Intro

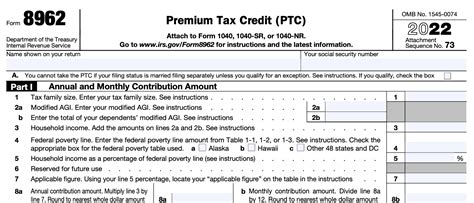

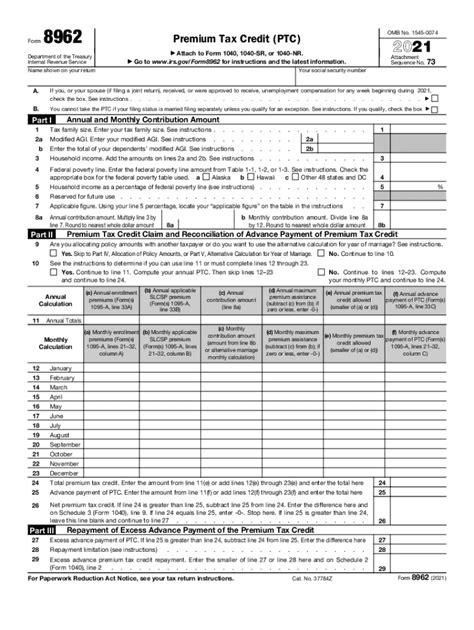

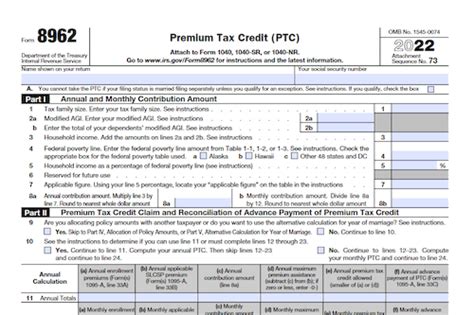

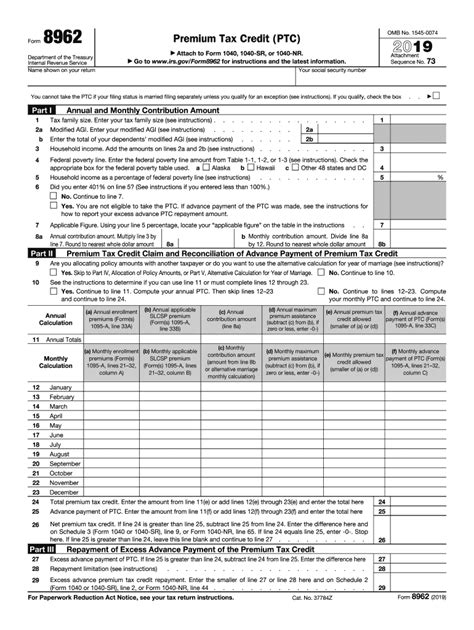

Streamline your tax filing with the printable IRS Tax Form 8962. Easily claim the Premium Tax Credit with this step-by-step guide. Understand form instructions, eligibility, and required documents. Get your printable 8962 form and maximize your tax refund. File accurately and efficiently with our expert tips and support.

Tax season can be a stressful time for many individuals, with numerous forms and paperwork to navigate. One crucial form for those claiming the Premium Tax Credit is the Tax Form 8962. This article will delve into the world of Tax Form 8962, exploring its purpose, benefits, and providing guidance on how to file it accurately. Whether you're a seasoned taxpayer or new to the process, this comprehensive guide will help you understand the ins and outs of the Tax Form 8962 printable version.

