Intro

Effortlessly manage student debt with 5 essential Excel templates. Track payments, interest rates, and outstanding balances with ease. Organize your finances, reduce stress, and make informed decisions about loan consolidation and repayment strategies. Discover how to create a personalized debt management plan using Excel and take control of your financial future.

Are you struggling to keep track of your student loans and managing your debt? With the rising cost of higher education, it's no surprise that many students are left with a significant amount of debt after graduation. However, having a clear understanding of your debt and creating a plan to pay it off can make all the difference. In this article, we'll explore five essential Excel templates that can help you manage your student debt and get back on track financially.

Student debt can be overwhelming, especially when you have multiple loans with different interest rates, payment due dates, and balances. Without a clear picture of your debt, it's easy to fall behind on payments or feel like you're drowning in debt. That's where Excel templates come in – by using these templates, you can organize your debt, prioritize your payments, and create a plan to pay off your loans.

In this article, we'll cover five essential Excel templates that can help you manage your student debt. From tracking your loan balances and interest rates to creating a budget and payment plan, these templates will provide you with the tools you need to take control of your debt.

Template 1: Student Loan Tracker

The first template we'll cover is the Student Loan Tracker. This template allows you to track the details of each of your student loans, including the loan balance, interest rate, payment due date, and minimum payment amount. With this template, you can easily see which loans have the highest interest rates or balances, and prioritize your payments accordingly.

To use this template, simply enter the details of each of your student loans into the table. The template will automatically calculate the total balance and minimum payment amount for all of your loans. You can also use the filters to sort your loans by interest rate, balance, or payment due date.

Benefits of the Student Loan Tracker Template

- Easily track the details of each of your student loans

- Prioritize your payments based on interest rate, balance, or payment due date

- Calculate the total balance and minimum payment amount for all of your loans

Template 2: Budget and Payment Plan

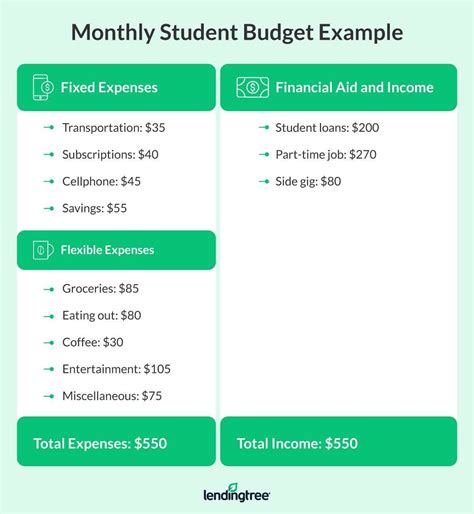

The second template we'll cover is the Budget and Payment Plan template. This template allows you to create a budget and payment plan that takes into account your income, expenses, and student loan payments. With this template, you can ensure that you're making enough money to cover your expenses and loan payments, and make adjustments as needed.

To use this template, simply enter your income and expenses into the table. The template will automatically calculate your net income and expenses, and provide you with a budget and payment plan that takes into account your student loan payments.

Benefits of the Budget and Payment Plan Template

- Create a budget and payment plan that takes into account your income, expenses, and student loan payments

- Ensure that you're making enough money to cover your expenses and loan payments

- Make adjustments to your budget and payment plan as needed

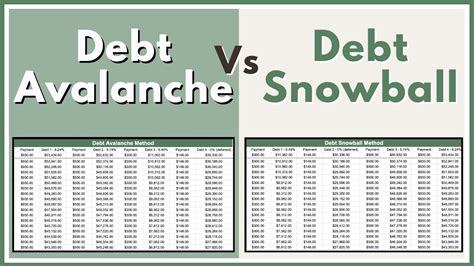

Template 3: Debt Snowball Calculator

The third template we'll cover is the Debt Snowball Calculator. This template allows you to calculate how long it will take to pay off your student loans using the debt snowball method. With this template, you can see how much interest you'll save by paying off your loans in a specific order, and create a plan to pay off your loans quickly and efficiently.

To use this template, simply enter the details of each of your student loans into the table. The template will automatically calculate how long it will take to pay off each loan, and provide you with a debt snowball plan that prioritizes your loans based on balance and interest rate.

Benefits of the Debt Snowball Calculator Template

- Calculate how long it will take to pay off your student loans using the debt snowball method

