Unlock the secrets to explosive fund growth with The Power Of Those Who Stay. Discover expert strategies for retaining loyal investors, leveraging relationship capital, and cultivating a loyal community to drive long-term success and maximize returns, while minimizing churn and maximizing the lifetime value of your fund.

Investing in the stock market can be a daunting experience, especially for those new to the game. With so many options available, it's easy to get caught up in the hype of trendy stocks and overlook the steady, long-term performers. However, for those who understand the power of patience and persistence, fund growth strategies can be a game-changer. In this article, we'll explore the benefits of fund growth strategies and provide insights into how to make the most of this investment approach.

For investors, the key to success lies not in chasing after quick profits but in cultivating a long-term perspective. Fund growth strategies involve investing in a diversified portfolio of stocks, bonds, or other securities with the goal of achieving steady, consistent returns over time. By focusing on the big picture, investors can ride out market fluctuations and benefit from the power of compounding.

Benefits of Fund Growth Strategies

So, why should investors consider fund growth strategies? Here are just a few benefits:

- Steady Returns: Fund growth strategies offer a steady, consistent return on investment, making them an attractive option for those seeking predictable income.

- Reduced Risk: By diversifying a portfolio across various asset classes, investors can minimize risk and maximize potential returns.

- Long-term Focus: Fund growth strategies encourage a long-term perspective, helping investors avoid the pitfalls of short-term market volatility.

- Professional Management: Many fund growth strategies are managed by experienced professionals, providing investors with access to expert guidance and oversight.

Key Principles of Fund Growth Strategies

To make the most of fund growth strategies, investors should keep the following key principles in mind:

- Diversification: Spread investments across various asset classes, sectors, and geographic regions to minimize risk and maximize potential returns.

- Long-term Perspective: Adopt a patient, long-term approach to investing, avoiding the temptation to buy and sell based on short-term market fluctuations.

- Regular Investing: Invest a fixed amount of money at regular intervals, regardless of market conditions, to reduce timing risks and avoid emotional decision-making.

- Cost Control: Keep costs low by selecting low-cost index funds or ETFs, minimizing management fees, and avoiding unnecessary expenses.

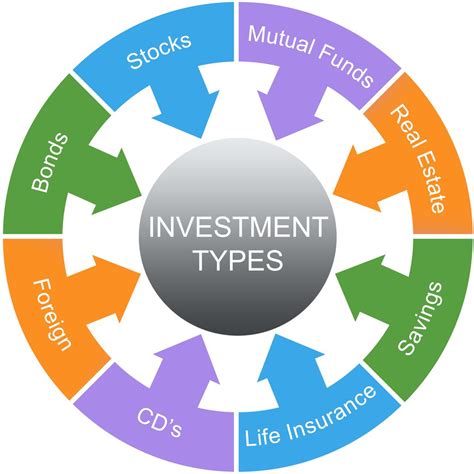

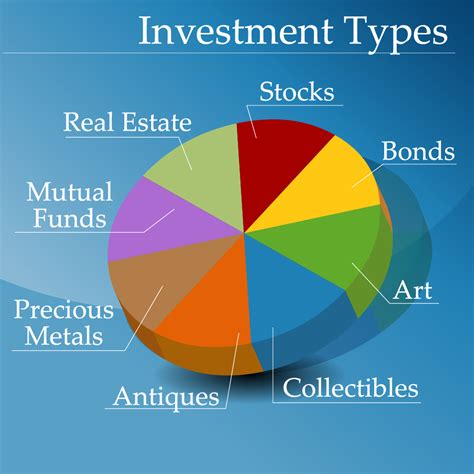

Types of Fund Growth Strategies

There are several types of fund growth strategies to choose from, each with its own unique characteristics and benefits. Here are a few examples:

- Index Funds: Track a specific market index, such as the S&P 500, to provide broad diversification and low costs.

- Mutual Funds: Actively managed funds that invest in a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Trade on an exchange like stocks, offering flexibility and diversification.

- Unit Investment Trusts (UITs): Invest in a fixed portfolio of securities, providing a low-cost, diversified investment option.

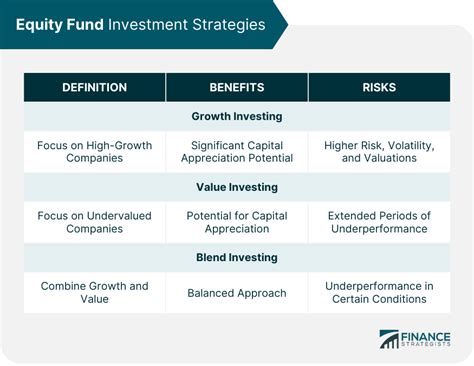

Investment Strategies for Fund Growth

When it comes to implementing fund growth strategies, investors have several options to choose from. Here are a few investment strategies to consider:

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions, to reduce timing risks and avoid emotional decision-making.

- Value Investing: Look for undervalued stocks or securities with strong growth potential, providing a margin of safety and potential for long-term returns.

- Growth Investing: Focus on high-growth stocks or securities, providing potential for long-term returns and capital appreciation.

- Income Investing: Invest in dividend-paying stocks or securities, providing a regular income stream and potential for long-term returns.

Getting Started with Fund Growth Strategies

So, how can investors get started with fund growth strategies? Here are a few steps to take:

- Define Investment Goals: Determine investment objectives, risk tolerance, and time horizon to guide investment decisions.

- Choose a Brokerage Account: Open a brokerage account with a reputable online broker, providing access to a range of investment products and tools.

- Select a Fund Growth Strategy: Choose a fund growth strategy that aligns with investment goals and risk tolerance, such as a diversified index fund or actively managed mutual fund.

- Start Investing: Begin investing a fixed amount of money at regular intervals, using dollar-cost averaging to reduce timing risks and avoid emotional decision-making.

Common Mistakes to Avoid

When implementing fund growth strategies, investors should avoid common mistakes that can derail investment success. Here are a few pitfalls to watch out for:

- Emotional Decision-Making: Avoid making investment decisions based on emotions, such as fear or greed, which can lead to poor investment choices.

- Lack of Diversification: Fail to diversify a portfolio, leaving investments vulnerable to market fluctuations and potential losses.

- High Fees: Pay high fees for investment products or services, eating into investment returns and reducing potential profits.

- Short-term Focus: Adopt a short-term perspective, leading to impulsive investment decisions and potential losses.

Conclusion

Fund growth strategies offer a powerful approach to investing, providing steady returns, reduced risk, and a long-term focus. By understanding the benefits and key principles of fund growth strategies, investors can make informed decisions and achieve their investment goals. Whether investing in index funds, mutual funds, or ETFs, the key to success lies in adopting a patient, long-term perspective and avoiding common mistakes. So, why not consider the power of those who stay? Start building your investment future today with fund growth strategies.

Fund Growth Strategies Image Gallery

We hope you've enjoyed this article on fund growth strategies. Share your thoughts and experiences with us in the comments below!