Effective invoice and payment tracking is crucial for the financial health of any business. It allows you to keep a record of all your transactions, ensure timely payments, and make informed decisions about your finances. One of the most popular tools for tracking invoices and payments is Microsoft Excel. In this article, we will explore how to use Excel to track invoices and payments easily.

Why Use Excel for Invoice and Payment Tracking?

Excel is an ideal tool for tracking invoices and payments due to its flexibility, scalability, and ease of use. With Excel, you can create custom templates, automate calculations, and generate reports to help you stay on top of your finances. Moreover, Excel is widely used and easily accessible, making it a great choice for businesses of all sizes.

Setting Up an Invoice and Payment Tracking System in Excel

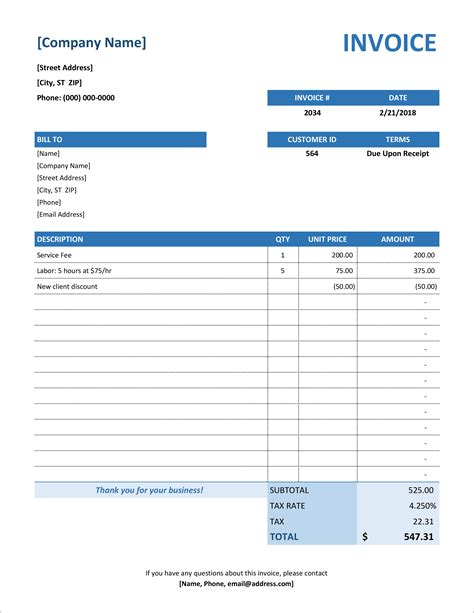

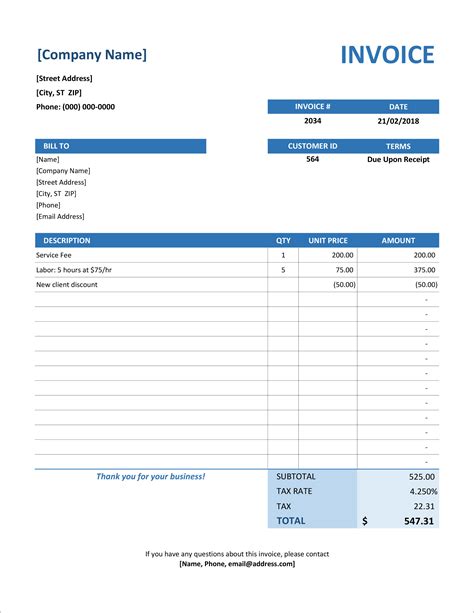

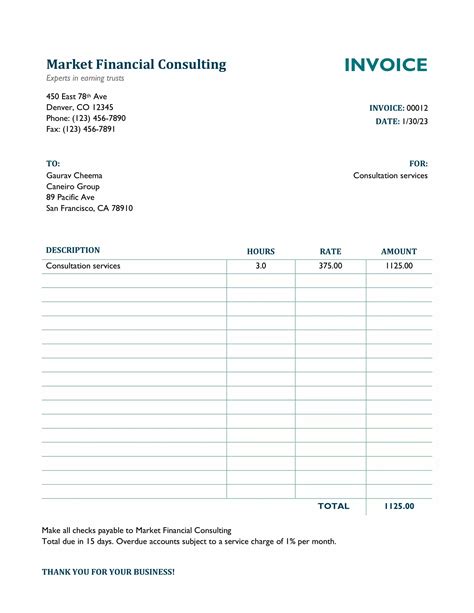

To set up an invoice and payment tracking system in Excel, you will need to create a new spreadsheet with the following columns:

- Invoice Number

- Date

- Client Name

- Invoice Amount

- Payment Status

- Payment Date

- Payment Amount

You can customize these columns to fit your specific needs, but this basic structure will provide a solid foundation for your tracking system.