- See how much interest you'll save by paying off your loans in a specific order

- Create a plan to pay off your loans quickly and efficiently

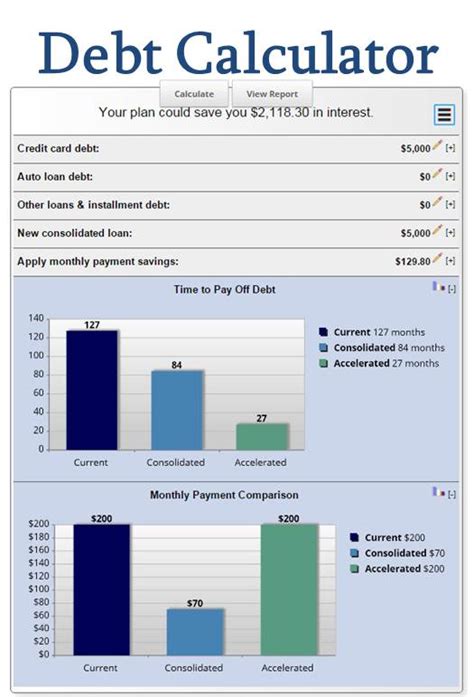

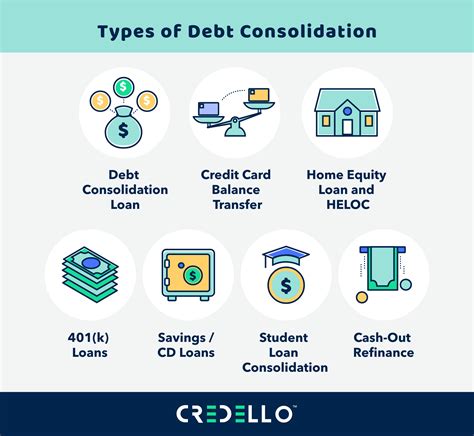

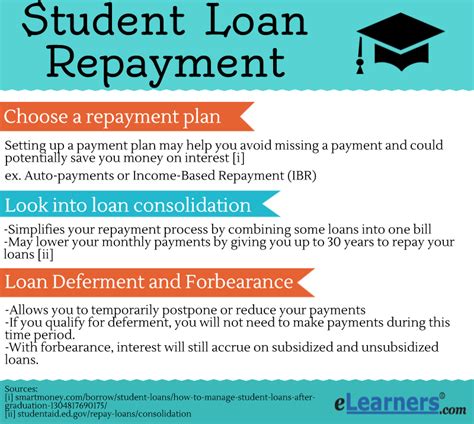

Template 4: Loan Consolidation Calculator

The fourth template we'll cover is the Loan Consolidation Calculator. This template allows you to calculate the benefits of consolidating your student loans into a single loan with a lower interest rate. With this template, you can see how much interest you'll save by consolidating your loans, and create a plan to pay off your loans more efficiently.

To use this template, simply enter the details of each of your student loans into the table. The template will automatically calculate the benefits of consolidating your loans, and provide you with a plan to pay off your loans more efficiently.

Benefits of the Loan Consolidation Calculator Template

- Calculate the benefits of consolidating your student loans into a single loan with a lower interest rate

- See how much interest you'll save by consolidating your loans

- Create a plan to pay off your loans more efficiently

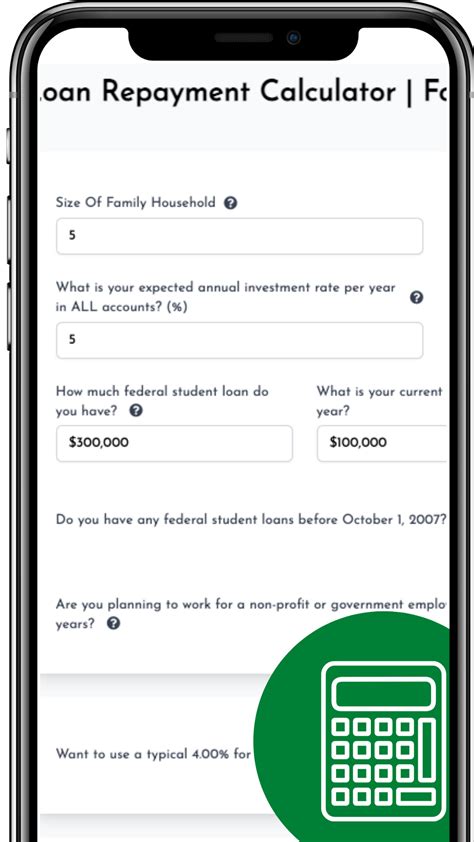

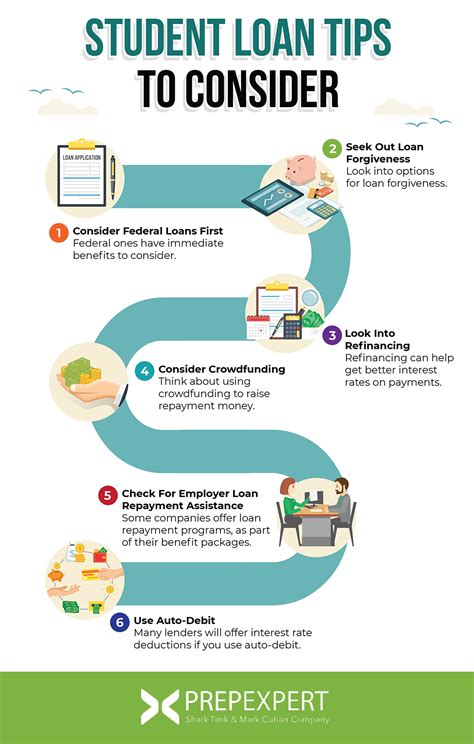

Template 5: Student Loan Forgiveness Calculator

The fifth and final template we'll cover is the Student Loan Forgiveness Calculator. This template allows you to calculate the benefits of student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. With this template, you can see how much of your loan balance may be forgiven, and create a plan to qualify for loan forgiveness.

To use this template, simply enter the details of each of your student loans into the table. The template will automatically calculate the benefits of student loan forgiveness programs, and provide you with a plan to qualify for loan forgiveness.

Benefits of the Student Loan Forgiveness Calculator Template

- Calculate the benefits of student loan forgiveness programs

- See how much of your loan balance may be forgiven

- Create a plan to qualify for loan forgiveness

Student Debt Management Image Gallery

By using these five essential Excel templates, you can take control of your student debt and create a plan to pay off your loans quickly and efficiently. Remember to stay organized, prioritize your payments, and seek help when needed. With the right tools and strategies, you can overcome your student debt and achieve financial freedom.

We hope this article has been helpful in providing you with the resources you need to manage your student debt. If you have any questions or comments, please feel free to share them below.