Calculating T-Bill returns can be a daunting task, especially for those without a strong financial background. However, with the help of Excel, you can easily calculate T-Bill returns and make informed investment decisions.

In this article, we will explore the importance of calculating T-Bill returns, the different types of T-Bills, and how to use Excel to calculate T-Bill returns.

Why Calculate T-Bill Returns?

Calculating T-Bill returns is essential for investors who want to make informed decisions about their investments. T-Bills are short-term government securities with maturities ranging from a few weeks to a year. They are considered to be one of the safest investments, as they are backed by the full faith and credit of the U.S. government.

By calculating T-Bill returns, investors can:

- Compare the returns of different T-Bills with varying maturities

- Determine the impact of changes in interest rates on T-Bill returns

- Evaluate the performance of their investment portfolio

Types of T-Bills

There are four main types of T-Bills:

- 4-Week T-Bill: Matures in 28 days

- 13-Week T-Bill: Matures in 91 days

- 26-Week T-Bill: Matures in 182 days

- 52-Week T-Bill: Matures in 364 days

Each type of T-Bill has its own unique characteristics and returns.

How to Calculate T-Bill Returns in Excel

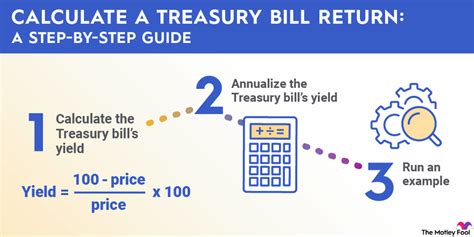

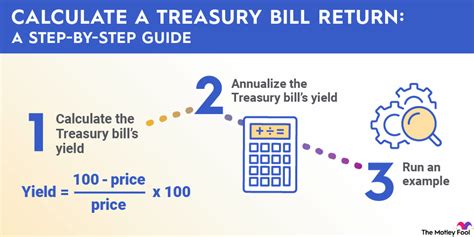

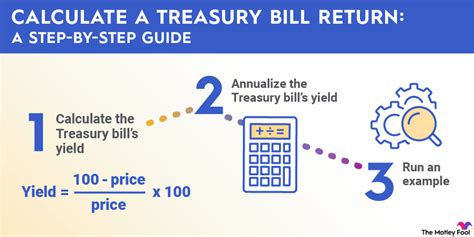

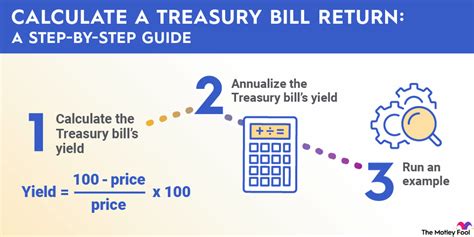

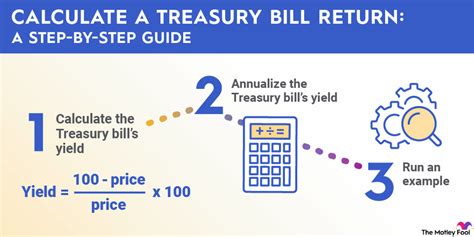

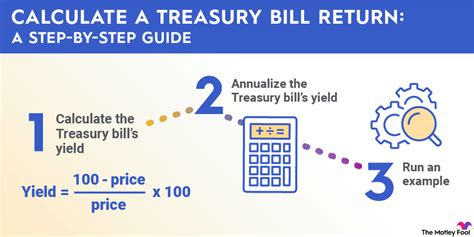

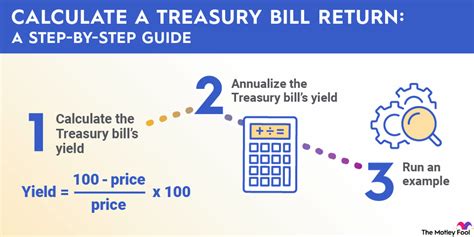

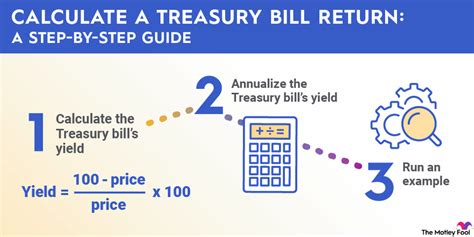

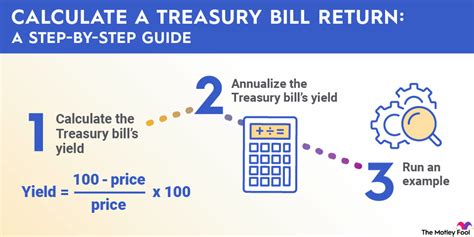

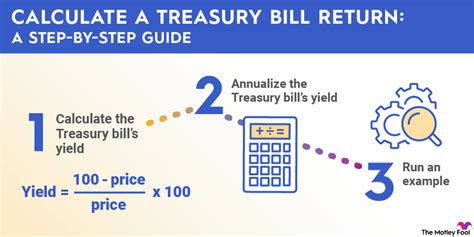

Calculating T-Bill returns in Excel is a straightforward process that involves using a few simple formulas. Here's a step-by-step guide:

- Enter the purchase price: Enter the purchase price of the T-Bill in a cell, say A1.

- Enter the face value: Enter the face value of the T-Bill in a cell, say A2.

- Enter the number of days: Enter the number of days until maturity in a cell, say A3.

- Calculate the return: Use the following formula to calculate the return:

= ((A2 - A1) / A1) \* (360 / A3)

This formula calculates the return as a percentage.

- Format the result: Format the result as a percentage by selecting the cell and clicking on the "Percentage" button in the "Number" group of the "Home" tab.

Example

Suppose you purchase a 13-Week T-Bill with a face value of $100 and a purchase price of $98.50. The number of days until maturity is 91.

| Purchase Price | Face Value | Number of Days |

|---|---|---|

| $98.50 | $100 | 91 |

Using the formula above, the return would be:

= ((100 - 98.50) / 98.50) \* (360 / 91) = 2.12%

Tips and Variations

Here are some tips and variations to keep in mind when calculating T-Bill returns in Excel:

- Use the XIRR function: If you have a series of cash flows, you can use the XIRR function to calculate the return.

- Use the T-Bill price: Instead of using the face value, you can use the T-Bill price to calculate the return.

- Account for compounding: If you want to calculate the return over a longer period, you need to account for compounding.

Gallery of T-Bill Return Calculations

T-Bill Return Calculations

Conclusion

Calculating T-Bill returns in Excel is a straightforward process that can help you make informed investment decisions. By following the steps outlined in this article, you can easily calculate T-Bill returns and compare the performance of different T-Bills.

Remember to use the formula = ((A2 - A1) / A1) \* (360 / A3) to calculate the return, and format the result as a percentage. You can also use the XIRR function to calculate the return over a longer period.

We hope this article has been helpful in explaining how to calculate T-Bill returns in Excel. If you have any questions or comments, please feel free to ask.