Intro

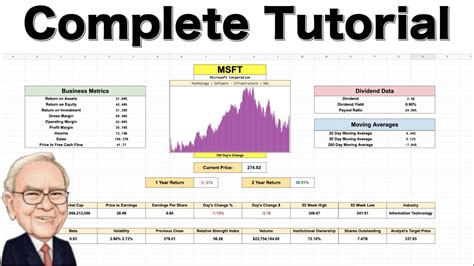

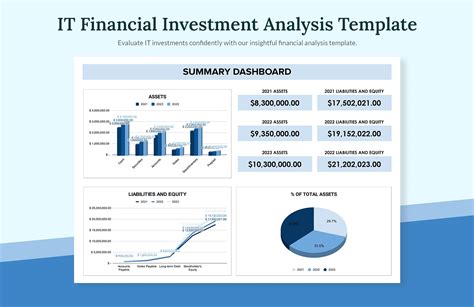

Unlock accurate stock valuations with our expert-designed Excel spreadsheet template. Perfect for investors, this template helps you analyze stock performance, calculate intrinsic value, and make informed investment decisions. Featuring key metrics and ratios, its your go-to tool for stock valuation and portfolio optimization.

Investing in the stock market can be a daunting task, especially for those who are new to the game. With so many different stocks to choose from, it can be difficult to determine which ones are worth investing in. That's where a stock valuation Excel spreadsheet template comes in. In this article, we'll take a closer look at the importance of stock valuation, the benefits of using a spreadsheet template, and provide a step-by-step guide on how to create your own template.

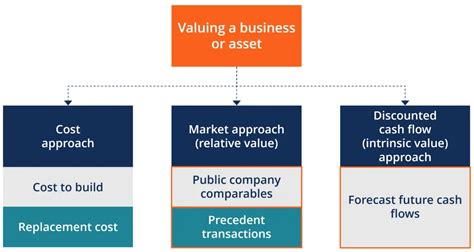

Why Stock Valuation Matters

Stock valuation is the process of determining the value of a company's stock. It's an essential tool for investors, as it helps them make informed decisions about which stocks to buy and sell. By valuing a company's stock, investors can determine whether it's overvalued or undervalued, and make decisions accordingly. Stock valuation can also help investors identify potential risks and opportunities, and make adjustments to their portfolios as needed.

Benefits of Using a Stock Valuation Excel Spreadsheet Template

Using a stock valuation Excel spreadsheet template can be incredibly beneficial for investors. Here are just a few of the benefits:

- Easy to use: A spreadsheet template makes it easy to input data and perform calculations, even for those who are new to stock valuation.

- Customizable: A template can be customized to fit your specific needs and investment goals.

- Accurate: A spreadsheet template helps ensure that calculations are accurate, reducing the risk of errors.

- Time-saving: A template saves time, as it eliminates the need to create a new spreadsheet from scratch each time you want to value a stock.

Creating Your Own Stock Valuation Excel Spreadsheet Template

Creating your own stock valuation Excel spreadsheet template is easier than you think. Here's a step-by-step guide to get you started:

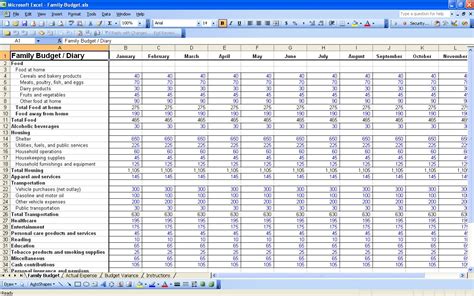

Step 1: Set Up Your Spreadsheet

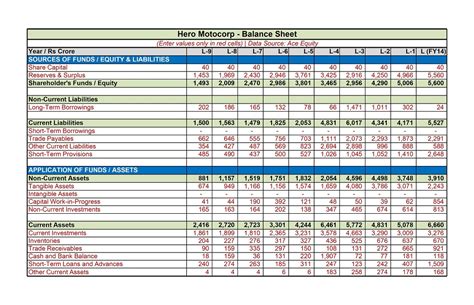

To start, create a new Excel spreadsheet and set up the following columns:

- Ticker symbol: The ticker symbol of the stock you want to value.

- Company name: The name of the company.

- Current price: The current price of the stock.

- Revenue: The company's revenue for the past year.

- Net income: The company's net income for the past year.

- EPS: The company's earnings per share (EPS) for the past year.

- Growth rate: The company's growth rate for the past year.

