Intro

Creating a startup business budget template in Excel can seem daunting, but it's a crucial step in managing your finances effectively. A well-crafted budget template helps you track income and expenses, make informed decisions, and ensure the financial sustainability of your startup. In this article, we'll break down the process of creating a startup business budget template in Excel, making it easy for you to get started.

Why Do Startups Need a Budget Template?

A budget template is essential for startups as it helps you manage your finances, prioritize spending, and make data-driven decisions. Without a budget, you risk overspending, missing opportunities, and struggling to achieve your business goals. A budget template also helps you:

- Track income and expenses

- Identify areas for cost-cutting

- Make informed decisions about investments and resource allocation

- Measure financial performance and progress

Creating a Startup Business Budget Template in Excel

Creating a startup business budget template in Excel involves several steps:

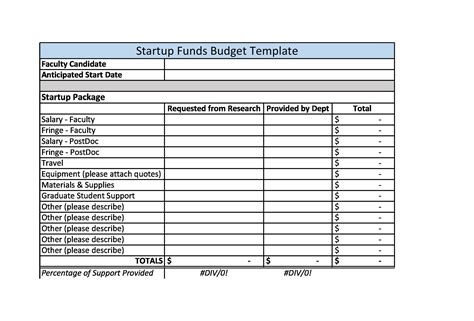

Step 1: Set Up Your Budget Template**

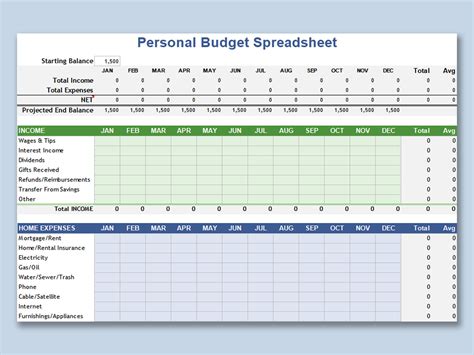

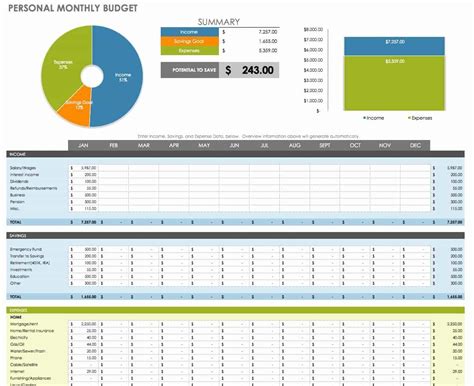

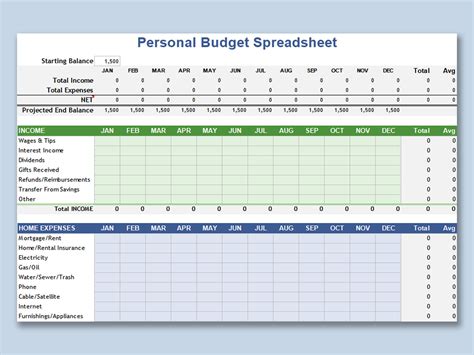

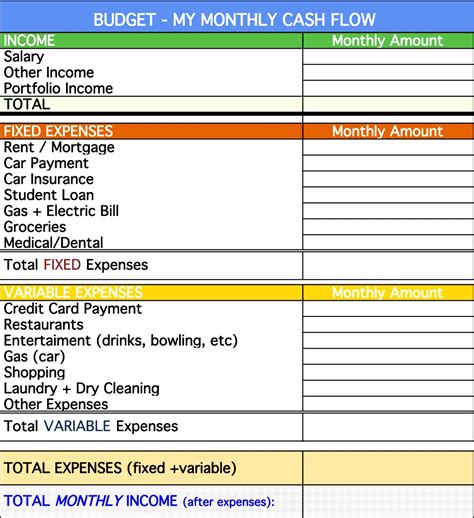

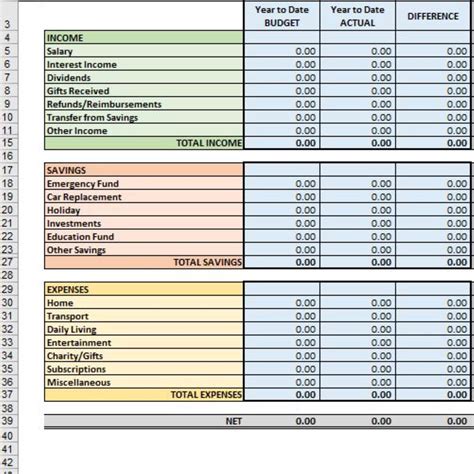

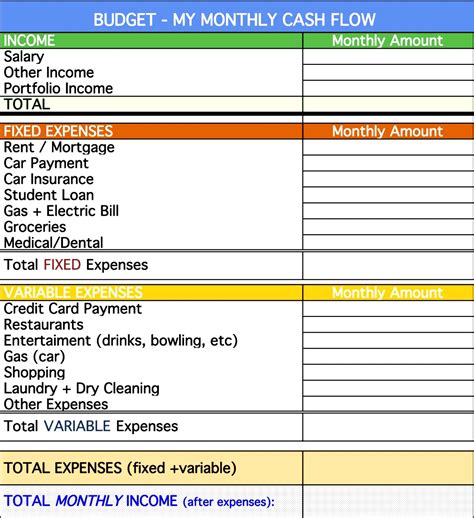

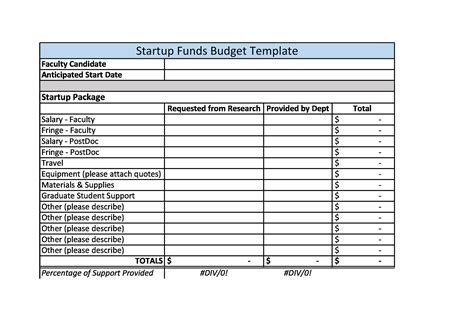

To start, open a new Excel spreadsheet and set up a basic budget template. You can use a simple table format with the following columns:

- Income

- Fixed Expenses

- Variable Expenses

- Total Expenses

- Net Income

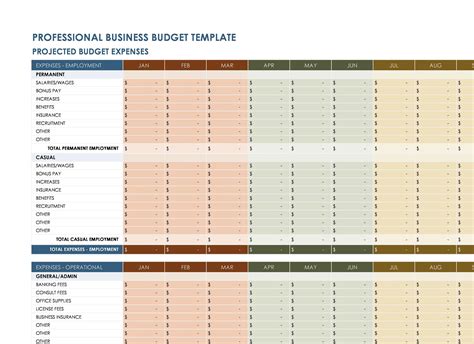

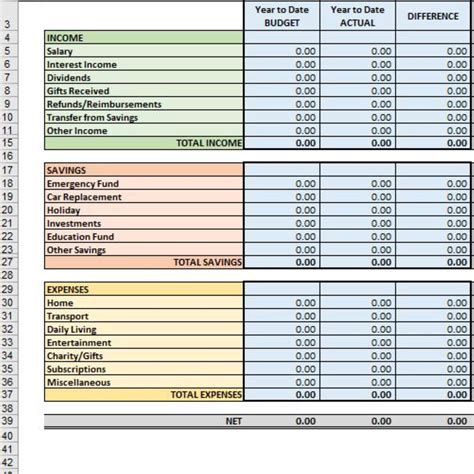

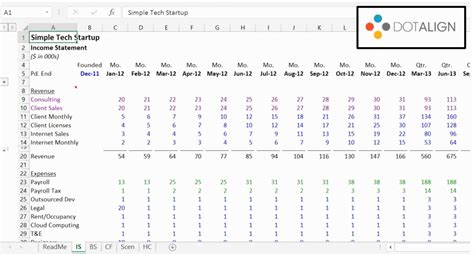

Step 2: Categorize Your Income and Expenses

Next, categorize your income and expenses into different groups. For example:

- Income:

- Sales Revenue

- Service Revenue

- Interest Income

- Fixed Expenses:

- Rent

- Salaries

