Intro

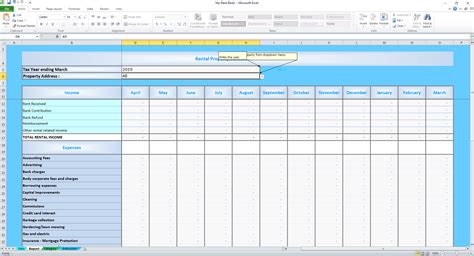

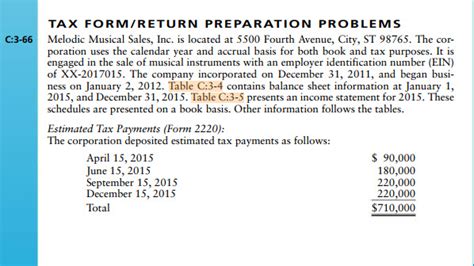

Simplify your tax return process with an easy-to-use Excel template. Our comprehensive guide provides a step-by-step tutorial on creating a tax return template, including income tracking, expense categorization, and deduction calculation. Easily manage your finances, maximize refunds, and reduce stress with our intuitive and customizable tax return Excel template.

Managing your finances and preparing your tax return can be a daunting task, especially when dealing with complex financial data. However, with the right tools, you can make the process much easier and less stressful. One such tool is a tax return Excel template. In this article, we will explore the benefits of using a tax return Excel template, how to create one, and provide tips on how to make the most out of it.

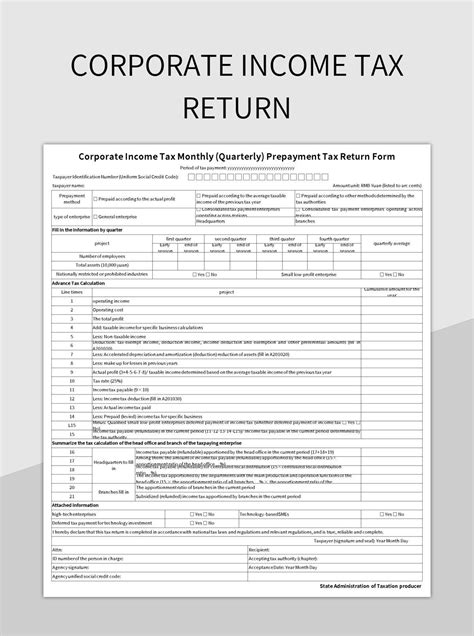

What is a Tax Return Excel Template?

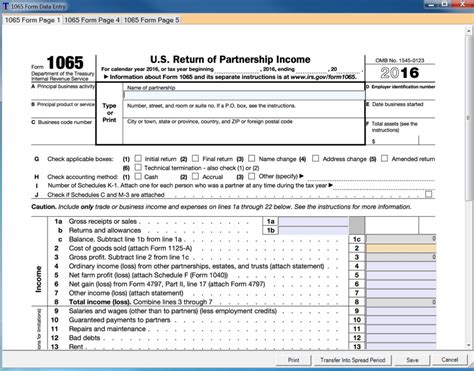

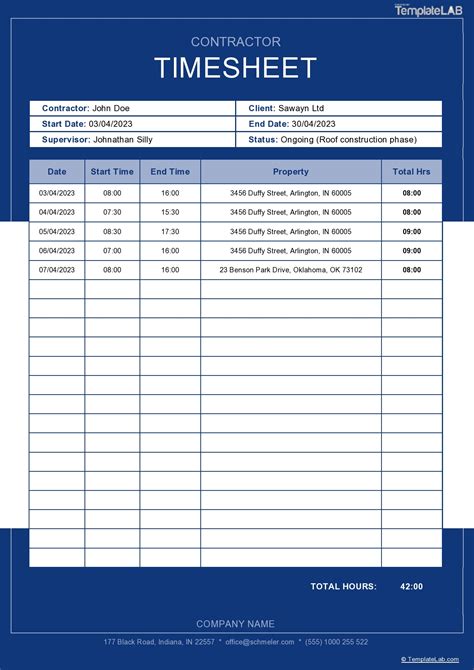

A tax return Excel template is a pre-designed spreadsheet that helps you organize and calculate your tax return information. It typically includes formulas and tables that make it easy to input your financial data and generate accurate calculations. With a tax return Excel template, you can streamline your tax preparation process, reduce errors, and save time.