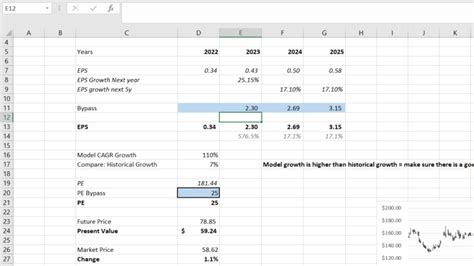

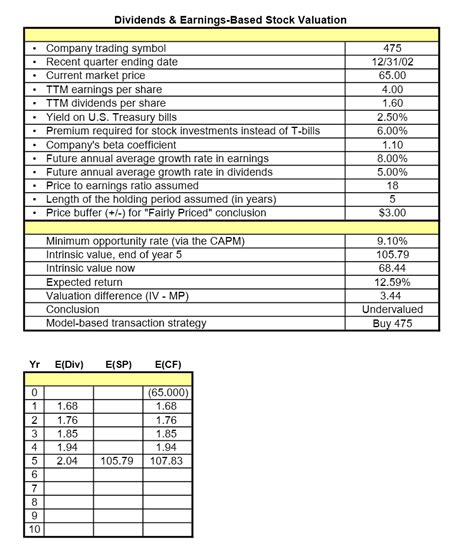

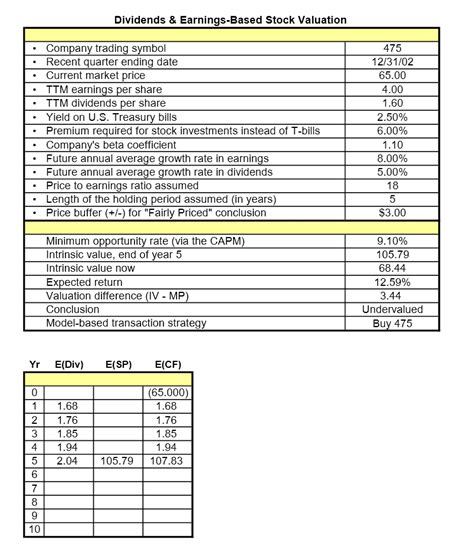

Step 2: Calculate the Intrinsic Value

Next, calculate the intrinsic value of the stock using the following formula:

Intrinsic value = (EPS x (1 + growth rate)) / (discount rate - growth rate)

This formula takes into account the company's EPS, growth rate, and discount rate to determine the intrinsic value of the stock.

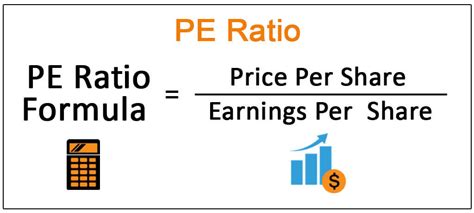

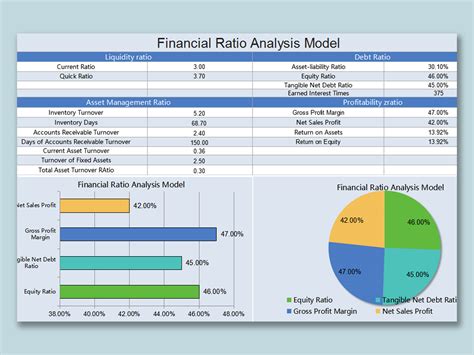

Step 3: Calculate the Price-to-Earnings (P/E) Ratio

The P/E ratio is a widely used metric for valuing stocks. To calculate the P/E ratio, use the following formula:

P/E ratio = current price / EPS

This formula takes into account the current price of the stock and the company's EPS to determine the P/E ratio.

Step 4: Calculate the Price-to-Book (P/B) Ratio

The P/B ratio is another widely used metric for valuing stocks. To calculate the P/B ratio, use the following formula:

P/B ratio = current price / book value per share

This formula takes into account the current price of the stock and the company's book value per share to determine the P/B ratio.

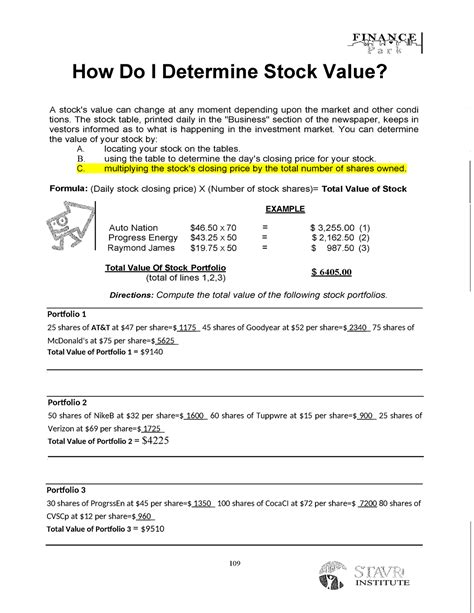

Step 5: Determine the Stock's Value

Using the intrinsic value, P/E ratio, and P/B ratio, you can determine the stock's value. If the intrinsic value is higher than the current price, the stock may be undervalued. If the intrinsic value is lower than the current price, the stock may be overvalued.

Tips and Variations

Here are a few tips and variations to keep in mind when using a stock valuation Excel spreadsheet template:

- Use historical data: Use historical data to determine the company's growth rate and EPS.

- Adjust the discount rate: Adjust the discount rate to reflect the company's risk level.

- Use different valuation models: Use different valuation models, such as the dividend discount model or the residual income model.

- Consider multiple scenarios: Consider multiple scenarios, such as best-case and worst-case scenarios.

Stock Valuation Excel Template Image Gallery

Conclusion

A stock valuation Excel spreadsheet template is a powerful tool for investors. By following the steps outlined in this article, you can create your own template and start making informed investment decisions. Remember to use historical data, adjust the discount rate, and consider multiple scenarios to get the most out of your template. Happy investing!