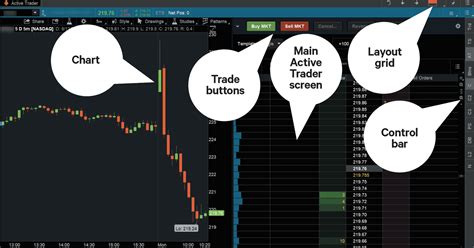

Thinkorswim, a popular trading platform developed by TD Ameritrade, offers a wide range of tools and features to help traders and investors analyze and execute trades. One of the most powerful features of thinkorswim is its custom order templates, which allow users to create and save complex trading strategies with ease. In this article, we will explore five ways to master thinkorswim custom order templates and take your trading to the next level.

Mastering thinkorswim custom order templates requires a combination of technical knowledge, trading expertise, and practice. With these templates, you can streamline your trading workflow, reduce errors, and increase efficiency. Whether you are a seasoned trader or just starting out, learning how to use custom order templates can help you achieve your trading goals.

Understanding the Basics of Custom Order Templates

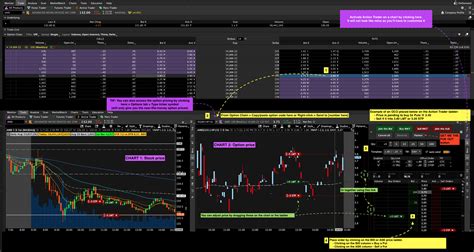

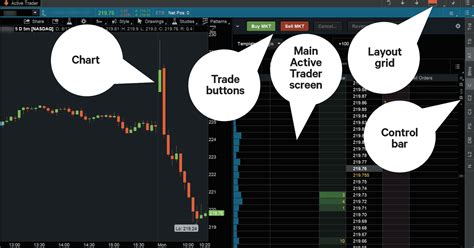

Before we dive into the advanced techniques, let's cover the basics of custom order templates. A custom order template is a pre-defined set of instructions that tells thinkorswim how to execute a trade. You can create templates for various trading strategies, including option spreads, iron condors, and volatility trades. Each template can be customized with specific parameters, such as the underlying asset, strike price, expiration date, and order type.

To create a custom order template, you need to navigate to the "Trade" tab in thinkorswim and click on the "Template" button. From there, you can select the type of template you want to create and customize the parameters to suit your trading strategy.

1. Simplify Complex Trading Strategies

One of the most significant advantages of custom order templates is the ability to simplify complex trading strategies. With a template, you can break down a multi-leg trade into a single, easy-to-execute order. For example, if you want to trade an iron condor, you can create a template that includes four legs: two call options and two put options. The template will automatically calculate the correct strike prices and expiration dates, saving you time and reducing the risk of errors.

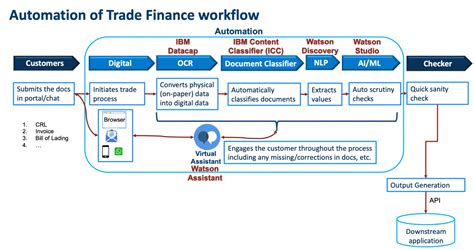

2. Automate Your Trading Workflow

Custom order templates can also help you automate your trading workflow. By creating templates for frequently used trading strategies, you can quickly execute trades without having to manually enter each leg of the trade. This can be especially useful for traders who execute multiple trades per day or who need to react quickly to changing market conditions.

To automate your trading workflow, you can create a template for each trading strategy you use and save it to your thinkorswim platform. Then, when you want to execute a trade, simply select the template and customize the parameters as needed.

3. Reduce Errors and Increase Efficiency

Another significant benefit of custom order templates is the reduction of errors and increase in efficiency. By using a template, you can avoid manual entry errors, which can result in significant losses or unwanted trades. Additionally, templates can help you execute trades more efficiently, as you don't need to manually enter each leg of the trade.

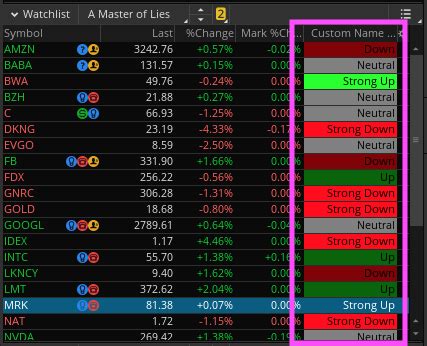

4. Create Customizable Watchlists

Custom order templates can also be used to create customizable watchlists. A watchlist is a list of stocks, options, or other securities that you want to monitor for trading opportunities. With thinkorswim, you can create a watchlist template that includes specific parameters, such as price movements, volume, and technical indicators.

To create a watchlist template, navigate to the "Analyze" tab in thinkorswim and click on the "Watchlist" button. From there, you can select the parameters you want to include in your watchlist and save it as a template.

5. Improve Your Trading Performance

Finally, mastering thinkorswim custom order templates can help you improve your trading performance. By simplifying complex trading strategies, automating your trading workflow, reducing errors, and creating customizable watchlists, you can increase your trading efficiency and effectiveness.

To improve your trading performance, focus on creating templates for your most frequently used trading strategies. Practice using the templates and customize them as needed to suit your trading style.

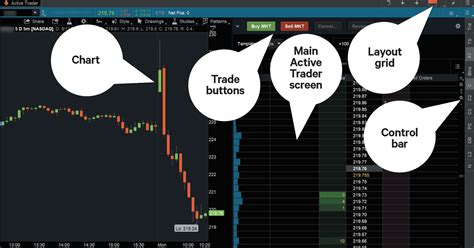

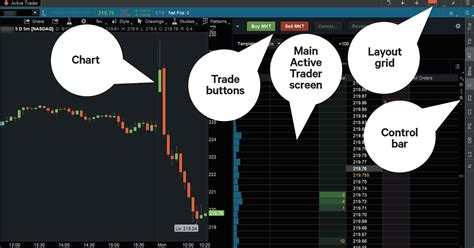

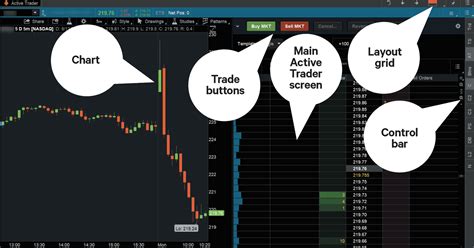

Gallery of Thinkorswim Custom Order Templates

Thinkorswim Custom Order Template Images

In conclusion, mastering thinkorswim custom order templates can help you take your trading to the next level. By simplifying complex trading strategies, automating your trading workflow, reducing errors, creating customizable watchlists, and improving your trading performance, you can increase your trading efficiency and effectiveness. Start creating your own custom order templates today and discover the power of thinkorswim!