Intro

When you're in need of financing for a purchase, it can be frustrating to be denied by a lender. Snap Finance is a popular financing option for many consumers, but even with its flexible approval process, some applicants may still be denied. If you've been denied by Snap Finance, it's essential to understand the reasons behind the decision. In this article, we'll explore five common reasons why Snap Finance may have denied your application.

Reason 1: Insufficient Income

One of the primary reasons Snap Finance may deny your application is if you don't meet their minimum income requirements. Snap Finance typically requires applicants to have a steady income of at least $1,000 per month. If you're self-employed or have an irregular income, you may not qualify for financing. Additionally, if you're receiving government assistance or have a history of bounced checks, this could also negatively impact your application.

Tips to Improve Your Income Status

- Consider taking on a part-time job to increase your income

- Provide documentation of any side hustles or freelance work

- If you're self-employed, provide detailed financial records to demonstrate your income stability

Reason 2: Poor Credit History

Snap Finance does consider credit history when evaluating applications. If you have a history of late payments, collections, or bankruptcies, this could lead to denial. Additionally, if you have a thin credit file or no credit history at all, this could also make it difficult to get approved.

Tips to Improve Your Credit History

- Make on-time payments for all debts and bills

- Consider a secured credit card to build credit

- Monitor your credit report and dispute any errors

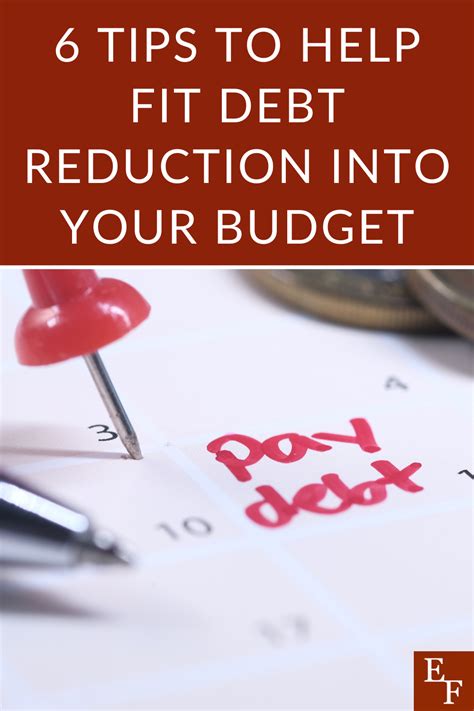

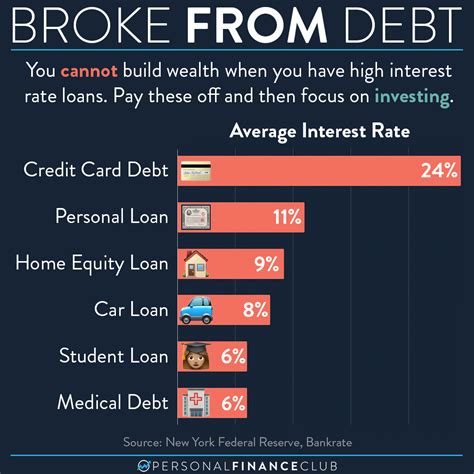

Reason 3: High Debt-to-Income Ratio

Snap Finance also evaluates your debt-to-income ratio when considering your application. If you have a high amount of debt compared to your income, this could indicate to Snap Finance that you may not be able to afford additional payments. Aim to keep your debt-to-income ratio below 36% to increase your chances of approval.

Tips to Reduce Your Debt-to-Income Ratio

- Create a budget to track your income and expenses

- Prioritize debt repayment, focusing on high-interest debts first

- Consider consolidating debts into a single, lower-interest loan

Reason 4: Incomplete or Inaccurate Application

It's essential to ensure that your application is complete and accurate. If you've missed required fields or provided incorrect information, this could lead to denial. Double-check your application before submitting it to ensure everything is correct.

Tips to Ensure a Complete and Accurate Application

- Take your time when filling out the application

- Double-check all information for accuracy

- If you're unsure about a particular field, contact Snap Finance customer support

Reason 5: No Credit or Banking History

Snap Finance requires applicants to have a valid bank account and some form of credit history. If you don't have a bank account or credit history, this could make it difficult to get approved.

Tips to Establish Credit and Banking History

- Open a checking or savings account with a reputable bank

- Consider applying for a secured credit card to build credit

- Make regular deposits into your bank account to demonstrate financial stability

Gallery of Snap Finance Denial Reasons

If you've been denied by Snap Finance, don't be discouraged. By understanding the reasons behind the denial, you can take steps to improve your financial situation and increase your chances of approval in the future. Take the time to review your application, credit report, and financial history to identify areas for improvement. With patience and persistence, you can work towards establishing a stronger financial foundation and increasing your chances of approval for financing.