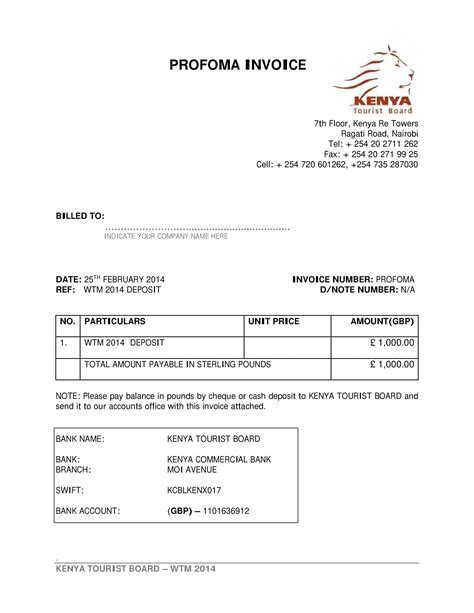

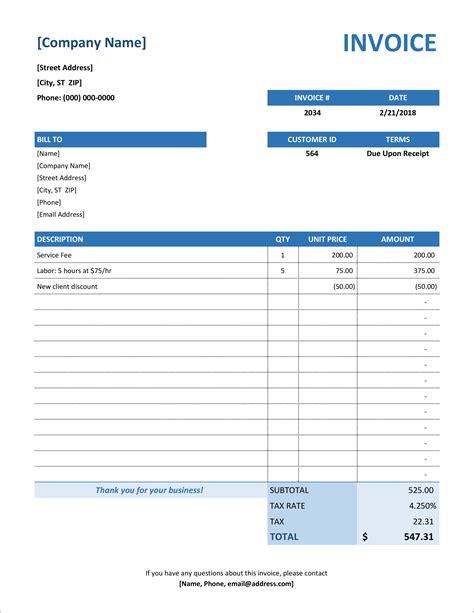

Creating a Template

Once you have set up your columns, you can create a template to make it easier to track your invoices and payments. A template will allow you to quickly add new invoices and payments without having to recreate the same format every time. To create a template, follow these steps:

- Select the entire range of cells that you want to use as your template.

- Go to the "Home" tab in the Excel ribbon.

- Click on the "Format as Table" button in the "Styles" group.

- Select a table style that suits your needs.

This will create a table that you can use as a template for tracking your invoices and payments.

Automating Calculations

One of the most powerful features of Excel is its ability to automate calculations. You can use formulas to calculate totals, balances, and other financial metrics that are relevant to your business. For example, you can use the SUM formula to calculate the total amount of all invoices or payments.

To automate calculations, follow these steps:

- Select the cell where you want to display the calculation.

- Type in the formula that you want to use.

- Press Enter to apply the formula.

For example, if you want to calculate the total amount of all invoices, you can use the formula =SUM(B:B), where B is the column that contains the invoice amounts.

Generating Reports

Excel also allows you to generate reports based on your data. Reports can help you to gain insights into your financial performance and make informed decisions about your business. To generate a report, follow these steps:

- Select the data range that you want to use for the report.

- Go to the "Insert" tab in the Excel ribbon.

- Click on the "PivotTable" button in the "Tables" group.

- Select a cell where you want to display the report.

This will create a pivot table that you can use to generate reports. You can customize the report by dragging and dropping fields into the pivot table.

Tips and Tricks

Here are some tips and tricks to help you get the most out of your invoice and payment tracking system in Excel:

- Use conditional formatting to highlight overdue payments or invoices.

- Use filters to quickly sort and analyze your data.

- Use pivot tables to generate reports and gain insights into your financial performance.

- Use Excel formulas to automate calculations and reduce errors.

Common Mistakes to Avoid

Here are some common mistakes to avoid when tracking invoices and payments in Excel:

- Not using a consistent format for your data.

- Not backing up your data regularly.

- Not using formulas to automate calculations.

- Not generating reports to gain insights into your financial performance.

Alternatives to Excel

While Excel is a powerful tool for tracking invoices and payments, there are alternative solutions available. Some popular alternatives include:

- Google Sheets: A cloud-based spreadsheet tool that allows real-time collaboration.

- QuickBooks: A comprehensive accounting software that includes invoice and payment tracking features.

- Zoho Invoice: A cloud-based invoicing software that allows you to track payments and generate reports.

Conclusion

Tracking invoices and payments is a crucial task for any business. By using Excel, you can create a custom tracking system that meets your specific needs. With its flexibility, scalability, and ease of use, Excel is an ideal tool for businesses of all sizes. By following the tips and tricks outlined in this article, you can create an effective invoice and payment tracking system in Excel.

Gallery of Invoice Tracking Excel Templates

Invoice Tracking Excel Templates

We hope this article has helped you to understand how to track invoices and payments with Excel easily. If you have any questions or need further assistance, please don't hesitate to ask.