- Utilities

- Variable Expenses:

- Marketing Expenses

- Raw Materials

- Travel Expenses

Step 3: Enter Your Budget Data**

Enter your budget data into the template, using historical data or projections for future periods. Be sure to include all income and expenses, even if they seem small.

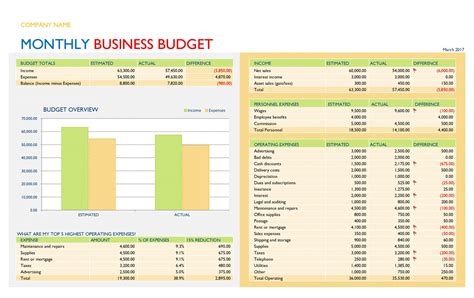

Step 4: Calculate Your Net Income

Calculate your net income by subtracting total expenses from total income.

Step 5: Review and Revise Your Budget

Review your budget regularly and revise it as needed. This will help you stay on track, identify areas for improvement, and make informed decisions about your business.

Tips for Creating an Effective Startup Business Budget Template

- Use a rolling budget: Update your budget regularly to reflect changes in your business.

- Prioritize needs over wants: Be honest about what expenses are essential and what can be cut.

- Use budgeting software: Consider using specialized budgeting software to streamline your budgeting process.

- Review and revise regularly: Regularly review your budget and make adjustments as needed.

Common Budgeting Mistakes to Avoid**

- Not having a budget: This is the most common budgeting mistake. Without a budget, you risk overspending and struggling to achieve your business goals.

- Underestimating expenses: Be realistic about your expenses and include all costs, even if they seem small.

- Not regularly reviewing your budget: Regularly review your budget to stay on track and make informed decisions.

Conclusion

Creating a startup business budget template in Excel is a straightforward process that can help you manage your finances effectively. By following the steps outlined above and avoiding common budgeting mistakes, you can create a budget that helps you achieve your business goals. Remember to regularly review and revise your budget to stay on track and make informed decisions about your business.

Gallery of Startup Business Budget Templates

Startup Business Budget Templates