Discover Nevada state income tax facts, including tax rates, deductions, and exemptions, to navigate the Silver States tax landscape and optimize your tax strategy with expert insights on Nevada tax laws and regulations.

Nevada is known for its unique blend of natural beauty, entertainment options, and business-friendly environment. One aspect that sets Nevada apart from many other states is its approach to state income tax. For individuals and businesses considering relocation or already residing in the Silver State, understanding Nevada state income tax facts is crucial for financial planning and decision-making. Nevada's state income tax policy has significant implications for its residents, from retirees to entrepreneurs, and plays a key role in the state's economic attractiveness.

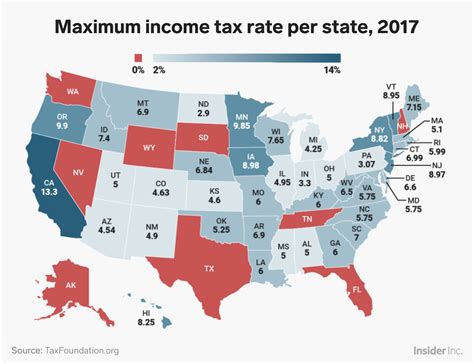

The absence of a state income tax in Nevada is a major draw for many individuals and corporations. This policy means that residents of Nevada do not have to pay state taxes on their income, which can lead to significant savings compared to states with high income tax rates. The implications of this policy are far-reaching, influencing not just personal finances but also the overall economy of the state. By not having a state income tax, Nevada aims to attract more residents, encourage business growth, and stimulate economic development.

For those looking to relocate or start a business, Nevada's tax environment is particularly appealing. The lack of state income tax, combined with other business-friendly policies, makes Nevada an attractive destination for entrepreneurs and corporations alike. However, it's essential to understand the broader tax landscape in Nevada, including other types of taxes that may apply, such as sales taxes and property taxes. A comprehensive understanding of these taxes can help individuals and businesses make informed decisions about their financial and operational strategies.

Nevada State Income Tax Overview

Nevada's decision not to impose a state income tax is rooted in its economic development strategy. By eliminating this tax burden, the state aims to create a more favorable business climate and attract high-income earners. This approach has contributed to Nevada's growth, particularly in sectors like technology, logistics, and professional services. However, it's crucial for residents and businesses to be aware of the potential trade-offs, such as higher sales taxes or fees in certain areas, which can impact their overall tax liability.

Benefits for Residents and Businesses

The benefits of Nevada's no-state-income-tax policy are multifaceted. For residents, the absence of state income tax can mean more disposable income, which can be invested, saved, or spent within the local economy. This can lead to increased consumer spending, potentially boosting local businesses and economic growth. For businesses, the lack of state income tax can reduce operational costs, making Nevada a more competitive location for startups and established companies alike.Understanding Other Taxes in Nevada

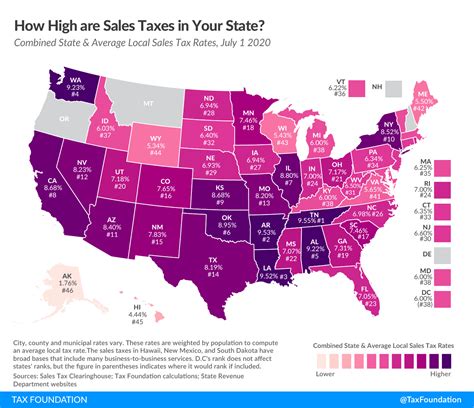

While Nevada does not have a state income tax, other taxes apply, including sales taxes and property taxes. Sales taxes in Nevada are imposed at the state and local levels, with the combined rate varying by location. Property taxes also exist, although they are generally considered to be moderate compared to other states. Understanding these taxes is essential for both individuals and businesses to accurately assess their total tax liability in Nevada.

Sales Taxes in Nevada

Sales taxes are a significant source of revenue for Nevada. The state imposes a base sales tax rate, and local jurisdictions can add additional taxes, leading to varying combined rates across different areas. For businesses, especially those in retail and hospitality, understanding the sales tax rates and how they apply to their operations is crucial for pricing strategies and tax compliance.Nevada's Economic Development

Nevada's economic development is closely tied to its tax policies, including the absence of a state income tax. The state has seen significant growth in various sectors, driven in part by its business-friendly environment. From technology and manufacturing to tourism and logistics, Nevada's diverse economy benefits from the state's strategic location, skilled workforce, and favorable tax climate.

Challenges and Opportunities

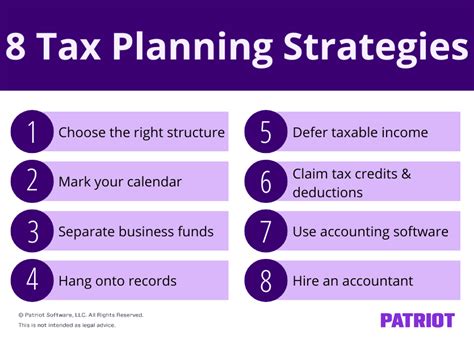

Despite the advantages, Nevada also faces challenges related to its tax structure. The reliance on sales taxes can make the state's revenue streams volatile, particularly during economic downturns. Additionally, the lack of a state income tax means that Nevada must find other ways to fund public services and infrastructure, which can sometimes lead to higher fees or taxes in specific areas. However, these challenges also present opportunities for innovation and strategic planning, allowing Nevada to continue evolving its economic development strategies.Tax Planning Strategies

For individuals and businesses in Nevada, tax planning is essential to minimize tax liabilities and maximize savings. This includes understanding how federal taxes apply, as well as any local or state-specific taxes. Strategies might involve optimizing business structures, leveraging tax deductions, and carefully managing income to reduce tax obligations. Given the complexity of tax laws, consulting with a tax professional can provide personalized advice tailored to specific situations.

Federal Tax Implications

While Nevada does not impose a state income tax, residents are still subject to federal income taxes. Understanding federal tax laws and how they interact with Nevada's state tax policies is vital for effective tax planning. This includes being aware of tax brackets, deductions, and credits that can impact federal tax liability.Gallery of Nevada Taxes

Nevada Taxes Image Gallery

Final Thoughts on Nevada State Income Tax

In conclusion, Nevada's approach to state income tax is a significant factor in its economic landscape. The absence of a state income tax offers numerous benefits for residents and businesses, from increased disposable income to a more competitive business environment. However, it's essential to consider the broader tax picture, including sales taxes, property taxes, and federal income taxes. By understanding these aspects, individuals and businesses can make informed decisions about their financial strategies and take full advantage of the opportunities Nevada offers.

As you consider the implications of Nevada state income tax facts for your personal or business finances, we invite you to share your thoughts and questions in the comments below. Whether you're a current resident of Nevada or considering making the Silver State your home, understanding its tax environment is a crucial step in navigating your financial future. Share this article with others who might benefit from insights into Nevada's unique tax landscape, and don't hesitate to reach out for more information on how to make the most of Nevada's tax-friendly environment.