Benefits of Using a Tax Return Excel Template

- Saves Time: A tax return Excel template can save you a significant amount of time and effort. You don't have to create a new spreadsheet from scratch or worry about formatting and formulas.

- Reduces Errors: With a pre-designed template, you can minimize errors and ensure accuracy. The formulas and calculations are already built-in, so you can focus on inputting your data.

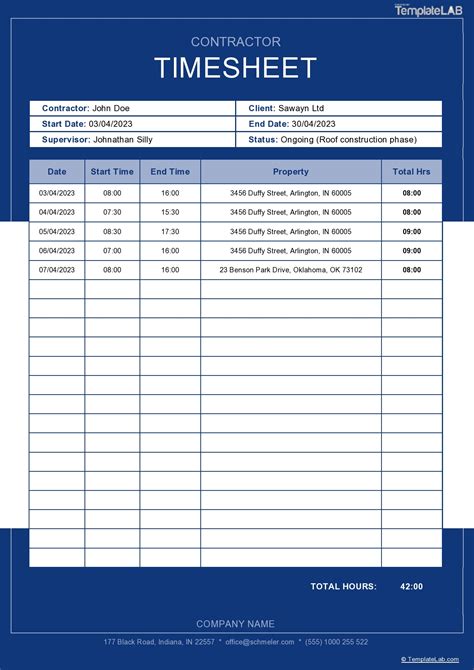

- Organizes Financial Data: A tax return Excel template helps you organize your financial data in a logical and structured way. This makes it easier to review and analyze your data.

- Customizable: You can customize the template to suit your specific needs. Add or remove sections, modify formulas, or change the layout to fit your requirements.

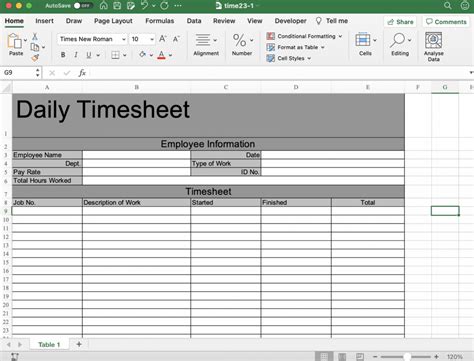

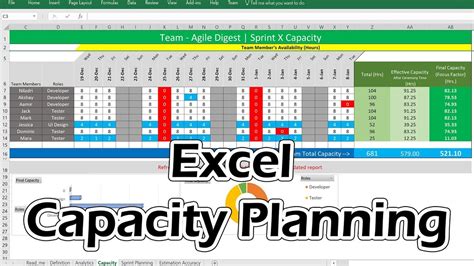

Creating a Tax Return Excel Template

Creating a tax return Excel template from scratch can be a complex task, but you can follow these steps to get started:

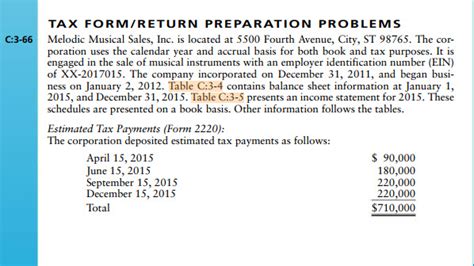

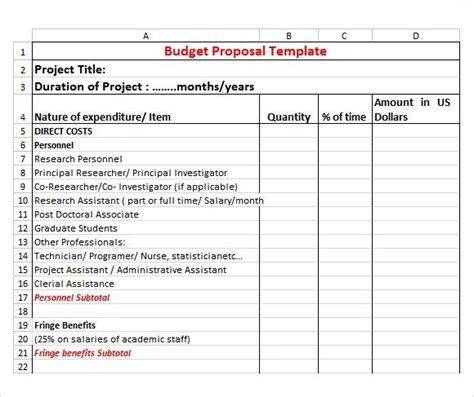

- Determine Your Requirements: Identify the specific tax return information you need to track. This may include income, deductions, credits, and other relevant data.