Understanding Tax Form 8962

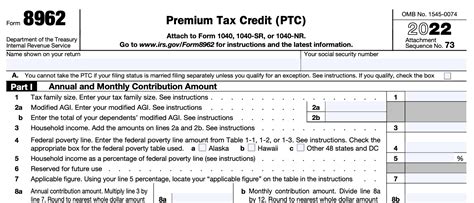

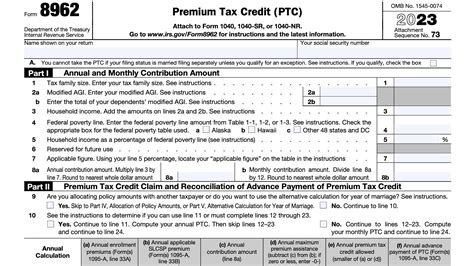

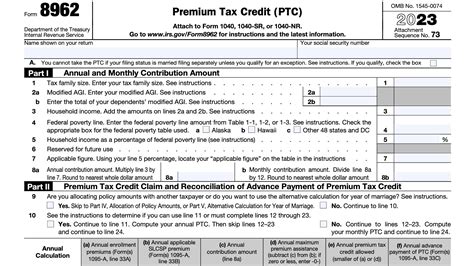

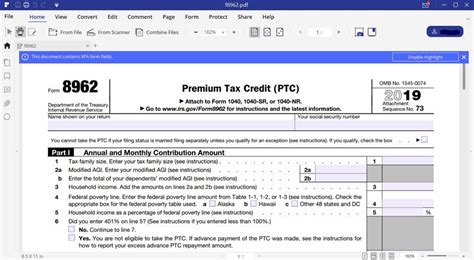

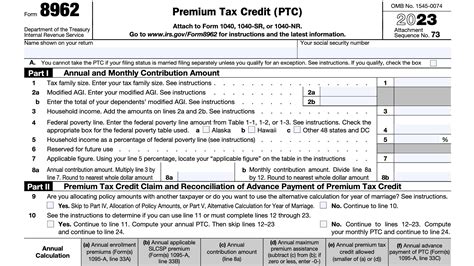

Tax Form 8962, also known as the Premium Tax Credit (PTC) form, is a crucial document for individuals and families who received advance payments of the Premium Tax Credit. This credit is a refundable tax credit designed to help eligible individuals and families with low to moderate income afford health insurance purchased through the Health Insurance Marketplace.

The primary purpose of Tax Form 8962 is to reconcile the advance payments of the Premium Tax Credit with the actual credit amount the individual or family is eligible for. This form ensures that the correct amount of credit is claimed, and any excess advance payments are repaid.

Benefits of Using the Tax Form 8962 Printable Version

While the IRS provides an electronic version of Tax Form 8962, many individuals prefer to use the printable version. Here are some benefits of using the printable version:

• Convenience: The printable version allows you to work on the form at your own pace, without the need for internet connectivity. • Accuracy: By filling out the form manually, you can double-check your calculations and reduce the likelihood of errors. • Record-keeping: A printed copy of the form provides a tangible record of your tax filing, which can be useful for future reference.

How to Fill Out Tax Form 8962

Filling out Tax Form 8962 requires attention to detail and accurate calculation. Here's a step-by-step guide to help you navigate the form:

- Part 1: Reconciliation of Advance Payments: Enter the total amount of advance payments received throughout the year.

- Part 2: Premium Tax Credit: Calculate the actual Premium Tax Credit amount based on your income and family size.

- Part 3: Excess Advance Payments: Determine the excess advance payments, if any, and calculate the repayment amount.

- Part 4: Additional Information: Provide any additional information required, such as changes to income or family size.

Tips for Accurate Filing

To ensure accurate filing, keep the following tips in mind:

• Gather necessary documents: Collect all relevant documents, including Form 1095-A, to support your tax filing. • Double-check calculations: Verify your calculations to avoid errors and potential delays in processing your tax return. • Seek professional help: If you're unsure about any aspect of the form, consider consulting a tax professional or seeking guidance from the IRS.

Common Errors to Avoid

To avoid common errors and potential delays in processing your tax return, be aware of the following:

• Incorrect social security numbers: Ensure that all social security numbers are accurate and match the numbers on file with the Social Security Administration. • Inconsistent income reporting: Verify that your income reporting is consistent across all tax forms and schedules. • Miscalculations: Double-check your calculations to avoid errors and potential delays in processing your tax return.

Gallery of Tax Form 8962 Printable Version

Tax Form 8962 Printable Version Gallery

Frequently Asked Questions

Q: What is the purpose of Tax Form 8962? A: Tax Form 8962 is used to reconcile the advance payments of the Premium Tax Credit with the actual credit amount.

Q: Who needs to file Tax Form 8962? A: Individuals and families who received advance payments of the Premium Tax Credit need to file Tax Form 8962.

Q: Can I file Tax Form 8962 electronically? A: Yes, you can file Tax Form 8962 electronically, but many individuals prefer to use the printable version.

Q: What is the deadline for filing Tax Form 8962? A: The deadline for filing Tax Form 8962 is typically April 15th, but it's essential to check the IRS website for any updates or changes.

Conclusion

Filing Tax Form 8962 can seem daunting, but with the right guidance, you can navigate the process with ease. By understanding the purpose and benefits of the form, following the step-by-step guide, and avoiding common errors, you'll be well on your way to accurate filing. Don't hesitate to seek professional help if you're unsure about any aspect of the form. Remember to share your experiences and tips in the comments below, and help others who may be struggling with the Tax Form 8962 printable version.