

Conclusion

Creating a small nonprofit budget template and financial planning guide is essential for effective financial management and sustainability. By following the steps outlined in this guide, you can develop a comprehensive budget template and financial planning guide that supports your organization's goals and objectives. Remember to regularly review and revise your financial plans and budgets to ensure they remain relevant and effective.

FAQs

Q: What is a nonprofit budget template? A: A nonprofit budget template is a comprehensive outline of projected income and expenses over a specific period.

Q: Why is a nonprofit budget template essential? A: A nonprofit budget template is essential for effective financial management, transparency, and accountability.

Q: What are the key components of a nonprofit budget template? A: The key components of a nonprofit budget template include the income statement, expense statement, cash flow statement, and balance sheet.

Q: How do I create a small nonprofit budget template? A: To create a small nonprofit budget template, identify income sources, categorize expenses, estimate income and expenses, and create a budget template using a spreadsheet or budgeting software.

Gallery of Nonprofit Budget Templates and Financial Planning Guides

Nonprofit Budget Template and Financial Planning Guide Gallery

We hope this comprehensive guide to creating a small nonprofit budget template and financial planning guide has been helpful. Remember to regularly review and revise your financial plans and budgets to ensure they remain relevant and effective. If you have any questions or need further guidance, please don't hesitate to reach out.