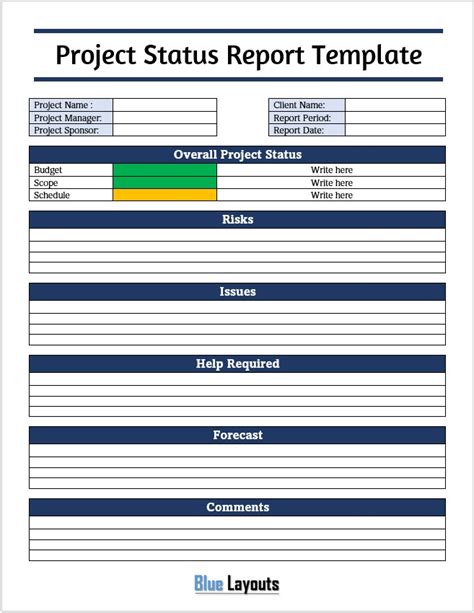

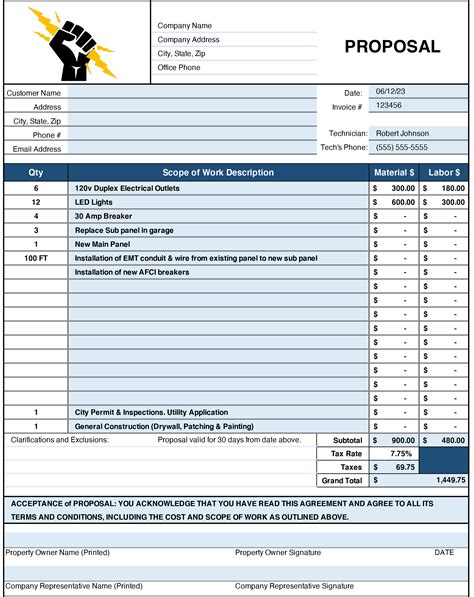

- Choose a Template Design: Decide on a template design that suits your needs. You can choose from various layouts, such as a simple table or a more complex dashboard.

- Set Up Your Template: Create a new Excel spreadsheet and set up your template. Use headings, labels, and formatting to make your template easy to read and understand.

- Add Formulas and Calculations: Add formulas and calculations to your template. This may include formulas for calculating taxes, deductions, and credits.

Using a Tax Return Excel Template

Using a tax return Excel template is straightforward. Here are some tips to help you get started:

- Input Your Data: Input your financial data into the template. Make sure to enter accurate and complete information.

- Review and Analyze: Review and analyze your data to ensure accuracy and completeness.

- Generate Reports: Use your template to generate reports and summaries of your tax return information.

- Update and Refine: Update and refine your template as needed. Add new sections, modify formulas, or change the layout to suit your changing needs.

Tips and Best Practices

Here are some tips and best practices to help you make the most out of your tax return Excel template:

- Use Clear and Concise Labels: Use clear and concise labels to make your template easy to read and understand.

- Use Formulas and Calculations: Use formulas and calculations to automate your calculations and reduce errors.

- Use Conditional Formatting: Use conditional formatting to highlight important information, such as errors or inconsistencies.

- Backup Your Template: Backup your template regularly to prevent data loss.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using a tax return Excel template:

- Inaccurate Data: Inaccurate data can lead to errors and inaccuracies in your tax return.

- Incomplete Data: Incomplete data can lead to missed deductions and credits.

- Incorrect Formulas: Incorrect formulas can lead to errors and inaccuracies in your calculations.

Conclusion

A tax return Excel template can be a valuable tool in managing your finances and preparing your tax return. By following the tips and best practices outlined in this article, you can create a template that suits your needs and streamlines your tax preparation process. Remember to use clear and concise labels, formulas and calculations, and conditional formatting to make your template easy to read and understand.

Tax Return Excel Template Image Gallery

We hope this article has been helpful in providing you with a comprehensive guide to creating and using a tax return Excel template. If you have any questions or comments, please feel free to share them below.