Startup Financial Projections Template Xls Free Download Guide Summary

Create a solid financial foundation for your startup with our expert guide to financial projections. Download a free Excel template (XLS) and learn how to forecast revenue, expenses, and cash flow with accuracy. Master key metrics, break-even analysis, and funding requirements to drive growth and secure investments.

As a startup founder, creating a comprehensive financial projection is crucial for securing funding, guiding business decisions, and measuring progress. However, developing a robust financial plan can be daunting, especially for those without extensive financial expertise. That's where a startup financial projections template comes in handy. In this article, we'll explore the importance of financial projections, discuss the key components of a template, and provide guidance on using a free downloadable template.

Why Financial Projections Matter for Startups

Financial projections serve as a roadmap for your startup's financial future. By creating a detailed and realistic financial plan, you'll be able to:

- Secure funding from investors by demonstrating a clear understanding of your business's financial potential

- Make informed decisions about resource allocation, pricing, and growth strategies

- Track progress and adjust your plan as needed to stay on course

- Identify potential financial pitfalls and develop strategies to mitigate risks

Key Components of a Startup Financial Projections Template

A comprehensive financial projections template should include the following key components:

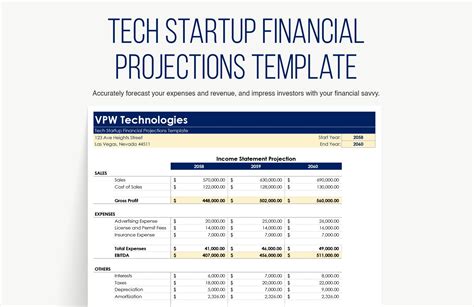

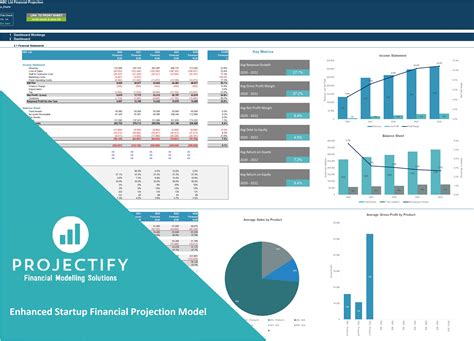

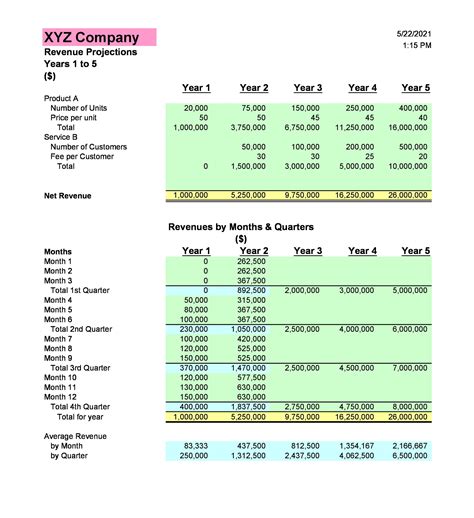

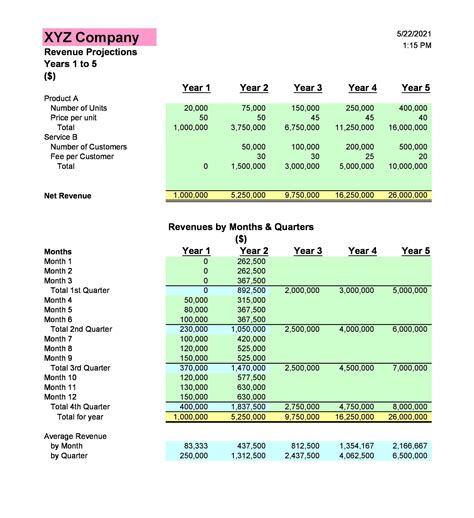

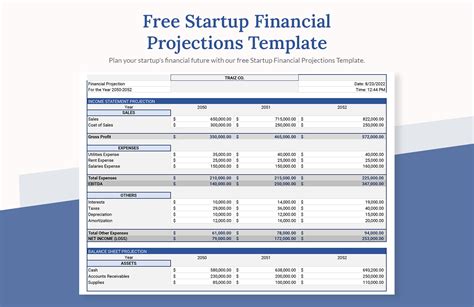

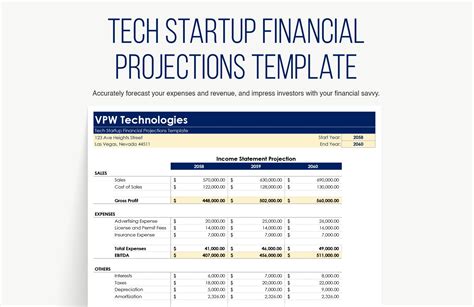

- Income Statement: A detailed breakdown of projected revenues and expenses over a specified period (typically 3-5 years)

- Balance Sheet: A snapshot of your startup's projected assets, liabilities, and equity at a given point in time

- Cash Flow Statement: A summary of projected inflows and outflows of cash over a specified period

- Break-Even Analysis: A calculation of the point at which your startup's revenues equal its fixed and variable costs

- Key Performance Indicators (KPIs): Metrics used to measure progress and track performance, such as customer acquisition costs, customer lifetime value, and retention rates

How to Use a Startup Financial Projections Template

Using a startup financial projections template is a straightforward process. Here's a step-by-step guide to get you started:

- Download a template: Choose a reputable source, such as a financial institution or a trusted business advisory firm, and download a free startup financial projections template in XLS format.

- Customize the template: Tailor the template to your startup's specific needs by adding or removing sections, rows, or columns as necessary.

- Enter historical data: Populate the template with your startup's historical financial data, including income statements, balance sheets, and cash flow statements.

- Make assumptions: Develop realistic assumptions about your startup's future financial performance, including revenue growth rates, expense levels, and funding requirements.

- Create projections: Use the template to create detailed financial projections, including income statements, balance sheets, cash flow statements, and break-even analyses.

- Review and refine: Regularly review and refine your financial projections to ensure they remain accurate and relevant.

Free Downloadable Templates

If you're looking for a free downloadable startup financial projections template, here are some reputable sources to consider:

- SCORE: A non-profit organization that offers a free startup financial projections template, as well as other business planning resources.

- Small Business Administration (SBA): A government agency that provides a free startup financial projections template, along with other business planning tools and resources.

- LivePlan: A business planning software company that offers a free startup financial projections template, as well as a range of other business planning resources.

Startup Financial Projections Template Xls Image Gallery

Final Thoughts

Creating a comprehensive financial plan is a critical step in securing funding, guiding business decisions, and measuring progress. By using a startup financial projections template, you'll be able to develop a robust financial plan that helps you achieve your business goals. Remember to customize the template to your startup's specific needs, enter historical data, make assumptions, create projections, and regularly review and refine your financial plan. With the right tools and resources, you'll be well on your way to creating a successful financial plan that drives business growth and success.

We hope this article has provided valuable insights into the importance of financial projections for startups. If you have any questions or comments, please feel free to share them below.